Phemex is a trading platform for cryptocurrencies and derivatives that focuses on speed, safety, and ease of use. It has many services, such as contract trading with up to 100X leverage, spot markets for trading over different crypto pairs, and Phemex Earn, a way to make money with cryptocurrencies that pay up to 18.8% APY. Here’s how to obtain your margin trade history in Phemex and why it’s crucial for your crypto tax calculations.

Importance of Trade History Export

Before we jump into the details, let’s discuss why exporting your Phemex margin trade history is crucial. Maintaining a thorough record of your trades is a good decision. This practice allows you to review your trading patterns, evaluate your performance, and, notably, stay on the right side of tax regulations. Exporting your trade history transforms it into a valuable asset, serving both as a tool for audits and a means to scrutinize and enhance your trading strategies.

Exporting Phemex Margin Trade History: A Step-by-Step Guide

- Sign in to your Phemex account.

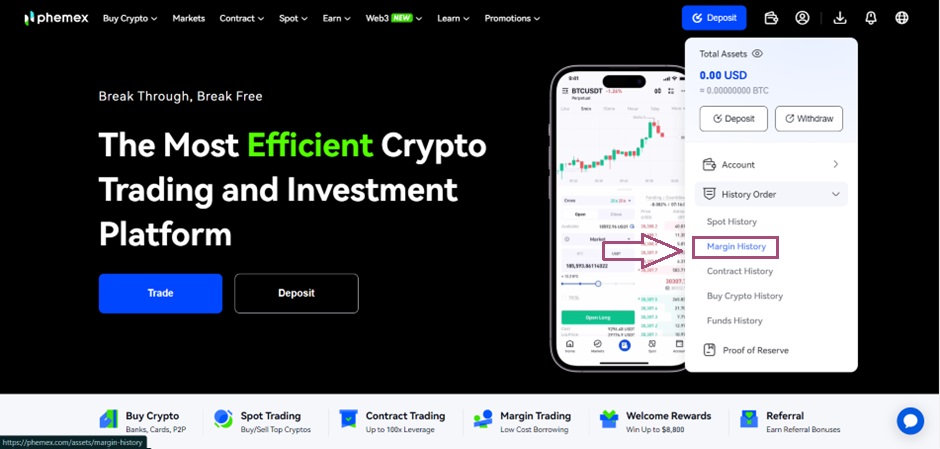

- Head to the wallet icon, and from the ‘History Order’ click on Margin History.

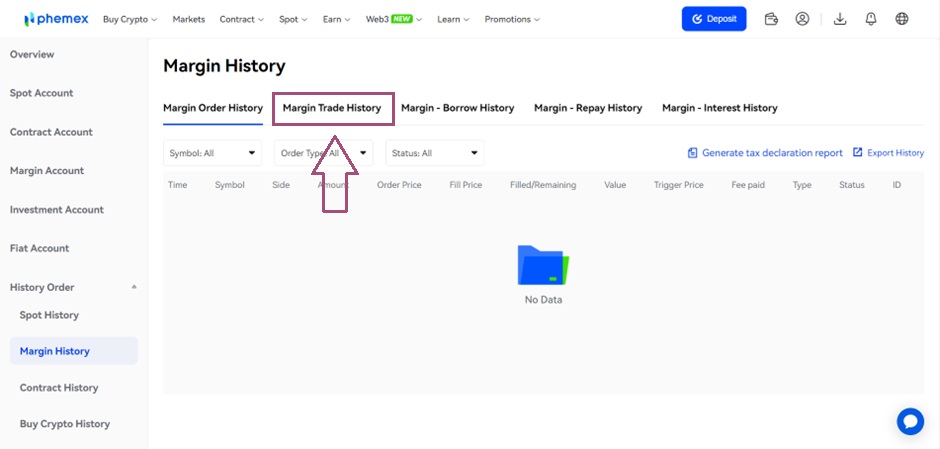

- In the Margin History section click on the ‘Margin Trade History’.

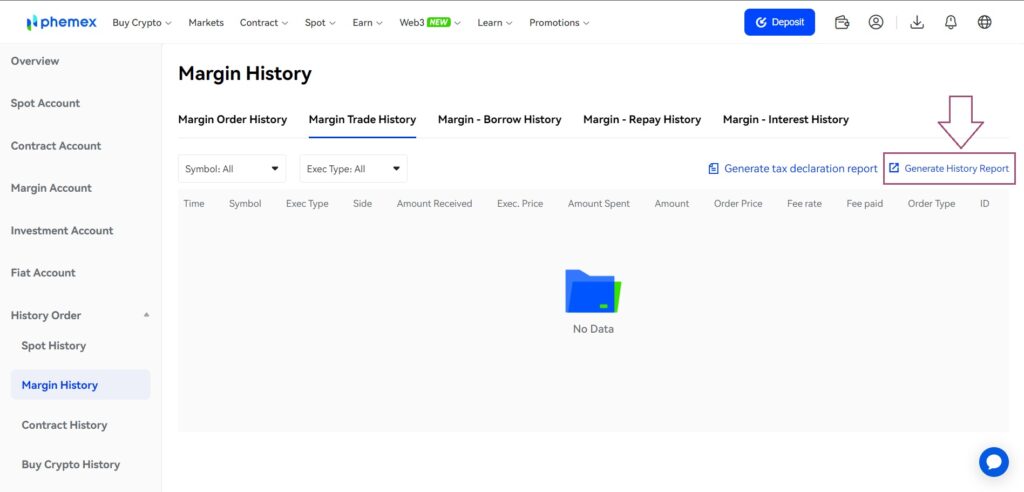

- In the Margin Trade History section click on ‘Generate History Report’.

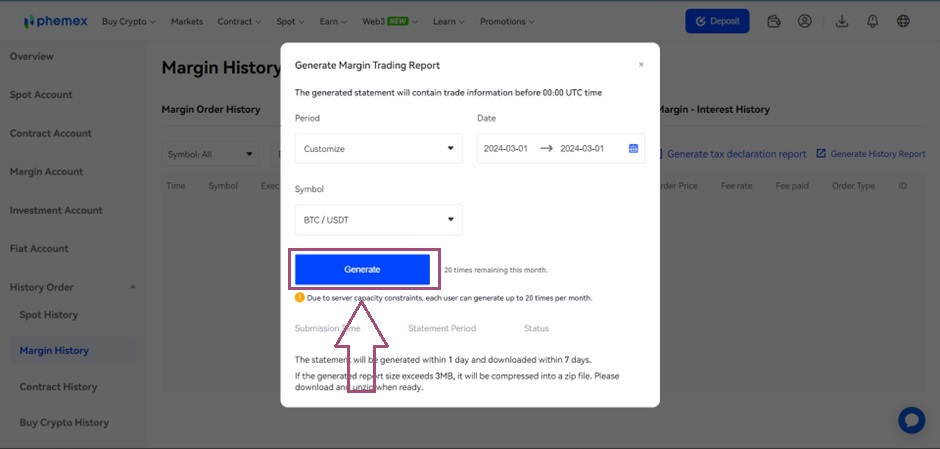

- Select your preferred date range, and click on ‘Generate’.

Is it Worth Integrating Your History with a Crypto Tax Calculator?

Integrating your Phemex margin history with a crypto tax calculator like Catax can be highly beneficial, especially for active traders and investors in the volatile cryptocurrency market. Here’s why it’s worth considering:

Accurate Tax Reporting: Financial activities involving cryptocurrencies, like margin trading, are taxed in many countries. Phemex Margin trading makes tax estimates harder because borrowed money is involved. Tax laws must be followed, and a crypto tax calculator that includes Phemex margin data can make the process automatic and accurate.

Simplification of Complex Calculations: Margin trades involve a lot of complicated deals that can be hard to keep track of by hand. In addition, a crypto tax calculator can make these calculations easier by incorporating your margin past. It looks at the cost base, gains, losses, and interest fees that come with borrowing money.

Time-Saving: Manually calculating taxes on cryptocurrency transactions is time-consuming, particularly for those with numerous trades.

Avoiding Penalties: Penalties and interest charges can happen if you don’t report your taxes correctly. Automated estimates also lower the chance of making mistakes, which can give you peace of mind and save you money on fines.

Historical Performance Analysis: Integrating margin history allows traders to analyze their performance over time. This analysis can inform margin trading strategies and tax planning, optimizing for profitability and tax efficiency.

Streamlining Record Keeping: It’s important to keep accurate records for tax reasons and for planning your finances. Moreover, integration makes sure that all transactions are recorded and organized. This makes keeping records easier and makes it simpler to answer any questions from tax officials.

Enhanced Decision Making: Understanding the tax implications of trades can influence trading strategies. Moreover, integration provides real-time insights into the tax impact of different trading decisions, helping traders make more informed choices.

The Role of Margin Trade History in Catax

Accurate Tax Reports: Your Phemex margin Trade History is very important for Catax to be able to make correct tax reports. By inputting this detailed information about your trades, Catax can accurately use the tax rules to determine your capital gains. Also, this information is necessary to make sure that tax rules are followed. You can also make sure that your tax return is complete and correct by giving this information.

Minimizing Errors: Doing tax calculations by hand due to the complexity of cryptocurrency trades and tax rules is prone to mistakes. Having a full Phemex margin Trade History automates this process lowers these risks and makes sure that your tax returns are correct and reliable.

Frequently Asked Questions (FAQs)

Phemex offers various services, including contract trading with up to 100X leverage, spot markets for trading across different crypto pairs, and Phemex Earn, a feature enabling users to earn up to 18.8% APY with cryptocurrencies.

Exporting Phemex trade history maintains records, enabling review of patterns, performance evaluation, and ensuring tax compliance.

Your Phemex margin trade history is crucial for Catax to generate accurate tax reports, ensuring the correct application of tax rules and minimizing errors in tax calculations.

Exporting your Phemex trade history allows you to maintain a thorough record of your trades, enabling you to review trading patterns, evaluate performance, and ensure compliance with tax regulations.

Phemex provides documentation and guides on their platform for creating APIs. You can refer to their official resources for detailed instructions on creating a Phemex API.