In this guide, we’ll walk you through the step-by-step process of managing your CoinDCX taxes and staying compliant. Whether you’re a trader or an investor, accurately reporting your transactions is essential to avoid potential tax issues.

Do I have to pay taxes when using CoinDCX?

Yes, crypto transactions on CoinDCX are generally considered taxable under capital gains tax or income tax in many countries. Tax rates depend on local regulations, and some regions may offer exemptions based on profit thresholds or the duration of asset holdings. For accurate tax calculations, it’s recommended to seek professional guidance.

If you find CoinDCX tax reporting challenging, try using Catax, an efficient cryptocurrency tax calculator. Follow these simple steps:

- Create a Catax account: Sign up, select India as your country, and set INR as your currency.

- Connect with CoinDCX: Link your CoinDCX account to Catax to automatically import your transaction details.

- Sort your transactions: Catax categorizes your CoinDCX activities into gains, losses, and income.

- Download your tax report: Get a detailed tax report from Catax for a clear overview of your crypto finances.

How are CoinDCX transactions taxed?

Understanding how your CoinDCX transactions are taxed helps you stay compliant and avoid unexpected tax bills. Here’s a simple breakdown:

- Capital Gains Tax

- Selling or Trading Crypto: Selling or trading crypto for a profit is usually considered a capital gain.

- Tax Rates: The rate depends on how long you’ve held the asset and your country’s tax laws.

- Income Tax

- Earning Crypto: Crypto earned through mining, staking, or payments is generally considered income.

- Tax Rates: Income from crypto is taxed based on your country’s income tax rate.

Tax rates and regulations vary by country, so it’s essential to understand your local tax laws. Consulting a tax professional can help you report your CoinDCX transactions accurately and stay compliant.

Connecting Your CoinDCX Account with Catax via API

In Coindcx:

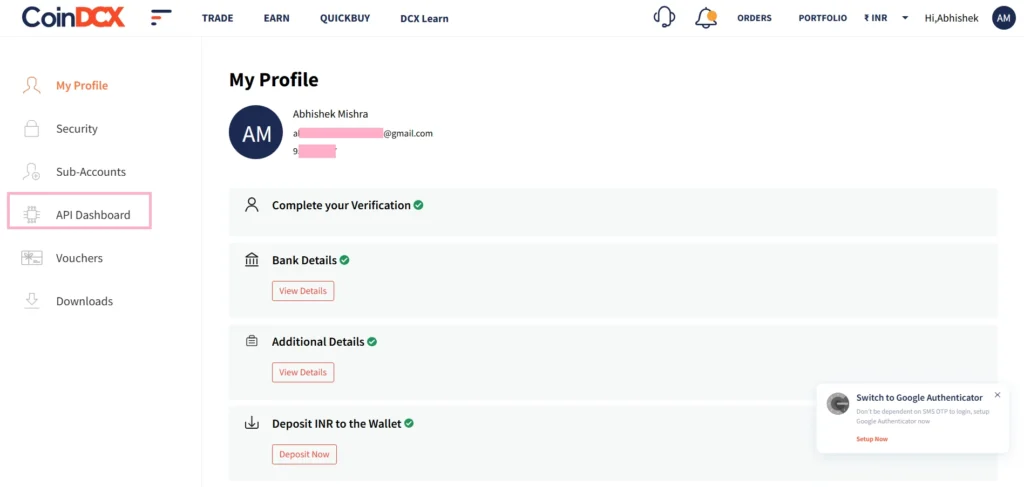

- Log in to your CoinDCX account.

- Click on your profile icon in the top-right corner.

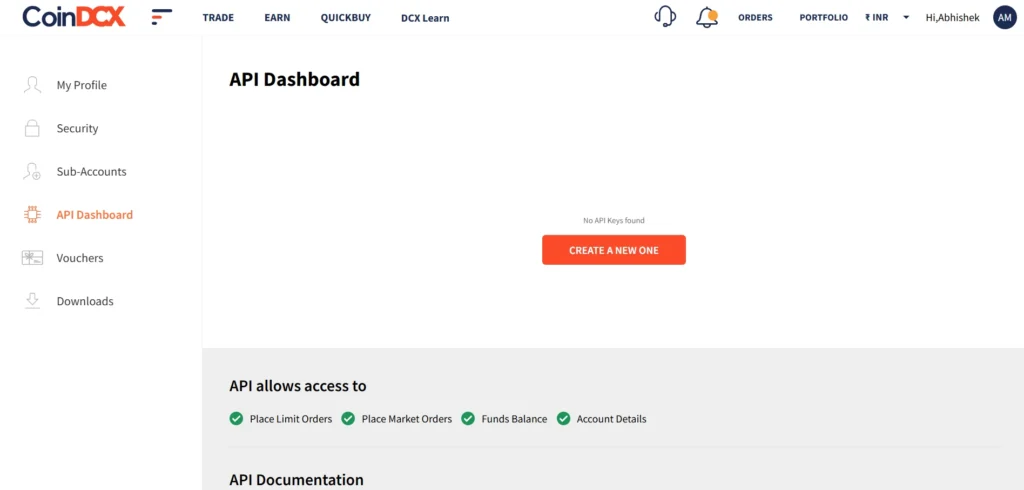

- Click Create a New One to generate a new API key.

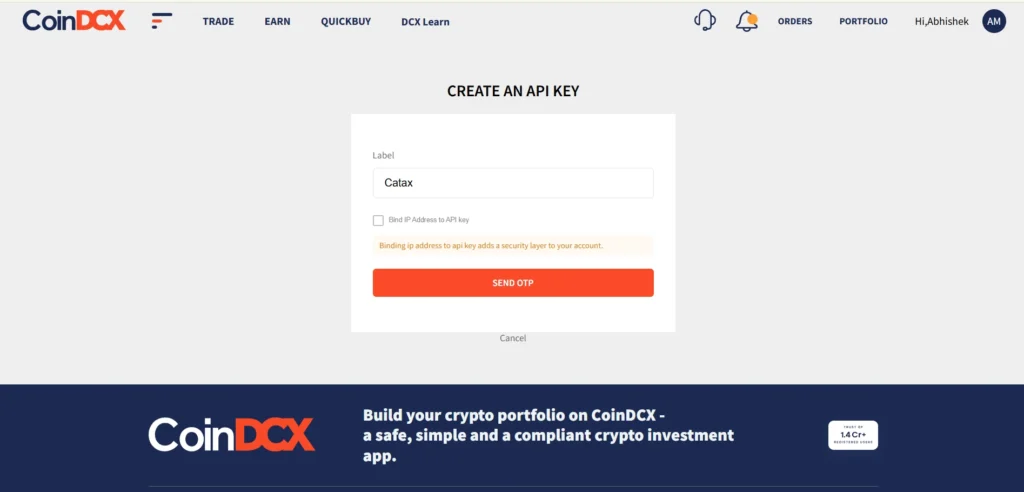

- Enter a label name for the API key (e.g., Catax).

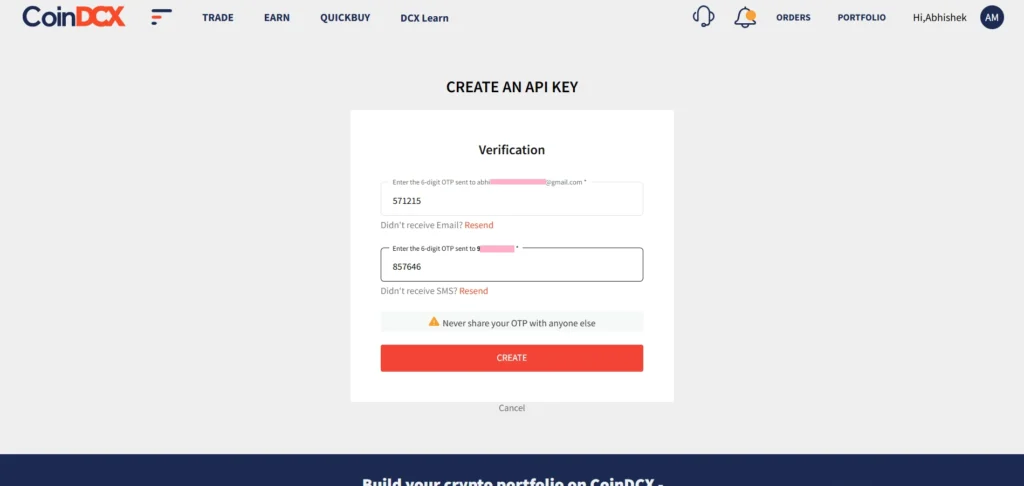

- Click Send OTP and enter the OTP from email and SMS, and click Create to generate the API key.

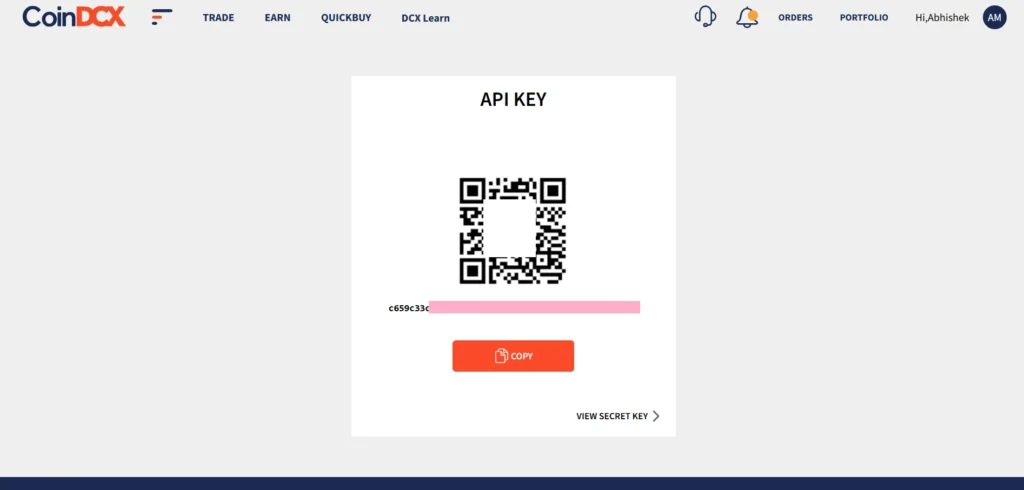

- Copy the API Key displayed on the screen.

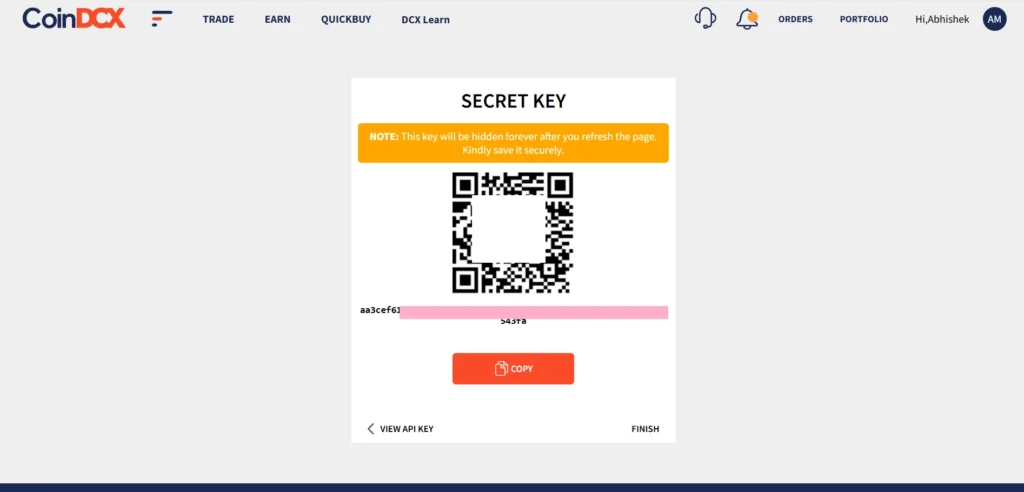

- Click View Secret Key and copy it securely (it won’t be visible again).

On Catax:

- First, log in to your Catax account.

- Go to the wallets section and upload your CoinDCX wallet.

- Enable auto-sync, then enter your CoinDCX API key and secret to import your data.

FAQs (Frequently Asked Questions)

To download your trade history, log in to your CoinDCX account, go to the Wallet section, click on Trade History, and select the desired date range. Then, click the Download CSV button to save your transaction data.

No, CoinDCX does not provide direct tax reports. However, you can export your trade history and use third-party tools like Catax to generate detailed tax reports.

Yes, crypto-to-crypto trades are generally taxable in most countries. The system calculates taxes based on the capital gains or losses incurred from the trade.

CoinDCX API keys allow third-party platforms like Catax to connect to your account for transaction syncing. If kept secure and used with read-only permissions, they are generally safe for tax calculation purposes.

Most countries consider staking rewards taxable income. Tax authorities calculate the tax based on the value of the rewards when you receive them.