This guide tells you everything you need to know to handle your CoinStore taxes. It’s meant to help both new and experienced traders handle their tax obligations when it comes to Coinstore deals.

To simplify your Coinstore tax reporting, consider using Catax.

- Commence Catax Account Setup: Initially, create your Catax account, selecting India as your country and setting the currency to INR.

- Secure Link with Coinstore: Establish a secure link between your Coinstore account and Catax for automatic transaction data transfer.

- Efficient Transaction Organization: Enable Catax to organize your Coinstore transactions efficiently, categorizing them into profits, losses, and income.

- Download Comprehensive Report: Easily download Catax’s cryptocurrency tax report for a detailed breakdown of financial activities.

What is Coinstore and how does it work?

Coinstore is a trading platform for digital assets. It serves customers all over the world, with a focus on new, high-growth areas. It was founded in 2020, and its main office is in Singapore. The platform is also made to make trading cryptocurrencies easier. It provides many services to its users, such as spot trading, futures trading, a place to start new tokens, ways to make money through crypto, and wallet services.

How Coinstore Works:

- Spot Trading: Users can buy, sell, or trade cryptocurrencies at current market prices. This service is fundamental for users looking to engage in immediate transactions.

- Perpetual Futures: This feature allows users to enter contracts by either buying long or selling short, providing opportunities for speculation or hedging against market movements.

- Coinstore Earn: It offers users a simple way to pledge their cryptocurrencies for daily income, catering to those looking to earn interest on their holdings.

- Prime and Launchpad: These services enable users to subscribe to high-quality new tokens, offering early access to potentially lucrative investment opportunities.

The platform has a simple interface that makes it easy for new traders to use and more advanced features for more experienced traders. Coinstore also emphasizes security, using multiple layers of defense to keep users’ funds and personal information safe.

How do I file my Coinstore taxes?

Adding Catax to your workflow is a simple way to keep track of your Coinstore fees. To start, link your Coinstore account to Catax. You can use an API connection to have your info synced automatically. This is a very important step because it lets Catax correctly figure out how much tax you owe based on your purchases.

Catax will search your transactions for taxable events using local tax rules after you connect your Coinstore account. The fact that Catax allows Coinstore users to estimate worldwide taxes ensures they follow local tax laws. It does more than just figure out your taxes; it also makes detailed reports of them that are easy to understand, which is especially helpful for people who are new to crypto tax reporting. This method lowers the chance of making mistakes that come up when you do your taxes by hand.

Furthermore, Catax’s reports explain your Coinstore taxes, including transaction taxes, and how they affect your total tax liability. This integration makes it easier for Coinstore users to figure out their taxes, takes into account different countries’ tax rules, and gives them accurate reports. Consequently, this makes paying taxes easier all over the world.

Connecting Catax and Coinstore via API:

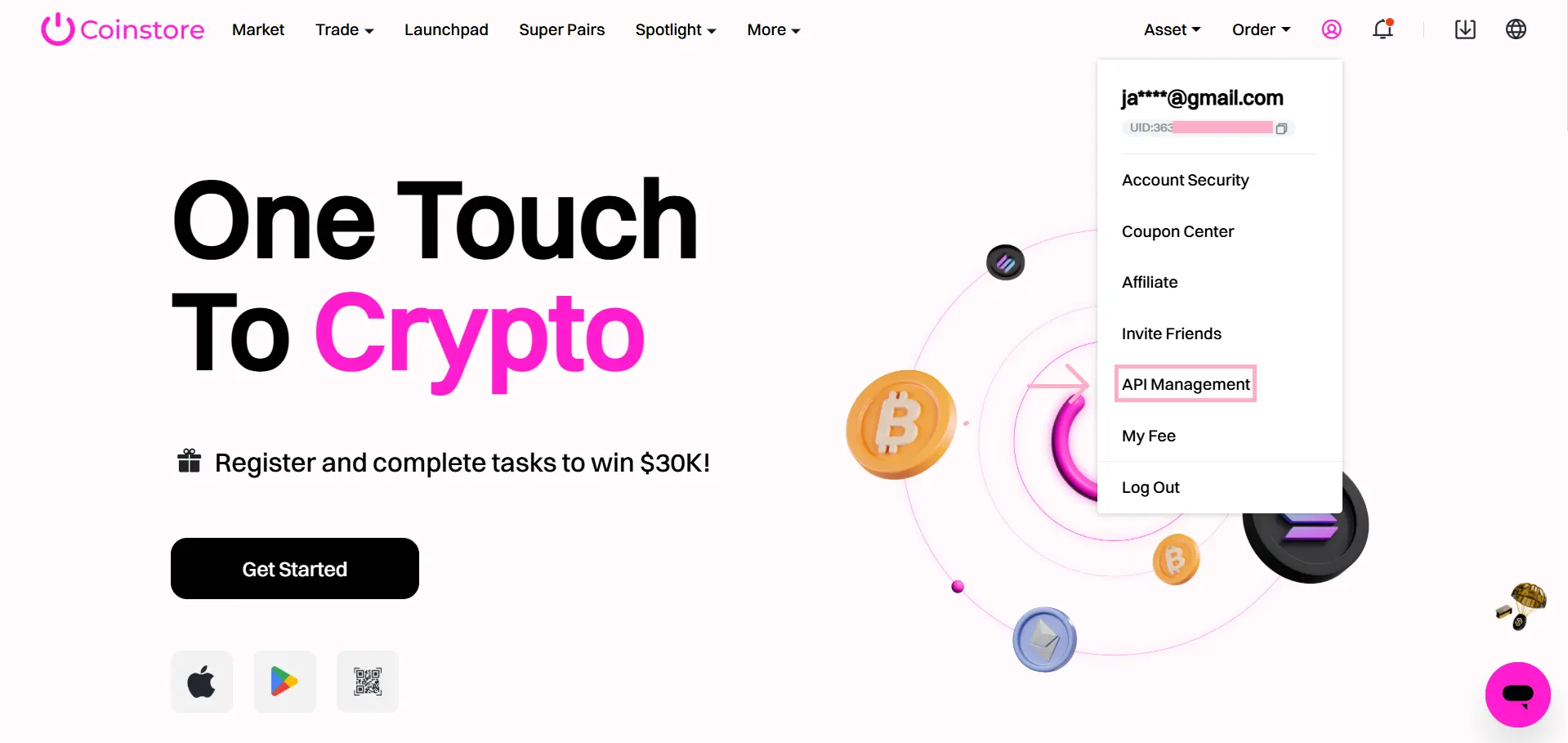

For Coinstore :

- Sign in to your Coinstore account.

- Head to the Profile Icon and click on API Management

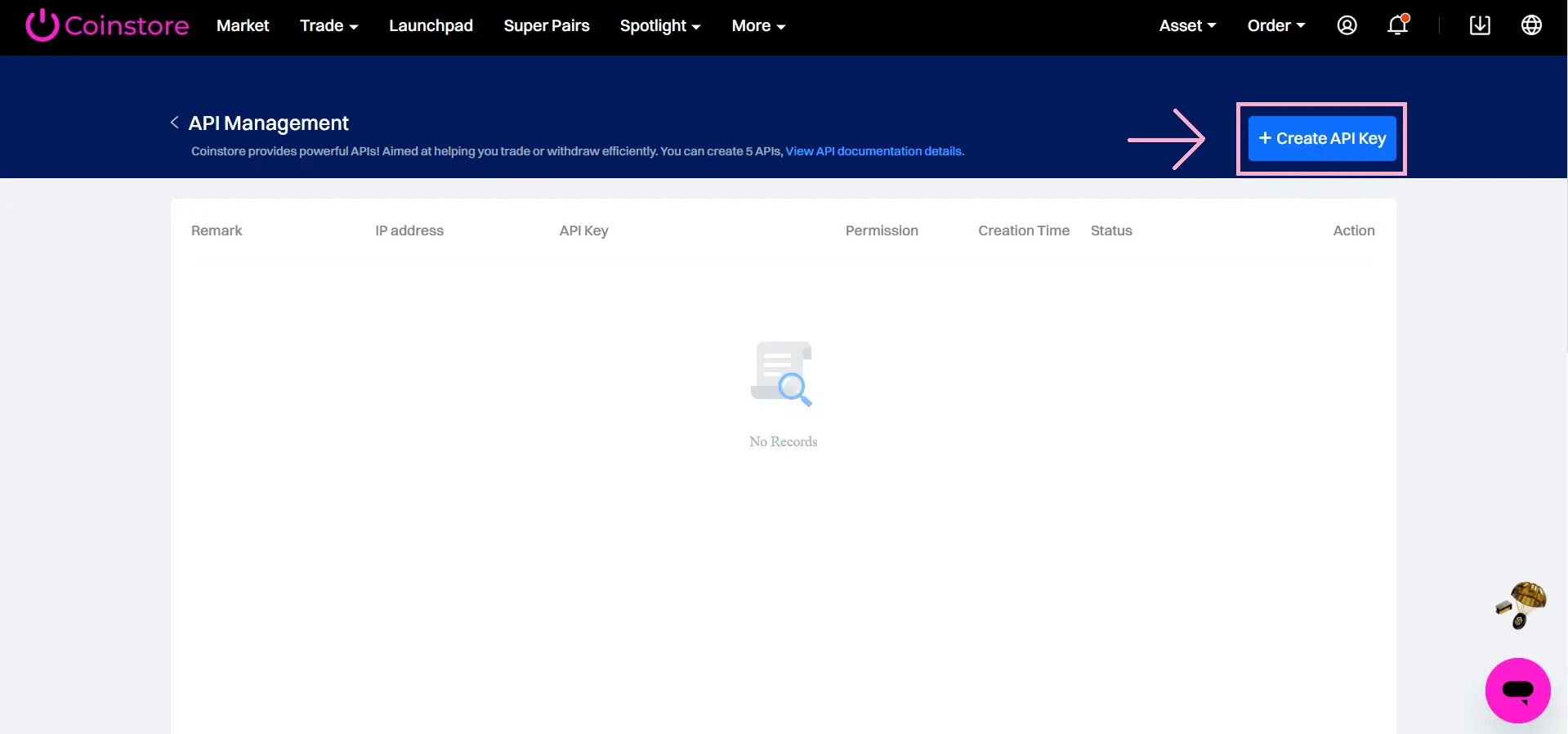

- Click on Create API Key.

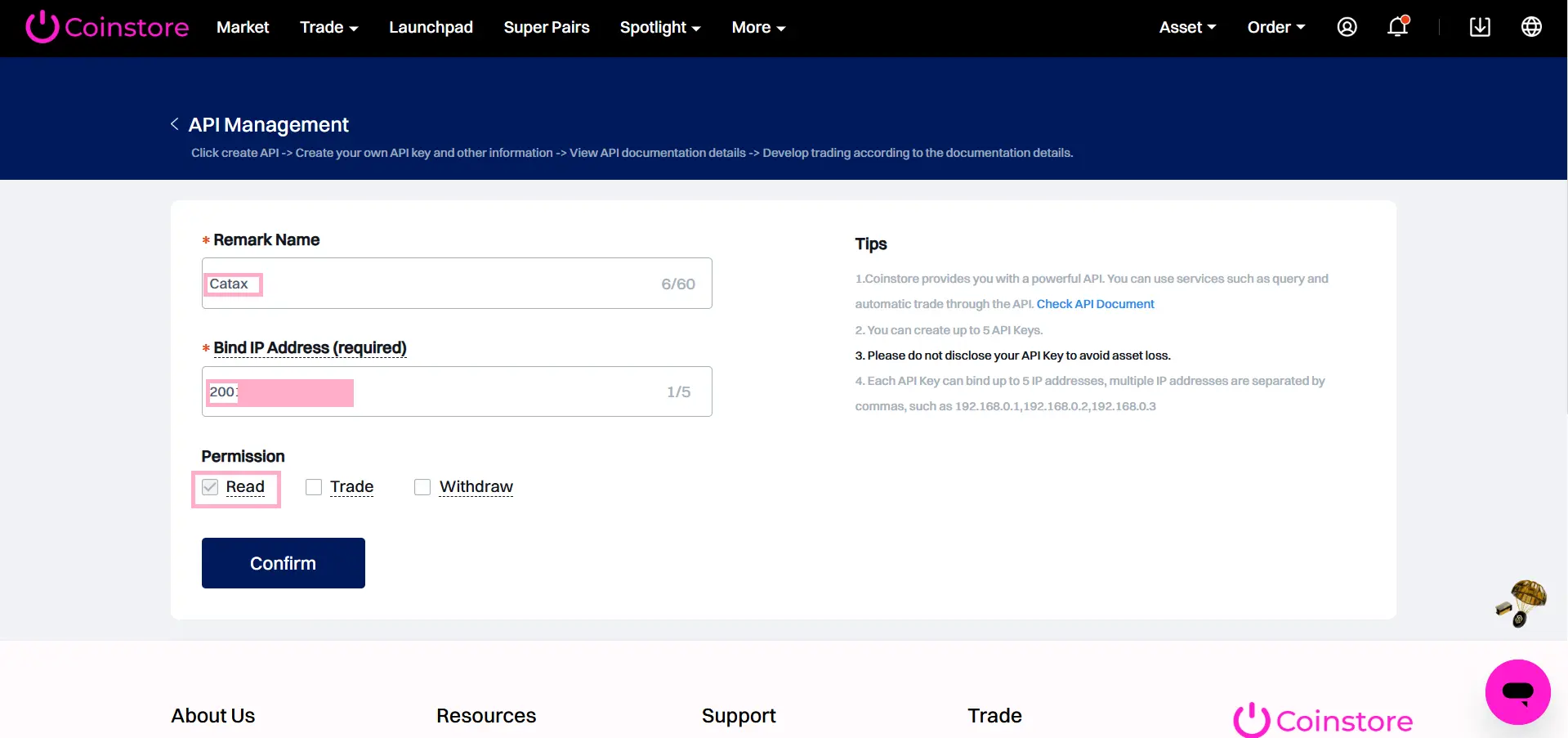

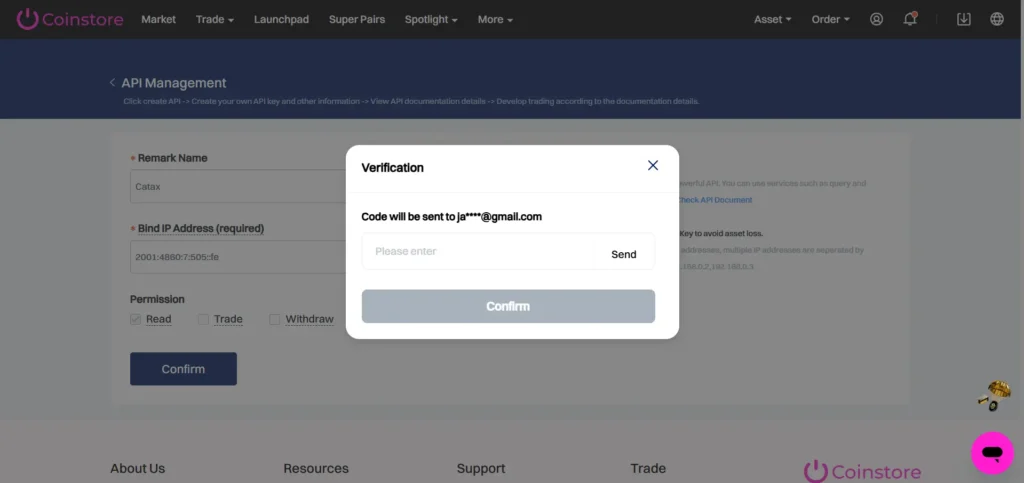

- Enter Remark Name your IP address and click on Confirm. (Note : Only checked the Read permission)

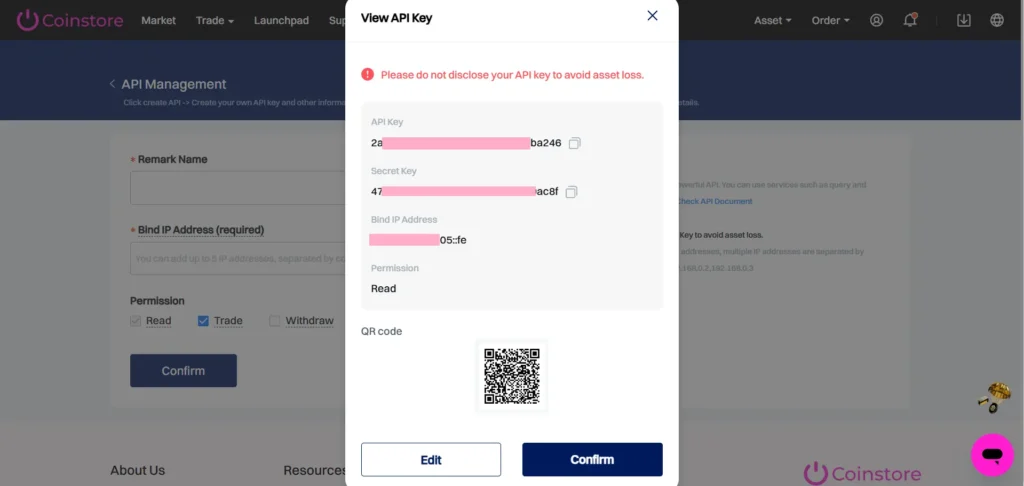

- Your API and Secret Key will be ready. Copy them, then click Confirm.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, and proceed to enter your API key and secret to import your data.

Frequently Asked Questions (FAQs)

Catax accounts must be created before Coinstore accounts can be linked. Select your nation and currency, then securely connect your Coinstore account to Catax. Create a Coinstore API key and enter it into Catax. Data synchronization will update your financial information across both platforms. These procedures must be followed carefully to protect and verify your account details.

Coinstore offers a variety of features, including spot trading and perpetual futures. Additionally, it provides Earn for earning interest on crypto holdings, as well as Prime and Launchpad services for early access to new tokens. Designed to be user-friendly for beginners, it also caters to experienced traders with advanced features, demonstrating its versatility. As a result, Coinstore stands out as a comprehensive platform that effectively meets the diverse needs of its users.

Coinstore is a global digital asset trading platform, established in 2020 and based in Singapore. It supports cryptocurrency trading, including spot and futures trading, and offers additional services such as a launchpad for new tokens and earning opportunities through cryptocurrency.

To simplify your Coinstore tax reporting, integrate Catax into your process. Initially, set up your Catax account by selecting your country and currency. Then, link your Coinstore account to Catax for automatic data transfer, enabling efficient organization of transactions and easy generation of detailed tax reports.