Established in 2018, BingX is a renowned cryptocurrency exchange with a vast user base exceeding 10 million, offering diverse services such as trading and asset management, customized for novice and experienced traders alike. This guide provides straightforward instructions for calculating taxes on BingX transactions, catering to individuals regardless of their trading experience, and ensuring seamless handling of taxes associated with BingX transactions.

For streamlined BingX tax reporting, consider using Catax.

- Start the Catax Account Setup: Create your Catax account, specifying your country, and set the currency according to your country.

- Establish Secure Link with BingX: Connect your BingX account securely with Catax to enable automatic transfer of transaction data.

- Efficient Transaction Organization: Allow Catax to organize your BingX transactions by categorizing them into profits, losses, and income.

- Download Comprehensive Report: Access Catax’s cryptocurrency tax report for a detailed breakdown of your financial activities.

- Seamless Tax Filing: Incorporate the detailed report effortlessly for online tax filing or share it with your tax professional for expert assistance.

BingX and its features

BingX is a cryptocurrency exchange that offers a variety of trading options, including spot trading, derivatives (such as perpetual and standard futures), and copy trading, where users can replicate the strategies of elite traders. It supports over 700 coins, offers leverage up to 150x, and features grid trading to create personalized trading strategies. BingX emphasizes security with compliance measures, 2FA authentication, and 100% proof-of-reserves, aiming for a user-friendly and secure trading experience.

In addition, BingX offers a range of features designed for cryptocurrency traders, including:

- Spot and Derivatives Trading: Users can trade a wide range of cryptocurrencies on both spot and derivatives markets.

- Copy Trading: This allows users to mimic the trades of experienced traders, potentially benefiting from their expertise.

- Grid Trading: A strategy that automatically buys and sells within a specified price range, aiming to profit from market volatility.

- High Leverage: Offers leverage up to 150x for certain trades, enabling users to multiply their potential profits.

- Security Measures: Implements 2FA, compliance measures, and proof-of-reserves for enhanced security.

How are BingX Transaction Taxed

When you use platforms like BingX for cryptocurrency transactions, the taxes you pay depend on your country’s rules. Essentially, many places treat cryptocurrencies such as Bitcoin and Ethereum as property. This means if you sell, trade, or use them in transactions and make a profit or loss, you need to pay capital gains tax.

Here’s what triggers these taxes: selling crypto for regular money, swapping one crypto for another, buying things with crypto, and getting crypto as income, like from mining or airdrops.

Keeping detailed records of all your crypto transactions is crucial. You need to know when you made each transaction, how much the crypto was worth then, and how much it cost you. Additionally, this info helps you figure out your profits or losses. Luckily, most crypto exchanges give you reports to make this easier. Furthermore, the rules around crypto taxes are changing fast and can be very different depending on where you live. For example, some countries are strict, requiring crypto businesses to check who their customers are to prevent illegal money flows. On the other hand, others are still figuring out their rules. In some places, crypto is taxed like a commodity; in others, it’s treated more like property or money.

How do I File my BingX Taxes?

Making your BingX tax filing process smoother is straightforward with a Crypto tax software like Catax. Let’s break it down simply for you:

- Connection. Link your BingX account to Catax. You have two options: a direct API link for real-time data synchronization or a manual CSV file upload for your transaction details. This initial step sets the foundation for a streamlined tax filing procedure.

- Analysis. Catax then dives into your BingX transactions, identifying which ones may incur taxes based on the tax rules that apply to your specific location. Its worldwide support means it’s equipped to handle the tax nuances of numerous countries, ensuring accurate tax assessment.

- Organization. The software organizes your transaction data into neat, easy-to-understand reports. This clarity is especially useful if you’re navigating the complexities of crypto taxes for the first time, helping you to avoid common filing mistakes.

- Reporting. Catax’s detailed reports offer a thorough view of your tax obligations related to BingX, enabling you to file your taxes with precision. These reports detail what you owe and how it fits into your overall tax profile, ensuring no detail is overlooked.

In Summary, Catax provides an effective and professional solution for managing BingX tax filings. It simplifies the connection to your account, demystifies international tax legislation, and delivers meticulous, regulation-adherent reports. For professionals and crypto traders worldwide, it’s a valuable tool for maintaining tax compliance with minimal hassle. Also, this approach saves time and ensures accuracy and peace of mind during the tax filing season.

Connecting Catax and BingX via API:

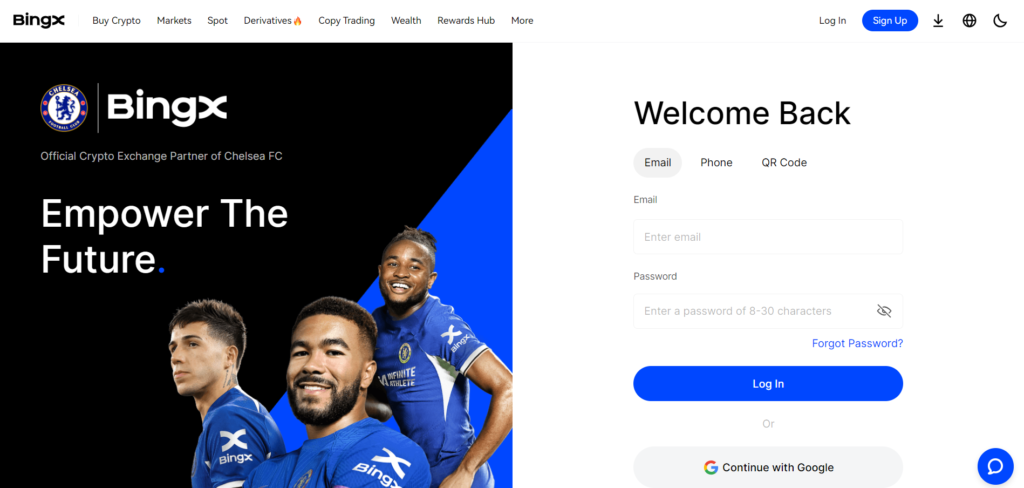

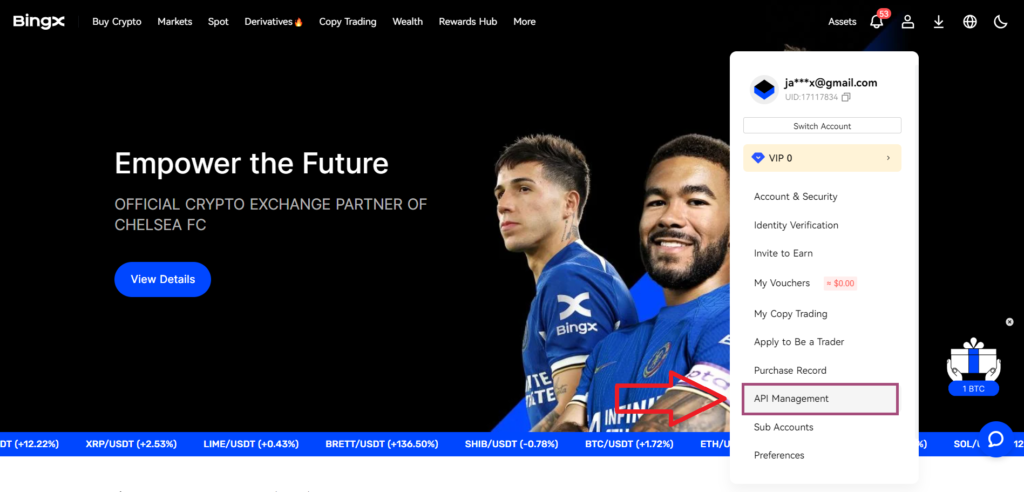

For BinX:

- Sign in to your BingX account.

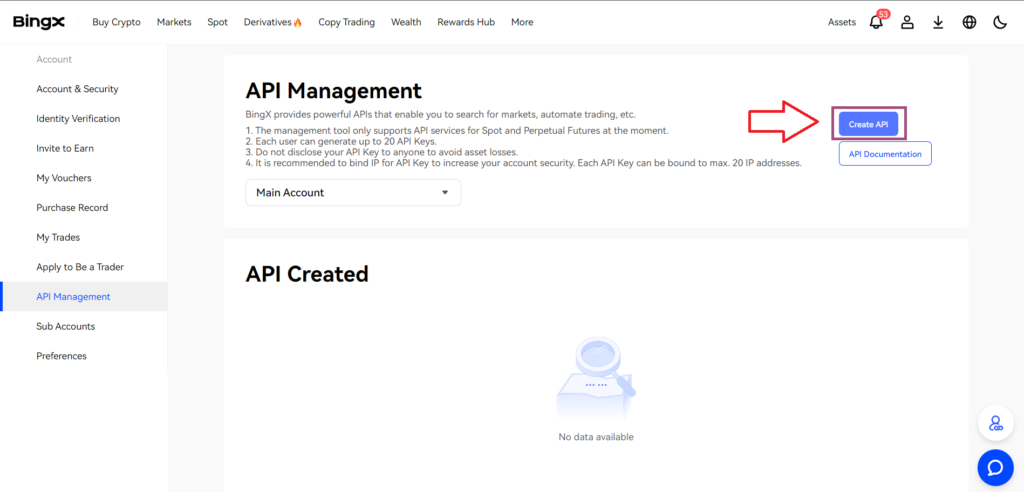

- Head to the profile icon, then click on ‘API Management’.

- In the API Management section click on ‘Create API’.

- Label your API, and then click on Next.

- Your API key will be created successfully

On Catax:

- To begin, log in to your Catax account.

- Navigate to the wallets section, then upload your BingX wallet.

- Enable auto-sync, and proceed to enter your API key and secret to import your data