This step-by-step guide simplifies managing your Probit Global taxes, ensuring compliance. Whether you trade or invest, accurate reporting is key to avoiding tax issues.

Do I have to pay taxes when using Probit Global?

Yes, crypto transactions on Probit Global are generally considered taxable under capital gains tax or income tax in many countries. Tax rates depend on local regulations, and some regions may offer exemptions based on profit thresholds or how long you hold the assets. For accurate tax calculations, it’s recommended to seek professional guidance.

If Probit Global tax reporting feels challenging, try using Catax, a powerful cryptocurrency tax calculator. Follow these simple steps:

- Create a Catax account – Sign up, select India as your country, and set INR as your currency.

- Connect with Probit Global – Link your Probit Global account to Catax for automatic transaction imports.

- Sort your transactions – Catax will categorize your Probit Global activities into gains, losses, and income.

- Download your tax report – Generate a detailed tax report for a clear view of your crypto finances.

How are Probit Global transactions taxed?

Understanding how your Probit Global transactions are taxed can help you stay compliant and avoid surprises. Here’s a simple breakdown:

- Capital Gains Tax

- Selling or Trading Crypto – If you sell or trade crypto for a profit, it’s usually considered a capital gain.

- Tax Rates – The rate depends on how long you held the asset and your country’s tax laws.

- Income Tax

- Earning Crypto – Crypto earned from mining, staking, or payments is generally considered income.

- Tax Rates – This is taxed at your regular income tax rate.

Since tax laws vary by country, it’s important to know your local regulations. Consulting a tax professional can help you report your Probit Global transactions correctly and stay compliant.

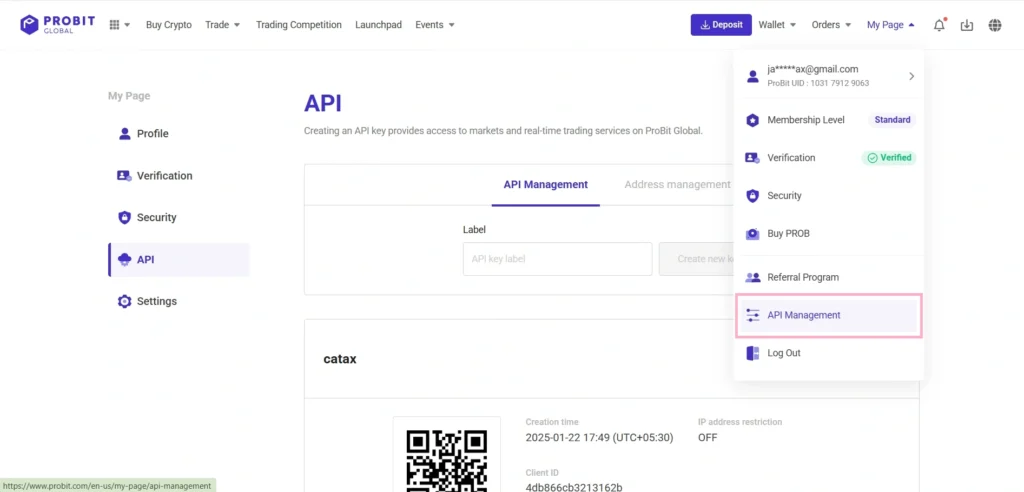

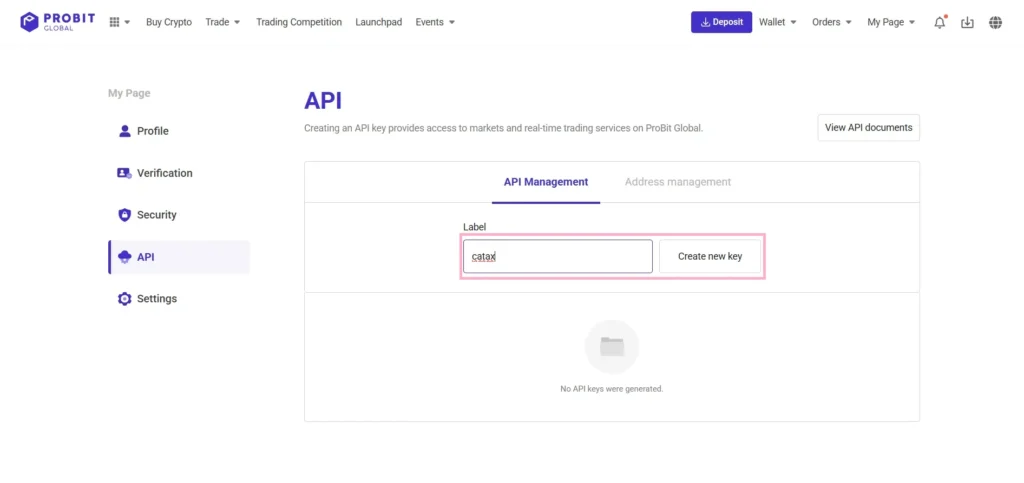

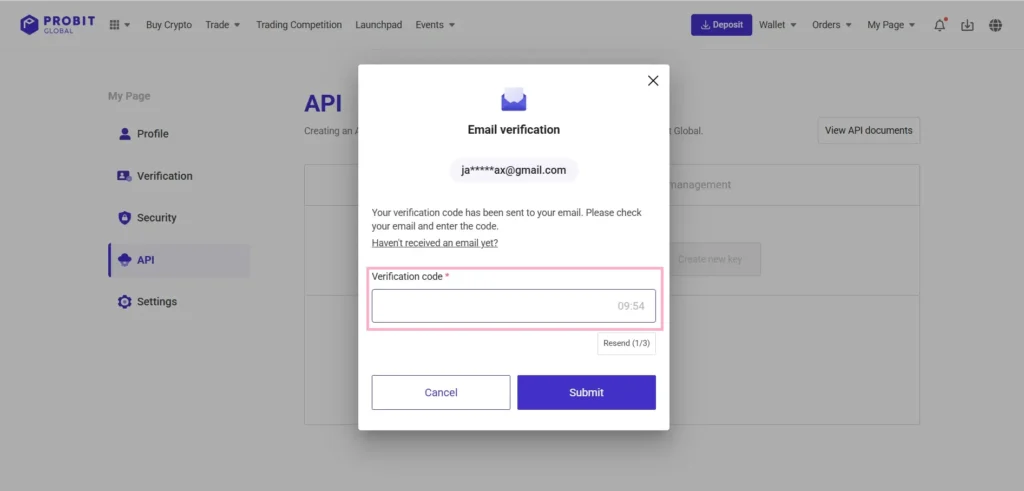

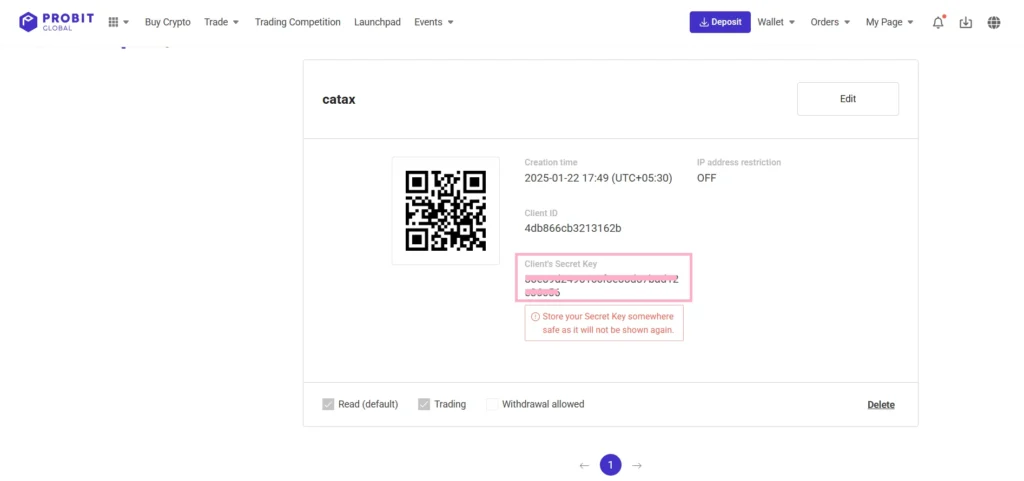

Connecting your Probit Global Account with Catax via API

In Probit Global:

- Enter a label (e.g., “catax“) and click

Create New Key.

- Enter the email verification code sent to your registered email and click Submit.

- Copy the Client’s Secret Key and save it somewhere safe.

On Catax:

- Log in to your Catax account.

- Enable auto-sync, then enter your API key and secret to import your data.

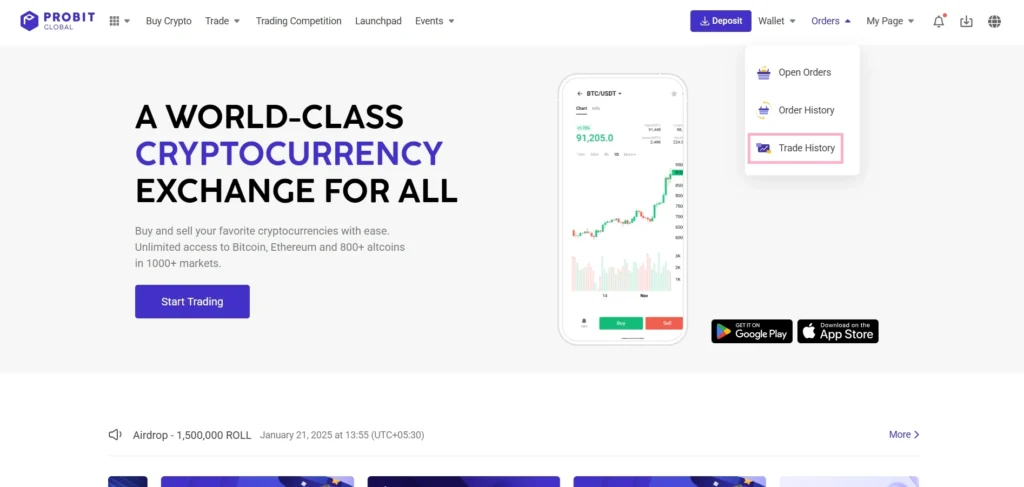

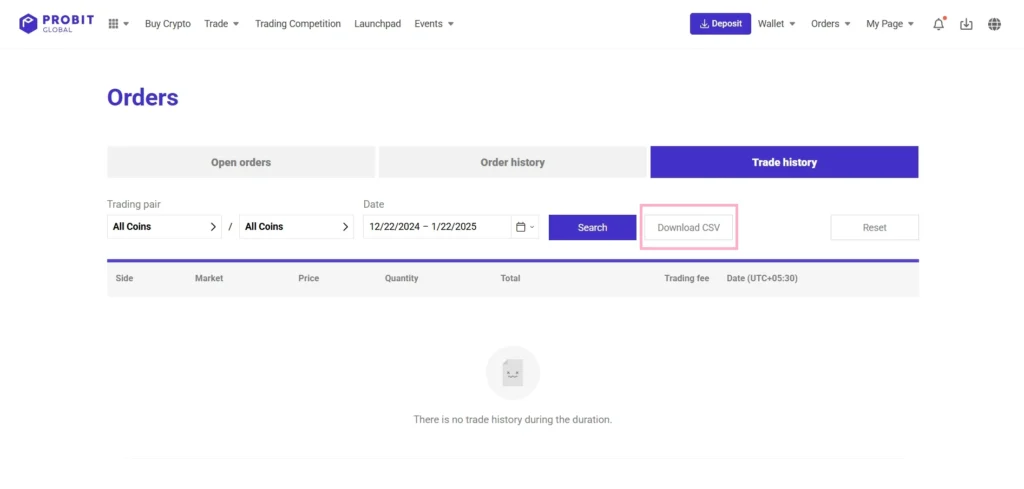

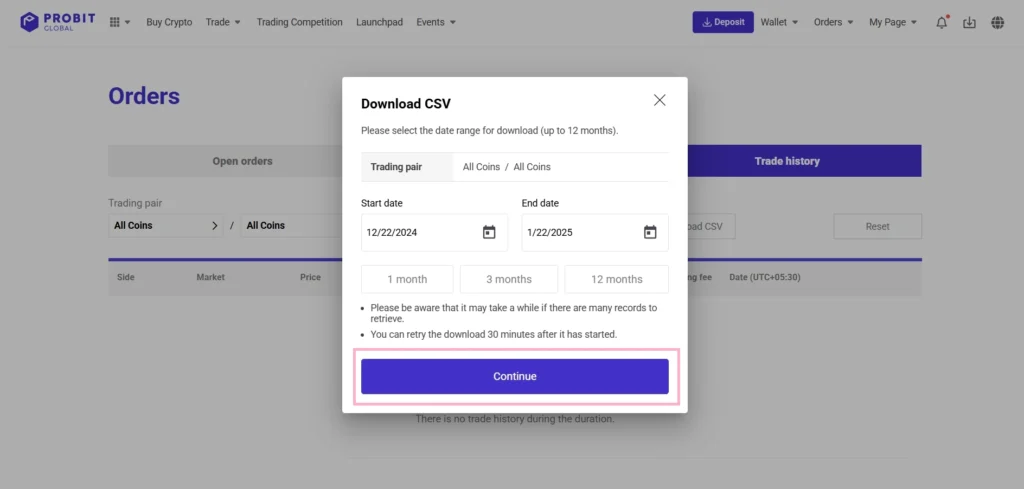

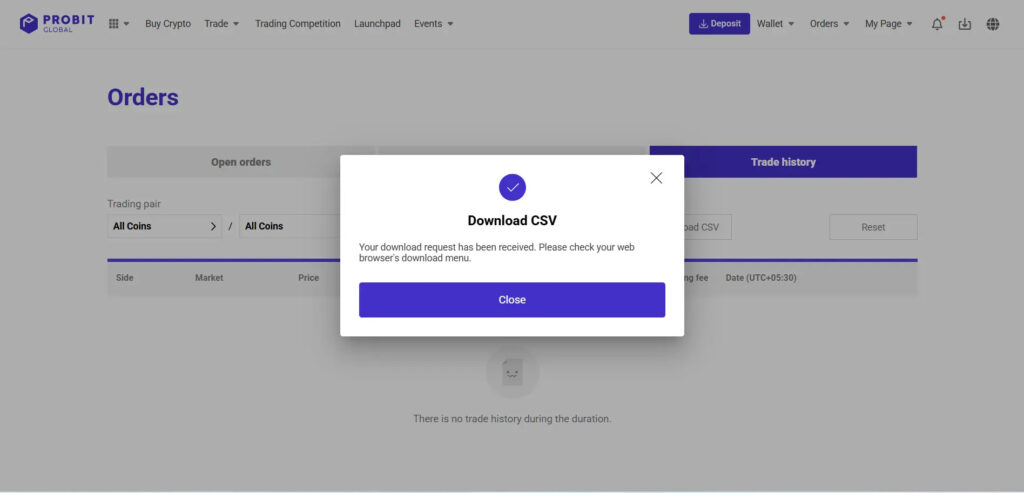

How to Export Trade History?

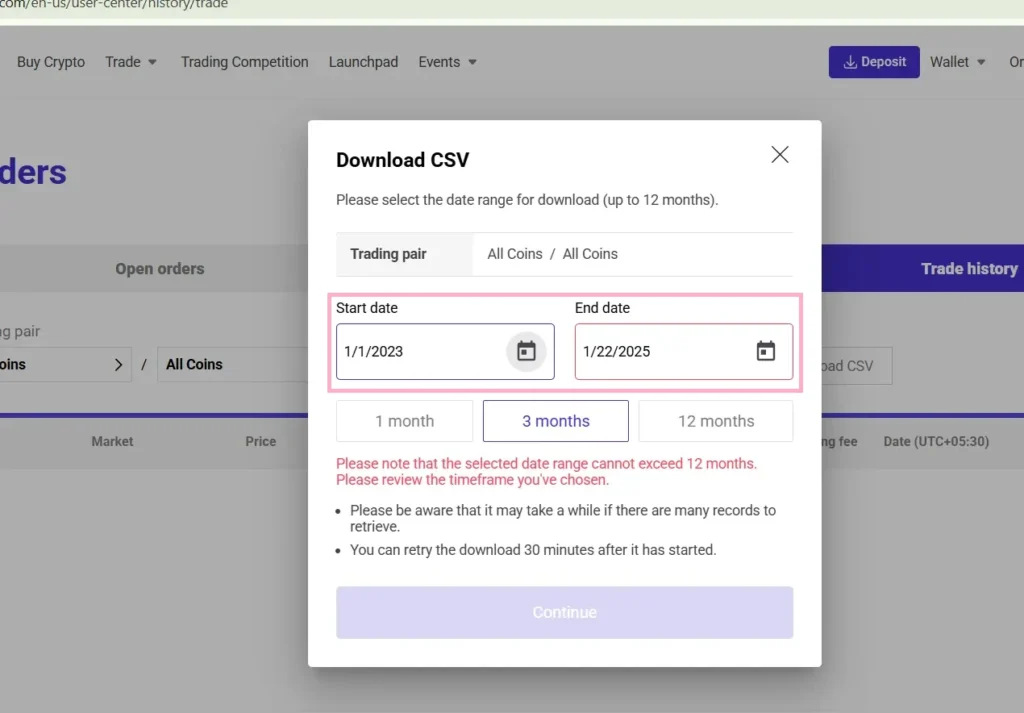

- Select Date Range and click download CSV.

- Set Start and End Dates cannot exceed 12 months.

- Now click

Continuefor CSV download

On Catax:

- Go to Catax.app

- Add your MEXC wallet,

- Choose the file import.

- Then Upload your CSV.

FAQs (Frequently Asked Questions)

To download your trade history, log in to your Probit Global account, go to the Orders > Trade History section, select the desired date range, and click the Download CSV button to export your transaction data.

No, Probit Global does not provide direct tax reports. However, you can export your trade history and use third-party tools like Catax to generate detailed tax reports.

Yes, crypto-to-crypto trades are generally taxable in most countries. Taxes are calculated based on the capital gains or losses from the trade.

Use API keys to connect your ProBit Global account to platforms like Catax for syncing transactions. If kept secure and used with read-only permissions, they are safe for tax calculation purposes.

Regularly export your trade history, categorize transactions properly (gains, losses, income), and use tools like Catax to generate tax reports that comply with your local tax laws.