Exporting your MEXC spot and futures history doesn’t have to be complicated. This guide provides clear, step-by-step instructions to help you efficiently download your spot and futures history, ensuring seamless tracking and management of your cryptocurrency transactions. Step-by-step guide for exporting MEXC transaction history.

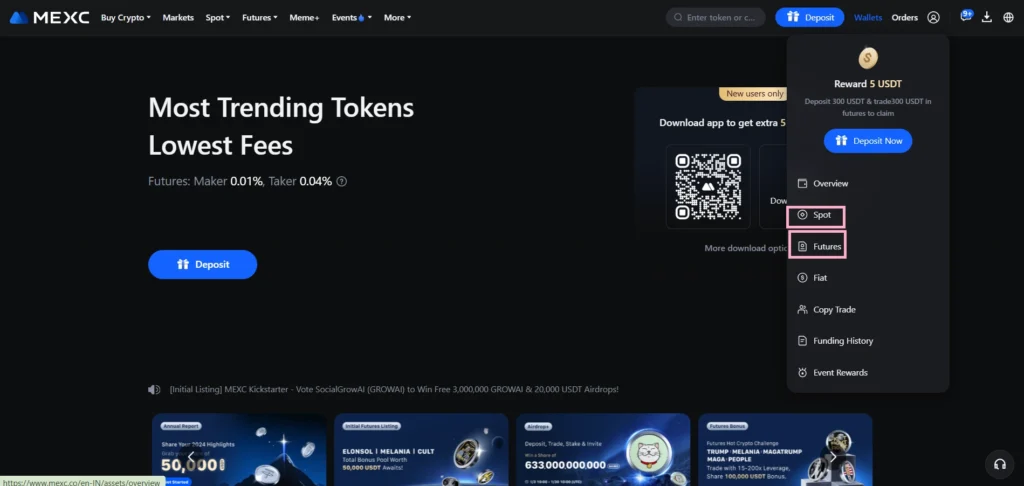

- Click your profile icon and select Spot or Futures to view balances and statements.

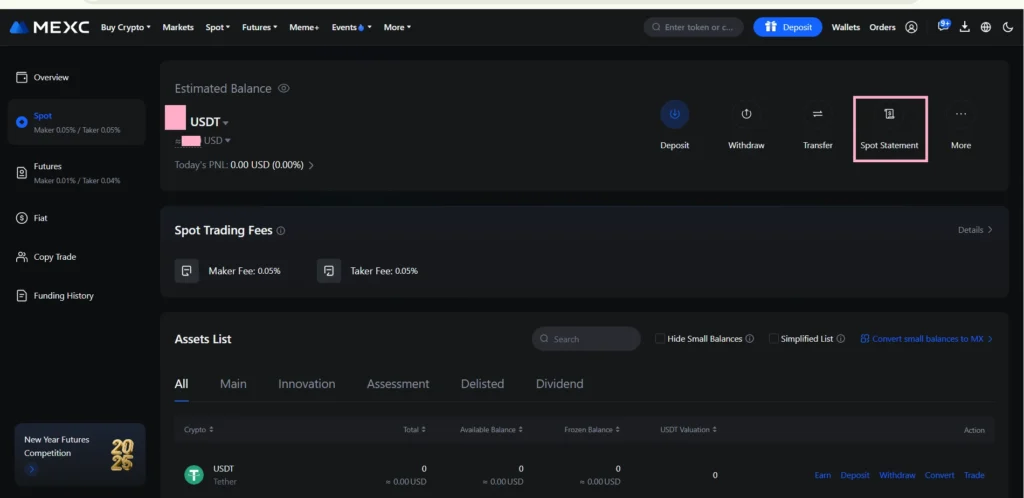

- Go to Spot Statement to check trading history. Do the same for Futures.

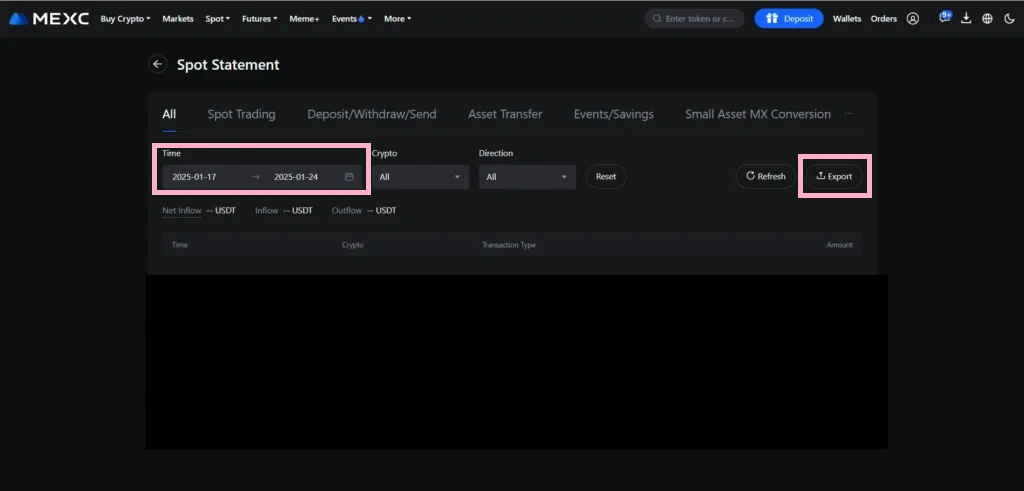

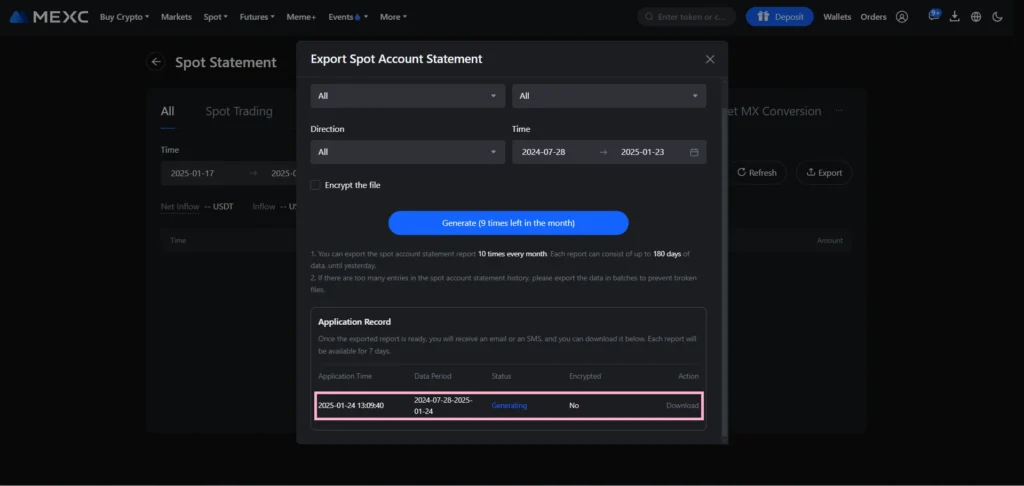

- Set filters (date, type, direction) and click Export.

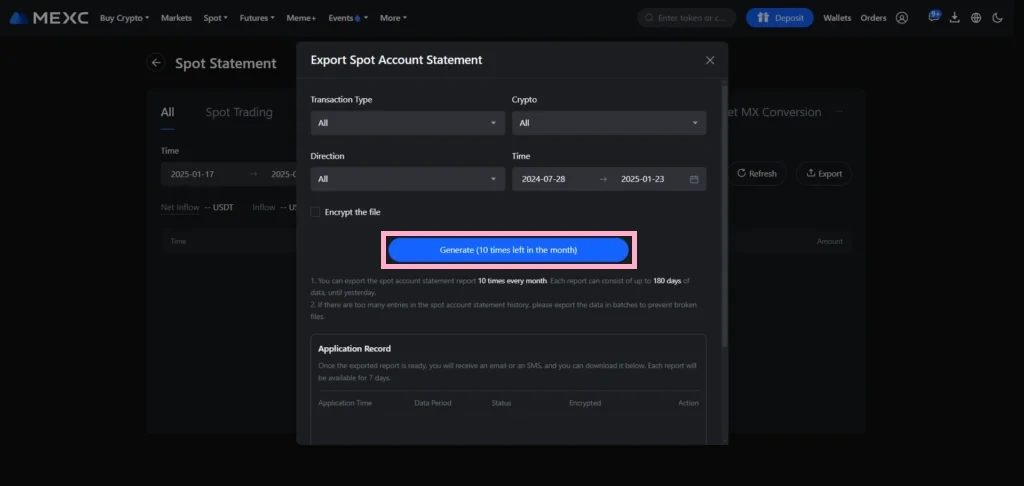

- Choose export option and click Generate to create the report.

- Click Download under Application Record to get the report.

Note: This applies to spot trade history on MEXC. To download your margin trade history, select the Margin Trade History section. The steps remain the same for other history sections.

Calculate Taxes Easily with MEXC and Catax!

Catax is the perfect solution for managing your crypto taxes, supporting platforms like Bitmart, Binance, WazirX, and more. It consolidates your trading data, making it easy to track profits, losses, and income across multiple platforms—all in one place.

What Makes Catax Special?

Catax connects seamlessly with MEXC to automatically import your spot and futures history. This ensures smooth tax preparation with accurate calculations. Whether you trade on Bitmart, Binance, or other platforms, Catax is your trusted tool for hassle-free tax filing.

Is It Safe to Add MEXC Trading History to Catax?

Absolutely! Adding your MEXC trade history to Catax is completely secure. Catax prioritizes your financial information’s safety, earning the trust of thousands of traders for accurate and secure tax reports.

Keep Your MEXC Trading History Secure

To enhance the security of your trading data:

- Use strong, unique passwords for your MEXC account and other platforms.

- Enable two-factor authentication (2FA) for an added layer of protection.

Why Use Crypto Tax Software?

Catax simplifies and streamlines crypto tax management by:

- Providing real-time updates for accurate tax calculations.

- Automating processes to save time and reduce errors.

With Catax, you can confidently manage your crypto taxes, stay compliant, and focus on your trading strategies without the stress of tax season!