Are you curious about your tax obligations regarding cryptocurrency trading in South Africa? Look no further! In this guide, we’ll provide you with all the necessary information to navigate the complexities of crypto taxation. From understanding your tax liabilities to step-by-step instructions on filing your Binance taxes in South Africa, we’ve got you covered. Stay informed and ensure compliance with South African tax laws with our easy-to-follow guide.

- Latest Crypto tax updates in South Africa

- What is the tax rate for trading crypto in South Africa?

- Can SARS trace crypto asset transactions?

- Crypto Transactions that are Subject to Tax in South Africa

- Investor vs Trader

- How South Africa Taxes Crypto

- Is there any way to reduce my crypto taxes?

- What happens in South Africa if I fail to file my crypto taxes?

- Using Catax to Manage Your Binance Taxes in South Africa: A Simplified Process

Do I need to pay tax on my cryptocurrency in South Africa?

In South Africa, you need to pay taxes on money you make from cryptocurrencies like trading, selling, or mining them. When you sell cryptocurrencies and make a profit, you also need to pay Capital Gains Tax. It’s important to include any money made from cryptocurrencies in your yearly tax return to follow South African tax rules.

So, if you’re trading on Binance or any other platform, you’ll likely have to deal with “Binance tax in South Africa”. And remember, Catax can help make figuring out your crypto taxes much simpler.

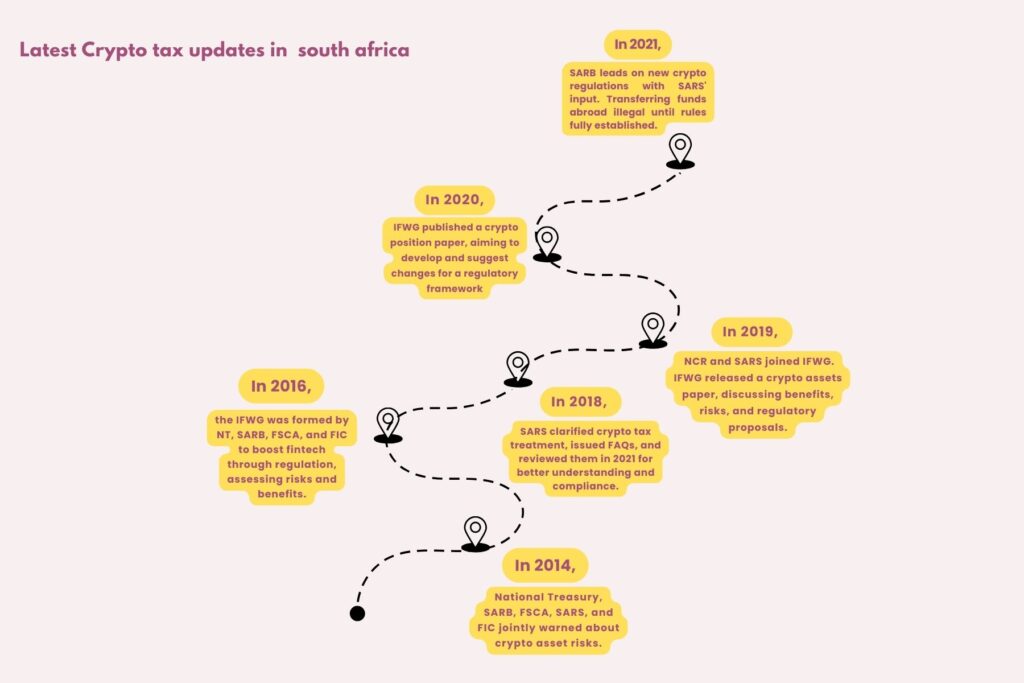

Latest Crypto tax updates in South Africa

In South Africa, crypto assets are considered “assets of an intangible nature” for tax purposes. SARS has also increased regulatory scrutiny to ensure tax compliance within the crypto sector. An annual capital gains exclusion of R40,000 is available, with 40% of any remaining gain taxable. Crypto transactions, including trades and payments for goods or services, are viewed as barter transactions, subject to capital gains tax at 18%. The adoption of the OECD’s Crypto-Asset Reporting Framework (CARF) by SARS aims to combat tax evasion and enhance transparency. Compliance and enforcement efforts are leveraging blockchain technology to trace and audit crypto transactions, indicating a move towards more sophisticated regulatory measures.

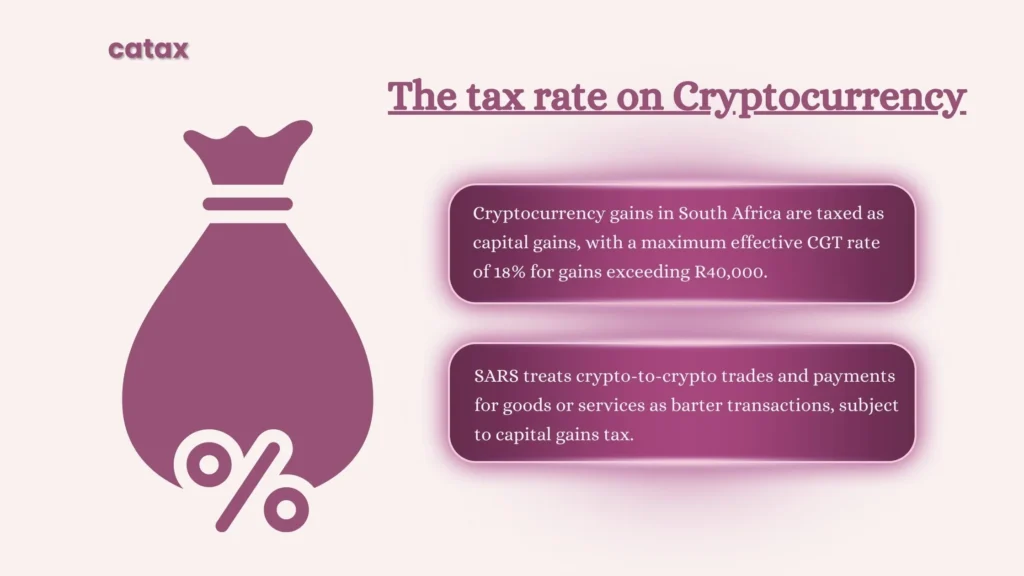

What is the tax rate for trading crypto in South Africa?

In South Africa, the tax rate for cryptocurrency transactions when filing Binance taxes primarily depends on whether the gains are classified as capital in nature. If a transaction is subject to Capital Gains Tax (CGT), individuals may pay a maximum effective rate of 18% on gains exceeding an annual exclusion of R40,000. This rate depends on their total taxable income. Additionally, 40% of any capital gains exceeding this exclusion become taxable for individuals. It’s important to note that the South African Revenue Service (SARS) treats crypto-to-crypto trades and payments for goods or services as barter transactions, taxing any resulting profit as capital gains at the mentioned rate.

Can SARS trace crypto asset transactions?

Yes, the South African Revenue Service (SARS) can trace crypto asset transactions. SARS utilizes a wide range of collection powers granted by the Income Tax Act, which includes the requirement for third-party service providers to submit financial data. SARS makes sure that crypto assets pay their taxes by using secret auditing and enforcement methods.

Moreover, SARS has aligned with the Crypto-Asset Reporting Framework (CARF), a global initiative developed by the OECD. This move signifies SARS’s commitment to enhancing tax transparency and combating tax evasion in the crypto sector. The CARF wants to make it easy for different places to automatically share information about crypto transactions with each other. Standard rules for reporting help make sure people pay the right taxes on their crypto activities. This is important because crypto deals often happen without much oversight. SARS is keeping up with the growth of cryptocurrency and setting rules to make sure taxes are fair and followed in the market.

Crypto Transactions that are Subject to Tax in South Africa

In South Africa, SARS taxes cryptocurrency like intangible assets. You get a R40,000 tax break on capital gains. After that, you pay up to 18% tax on the rest. Selling, trading, or using crypto for goods counts as taxable. Crypto trades and purchases act like swaps, with profits taxed as gains.

If you mine, stake, get airdrops, or hard fork income, it’s taxed up to 45% as income. But, holding it long-term might just tax you 18% as gains. Whether it’s taxed as gains or income depends on your intent and actions. They suggest using a FIFO method for accounting, but you can also pick another way. Therefore, it’s key to know these tax rules and maybe get a tax expert’s advice. To sum up, Crypto tax details can be complex and vary by your situation.

| Transaction Type | Capital Gains Tax (CGT) | Income Tax | Notes |

|---|---|---|---|

| Selling crypto for fiat | ✔ | ❌ | CGT applies if held as an investment, after R40,000 exclusion. |

| Swapping crypto for crypto | ✔ | ❌ | Treated like selling for fiat, may attract CGT. |

| Spending crypto on goods/services | ✔ | ❌ | Seen as barter, might be subject to CGT. |

| Gifting crypto | ✔ | ❌ | Subject to CGT, with specific exclusions. |

| Mining crypto | ❌ | ✔ | Counted as income and taxed when received. |

| Receiving crypto as payment | ❌ | ✔ | Taxed as income at market value when received. |

| Staking or lending rewards | ❌ | ✔ | Considered income, taxed upon receipt. |

| Airdrops | ❌ | ✔ (Assumed) | Likely treated as income, despite lack of clear SARS guidelines. |

| Buying and holding crypto | Not taxable until sold or otherwise disposed | ||

| Transferring crypto between wallets | Not a taxable event. |

Investor vs Trader

In South Africa, the way the tax authorities tax your crypto transactions hinges on whether they classify you as a crypto investor or trader.

- Investors: They experience a lighter tax treatment. When you sell crypto assets and make a profit, that profit is subject to Capital Gains Tax (CGT). The first R40,000 of your gain each year is not taxed. After that, 40% of your remaining gain is taxable at rates up to 18%. The tax authorities treat transactions such as trading one crypto for another or using crypto to pay for goods as “barter transactions,” and tax the profits from these as capital gains.

- Traders: On the other hand, face a heavier tax burden. When you frequently trade cryptocurrencies, the law taxes your profits as income at the marginal Income Tax rate, starting from the first rand you earn. You don’t get the R40,000 exemption, but you can deduct expenses that are directly related to your trading activities.

For example, if you hold an asset for more than three years, you usually consider it an investment for CGT purposes, highlighting your intent’s importance when you buy or sell.

Investment or trader taxation depends on your intentions and how often you purchase and sell crypto. Investors maintain assets for lengthy durations to increase capital. Traders buy and sell crypto regularly to profit from market swings. SARS considers crypto an intangible asset but hasn’t established crypto tax laws. General tax principles apply.

Due to the complex nature of crypto taxes and the lack of detailed guidance from SARS, it’s wise to seek advice from a tax professional who understands both the crypto market and South African tax laws. Furthermore, this ensures you stay compliant and optimally manage your tax obligations.

How South Africa Taxes Crypto

To file Binance taxes in South Africa, you must understand how crypto assets are taxed. They are subject to normal income tax rules, and taxpayers must declare their gains or losses as part of their taxable income. SARS has the authority to enforce tax obligations through various powers, including requiring third-party service providers to report financial data. Additionally, SARS has adopted the Crypto-Asset Reporting Framework (CARF), a global initiative to enhance tax transparency and combat tax evasion in the crypto sector.

Is there any way to reduce my crypto taxes?

South Africa considers cryptocurrency “assets of an intangible nature,” hence SARS has boosted crypto transaction monitoring to strengthen fintech regulation. Crypto investment capital gains are exempt up to R40,000 per year. Following this exclusion, individual taxpayers must pay an 18% tax on 40% of any leftover gain. To reduce your crypto tax liability in South Africa, consider these strategies:

- Harvesting losses: Selling assets at a loss to offset capital gains and reduce your tax liability.

- Receiving crypto as a gift: Not considered a taxable event. However, it’s important to keep records for future disposals.

- Investing in cryptocurrency via an IRA or 401-K: This allows for tax-efficient growth of investments.

- Hiring a specialized crypto CPA: They can help identify strategies to minimize your tax burden.

- Donating cryptocurrency: This can provide tax benefits as it is not considered a disposal event.

- Taking out a cryptocurrency loan: Avoids taxes on disposals by using crypto as collateral for fiat currency.

- Relocating: Moving to regions with more favorable tax rates, though this is more extreme.

- Keeping detailed records: Essential for accurately filing taxes and potentially reducing your tax bill.

- Using crypto tax software: Automates the process of generating comprehensive tax reports.

These tactics are for lawful tax avoidance, not tax evasion, a serious felony. To negotiate South Africa’s complex crypto taxation landscape, comply with local tax rules, and consult a tax specialist.

What happens in South Africa if I fail to file my crypto taxes?

In South Africa, failing to file crypto taxes can result in significant consequences, including a maximum prison sentence of up to five years for tax evasion or tax fraud. Additionally, the South African Revenue Service (SARS) can impose penalties of up to R16,000 a month for each month of non-compliance, up to a maximum of 35 months. It’s crucial to distinguish between legal tax planning and illegal tax evasion or avoidance, with the latter carrying severe penalties.

Using Catax to Manage Your Binance Taxes in South Africa: A Simplified Process

Connect Your Accounts Effortlessly: Start by linking your Binance and Catax accounts. This process involves generating API keys, which create a secure connection for transferring your transaction details directly to Catax. So It’s a straightforward way to ensure your crypto activity is recorded precisely.

Import Your Transactions Seamlessly: With a single click, Catax will begin to import all your Binance transactions, including trades, deposits, and withdrawals. It’s akin to having an efficient assistant who meticulously tracks every transaction. However, it’s still prudent for you to review the data to confirm its accuracy.

Review Your Data Thoroughly: Once your transactions are imported, take the time to verify that all details are correct. Addressing discrepancies early on is crucial for ensuring the integrity of your tax report.

Generate Your Tax Report with Ease: Catax simplifies the tax calculation process by generating a comprehensive report that clearly outlines your capital gains, losses, and potential deductions. This report is a crucial document that streamlines your tax filing process.

File Accurately with the Authorities: With your checked report ready, the next step is to file it with the South African tax authorities.

Frequently Asked Questions (FAQs)

Tax rates depend on whether gains are considered capital or revenue. CGT rates can go up to 18% on gains exceeding R40,000 annual exclusion. Income tax rates apply to revenue gains.

SARS can trace crypto transactions and enforce tax obligations through various means, including requiring third-party service providers to submit financial data. SARS has aligned with the Crypto-Asset Reporting Framework (CARF) to enhance transparency and combat tax evasion.

Some strategies are to collect losses, receive crypto as gifts, invest through tax-efficient vehicles, hire specialized CPAs, donate crypto, take out loans, move, keep thorough records, and use tax software.

Connect your Binance and Catax accounts, import transactions seamlessly, review data thoroughly, generate tax reports, and file accurately with the authorities.