This guide provides a detailed method for managing your Luno taxes. It’s tailored to help you, whether you’re new or experienced in trading, in correctly managing your tax matters related to your Luno transactions.

To make Luno tax reporting easier, consider using Catax, an effective cryptocurrency tax calculator. Follow these simple steps:

- Create an account on Catax : Choose India as your country and set the currency to INR.

- Safely link your Luno account to Catax. This will automatically transfer your transaction data.

- Catax will organize your Luno transactions, separating them into profits, losses, and income.

- After this, you can easily download your cryptocurrency tax report from Catax.

- Finally, use this report to file your taxes online or give it to your tax professional for assistance.

What is Luno and how does it work?

Luno is a trusted cryptocurrency investment app that lets you buy, keep, and learn about crypto safely. They focus on making cryptocurrency accessible and understandable for everyone. Since starting in 2013, Luno has helped millions worldwide to invest in crypto securely.

How do I file my luno taxes?

To handle your Luno taxes efficiently, integrating Catax into your process is a smooth solution. You can link your Luno account with Catax, either through an API for automatic data updates or by uploading a CSV file of your trades. This is important because Catax uses this data to accurately figure out your tax duties.

Once connected, Catax sorts your transactions to identify taxable events. It applies tax rules specific to your country. Catax is designed to deal with Luno taxes for users worldwide, so whether you’re in India, the USA, or elsewhere, it adjusts to your local tax laws, ensuring your reports are correct and lawful.

Catax does more than just calculate your Luno taxes. It also organizes them into clear reports, which is great for those not used to the complex nature of crypto tax reporting. This removes the chance of mistakes often made in manual calculations.

The reports from Catax provide a clear view of your Luno taxes and help you understand how to file them. With Catax’s thorough breakdown, you’ll get a clear picture of your tax position from your Luno activities and how they fit into your overall tax obligations.

In short, Catax is an essential tool for simplifying Luno tax calculations. Its ability to integrate with Luno, adapt to different global tax regulations, and generate detailed, compliant reports, makes managing crypto taxes much simpler for investors everywhere.

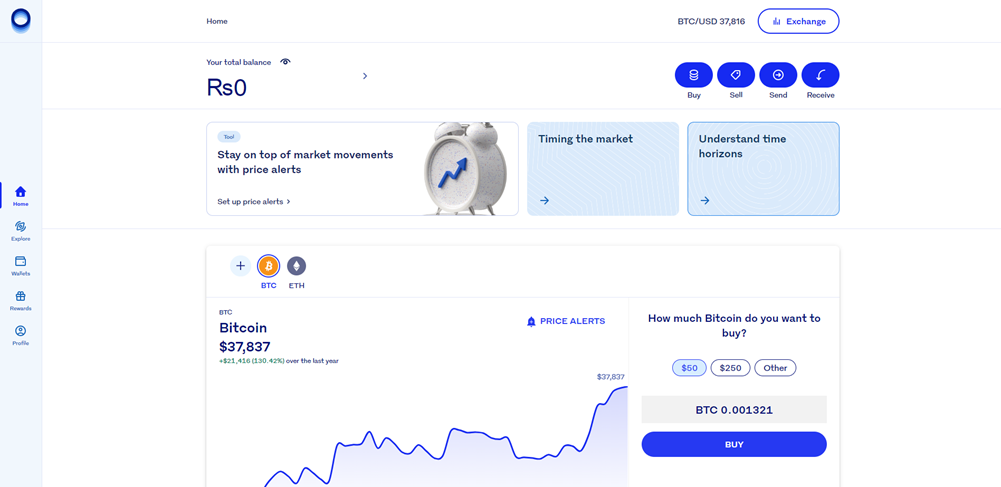

Connecting Catax and Luno:

For Luno:

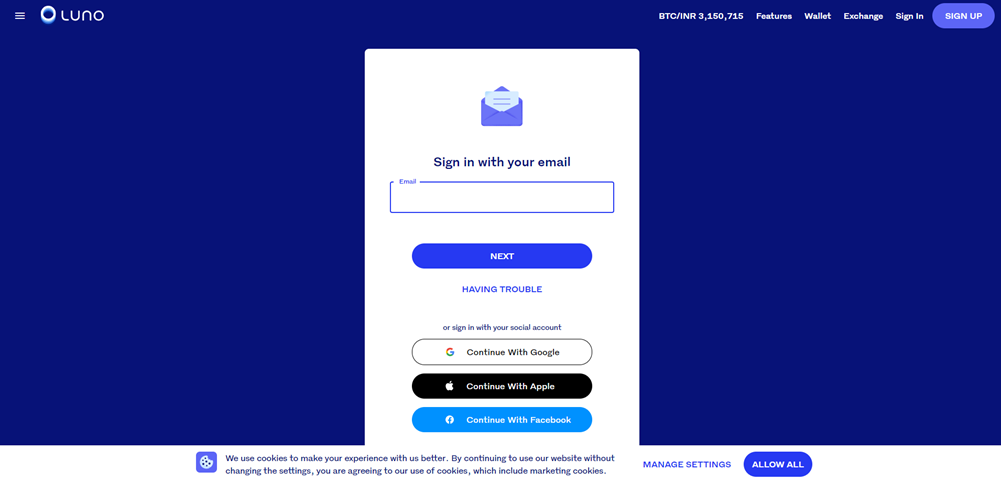

- Sign into your Luno account.

- In the bottom left corner, find and click on account settings.

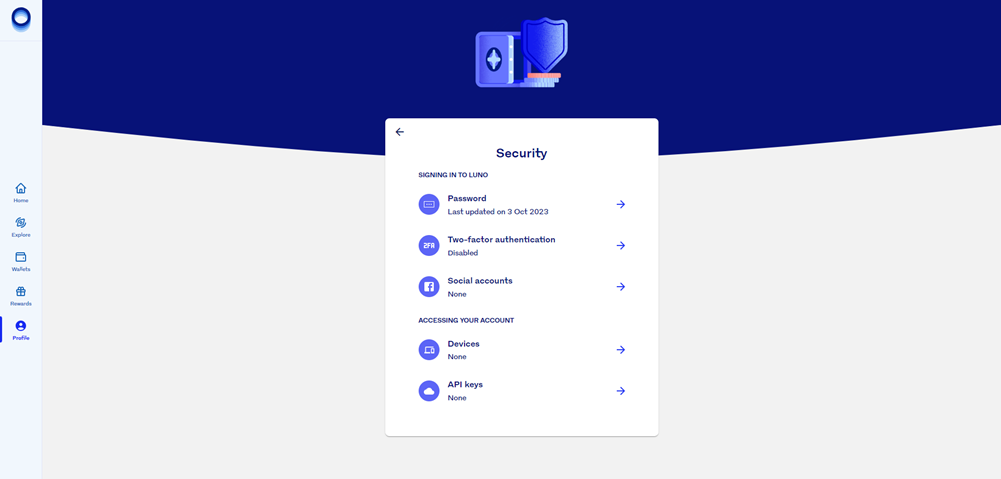

- Inside settings, go to the security section.

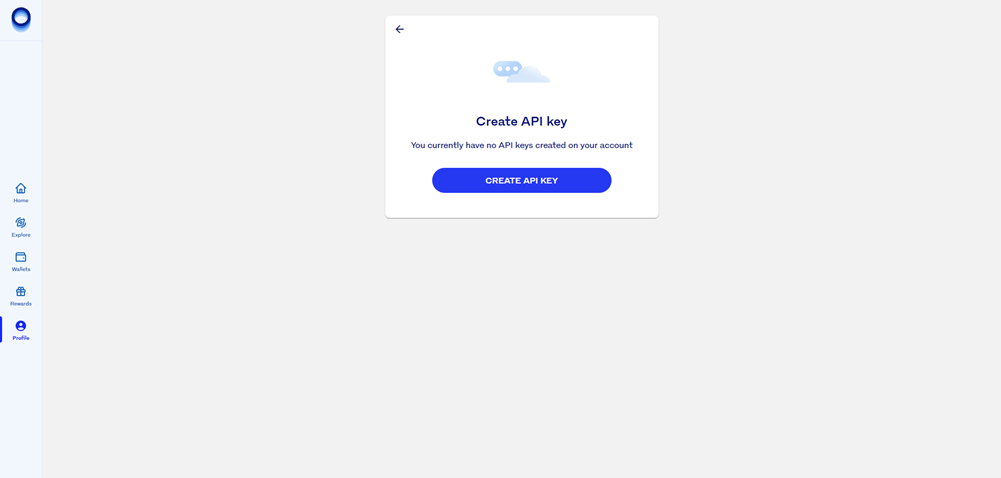

- In the Security area, choose API keys and opt to make a new API key.

- When in the API keys section, proceed to create a new API key.

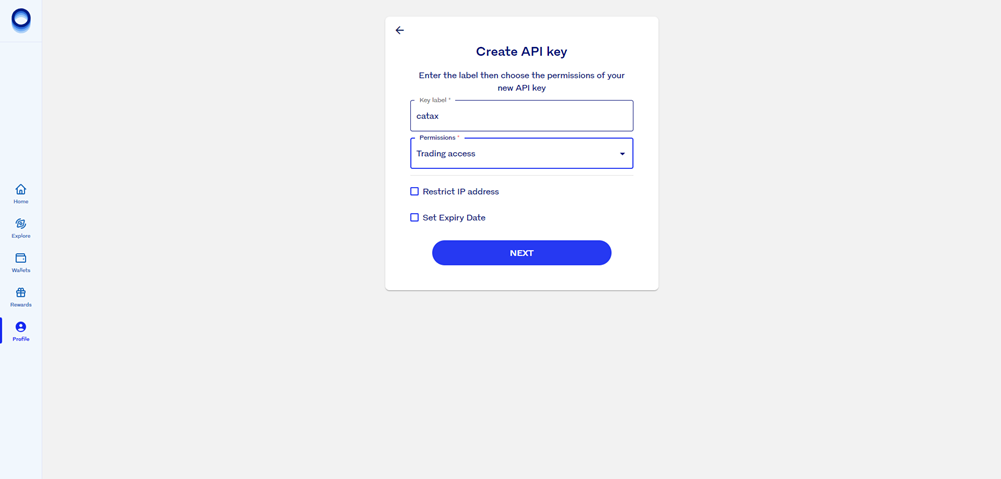

- Give your key a name (like ‘catax’) and decide whether you want trading access or read-only access.

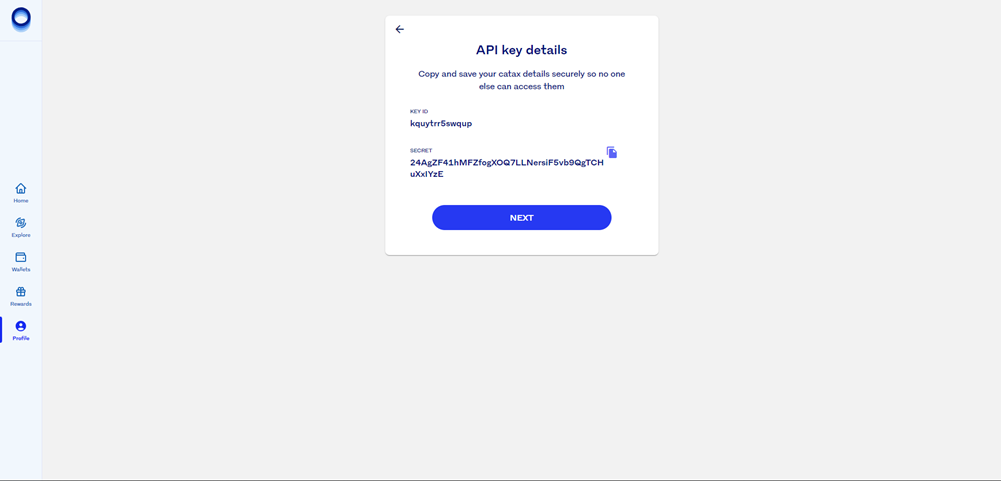

- Your API key is now successfully set up.

For Catax:

- Start via logging into Catax.

- Head over to the wallets area and upload your luno wallet.

- Set it to auto-sync after which input your API key and mystery to safely import your records.