If you’re preparing to file your Cryptocurrency taxes, you’ll need a record of your Binance account transactions to make precise computations. Here’s how to generate a transaction history for Binance:

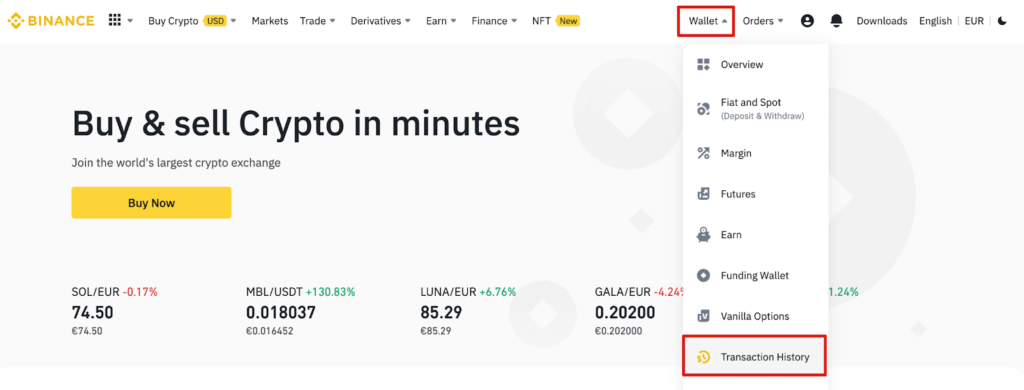

- Log in to your Binance account and go to the Wallet then the Transaction history section.

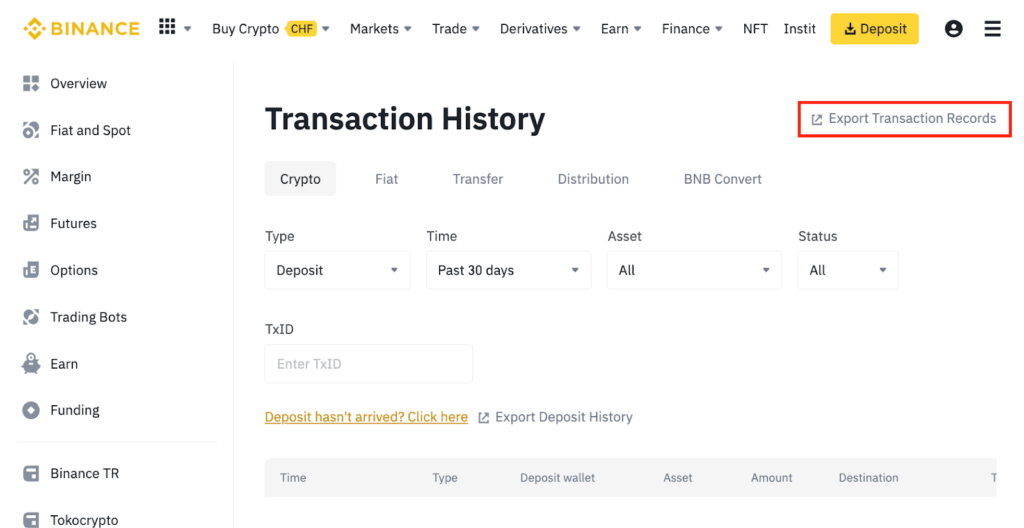

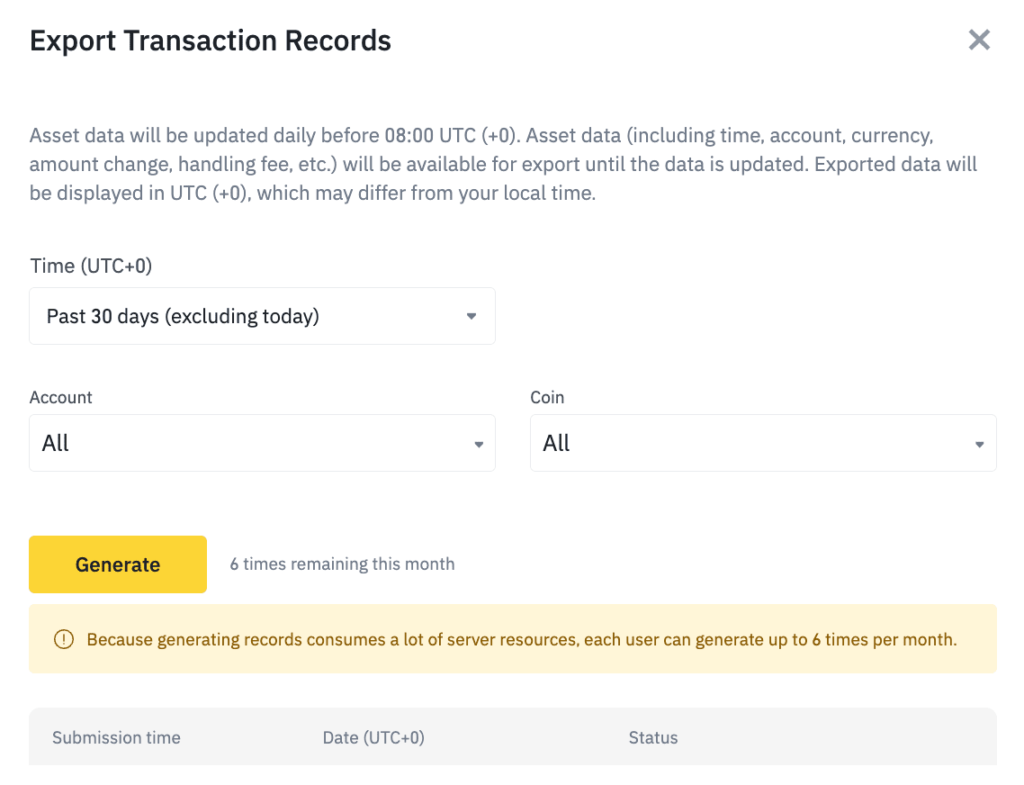

- Choose Export Transaction Records.

- Select the date range, account, and coin to include in your statement. Then press the Generate button.

#Please keep in mind that creating these records uses server resources, thus each user can only do so up to 15 times each month. *As Binance enhances the platform for a better user experience, the export limit may vary.

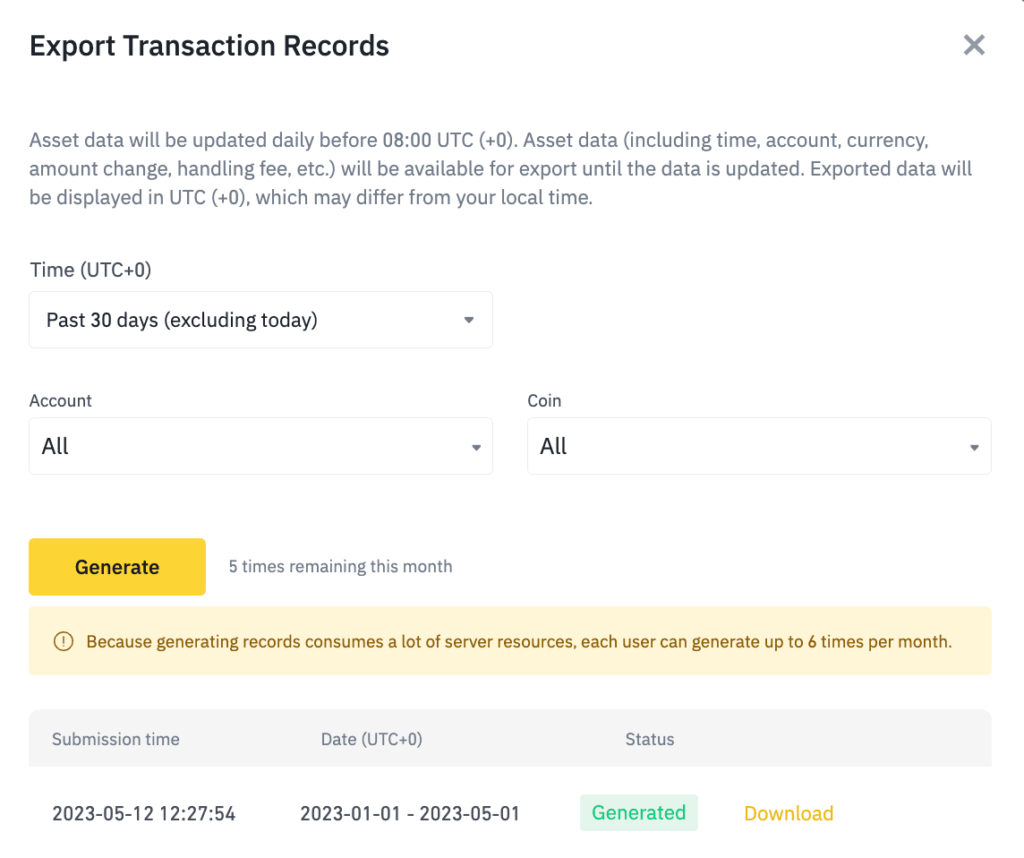

- You will be notified through SMS or email when the statement is complete.

- Now choose Transaction History then export transaction records from the menu. Find the Download button next to the created statement.

NOTE:- Remember that the download link for your Binance transaction history statement will remain valid for seven days only, so it’s essential to download it promptly to have a complete record for your tax reporting.

Lets Calculate Taxes with Catax

Catax is a handy tool for managing your crypto taxes. It works well with many big exchanges like Binance, WazirX, and others. It gathers all your trading info, making it easy to track your gains, losses, and income. This is really helpful if you trade on different platforms and need to organize all your tax info.

A Cool Thing About Catax:

One of the best things about Catax is how it easily collects your Binance transaction history. This makes getting ready for tax season much simpler and ensures everything is calculated correctly. So, for people using Binance, WazirX, or other exchanges, Catax is essential to make tax time less stressful.

Is it safe to add Binance trading history to Catax?

Yes, it’s safe to add your Binance transaction history to Catax. Catax takes your financial security seriously. It makes figuring out taxes for Binance trades easier while keeping your transactions safe. Many traders trust Catax for secure and easy tax reporting with their trading history.

Making Your Binance Transaction History More Secure:

To keep your trading history extra secure, do two things. First, use different passwords for each account to increase security. Second, enable two-factor authentication for an added layer of protection for your money and trades.

Why Crypto Tax Software is a better option

Catax is much better than the old way of doing taxes because it’s user-friendly and fast. It updates in real-time, so you know the info is accurate and follows tax laws. Plus, it automates tasks, saving time and reducing errors. This means people can manage their crypto taxes smoothly and with peace of mind.

As you prepare for tax season, here are a few more essential tips to keep in mind:

- Stay Organized: Keep a well-organized record of all your cryptocurrency transactions throughout the year. This will make the tax reporting process significantly smoother.

- Consult a Tax Professional: If you’re unsure about any aspect of cryptocurrency taxation, don’t hesitate to consult a tax professional or advisor. They can offer tailored guidance.

- Report Accurately: Accuracy is paramount when reporting your cryptocurrency earnings. Ensure that your tax calculations are precise to avoid any issues with tax authorities.