This guide will walk you through the process step by step, making it easy to manage your WazirX taxes and stay compliant. Whether you’re a trader or an investor, accurately reporting your transactions is essential to avoid any tax-related issues.

Do I Have to Pay Taxes When Using WazirX?

Yes, crypto transactions on WazirX are generally considered taxable under capital gains tax or income tax in many countries. Tax rates vary based on local regulations, and some regions may offer exemptions depending on profit thresholds or the holding period of your assets. For accurate tax calculations, it’s advisable to seek professional guidance.

If you find WazirX tax reporting challenging, try using Catax, an efficient cryptocurrency tax calculator. Follow these simple steps:

- Create a Catax Account: Sign up, select India as your country, and set INR as your currency.

- Connect with WazirX: Link your WazirX account to Catax to automatically import your transaction details.

- Sort Your Transactions: Catax will categorize your WazirX activities into gains, losses, and income for easy understanding.

- Download Your Tax Report: Get a detailed tax report from Catax for a clear overview of your crypto finances.

What are the various Taxes in WazirX Transaction?

WazirX transactions can be taxed at different rates depending on what you’re doing:

- 1% TDS (Tax Deducted at Source): If you buy crypto through the Income Tax Department (ITD), then make crypto-to-crypto trades over Rs 50,000 in a year, 1% of the transaction value is deducted as tax.

- 30% Tax: When you make a profit by selling, swapping, or spending crypto, you typically have to pay a fixed 30% tax on that profit.

- Income Tax at Your Tax Rate: if you receive crypto as a form of payment or in exchange for goods or services, it could also be considered taxable income. On the other hand, if you hold onto your crypto and it increases in value, you may be subject to Capital Gains Tax when you sell or exchange it. However, it’s important to consult with a tax professional to ensure compliance with tax laws and regulations.

These tax rates can change depending on your specific transactions and earnings, so it’s crucial to understand how they apply to your situation.

Additionally, WazirX has developed a user-friendly interface and robust security measures to ensure a smooth and secure trading experience for its users. Furthermore, the platform provides real-time market data and advanced trading tools to assist users in making informed decisions. Consequently, WazirX has become a preferred choice for individuals looking to participate in the burgeoning cryptocurrency market in India.

Connecting Your WazirX Account with Catax via API

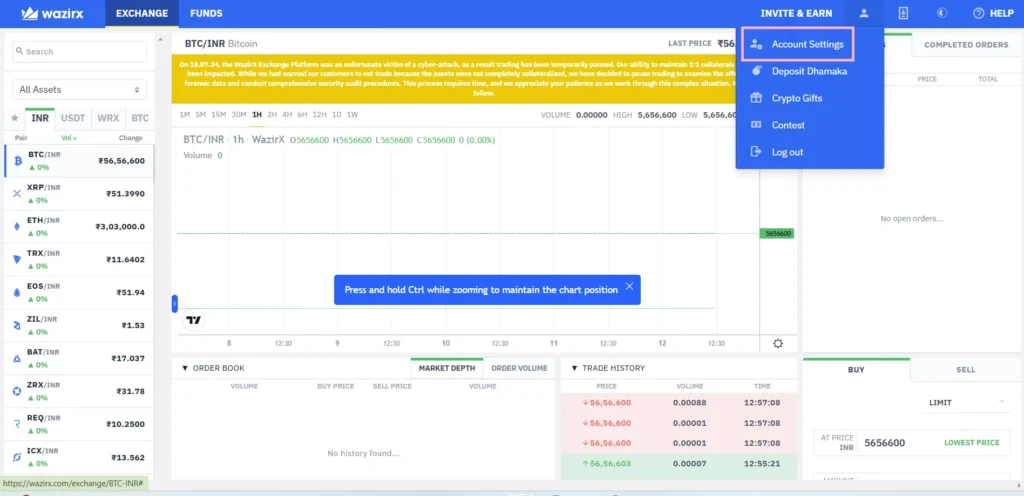

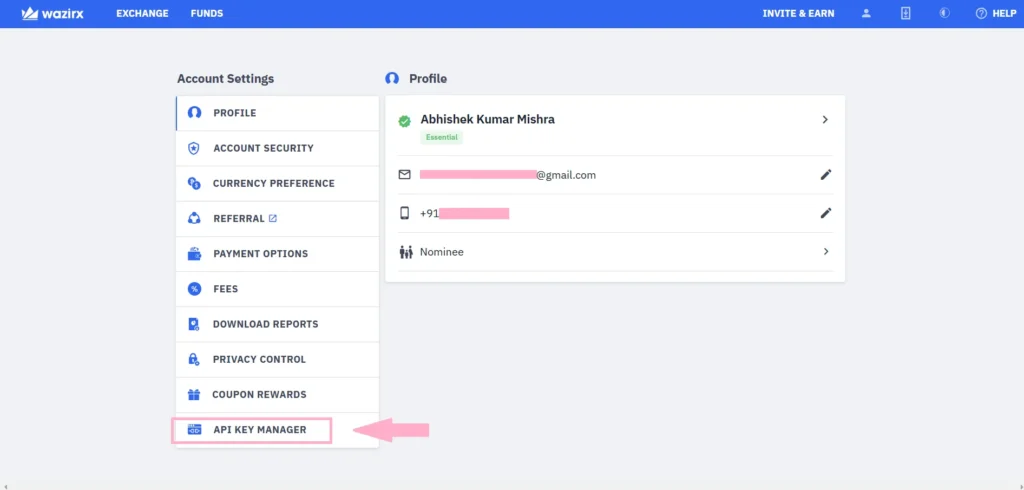

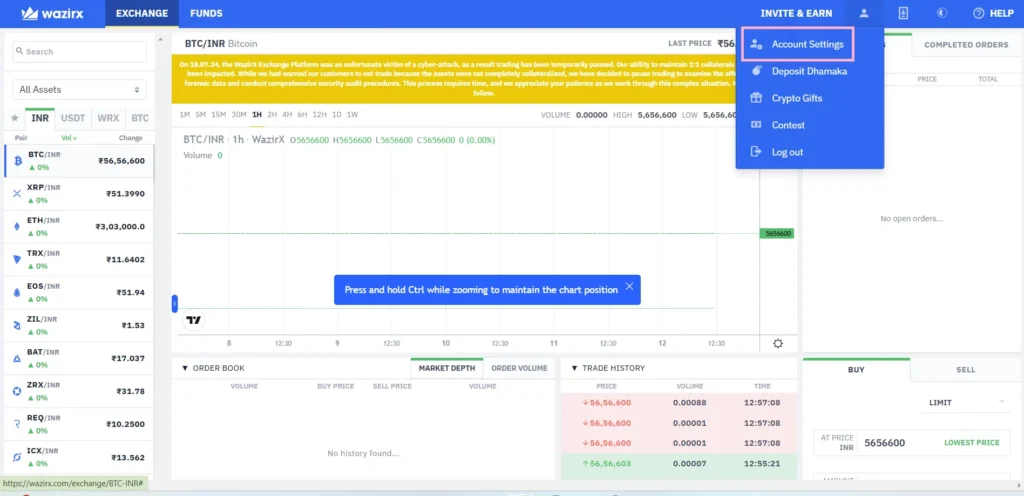

- In the top right corner, click on the profile icon and choose Account Settings.

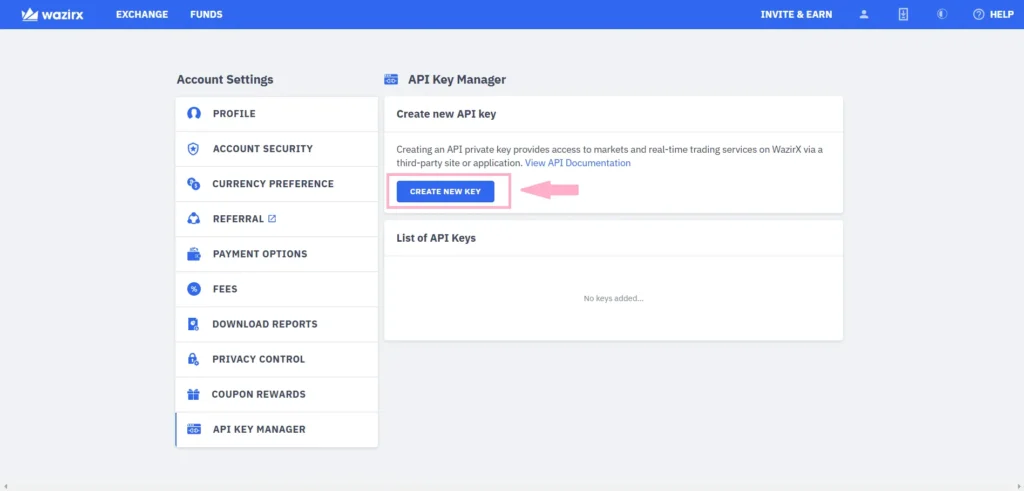

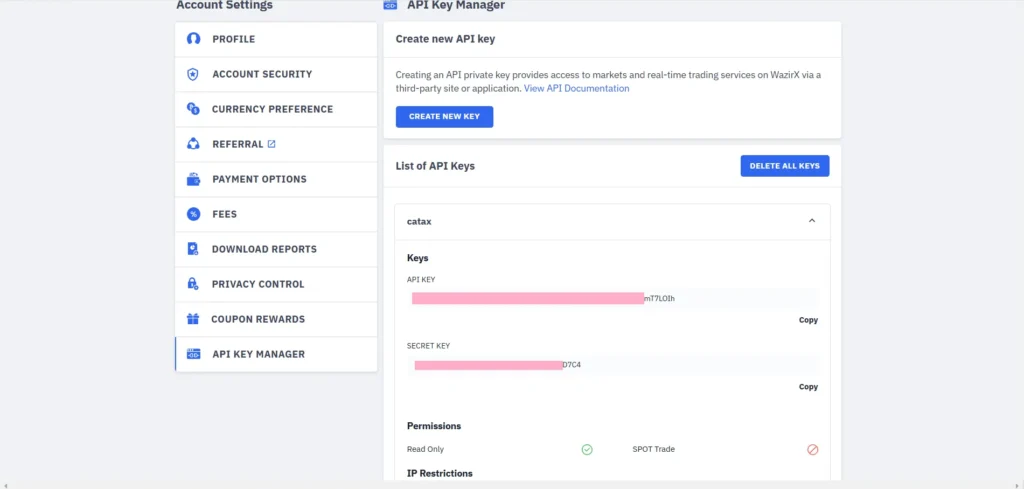

- Click on CREATE NEW KEY.

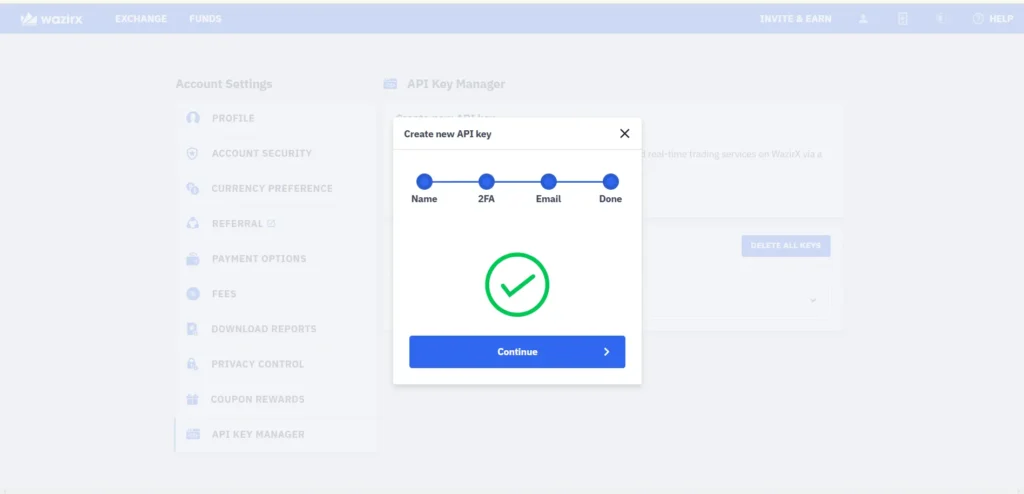

- Give your API key a name, for example, Catax and complete the 2FA.

- The API and Secret key will be ready.

On Catax:

- First, log in to your Catax account.

- Go to the integration section, select WazirX and enter your API and secret key.

- Enable auto-sync to sync the full transaction history.

Connecting Your XT.com Account with Catax via Trade History

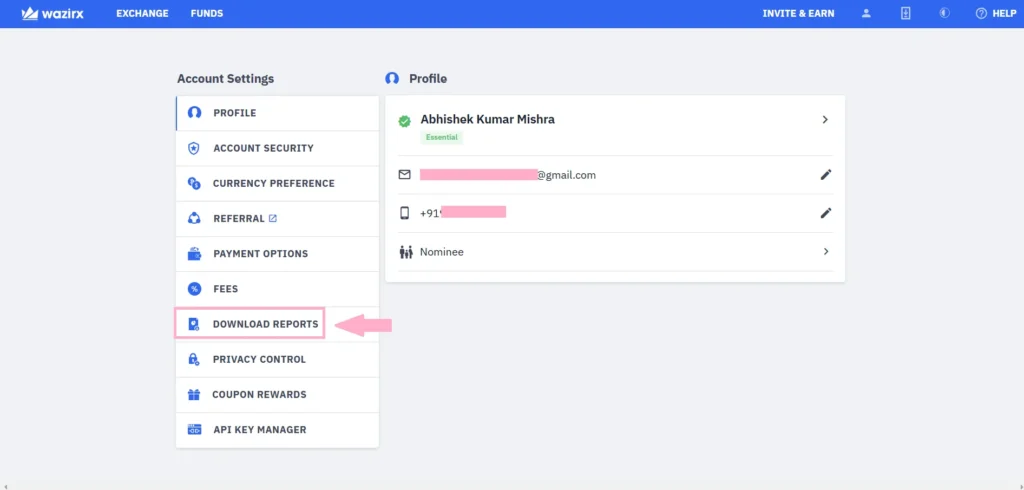

- In the top right corner, click on the profile icon and choose Account Settings.

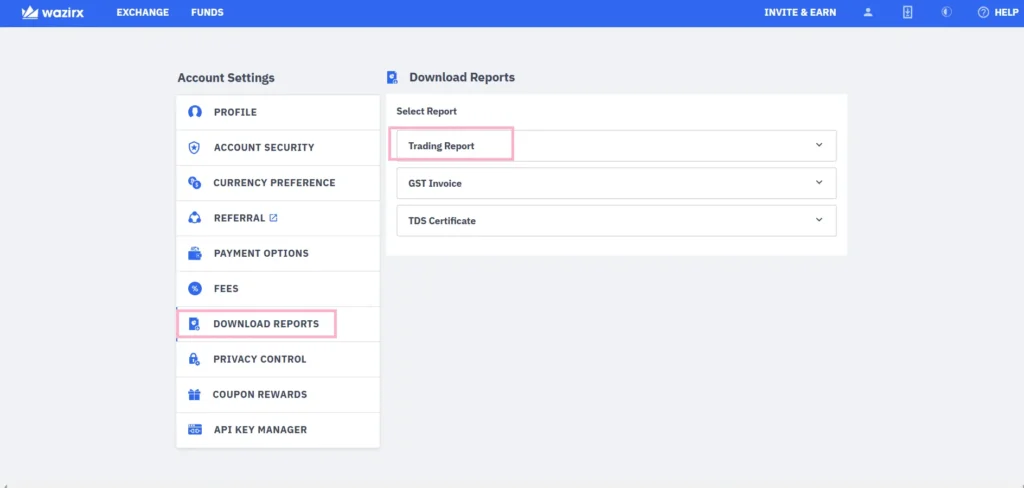

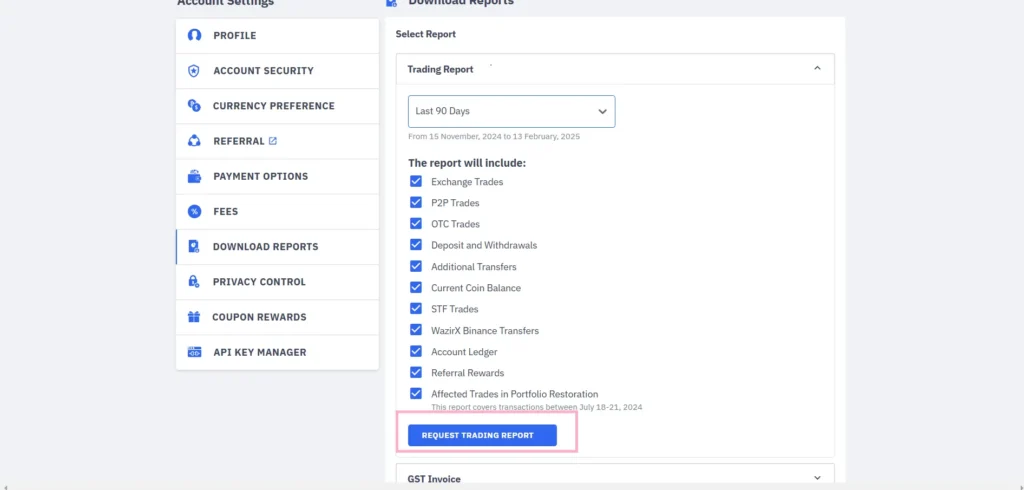

- Click on the Trading Report section.

- Set your Time Range, check all the boxes and then click on REQUEST TRADING REPORT.

On Catax:

- First, log in to your Catax account.

- Go to the integration section and enter your API and secret key.

- Enable auto-sync to sync the full transaction history.

FAQs (Frequently Asked Questions)

Yes, tax tools like Catax, Koinly, ZenLedger, and CoinTracker support WazirX API integration to import transactions and calculate tax reports automatically.

Transferring funds from WazirX to another wallet does not trigger a taxable event. However, converting crypto to fiat before withdrawal incurs capital gains tax.

Yes, tax authorities tax rewards from staking, lending, or earning interest on WazirX as income based on their fair market value at receipt.

You should report crypto taxes annually with your regular tax return. However, some countries require active traders to file taxes quarterly.

Yes, tax authorities typically apply capital gains tax to NFT sales and income tax to rewards earned from NFT activities like royalties or staking.