This guide is a comprehensive resource for understanding and calculating Binance taxes in Canada. Additionally, it provides clear instructions and essential information to navigate through the process with ease and accuracy under the latest 2024 CRA Rules.

How to do your Binance taxes in Canada with simple and Easy Steps?

Start Connecting Catax and Binance: Kick things off by linking your Binance and Catax accounts. You’ll use API keys for a safe link-up. It’s pretty straightforward.

Import Your Trades: Catax jumps into action, pulling in your Binance trades, deposits, and withdrawals. Check everything to ensure no transaction gets missed.

Review Everything: Now, take a close look at your transactions. Spotting any differences or missing bits is crucial for accurate tax calculations.

Pick Your Tax Year: Select the year you’re sorting taxes for. This ensures your Catax report matches what the CRA expects.

Generate Your Report: Catax works its magic, crafting a detailed tax report. This includes all the gains and losses in the CRA needs.

Double-check the Report: Give your tax report a thorough review. You want to catch any errors to make sure it’s spot-on.

Submit to the CRA: Once you’re happy with the report, send it off to the CRA. Remember, beating the deadline is key to avoiding any hiccups.

Why This Matters: Dealing with crypto taxes keeps you right with the CRA and ensures you’re making the most of your investments. Catax makes this whole process simple and stress-free. It’s like having a tax pro by your side, guiding you through each step, ensuring you tackle tax season with confidence.

How Catax Can Streamline Your Binance Taxes in Canada

Additionally, as cryptocurrency continues to make waves in the investment and transaction worlds across the globe, Canada is no exception. Moreover, with the rising interest, there’s been a significant uptick in accounting professionals offering specialized tax services for the crypto space. It’s always a smart move to get advice from these savvy accountants to manage your crypto taxes smoothly.

Additionally, Catax provides comprehensive tax reporting services, including the calculation of capital gains and losses. Furthermore, Catax ensures compliance with Canadian tax laws and regulations, giving you peace of mind. Moreover, Catax’s team of experts is dedicated to simplifying the complex world of crypto taxes for Canadian taxpayers.

Making Tax Reporting a Breeze with Catax: Catax delivers a hassle-free sync process. By connecting your Binance account to Catax, the platform securely pulls your trading history, streamlining the task of calculating your crypto taxes without a hitch.

Step-by-Step Sync Guide: To enhance your experience and ensure you’re getting the most out of Catax, a detailed guide on linking your Binance account with Catax will be handy. This step ensures you can generate precise and compliant tax reports effortlessly.

Tax Calculation Tips: Binance’s Canadian crypto tax calculator comes in handy, offering a solid ballpark figure of the taxes you might owe from your crypto trading adventures.

Is Binance Taxable in Canada?

In Canada, the Canada Revenue Agency (CRA) views cryptocurrency as a type of property. This means when you make money from it, you need to pay taxes, similar to how you would with profits from stocks or real estate. The taxes you pay depend on whether your crypto activities are considered as running a business or just personal investments. If it’s investment income, you’re taxed on half of your capital gains. But if it’s business income, the whole amount is taxable.

Figuring out if your crypto dealings are a hobby or a full-blown business is crucial here. In this guide, we dive into how each scenario affects your taxes and tackle some common queries around crypto taxes in Canada, especially focusing on “Binance tax in Canada.” With Catax stepping in, managing your crypto taxes becomes clearer and simpler, ensuring you stay on the right side of the CRA’s rules.

Tax Rate of Crypto in Canada – 2024

In Canada, when it comes to paying Binance taxes on your crypto gains in 2024, the situation is pretty straightforward. Unlike some places that have different tax rates for short-term and long-term gains, Canada doesn’t differentiate. Here, whether you’ve held your crypto for a short period or a long one, your capital gains from crypto are taxed just like your regular income, following both Federal Income Tax and Provincial Income Tax rates.

However, there’s a silver lining for individual crypto investors. You’re only on the hook for taxes on half (50%) of your capital gains. But if you’re trading crypto like a pro, akin to a day trader, the rules tighten up a bit, requiring you to pay taxes on the full 100% of your gains.

| Federal income tax bands (CAD) | Income (2022) | Income (2023) |

|---|---|---|

| 15% | On your first $50,197 of taxable income | On your first $53,359 of taxable income |

| 20.5% | $50,197 – $100,392 | $53,359 – $106,717 |

| 26% | $100,392 – $155,625 | $106,717 – $165,430 |

| 29% | $155,625 – $221,708 | $165,430 – $235,675 |

| 33% | $221,708+ | $235,675+ |

What is the Difference Between Capital Gains and Business Income

Figuring out if your crypto hustle counts as a business or just some savvy investing can be a head-scratcher. It’s like this: the details depend on your unique situation, and sometimes, it’s best to chat with a tax pro to get the lowdown. But here’s a quick guide to help you start thinking about it:

| What’s Your Vibe? | Business Income | Capital Gains |

|---|---|---|

| What Are You Up To? | – Pumping up a product or service<br>- Drafting a business blueprint<br>- Stocking up on inventory or assets | – Dabbling in a few transactions here and there |

| What’s Your Goal? | – Eyeing that profit like a hawk | – Not really counting on it to pay the bills |

| How’s It Look to the Outside? | – Looks like you’ve set up shop for commercial reasons | – More like a hobby or side interest |

| Consistency? | – Regular as your morning coffee | – Sporadic, like picking up a new hobby |

| Could One Deal Seal the Deal? | – Yep, sometimes one big move screams “business” | – Rarely the case, but again, it’s about the whole picture |

So, What Counts as a Crypto Business?

- Mining Crypto: If you’ve got a rig and you’re mining, it’s pretty much a business.

- Trading Regularly: More trades than you have fingers? Sounds business.

- Running an Exchange: If you’re the go-to for swapping crypto, that’s a definite business.

CRA track Binance or Not?

The Canadian government has its ways of keeping an eye on crypto transactions, even with the privacy crypto tends to offer. However, if you’re trading big, like over $10,000 big, crypto exchanges have to give the Canada Revenue Agency (CRA) a heads-up about your transactions.

Now, if your trades don’t hit that $10,000 mark, don’t think you’re flying under the radar. Crypto exchanges in Canada still need to know who you are and keep your details on file, just in case the CRA asks. So, it’s smart to play it safe and act as if the CRA can see all your crypto moves.

Regarding staying on the right side of the rules, especially with your Binance taxes in Canada, it’s wise to report all your crypto dealings. If you’re finding it a bit daunting, don’t worry. Our team here at Catax is all geared up to help you stay compliant, not just this tax season but every tax season moving forward.

The CRA & crypto tax in Canada

The Canada Revenue Agency (CRA) is the authority managing tax laws for both the Government of Canada. Additionally, in most provinces and territories, it oversees how crypto tax works in Canada too.

Here’s the scoop from the CRA: “Money you make from dealing with cryptocurrency usually counts as either business income or a capital gain. All based on what’s going on with your transactions. And just like that. If you’ve got earnings that fall into business income or capital gains, any losses you have are considered business losses or capital losses.”

So, whether you’re pocketing some cash from your crypto adventures or facing a bit of a financial dip. how it impacts your taxes hinges on whether the CRA sees your crypto activity as a business move or an investment strategy.

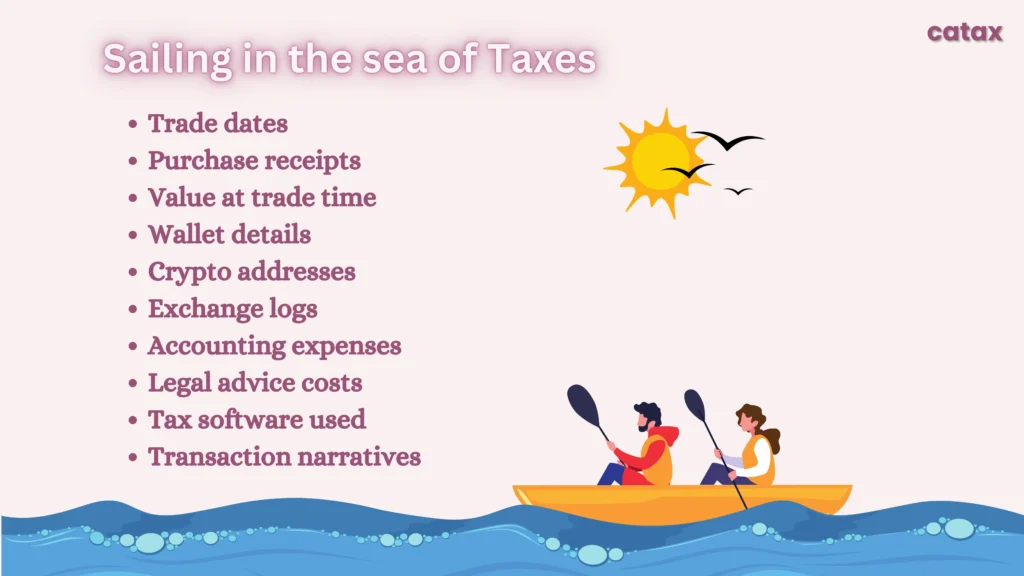

Navigating Crypto Tax Seas

Sailing through the waters of crypto taxes means keeping a log of all your digital currency dealings across various platforms. Each exchange is a unique island with its way of tracking your treasure. As a savvy crypto navigator, you’re required to map out each transaction for the tax officials, holding onto these records for a good six years after the tax year’s close.

Your treasure map should mark the spots of:

- Dates when you traded the digital gold

- Receipts of your purchases and bounty transfers

- The market’s whisper of your crypto’s value when you traded

- The safe harbors where you dock your crypto (wallets)

- The secret codes of your crypto (addresses)

- Logs from each exchange island

- The coins spent on your tax-savvy crew (accounting costs)

- Advice from legal sages

- Tools that help you tally your crypto coins (tax software)

- Tales of each crypto quest (transaction descriptions)

Binance and Your Canadian Tax Journey

While Binance doesn’t hand over tax documents for your returns, they’ve got a handy record of your trades. Just hop onto your account and grab your transaction history anytime. It’s not a complete tax package, but it lays out all your Binance moves for you.

To dig into this treasure trove, there’s the Binance Tax Tool at your service. Peek at your tax dealings, tweak them and then hit generate for a report that eases up the task of figuring out what you owe.

And here’s a heads-up for the Binance tax in Canada: Binance doesn’t report every single transaction to the Canada Revenue Agency (CRA), but they do spill the beans on any that hit the $10,000 mark. It’s not just them; any financial platform, including the likes of crypto.com, has to report these big-ticket transactions. It’s all about keeping things above board when it comes to the big bucks!

Navigating Canadian Crypto Taxes: A Friendly Heads-Up

So, you’re thinking about cashing out your crypto? In Canada, that’s going to bring taxes into the picture. Whether it’s seen as business income or a capital gain, the taxman, aka the Canada Revenue Agency (CRA), expects a slice of the pie. And here’s something many folks might not know — the CRA has its eyes on all things crypto. They’re in cahoots with various crypto platforms, ensuring that everyone’s playing by the tax rules.

Now, the CRA also dances with FINTRAC, short for Financial Transactions and Reports Analysis Centre of Canada. These guys are the financial watchdogs, sniffing around for dodgy dealings like money laundering and tax dodging. And yep, they’re pretty good at connecting the dots back to you, thanks to the ID info they’ve got.

When it comes to “Binance taxes in Canada,” there’s really no magic cloak of invisibility to dodge taxes. And trying to outsmart the system? Well, that could land you in the hot seat for tax evasion.

Some folks think they can sidestep taxes by parking their money in TFSAs (Tax-Free Savings Accounts) or RRSPs (Registered Retirement Savings Plans). But crypto doesn’t play that game — these accounts aren’t a hideout for your digital coins. And even with other investments, messing up could mean penalties and taxes knocking at your door.

But hey, if you’re looking to grow your crypto stash, you might look into crypto-backed ETFs or other crypto investment avenues. Just remember, when it’s time to turn those investments into cash, the CRA will want to know. It’s not about skipping the tax part; it’s about possibly making your money work harder for you.

Making Canadian Crypto Taxes a Breeze with Catax

For Canadians tangled in the complex web of cryptocurrency taxes, Catax offers a breath of fresh air. Additionally, picture this: a crypto tax calculator that’s as Canadian as maple syrup, works with over 750 crypto platforms, and calculates your gains and losses..

Filing your taxes with the CRA can feel like walking through a maze blindfolded, but it’s no secret they’re keeping tabs on your crypto transactions. That’s where Catax steps in—it gathers all your crypto adventures in one place, helping you steer clear of mistakes. Skipping a transaction could lead to a mountain of stress, so leaning on Catax can smooth out the journey.

How should You Avoid Binance Taxes in Canada

- Hang onto Your Crypto: Think of your digital coins like a collection of hockey cards. If you keep them in your virtual binder and don’t sell them, you won’t trigger any gains that the tax folks can see.

- Choose Your Moment: If you’re having a year where your income is more like a gentle stream than a roaring river, it might be the perfect time to cash in on some of your crypto.

- Smart Loss Moves: Just like in hockey, sometimes you can turn a loss into a win. If you’ve got capital losses, they can play defense against your taxable capital gains, cutting what you owe by up to 50%.

- Give Generously: Sharing is part of the Canadian way, eh? If you donate your crypto to a registered charity, not only do you spread kindness, but you also get a nice tax credit to boot.

- Tuck It Away for Later: With a TFSA or RRSP, you can shield your crypto growth from taxes. For 2023, you’ve got a $6,500 goalie guarding your TFSA net and up to $30,780 or 18% of your income for the RRSP rink. While the RRSP saves you taxes now, remember you’ll face the tax music when you withdraw.

Some crypto transactions that are tax-free in Canada.

- Buying and holding crypto with fiat currency.

- Getting crypto as a gift.

- Transferring crypto between your own wallets.

- Starting a DAO (Decentralized Autonomous Organization).

In the world of Canadian crypto, not all moves you make will have the taxman knocking. Here’s a friendly rundown of what’s chill, tax-wise:

Frequently Asked Questions(FAQs)

Absolutely! Catax makes it super simple to keep an eye on all your Binance trades, ensuring nothing slips through the cracks.

Nope, if you’re just holding on to your crypto without selling, you’re in the clear and don’t need to report it as a gain or income.

Don’t sweat it! Mistakes happen. You can always amend your report. Catax can help ensure everything is accurate before you submit.

Catax simplifies the whole process, from tracking transactions to generating the tax report that aligns with CRA guidelines, making your tax season stress-free.

Transferring crypto between your wallets is not a taxable event, so you can move your digital assets around without tax worries.

Yes, Catax can manage transactions across various platforms, not just Binance, making it your one-stop solution for crypto taxes in Canada.