Welcome to your friendly guide on sorting out your バイナンス – Bainansu – Binance taxes in Japan! With a few simple steps, we’ll make sure you’re all set to meet the National Tax Agency’s (NTA) rules without breaking a sweat.

How to do your Binance taxes in Japan with simple and Easy Steps?

- Connect Catax and Binance: Start by linking your Binance account to Catax using API keys. This is how they talk to each other securely and share your transaction data. It’s easier than it sounds, promise!

- Gather Your Trades: Catax will now start pulling in all the details of your trades, and money moving in and out of Binance. Make sure to check that it’s grabbed everything, so nothing slips through the cracks.

- Review Your Transactions: Take a good look at what Catax has gathered. This step is super important because you want to catch any discrepancies early on. It’s all about making sure every dot is connected.

- Choose Your Tax Year: In Japan, the tax year runs from January 1st to December 31st. Pick the year you’re working on to ensure your Catax report is in line with what the NTA is expecting for that period.

- Generate Your Tax Report: Let Catax do its thing and put together a comprehensive tax report for you. This report will cover all your crypto gains and losses, exactly what the NTA needs to see.

- Double-check Your Report: Before you think about submitting, go over your report in fine detail. You’re looking to catch any potential errors to make sure your submission is flawless.

- Submit to the NTA: Feeling confident about your report? Time to submit it to the National Tax Agency. Just make sure you’re doing this before the deadline to keep everything on track.

Why This Matters:

Staying on top of your Binance taxes in Japan keeps you in good standing with the NTA and ensures you’re accurately reporting your crypto activities. Plus, using a tool like Catax not only simplifies the process but also gives you peace of mind knowing you’re covering all your bases.

Is Crypto of Binance Taxable in Japan?

In Japan, think of cryptocurrency like you would any other piece of property. It falls under the “Miscellaneous Income” category, according to laws like the Payment Services Act (PSA) and the Financial Instruments and Exchange Act (FIEA).

The good news: you won’t face any taxes just for buying, holding, or moving your crypto from one wallet to another. Also, the National Tax Agency (NTA) treats everyone the same when it comes to crypto taxes, not making any special rules for individuals or businesses.

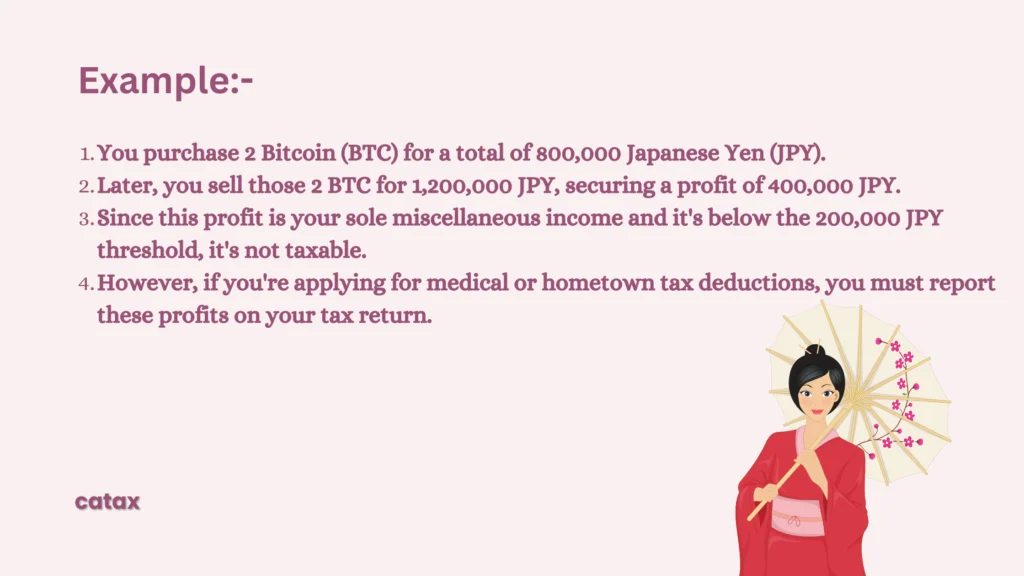

If you’ve traded cryptocurrency on Binance or any other platform in the last financial year. Your gains exceeded 200,000 JPY, it’s time to include those numbers in your Income Tax return.

And if you’re looking for a smooth way to handle this, Catax has got your back. It’s like having a crypto-savvy friend who makes sure you dot your i’s and cross your t’s for the tax season.

Will the NTA know about your crypto?

Yes, the National Tax Agency (NTA) in Japan is pretty clued in about your crypto activities. If you’re using a crypto exchange based in Japan, there’s a good chance the NTA already knows about your transactions.

- Here’s why: Crypto exchanges in Japan need to get the green light from the Financial Services Agency (FSA) before they can start operating. This approval process is thorough, taking up to six months, and it means the exchanges have to be tight on cybersecurity and sharing data with authorities.

- Japan also plays a big role in international groups focused on fighting money laundering, like the Financial Action Task Force (FATF) and the Asia-Pacific Group on Money Laundering (APG). These groups work together to make sure countries are on their A-game when it comes to following guidelines on financial crimes, including those related to crypto.

- And here’s a heads-up: Japan is serious about going after people who try to dodge their crypto taxes. For example, in 2021, a guy was sentenced to a year in prison and had to pay a fine of over 22 million JPY for not reporting his crypto earnings correctly.

So, when it comes to handling your Binance taxes in Japan, it’s pretty important to get everything right. Catax can help make sure you’re on track, making it easier to report your crypto taxes without any stress.

What are the crypto tax rates in Japan?

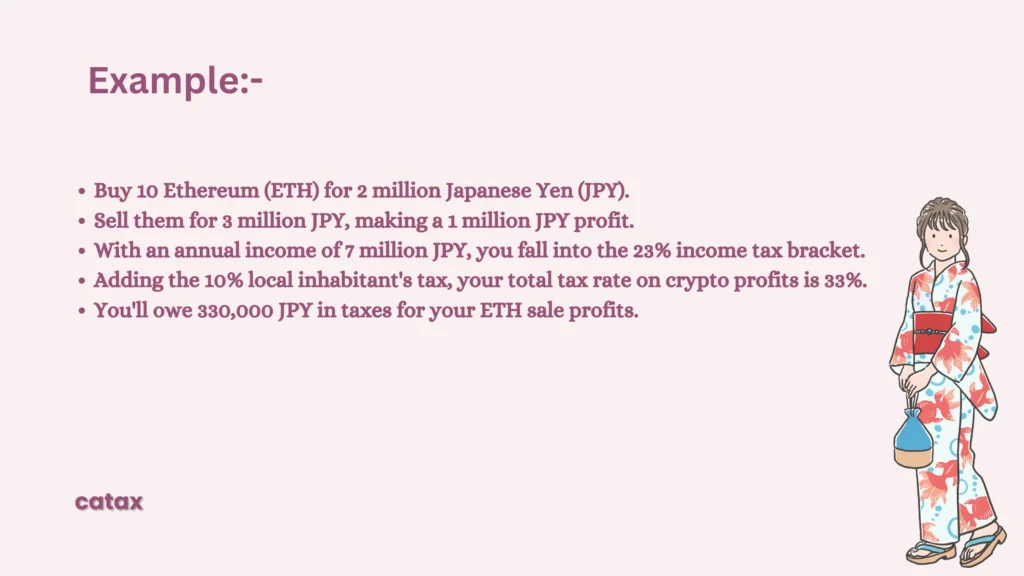

In Japan, if you make more than 200,000 JPY from your crypto activities, it counts as “miscellaneous income.” This means your crypto earnings could be taxed as much as 55%. Whether you’re making profits from trading on Binance, mining Bitcoin, or earning through DeFi lending, if you’re a permanent resident, these rules apply to you. Compared to a flat 20% tax rate on stock profits, Binance tax rates in Japan are on the higher side.

The tax system for miscellaneous income in Japan is progressive, which means it ranges from 5% to 45% depending on how much profit you make. But there’s more – Japanese taxpayers also need to cover an inhabitant tax of 10% on their profits. This includes both a prefectural rate of 4% and a municipal rate of 6%, making the total effective tax rate for crypto between 15% and 55%.

For those living in Japan but not considered permanent residents, there’s a simpler setup: a flat 20% tax on any income made within the country, including crypto earnings.

So, when dealing with Binance tax in Japan, it’s crucial to get a handle on these rates. Catax can help you navigate through, ensuring you stay compliant with Japanese tax laws while managing your crypto taxes efficiently.

| Taxable Income Range (JPY) | Tax Rate (%) | Deduction (JPY) | Tax on Column One (JPY) |

|---|---|---|---|

| 0 – ¥1,950,000 | 5 | 0 | 0 |

| ¥1,950,000 – ¥3,300,000 | 10 | 97,500 | 97,500 |

| ¥3,300,000 – ¥6,950,000 | 20 | 427,500 | 232,500 |

| ¥6,950,000 – ¥9,000,000 | 23 | 636,000 | 962,500 |

| ¥9,000,000 – ¥18,000,000 | 33 | 1,536,000 | 1,434,000 |

| ¥18,000,000 – ¥40,000,000 | 40 | 2,796,000 | 4,404,000 |

| ¥40,000,000+ | 45 | 4,796,000 | 13,204,000 |

Crypto Tax Calculation in Japan

In Japan, how much tax you pay on your crypto gains from Binance doesn’t always hit that top 55% rate. It all depends on which income tax bracket you fall into. So, you might end up paying a lot less on your cryptocurrency earnings. Let’s break it down:

Which transactions are taxed in Japan?

Next, let’s look at the typical transactions that might bring about taxes for folks in Japan who trade on Binance or deal with cryptocurrencies.

- Selling Crypto for Cash For Example:(BTC to YEN): When you sell your cryptocurrency for fiat money (like yen), that’s a taxable event.

- Swapping One Crypto for Another: Trading one Type of crypto for another? Yep, Japan considers this taxable too.

- Spending Crypto on Goods or Services: If you use your digital coins to buy stuff or pay for services, it counts as a taxable transaction.

- Earning Crypto from Mining: Those who mine cryptocurrency need to pay taxes on their earnings as well.

- Getting Paid in Crypto: If you receive cryptocurrencies as payment for work, that’s income, and it’s taxable.

- Airdrops, Interest, and Bonuses in Crypto: Getting cryptocurrency through airdrops, interest payments, sign-up bonuses, or trading rewards? In Japan, all of these count as “miscellaneous income.” That means you’ll need to pay taxes on them, based on the tax rate that applies to your total income.

Binance Tax Deadline in Japan

In Japan, the financial year starts on January 1st and ends on December 31st. You can start filing your taxes for things like Binance transactions from February 16th, but make sure you’ve got everything wrapped up by March 15th—that’s your final deadline.

If you’re worried you won’t make the March 15th cutoff, Japan offers some wiggle room with extension options. It’s a good idea to chat with the National Tax Agency (NTA) or a local tax expert to see how you can get a bit more time. They’ll have the best advice for handling your “Binance taxes in Japan” without any last-minute panic.

How to Reduce Your Crypto Taxes in Japan

Looking to keep your crypto tax bill as low as possible in Japan? Here are a few pointers:

- Timing is Everything: Consider holding onto your crypto and choose a year when your income is lower to sell. This could mean you end up paying less tax.

- Know the Rules: In Japan, crypto is taxed like regular income, so cutting down your tax bill can be tricky. Trying to dodge these taxes isn’t worth it and can lead to big trouble.

- Losses Don’t Carry Over: Unlike some places, in Japan, you can’t use losses from one year to reduce your taxes in another. So, that strategy won’t help you here.

- Watch the Threshold: If you can manage to keep your crypto income below 200,000 JPY each year, you might just lower your tax duties. But remember, claiming certain deductions on your taxes means you’ll owe taxes, even if you made less than 200,000 JPY from crypto.

How Catax Can Simplify Your Binance Taxes in Japan

As the crypto wave continues to surge across the globe, Japan is riding high on the crest. With more folks jumping into the crypto pool, there’s a growing need for expert advice to navigate the choppy waters of crypto taxation. Teaming up with seasoned accountants who know the ropes can make a world of difference in managing your crypto taxes smoothly.

Catax steps up to the plate, offering a full suite of tax reporting services tailored for the Japanese market. From calculating your capital gains and losses to ensuring you’re in lockstep with Japan’s tax laws and regulations, Catax is your peace-of-mind partner. Plus, the Catax crew is all about demystifying the crypto tax puzzle for Japanese taxpayers.

- Tax Reporting Made Easy with Catax: Catax shines when it comes to syncing up with your Binance account. It securely gathers your trade history, making the task of figuring out your crypto taxes a breeze.

- A Guide to Syncing Success: Catax doesn’t just leave you to figure things out on your own. With a comprehensive guide to connecting your Binance account to Catax, you’re equipped to create accurate and rule-abiding tax reports with ease.

- Navigating Binance Taxes in Japan: When it comes to crunching those tax numbers. Binance’s tax calculator for Japanese traders is a real gem. It gives you a good estimate of what you might owe from your crypto escapades, helping you plan ahead.

Step-to-Step Guide for Calculating Binance Taxes

With Catax by your side, tackling your Binance taxes in Japan doesn’t have to be daunting. It’s all about making the process straightforward, compliant, and, dare we say, a little less taxing on your mind.

Frequently Asked Questions(FAQs)

Just use your API keys to link both accounts directly on Catax. It’s a safe and easy way to share your transaction data.

If that’s all the crypto income you have for the year, you might not need to pay taxes on it. But, if you’re claiming other deductions, you’ll still need to report it.

Holding onto your crypto and selling in a lower-income year can help. Remember, Japan has strict rules, so it’s best to play it safe and not try to dodge taxes.

In Japan, airdrops, mining rewards, and similar crypto earnings are considered miscellaneous income and are taxable. Catax can help you sort this out.

You’ve got from February 16th to March 15th to file your taxes, including any from Binance. If you need more time, it’s wise to talk to the NTA or a tax advisor.