The WazirX trading platform, one of India’s most prominent crypto exchanges, provides an easy-to-use interface for managing and downloading your transactional information. Here’s how you can obtain your trading report in WazirX and why it’s essential for your crypto tax calculations.

Your Step-by-Step Guide to Downloading Your WazirX Trading Report

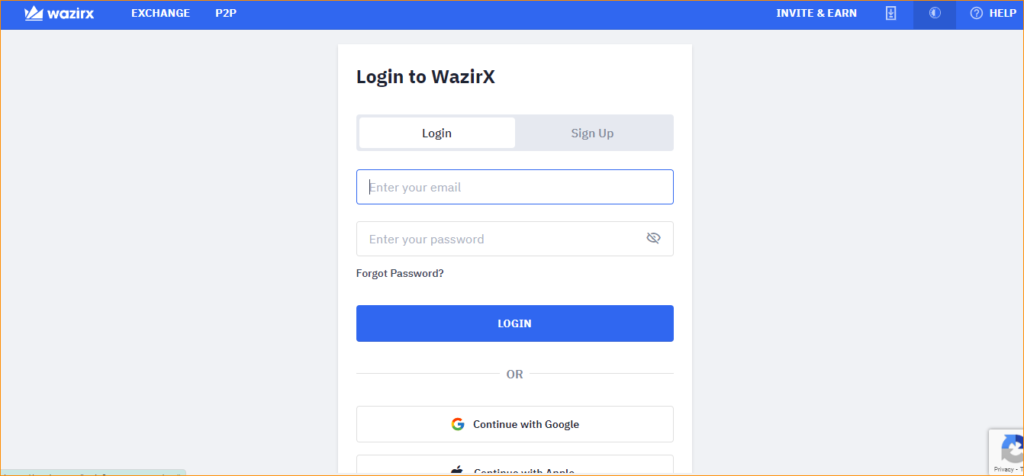

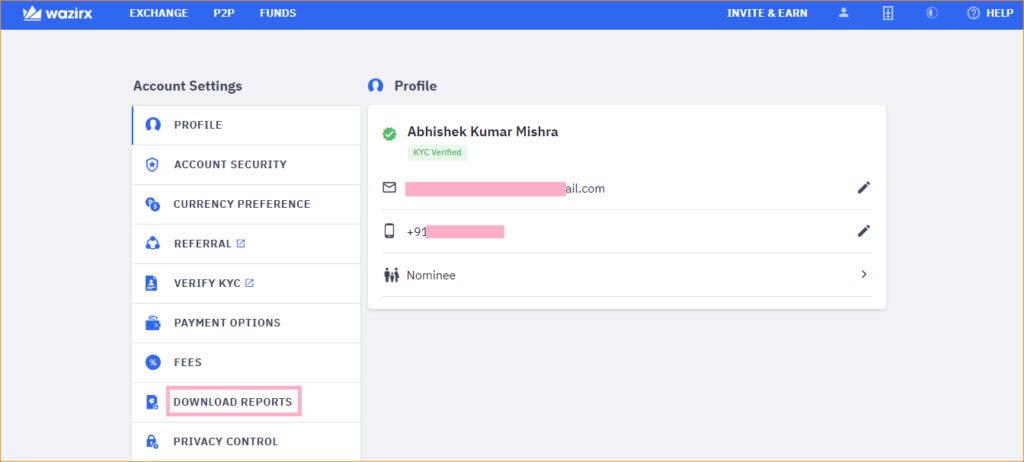

- First, Logging In to your WazirX Account with Your Credentials.

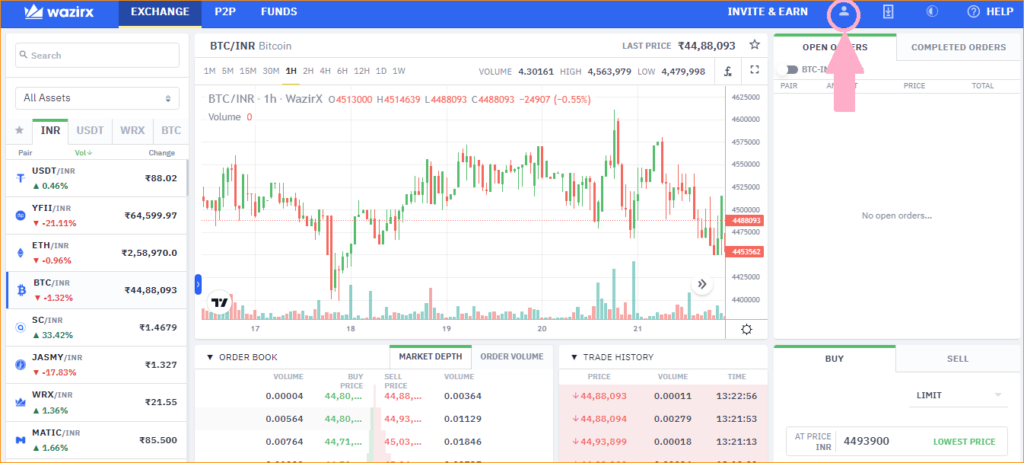

- After logging in Head to the ‘Profile‘ Icon in the Top Right Corner.

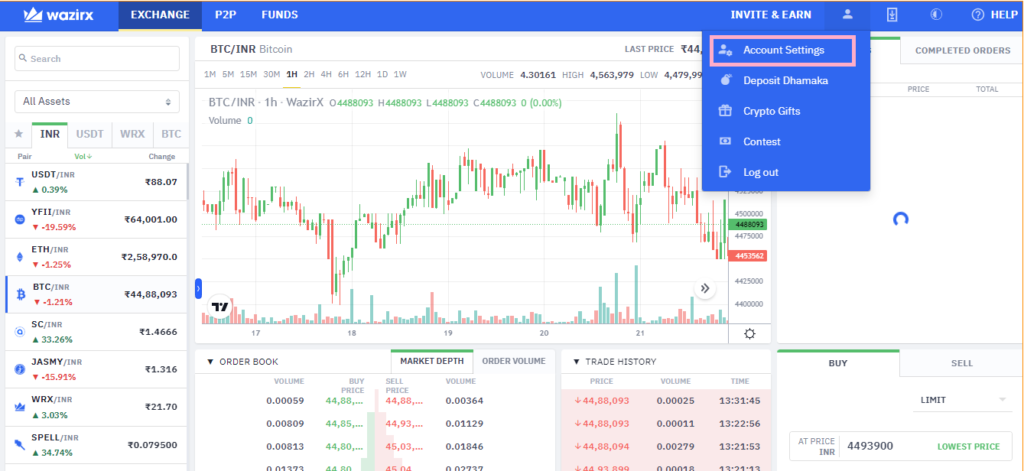

- Then Click on ‘Account Setting‘ in the Profile Section.

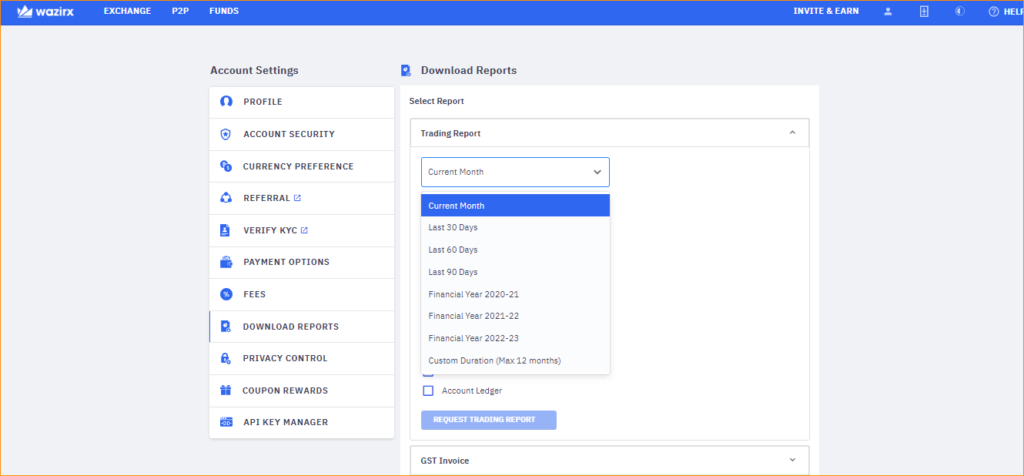

- After that, Click on the ‘Download Report‘ in the Sidebar.

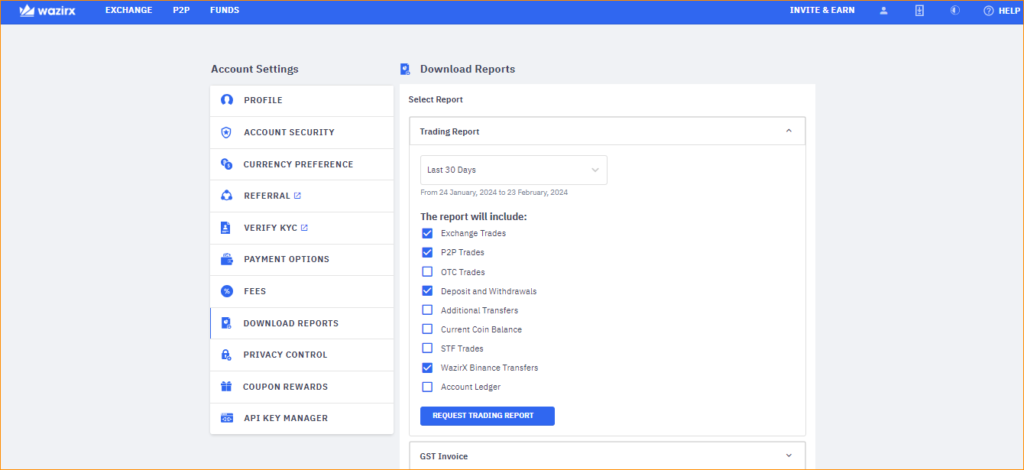

- Select Your Date Range You can also add a Custom date Range.

- Check all Your Preferred Trading Reports.

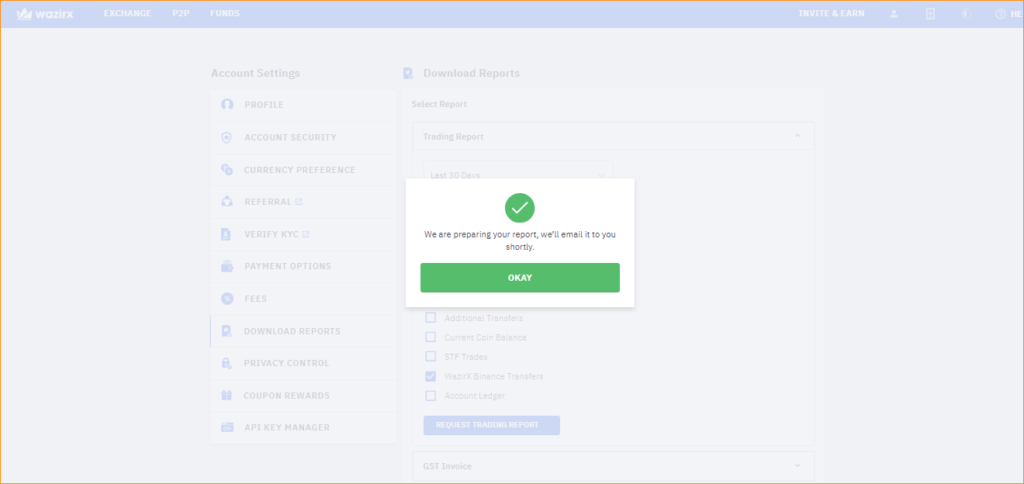

Your WazirX trading report will be sent to your registered email address.

Why Connect Your WazirX Trading Report with a Crypto Tax Calculator?

The complex world of cryptocurrency dealings indicates that each transaction could potentially alter your tax obligations. This is precisely why the integration of your trading report, Margin history, or C2C history with a dedicated crypto tax calculator is not just beneficial, but crucial:

Simplifying the Complex

Your trading report contains every transaction that could potentially impact your tax standing. Furthermore, a crypto tax calculator takes this data and simplifies the complex web of buy-sell events into a clear financial picture for the fiscal year.

Ensuring Accuracy

The precision of a crypto tax calculator in handling your trading report, Margin history, or C2C history data is invaluable. Additionally, it minimizes human error and ensures that your reported gains, losses, and holdings reflect the actual figures. Consequently, this is crucial for legal compliance.

Time-Efficiency

Manually calculating your taxes can be time-consuming. By uploading your trading report, Margin history, or C2C history to a platform like Catax, you reclaim hours, if not days, that you can reinvest in the market.

Staying Compliant

Tax regulations, especially concerning cryptocurrencies, can be labyrinthine. A crypto tax calculator stays abreast of the latest tax laws, ensuring that your trading report, Margin history, C2C history, and P2P trading history are used to file a compliant and up-to-date return.

The Role of WazirX Trading Report in Catax

Integrating your trading report, Margin history, or C2C history with Catax opens the door to a streamlined tax calculation experience. Additionally, Catax’s role is multifaceted:

- Analytical Powerhouse: Catax uses this information to provide personalized tax advice and help you optimize your tax strategy. Moreover, it helps you identify any potential tax savings opportunities and simplify your tax filing process. In conclusion, Catax’s innovative approach can greatly benefit your overall financial planning and management.

- Tax Liability Forecasting: Based on your trading report, Margin history, or C2C history, Catax can forecast your potential tax dues, allowing you to plan your finances accordingly and avoid year-end surprises.

- Strategy Formulation: Catax also provides personalized recommendations for tax-saving strategies by analyzing your trading report, Margin history, or C2C history. Furthermore, it may advise on the optimal timing to realize gains or losses, taking into consideration your specific tax situation.

Maximizing Benefits with WazirX Trading Report and Catax

Your trading report, Margin history, C2C history, or P2P trading history is a powerful asset in your crypto trading arsenal. When paired with Catax, it becomes the cornerstone of a savvy tax strategy that saves you time and money while ensuring compliance. Leveraging your Trading Report with a crypto tax calculator like Catax is not just about meeting tax obligations; it’s about gaining a competitive edge in both the crypto market and the realm of personal finance. As you prepare for tax season, remember that Catax is your partner in demystifying the complex world of crypto taxes. Additionally, visit Catax to simplify your tax reporting process and turn your WazirX trading report into a strategic advantage.

FAQs (Frequently Asked Questions)

Downloading your report is crucial for accurately reporting your cryptocurrency transactions for tax purposes, enabling you to track your trading activity and calculate your tax obligations correctly.

It’s recommended to download your trading report at least once a year before tax season to prepare your cryptocurrency taxes. However, frequent traders may benefit from quarterly downloads to stay on top of their tax obligations.

If you face any issues downloading your report, it’s best to contact WazirX support for assistance. Ensure your internet connection is stable and try downloading the report during off-peak hours.

Yes, Catax can integrate trading reports from multiple exchanges, offering a comprehensive analysis of your total crypto trading activity and tax liabilities across all platforms you use.