Exporting your Phemex Spot Trading History is a straightforward process that enables you to keep a detailed record of all your transactions for review, analysis, or tax purposes. Here is a simple Guide to Exporting your Phemex Spot Trading History.

Why Spot Trading History Matters?

This history is critical for getting a clear overview of your trading activities. Your Phemex Spot Trade History keeps detailed records that help you understand how your investments did and make sure you file your taxes correctly.

Step to Step explain how you can export your Phemex Spot Trading History

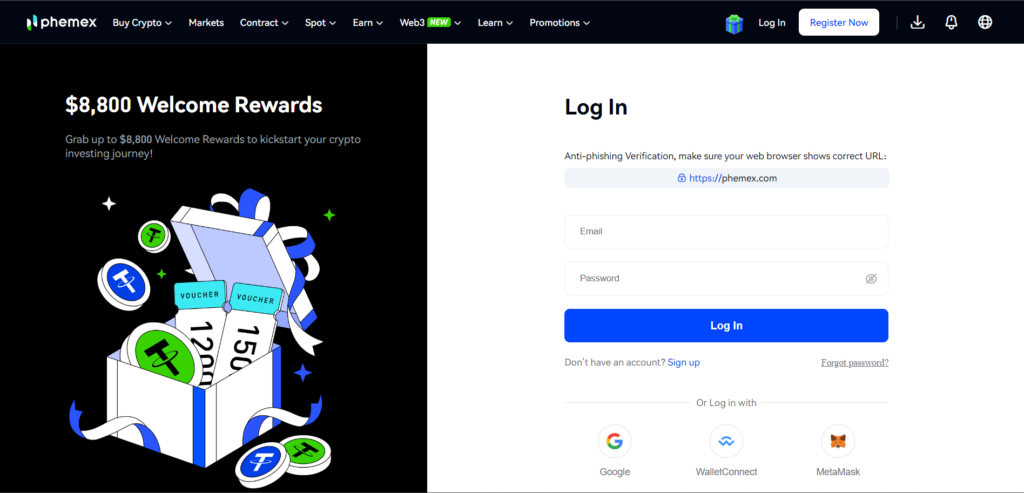

- Sign in to your Phemex account.

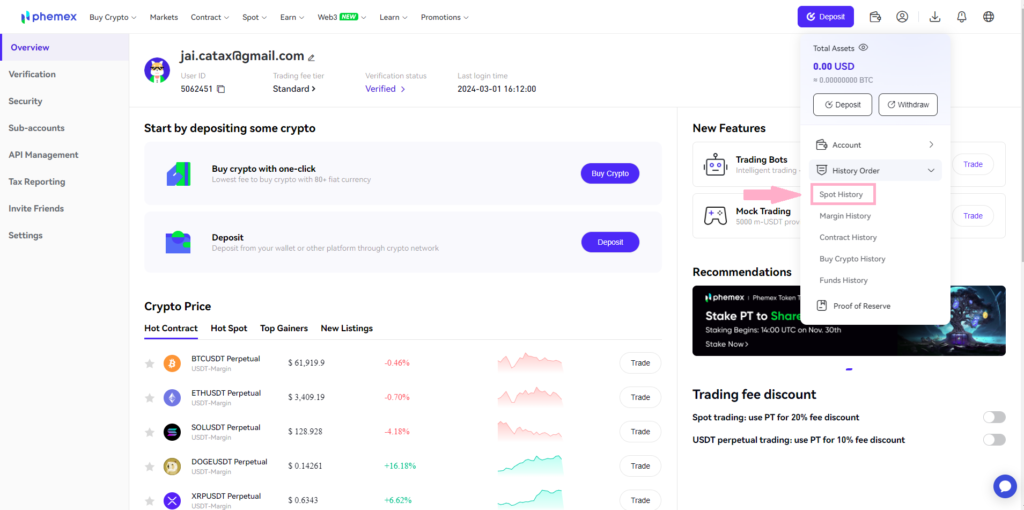

- Head to the wallet icon, and from the ‘History Order’ click on Spot History.

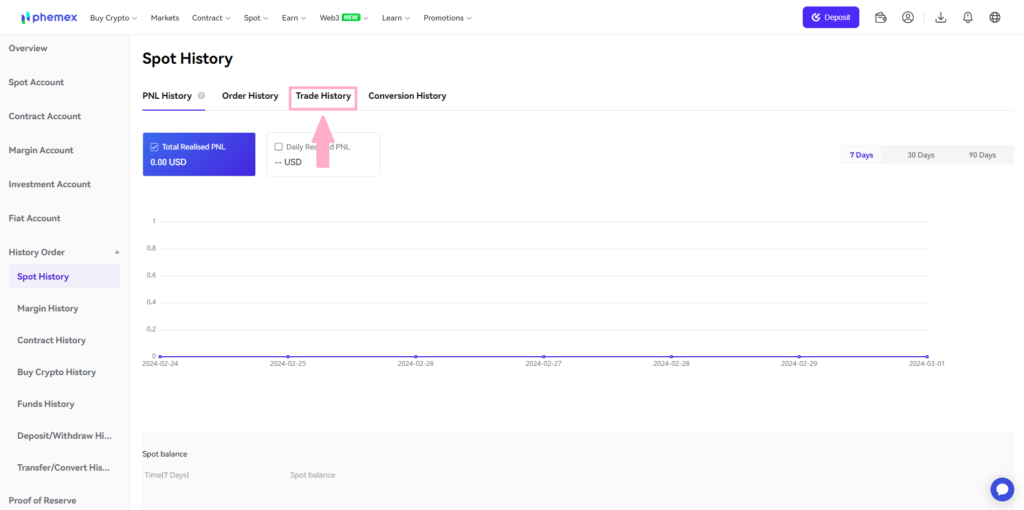

- In the Spot History section click on the ‘Trade History’.

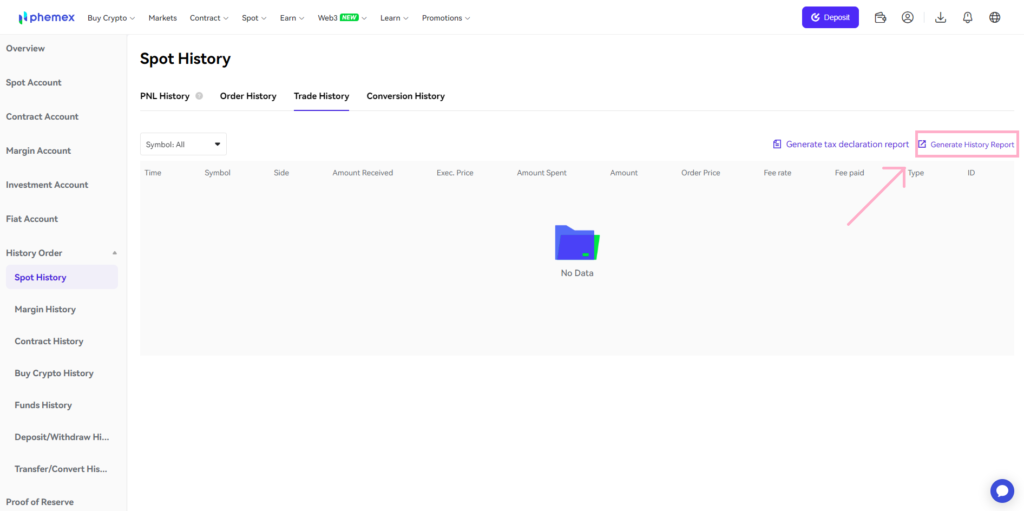

- In the Trade History section click on ‘Generate History Report’.

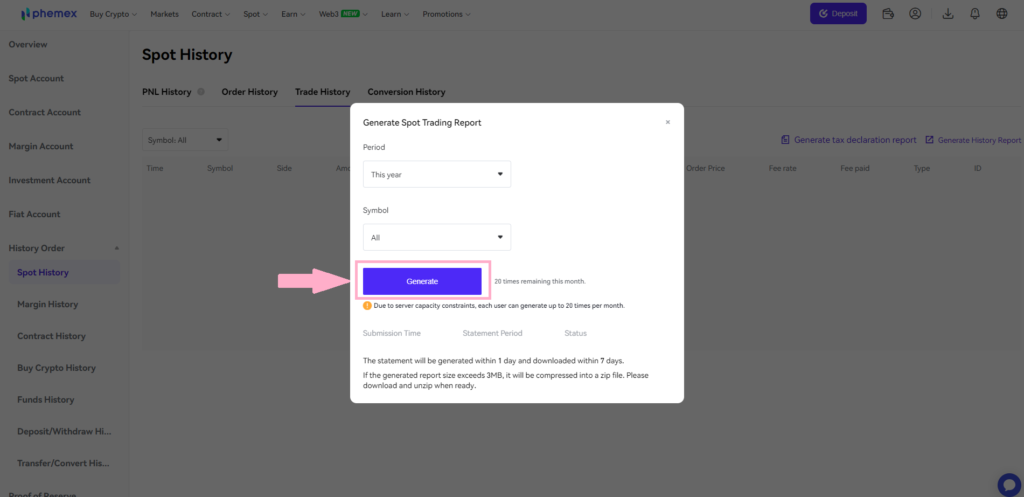

- Select your preferred ‘period‘, and click on ‘Generate’.

Is it Worth It to Integrate Your Spot Trade History with the Crypto Tax Calculator?

Adding your Phemex Spot Trading History to a Crypto tax calculator like Catax will give you a full picture of all the trades you’ve made. This will also help you get a good idea of your cash gains and losses. It will also make making tax returns easier, which will save you time and effort. Also, it will make sure that you follow all tax rules to avoid any fines or legal problems. Connecting your Phemex Spot Trading History to a Crypto tax Calculator is crucial for managing investments and ensuring timely tax payments.

Simplifying Tax Calculations: Crypto tax calculators like Catax utilize your Phemex Spot Trade History to calculate your taxes based on your trading activities automatically. Moreover, they consider the cost basis and calculate gains or losses, providing an easy approach to handling your cryptocurrency taxes.

Why Use a Tax Calculator?

Tax calculations are easier to do when you use a tax tool like Catax and have your Phemex Spot Trade History handy. It makes sure the numbers are correct and helps you follow tax laws. It also saves you a lot of time and effort that you would have spent doing math by hand.

The Role of Spot Trade History in Catax

Accurate Tax Reports: Your Phemex Spot Trade report is key to allowing Catax to generate accurate tax reports. By inputting this detailed transaction data, Catax can apply the related tax rules to calculate your capital gains or losses accurately. Also, this information is crucial for ensuring compliance with tax regulations. Furthermore, by providing this data, you can ensure that your tax reporting is thorough and precise.

Minimizing Errors: Given the complexity of cryptocurrency transactions and tax regulations, manual tax calculations are prone to errors. Automating with Phemex spot trade reports minimizes risks, ensuring tax reports are precise and reliable.