Bitbns, started in Bengaluru, India, is known as the first exchange in the country for trading digital money. Here’s how you can obtain your Bitbns trade report and why it’s essential for your crypto tax calculations.

Your Step-by-Step Guide to Downloading Your WazirX Trading Report

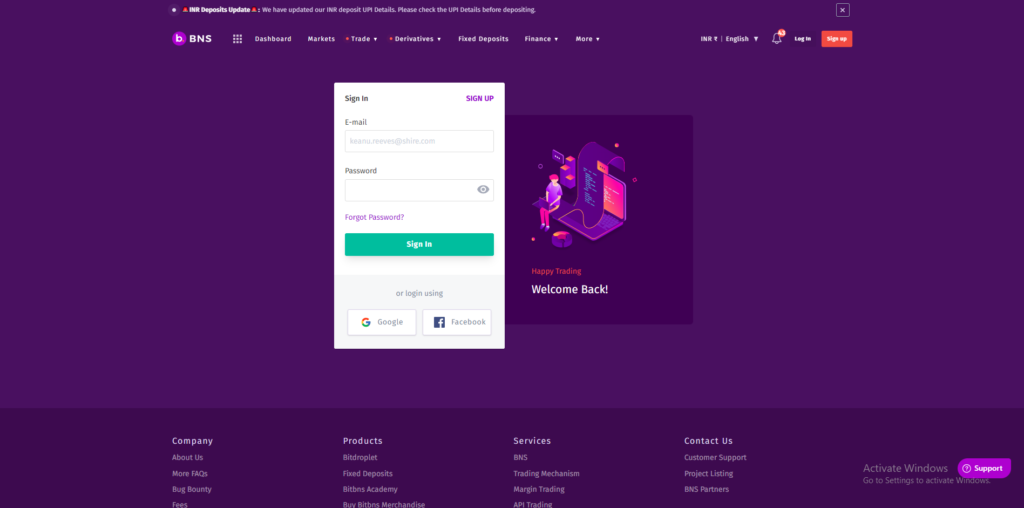

- First, Logging In to your Bitbns Account with Your Credentials.

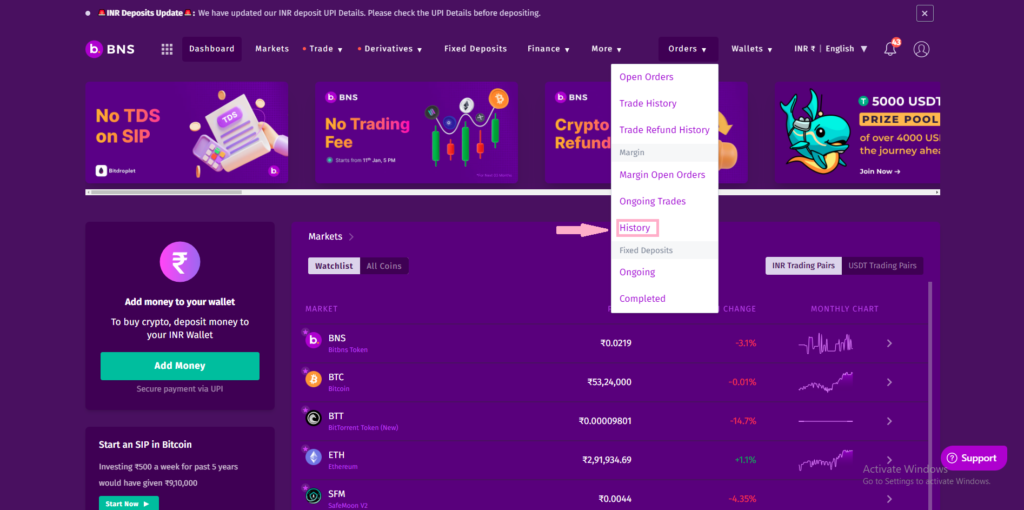

- After logging in Head to the ‘Orders‘ in the Top Right Corner and click on ‘History‘.

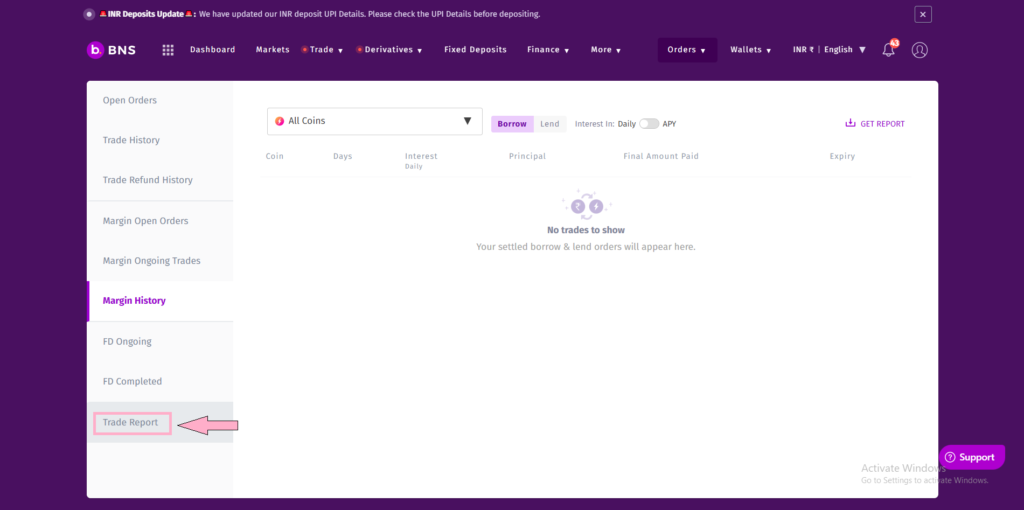

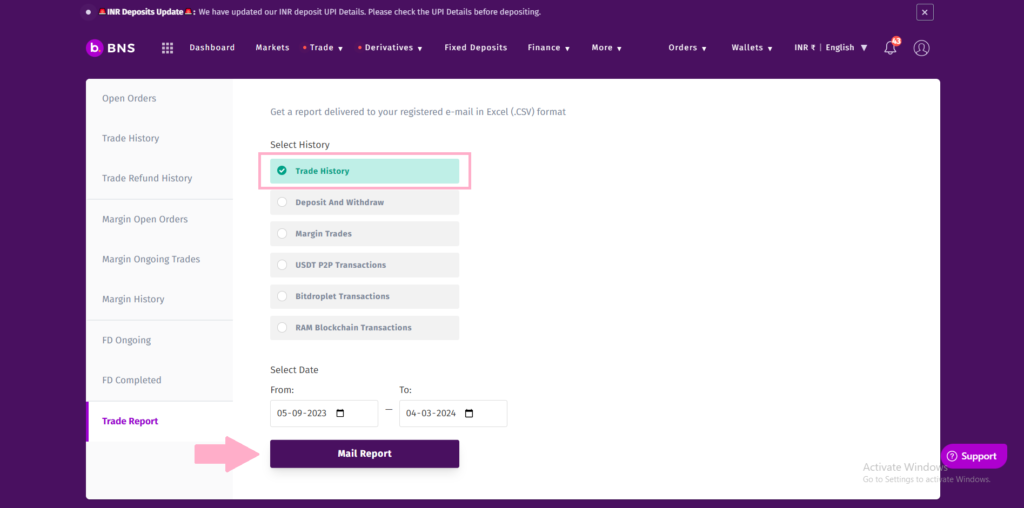

- Click on ‘Trade report‘ section on the left sidebar.

- Choose ‘Trade history‘ from select history section and select your date range. Then click on ‘Mail Report‘

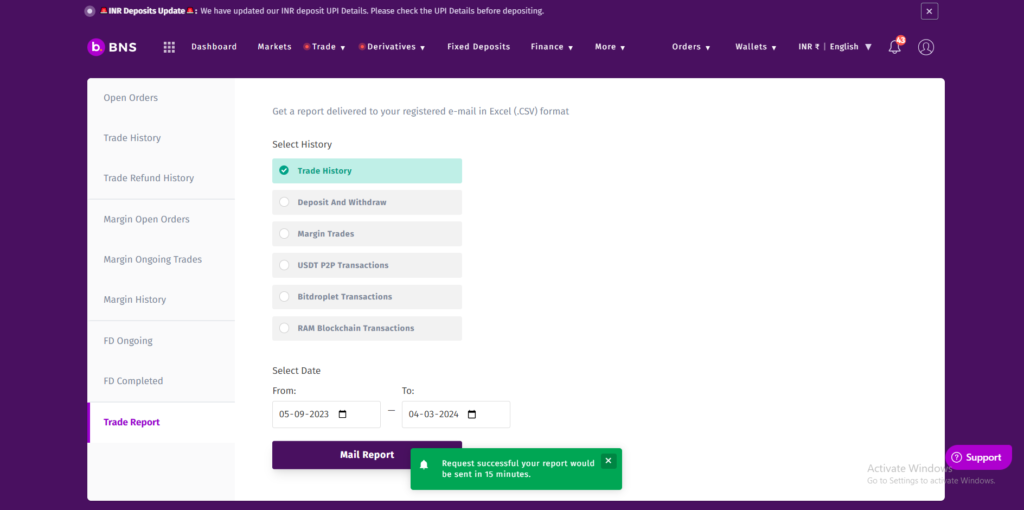

- Your report will be sent to the registered email address under 15 minutes.

Note: You can also export ‘deposit and withdraw’, ‘margin trade’, ‘USDT P2P transactions’, ‘bitdroplet transactions’ and ‘ram blockchain transactions’ as well.

Why Connect Your Bitbns Trading Report with a Crypto Tax Calculator?

The complex world of cryptocurrency dealings indicates that each transaction could potentially alter your tax obligations. This is precisely why the integration of your Bitbns trading report, Margin history, or C2C history with a dedicated crypto tax calculator is not just beneficial, but crucial:

Simplifying the Complex

Your Bitbns trading report contains every transaction that could potentially impact your tax standing. Furthermore, a crypto tax calculator takes this data and simplifies the complex web of buy-sell events into a clear financial picture for the fiscal year.

Ensuring Accuracy

The precision of a crypto tax calculator in handling your Bitbns trading report, Margin history, or C2C history data is invaluable. Additionally, it minimizes human error and ensures that your reported gains, losses, and holdings reflect the actual figures. Consequently, this is crucial for legal compliance.

Time-Efficiency

Manually calculating your taxes can be time-consuming. Moreover, by uploading your trading report, Margin history, or C2C history to a platform like Catax, you reclaim hours, if not days, that you can reinvest in the market.

Staying Compliant

Tax regulations, especially concerning cryptocurrencies, can be labyrinthine. A crypto tax calculator stays abreast of the latest tax laws, ensuring that your trading report, Margin history, C2C history, and P2P trading history are used to file a compliant and up-to-date return.

The Role of Bitbns Trade Report in Catax

Integrating your Bitbns trading history, Margin history, or C2C history with Catax opens the door to a streamlined tax calculation experience. Additionally, Catax’s role is multifaceted:

- Analytical Powerhouse: Catax uses this information to provide personalized tax advice and help you optimize your tax strategy. Moreover, it helps you identify any potential tax savings opportunities and simplify your tax filing process. In conclusion, Catax’s innovative approach can greatly benefit your overall financial planning and management.

- Tax Liability Forecasting: Based on your Bitbns trading history, Margin history, or C2C history, Catax can forecast your potential tax dues, allowing you to plan your finances accordingly and avoid year-end surprises.

- Strategy Formulation: Catax also provides personalized recommendations for tax-saving strategies by analyzing your Bitbns trading history, Margin history, or C2C history. Furthermore, it may advise on the optimal timing to realize gains or losses, taking into consideration your specific tax situation.

Maximizing Benefits with Bitbns Trade Report and Catax

Your trading report, Margin history, C2C history, or P2P trading history is a powerful asset in your crypto trading arsenal. When paired with Catax, it becomes the cornerstone of a savvy tax strategy that saves you time and money while ensuring compliance. Leveraging your Trading Report with a crypto tax calculator like Catax is not just about meeting tax obligations; it’s about gaining a competitive edge in both the crypto market and the realm of personal finance. As you prepare for tax season, remember that Catax is your partner in demystifying the complex world of crypto taxes. Additionally, visit Catax to simplify your tax reporting process and turn your Bitbns trade report into a strategic advantage.