This guide helps you manage your taxes from CoinSwitch trading easily, even if you’re new to it or already know a bit. Here’s how to use Catax, a good crypto tax calculator, to make things smoother:

To make your Bitmart tax reporting easier, try using Catax, a simple cryptocurrency tax calculator. Here’s how to do it:

- Sign Up: First, create a Catax account. If you’re in India, pick India for your country and INR for currency.

- Organize Your Trades: Catax will sort out your CoinSwitch trades, categorizing them into profits, losses, and income.

- Tax Report: Download a detailed tax report from Catax that shows all your crypto transactions.

- File Your Taxes: With this report, you can file your taxes online on your own or get a tax expert to help you can also consult with catax expert team.

How do i file my Coinswitch Taxes?

To handle your CoinSwitch taxes without hassle, using Catax is a smart move. You can connect CoinSwitch to Catax through an API for continuous updates or upload a CSV file of your trades. after, this step lets Catax figure out your taxes based on your activity.

Once connected, Catax starts identifying taxable events from your trades and applies the right tax rules for your country. Catax is designed for people all over the world, so whether you’re in India or the USA, it gets your tax reports right.

Besides calculating taxes from CoinSwitch trades, Catax also makes these reports easy to understand. This is especially helpful if you’re not familiar with the details of crypto tax reporting, helping you avoid common mistakes.

The reports from Catax give you a clear view of your CoinSwitch taxes, guiding you on how to file them properly. With Catax, you get a full picture of your tax situation, including how it fits into your overall tax duties and what you need to do to comply.

In short, Catax makes it easier to deal with CoinSwitch taxes by linking up with CoinSwitch. Adjusting to tax laws around the globe, and giving you straightforward, compliant reports. It simplifies the complicated world of crypto taxes for investors everywhere.

Connecting Catax and Coinswitch via CSV:

For Coinswitch:

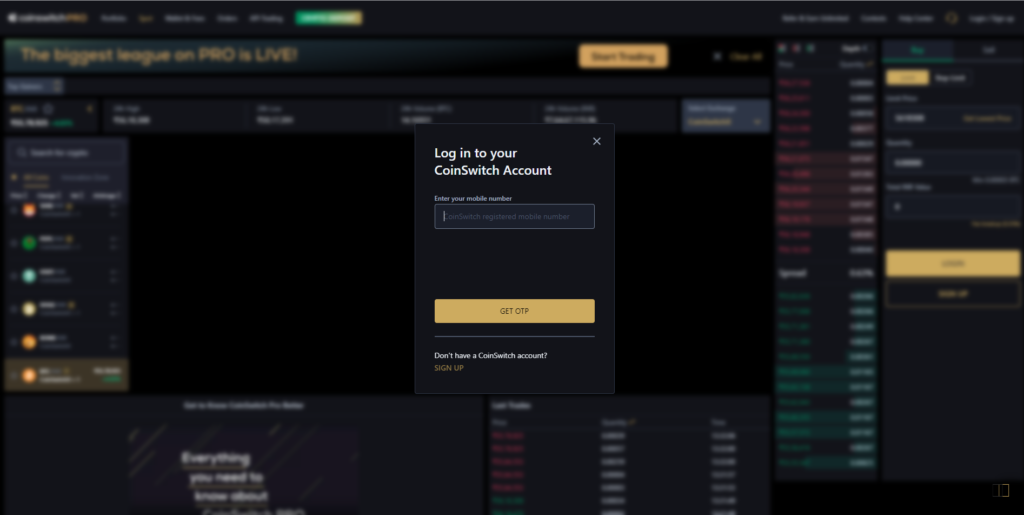

- Go to Coinswitch.co, click on ‘login to pro’ then sign into your Coinswitch account.

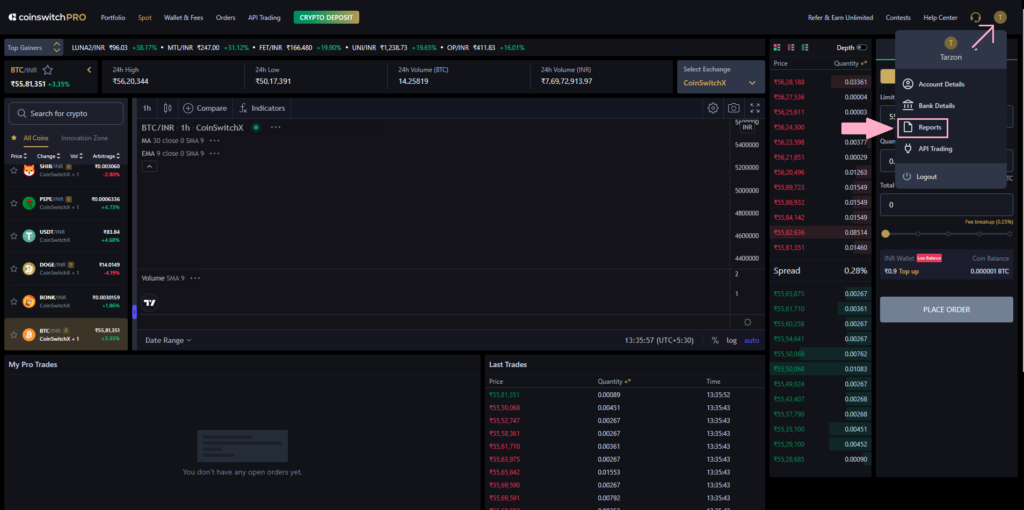

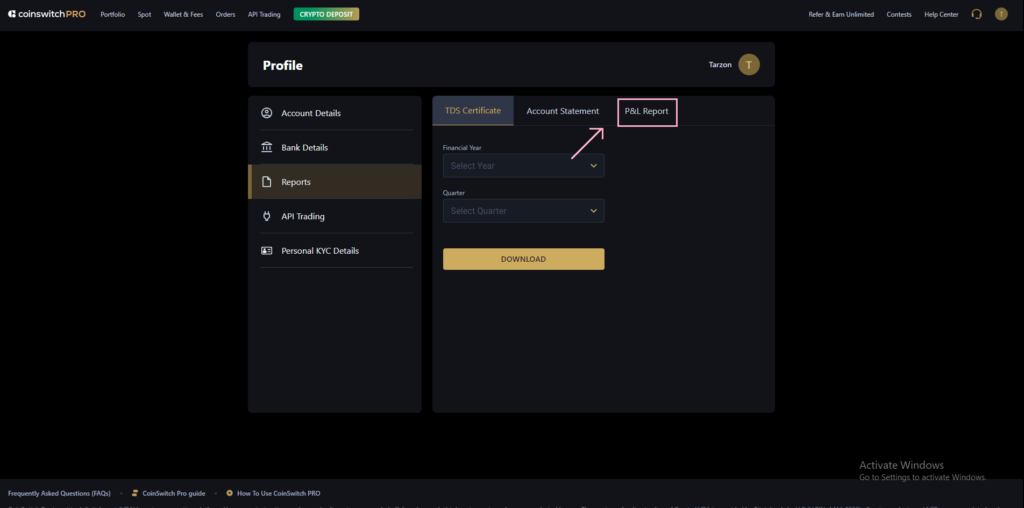

- After logging in, head to the profile icon in the top right corner then click on ‘Reports‘.

- In the Reports section click on ‘P&L Report‘.

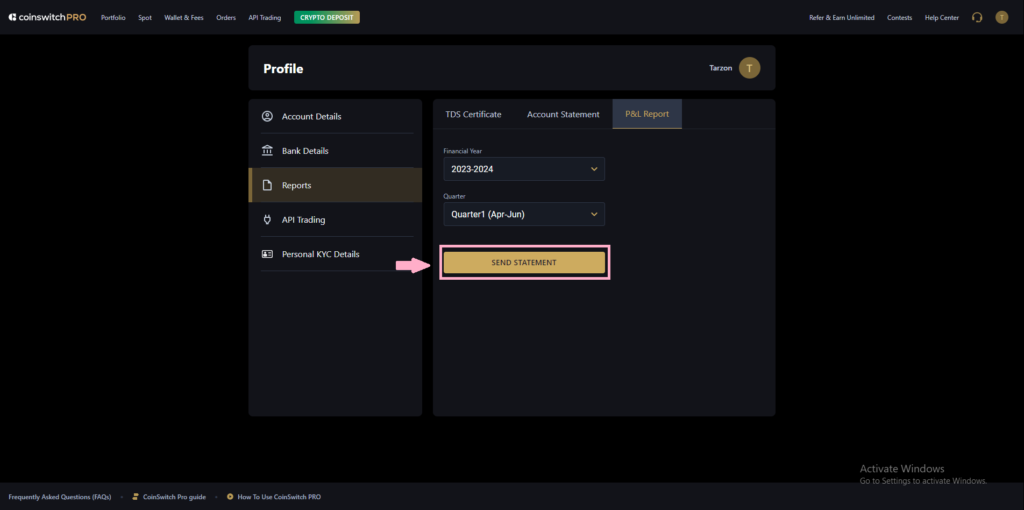

- Next, select your financial year and quarter, then click on ‘Send Statement’.

“Your statement will be sent to your registered email address.”

Now On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select ‘Coinswitch.

- Choose ‘Import from File’.

- Upload your Coinswitch CSV file.

Important points to remember while preparing Coinswitch tax report

When preparing your CoinSwitch tax report with Catax, it’s crucial to pay attention to a few key steps for a smooth experience:

- Make sure everything’s connected properly. Before starting, double-check that your CoinSwitch account and any other accounts you’re using are correctly linked to Catax.

- Sync your transactions. Catax will automatically update transactions from your wallet. If you notice something’s missing, you can update your transactions manually with the “Sync Now” option.

- Include all your transaction history. For Catax to figure out what you owe in taxes accurately, it needs to see your entire trading history.

- Look out for any alerts. If Catax flags any issues or warnings when you’re importing your data, make sure to check them out and follow the steps to fix them.

FAQs (Frequently Asked Questions)

First, make sure the CSV file format hasn’t been altered. If the error continues, reach out to Catax support for guidance on how to correctly upload your file.

Yes, Catax can update your tax report with new trades if you sync your CoinSwitch account again. It’s a good idea to do a final sync at the end of the tax year to ensure all transactions are captured.

Absolutely! Catax is designed to support a global user base with different tax laws. Just select your country when setting up your account, and Catax will apply the relevant tax rules for your location.

Review the transaction details for accuracy and completeness. If Catax still doesn’t recognize them, consult Catax’s support for guidance on how to categorize these transactions properly.

Yes, as long as you can access the historical data from CoinSwitch, you can input this information into Catax to calculate taxes for past years.