Downloading your Mudrex trade history can be challenging for some, but don’t worry! In this blog, we provide step-by-step instructions to help you effortlessly download your Mudrex trade history, making it easier to track your crypto transactions.

Step-by-step guide for exporting Giottus transaction history

- Log in to your Mudrex account using the mobile app.

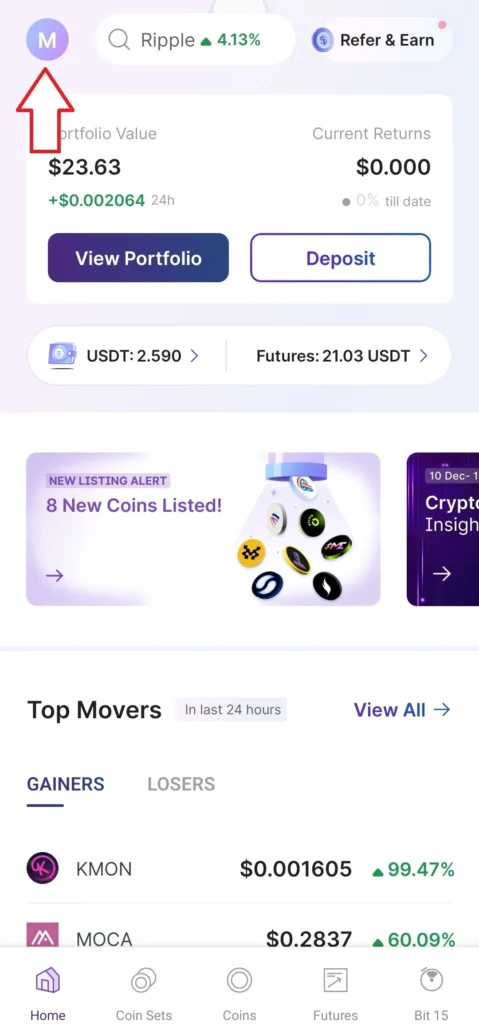

- Tap on your profile icon in the upper-left corner of the screen.

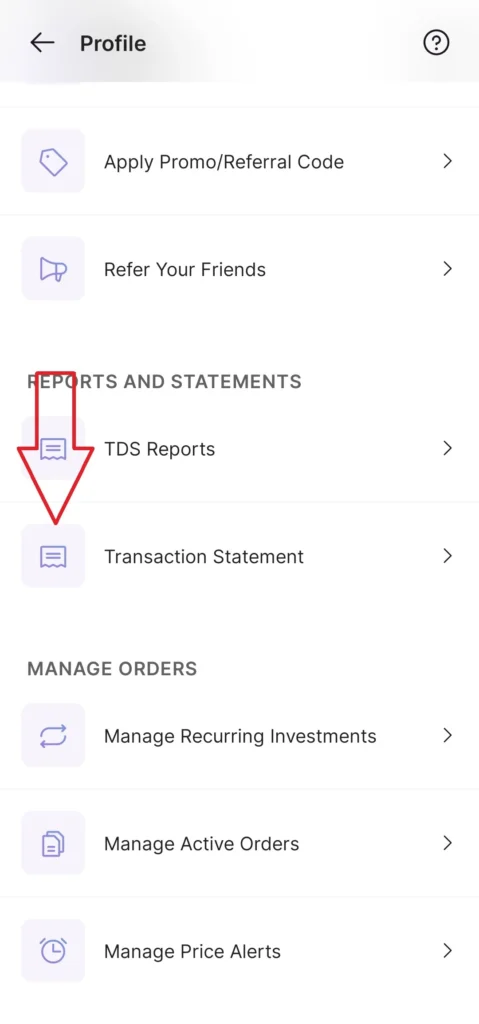

- Scroll down in the profile section and select “Transaction Statement” under Reports and Statements.

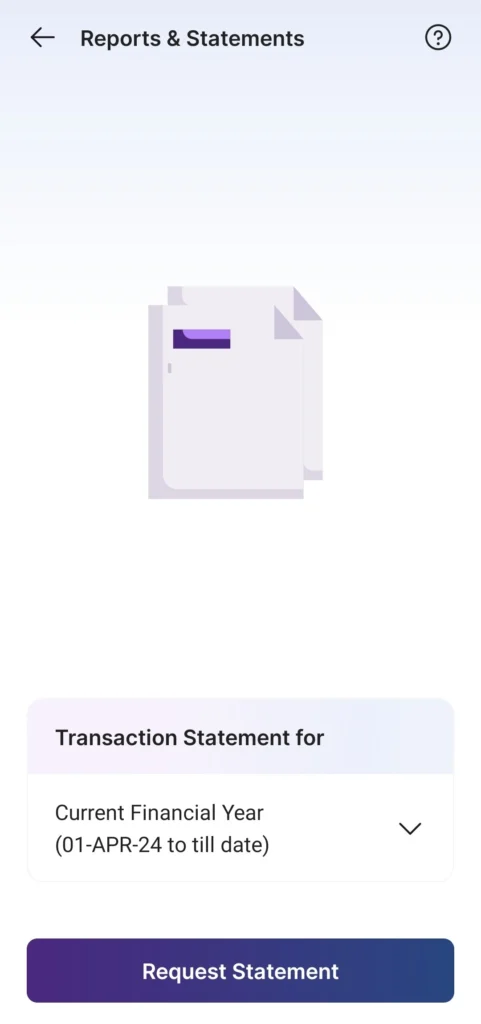

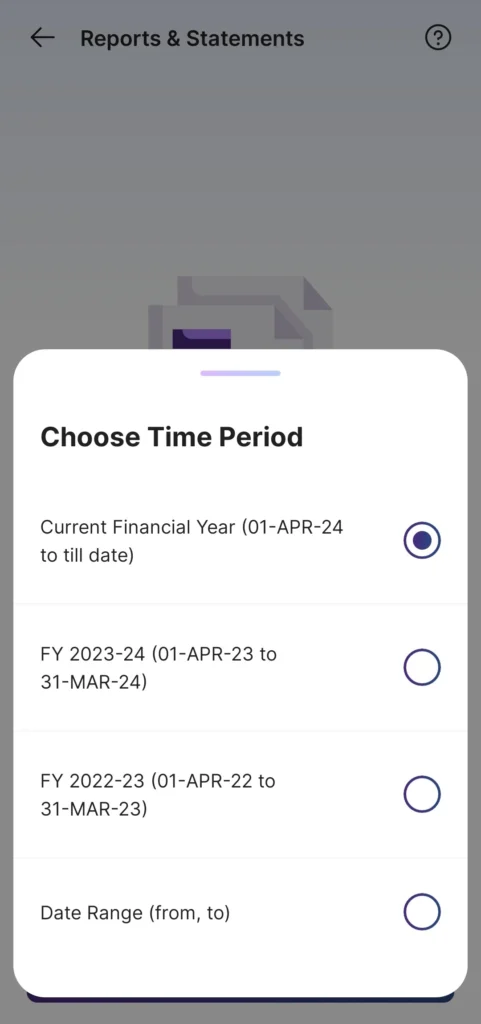

- Select the financial year for which you want to generate your crypto tax report, then tap “Request Statement.”.

- The report will be sent to your registered email address.

Let’s Calculate Taxes with Catax

Catax is an efficient tool for managing your crypto taxes, designed to simplify tax preparation and provide accurate calculations. It supports numerous major exchanges, including Mudrex, WazirX, and Binance, gathering all your trading data in one place. This makes tracking your profits, losses, and income straightforward, especially if you’re active on multiple platforms.

A Cool Thing About Catax:

One standout feature is its seamless integration with Mudrex, making it incredibly easy to import your trade history. This feature ensures precise tax calculations and saves time during tax season. Whether you’re using Mudrex, WazirX, Binance, or other platforms, Catax is the ultimate companion for stress-free crypto tax management.

Is it safe to add Mudrex trading history to Catax?

Yes, it’s safe to add your Mudrex transaction history to Catax. Additionally, Catax prioritizes the security of your financial information. It simplifies tax calculations for your trades by securely processing transactions. As a result, many traders rely on Catax for easy and secure tax reports from their trading activity.

Why Crypto Tax Software is Useful

Catax offers a modern, user-friendly approach to taxes, providing real-time updates for accurate and compliant information. It automates processes, saving you time and minimizing mistakes. Also, this allows people to handle their crypto taxes efficiently and with confidence.