Calculating taxes on cryptocurrency transactions, like those on platforms such as Zebpay, can be quite different depending on the country due to varying tax laws. Here’s a basic method to use when calculating your Zebpay taxes, which is generally applicable across many countries:

How can you easily calculate and file your Zebpay taxes using Catax?

To easily calculate and file your taxes from Zebpay using Catax, you can follow these simplified steps:

- Set Up Catax Account: First, sign up at Catax.app Create your profile. Choose your country, like India. Pick your currency, say INR. This ensures accurate tax calculations.

- Link Zebpay to Catax: Connect your Zebpay account to Catax. Use API keys or upload transaction files. Catax uses read-only access. This keeps your data safe while importing history.

- Automated Sorting: Catax sorts your Zebpay transactions. It categorizes them as capital gains, losses, or income. Each transaction type is identified.

- Review Tax Summary: Catax shows your tax summary. It details what you owe or can deduct.

- Download Tax Report: After processing, download your tax report from Catax. It contains all the necessary details for tax filing in your area.

- File Taxes Easily: Use the Catax report to file your taxes. You can upload it to the Income Tax Return Portal. Or, give it to your accountant for filing.

What is ZebPay?

ZebPay is a digital currency exchange platform. It lets users buy, sell, and trade various cryptocurrencies. Understanding ZebPay taxes is crucial for users. When you trade on ZebPay, you might make a profit or incur losses. These need to be reported in your taxes. Calculating ZebPay taxes involves understanding the tax laws of your country. ZebPay provides transaction histories. These are essential for accurate ZebPay tax calculations. When filing taxes, include all your ZebPay activities. This ensures compliance with tax regulations.

Does ZebPay provide transaction reports to India’s Income Tax Department?

Yes, ZebPay does report to the Income Tax Department (ITD) in India. As a regulated crypto exchange in India, ZebPay adheres to all governmental regulations. This includes deducting and submitting Tax Deducted at Source (TDS) to the ITD on behalf of its users. The implementation of TDS aims to help the ITD monitor crypto investments for Indian taxpayers. Additionally, the ITD can ask ZebPay to share user data to verify tax compliance. It’s important to accurately declare your crypto investments, including those from ZebPay, to avoid severe penalties for tax evasion in India. Using Catax for your ZebPay taxes can help ensure accuracy in reporting.

How ZebPay transactions taxed?

Taxation on ZebPay transactions in India varies based on the type of transaction:

1% TDS: When you buy crypto with INR or swap one cryptocurrency for another on ZebPay, a 1% Tax Deducted at Source (TDS) applies. ZebPay automatically deducts this for you.

30% Flat Tax: Any profit you make from trading, selling, or using crypto on ZebPay attracts a 30% tax. However, you can’t use losses from these activities to reduce your taxable gains.

Individual Income Tax Rate Slab: If you earn crypto, like receiving new tokens from lending, it’s taxed according to your personal income tax rate.

Step-by-Step Guide to Creating Your ZebPay Taxes Report Using Catax

Creating an accurate tax report for your ZebPay transactions can be easily done using Catax. This powerful crypto tax software streamlines the process, making sure your report is precise and adheres to tax rules.

Connect Zebpay to Catax manually via CSV file

To get your ZebPay transaction history Or CSV file:

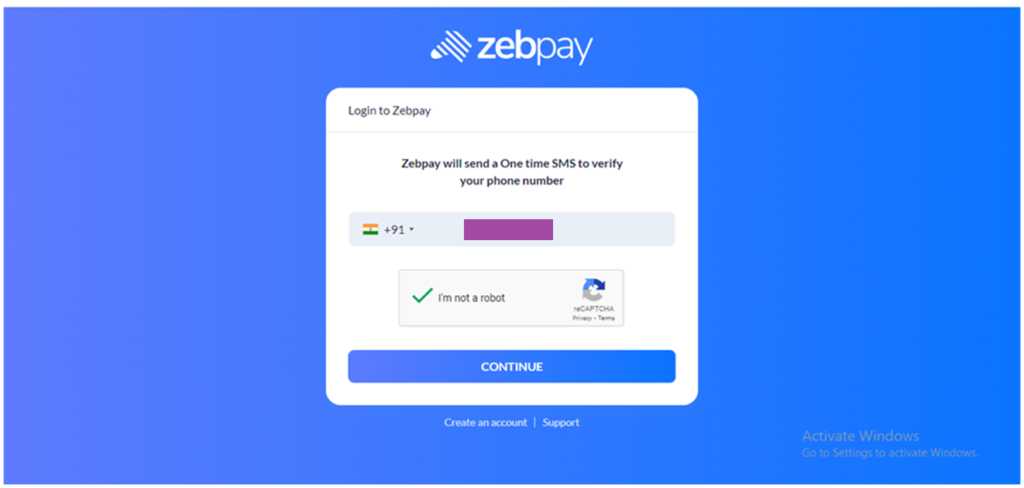

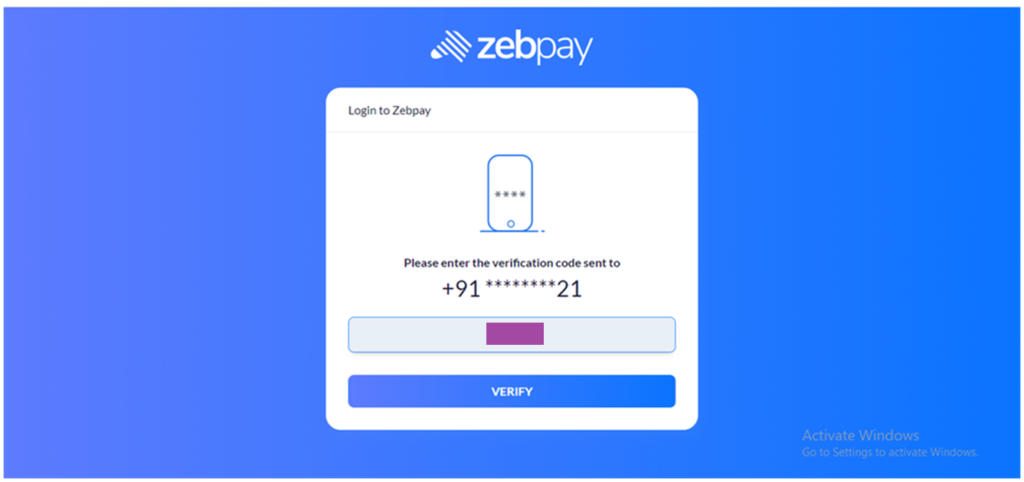

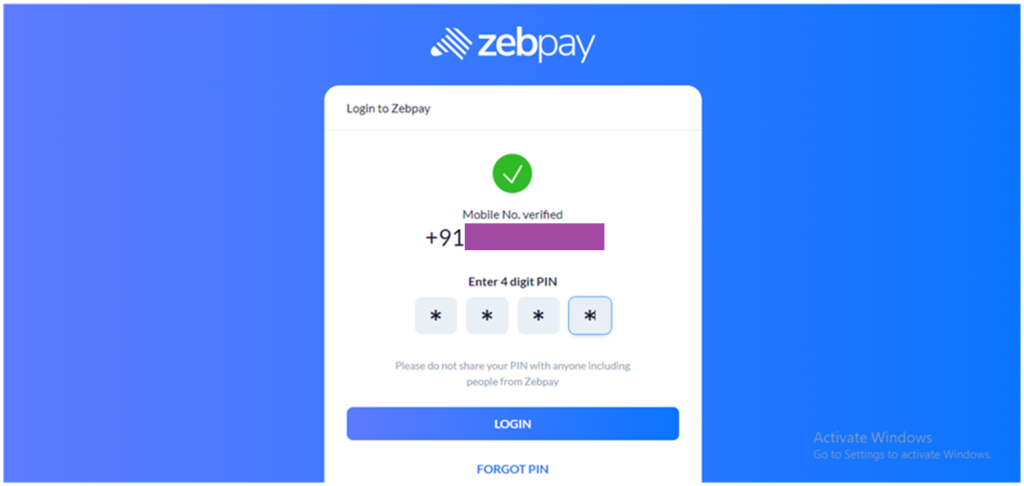

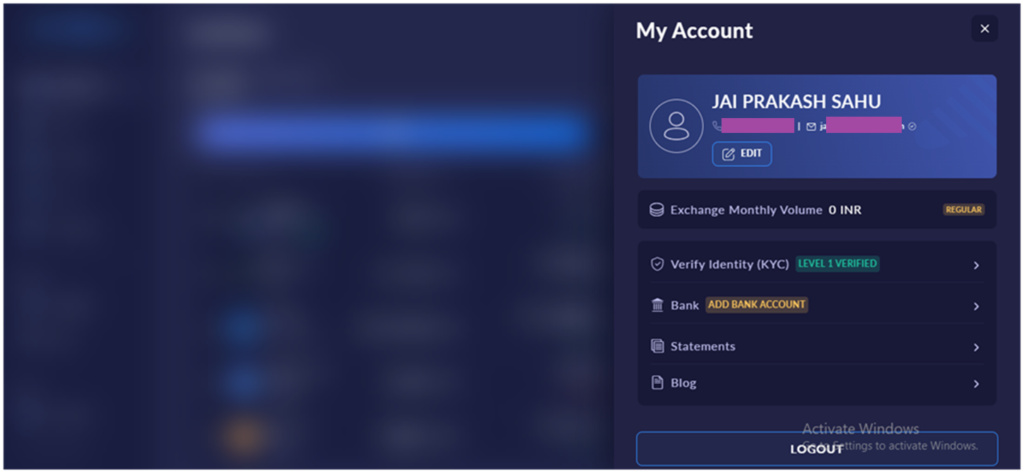

- Go to zebpay.com, and login to your account.

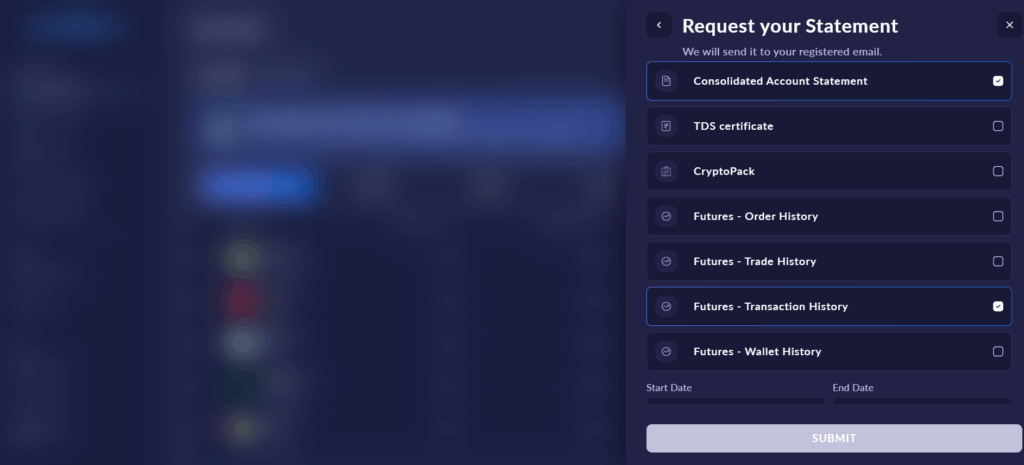

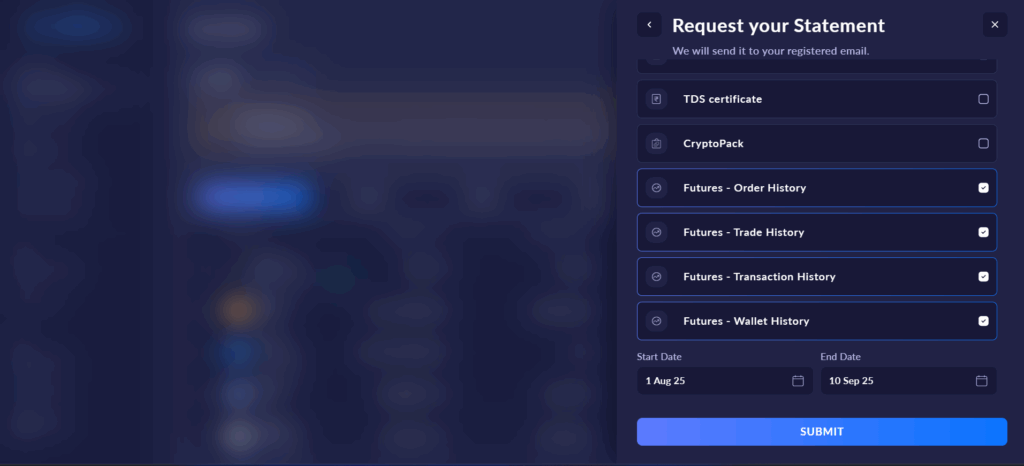

- Pick the types of transactions Consolidated Account Statement and Futures – Transaction History, etc.

- Choose a start and end date for the ZebPay transaction history you want and then click Submit to send your request.

- ZebPay will email the transaction report to your registered email.

- Check the report to ensure all transactions are included and correct.

To add your ZebPay transactions to Catax:

- Log In: Access your Catax account.

- Add New Wallet: Choose ‘Add New Wallet’ and select ‘ZebPay’.

- Import from File: Click on ‘Import from File’.

- Upload CSV: Upload your CSV file(s) from ZebPay.