This guide will walk you through the process step by step, making it simple to manage your Nexo taxes and ensure compliance. Whether you’re a trader or an investor, therefore, accurately reporting your transactions is especially crucial to avoid any tax-related complications.

Do I have to pay taxes when using XT.com?

Yes, crypto transactions on Nexo are generally considered taxable under capital gains tax or income tax in many countries. Tax rates vary based on local regulations, and some regions may offer exemptions depending on profit thresholds or the holding period of your assets. For accurate tax calculations, it’s advisable to seek professional guidance.

If you find Nexo tax reporting challenging, try using Catax, an efficient cryptocurrency tax calculator. Follow these simple steps:

- Create a Catax Account: Sign up, select India as your country, and set INR as your currency.

- Connect with Nexo: Link your Nexo account to Catax to automatically import your transaction details.

- Sort Your Transactions: Catax will categorize your Nexo activities into gains, losses, and income for easy understanding.

- Download Your Tax Report: Get a detailed tax report from Catax for a clear overview of your crypto finances.

How Are Nexo Transactions Taxed?

Understanding how your Nexo transactions are taxed helps you stay compliant and avoid unexpected tax bills. Here’s a simple breakdown:

- Capital Gains Tax:

- Selling or Trading Crypto: Selling or trading crypto for a profit is generally considered a capital gain.

- Tax Rates: The rate depends on how long you’ve held the asset and your country’s tax laws.

- Income Tax:

- You must report crypto earned through staking, interest rewards, or payments as taxable income.

Since tax rates and regulations vary by country, it’s essential to understand your local tax laws. Consulting a tax professional can help you report your Nexo transactions accurately and stay compliant.

Connecting Your nexo Account with Catax via Trade History

In Nexo:

- Go to Nexo.com, log in to your Nexo account.

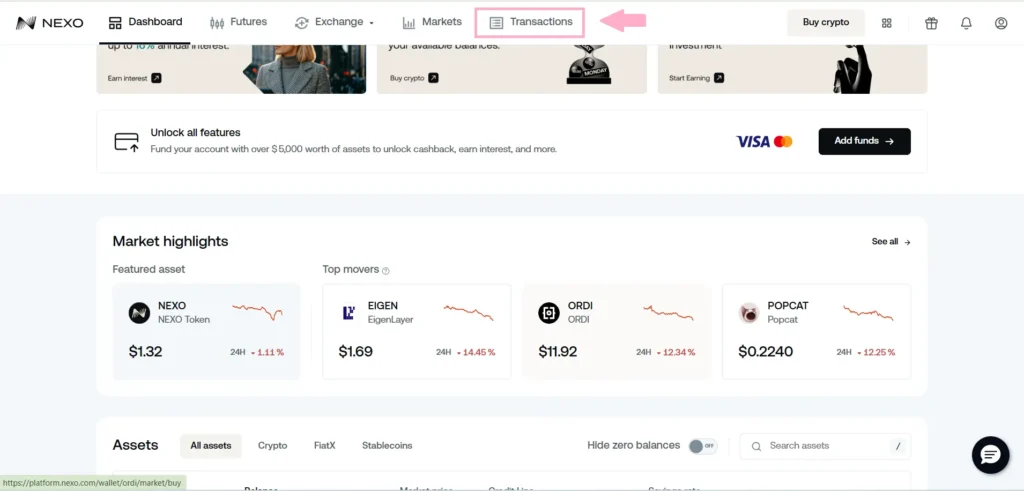

- After logging in, click on ‘Transactions’.

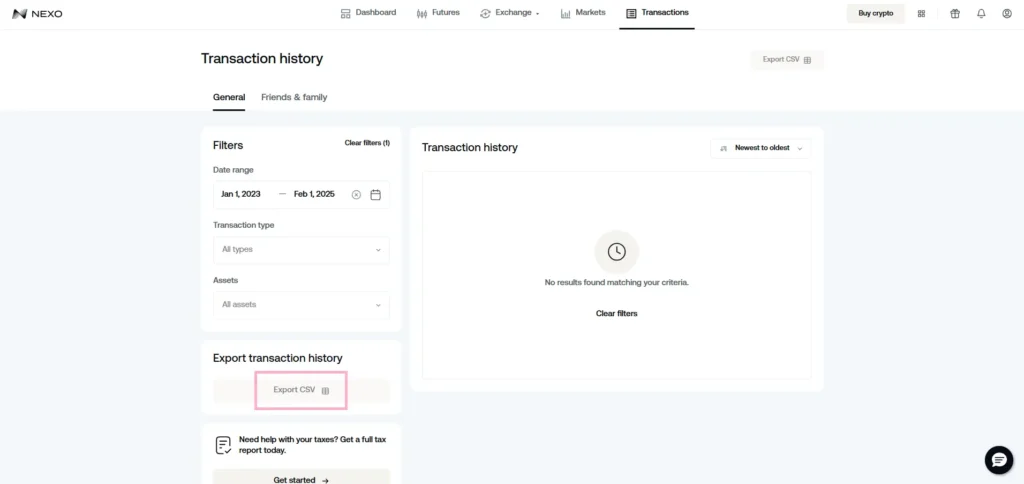

- In ‘Transaction’ Section, Select Date Range, In Transaction Type and Asset Select All types and all assets.

On Catax:

- First, log in to your Catax account.

- Go to the integration section, select Nexo and enter your API and secret key.

- Enable auto-sync to sync the full transaction history.