- For simpler tax reporting on Deribit in India, use Catax, a handy crypto tax calculator. Here’s how to do it easily:

- Why is it important to keep good records for your taxes?

- How does Catax help with Deribit taxes, and why should you use a crypto tax calculator?

- How do I file my Deribit taxes?

- Connect Buycoin Manually with Catax via CSV:

Deribit, a popular global crypto exchange, has a lot of trading activity every day, including spot and margin trading, derivatives, and earning options. Catax is here to help with all your Deribit tax needs in India.

For simpler tax reporting on Deribit in India, use Catax, a handy crypto tax calculator. Here’s how to do it easily:

- Firstly, sign up on Catax and select India as your country, then choose your preferred currency.

- Next, securely link your Deribit account to Catax to import your trading details.

- Following this, Catax will automatically sort your Deribit transactions into profits, losses, and income.

- Subsequently, Catax calculates your Capital Gains Tax for Deribit transactions and income tax according to Indian regulations.

- Afterward, effortlessly download your crypto tax report from Catax.

- Finally, file your crypto taxes online, by post, or with the assistance of a tax expert knowledgeable in crypto matters.

Why is it important to keep good records for your taxes?

When you’re dealing with Deribit taxes, it’s really important to keep track of a few key things. Make sure you know how much you paid for your crypto when you bought or sold it, and how much money you made from each deal. Also, figure out the value of any crypto you earn in Indian Rupees (INR) at the time you get it.

How does Catax help with Deribit taxes, and why should you use a crypto tax calculator?

Catax is super helpful for doing your crypto taxes. It takes care of the tough math parts. Once you connect your Deribit account to Catax, it puts together detailed tax reports for you fast. The cool thing about a crypto tax tool like Catax is that it makes doing your taxes easier and more accurate.

How do I file my Deribit taxes?

To manage your Deribit taxes with ease, Catax is a great solution. You can connect your Deribit account to Catax in two ways: either directly using an API for automatic trade data updates, or by uploading a CSV file of your trades. Catax uses this data to accurately calculate the taxes you owe.

Once connected, Catax organizes all your transactions. It identifies taxable events and applies the tax rules specific to your country. Catax is designed for Deribit users globally, ensuring that your tax reports comply with local laws, whether you’re in India or elsewhere.

But Catax does more than just calculate your Deribit taxes. It also converts them into easy-to-understand reports, which is incredibly useful if you find the world of crypto taxes daunting. This clarity reduces the likelihood of errors that might occur if you were handling it on your own.

The reports from Catax provide a complete overview of your Deribit taxes, guiding you on how to file them accurately. With Catax’s detailed summaries, you can see how your Deribit trading activities fit into your overall tax obligations.

In essence, Catax simplifies Deribit tax calculations. It’s effective for working with Deribit, aligns with international tax regulations, and generates clear, accurate reports. This makes the process of managing crypto taxes much more straightforward for investors worldwide.

Connecting Catax and Deribit:

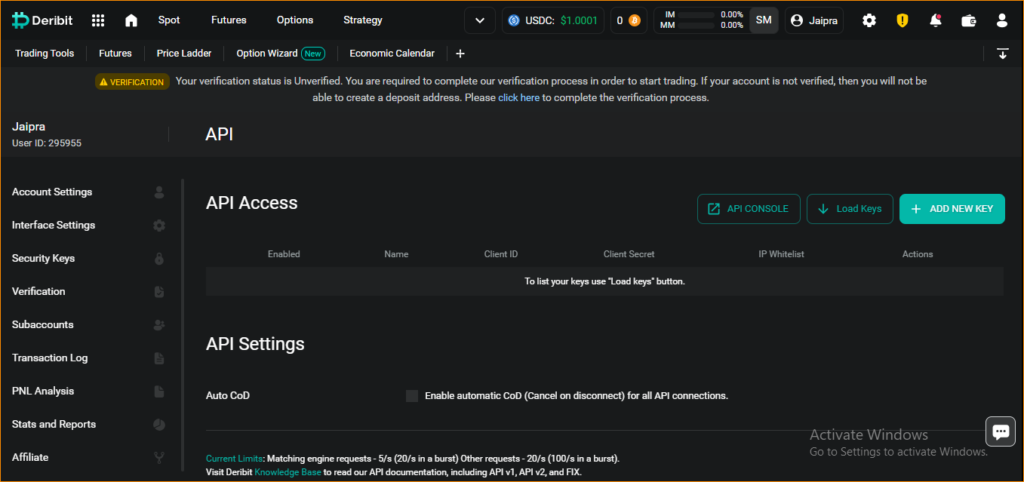

Connecting Deribit to Catax via API

For Deribit:

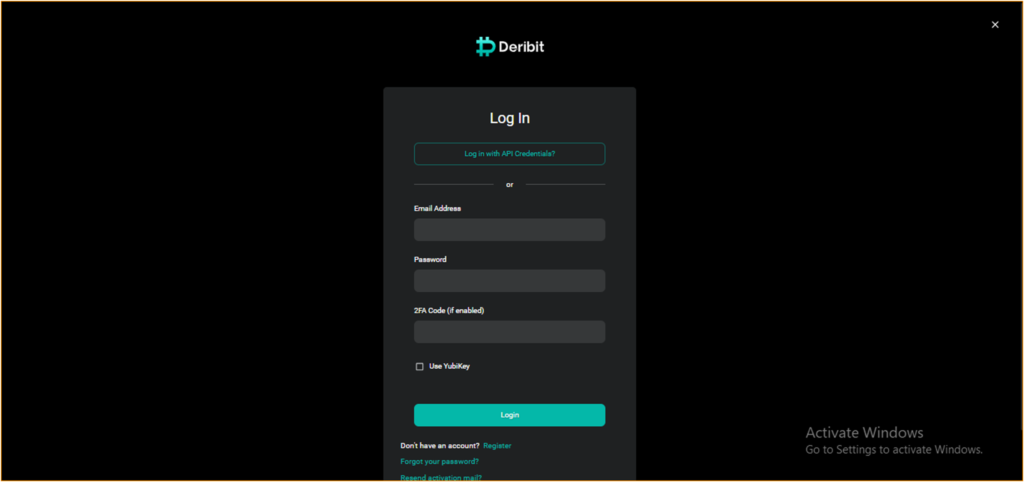

- Sign into your Deribit account.

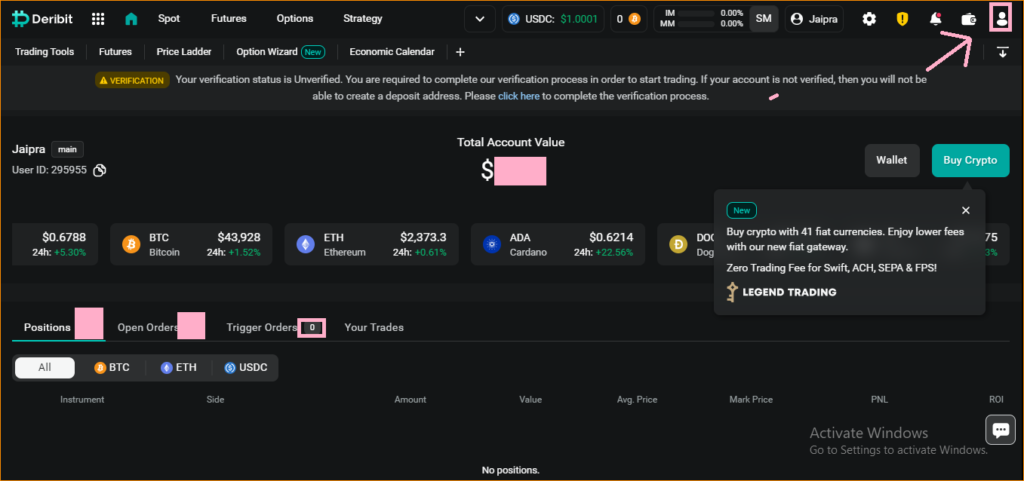

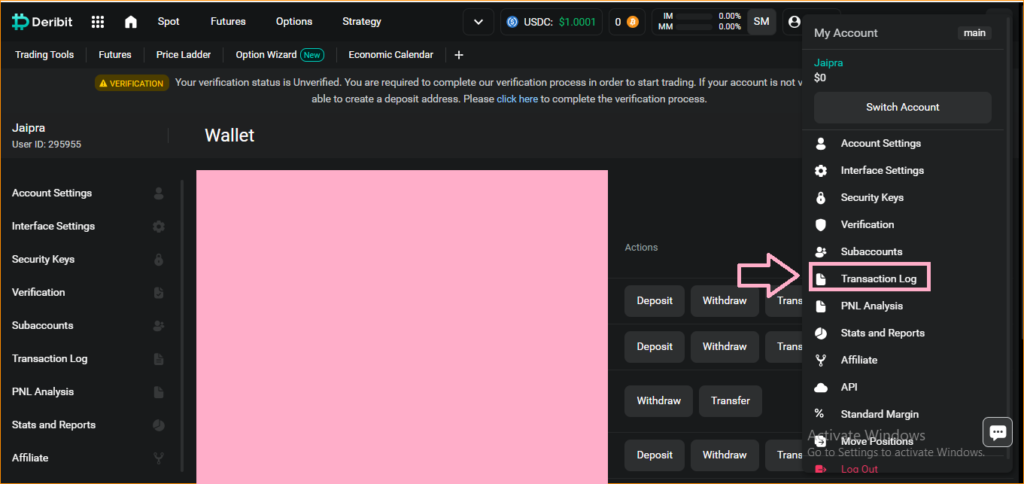

- In the top right corner, Click on Profile icon.

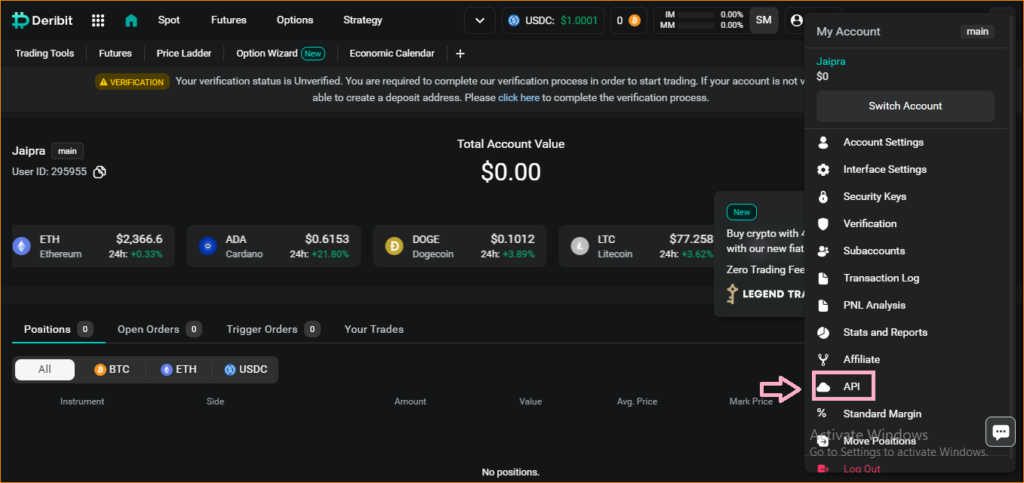

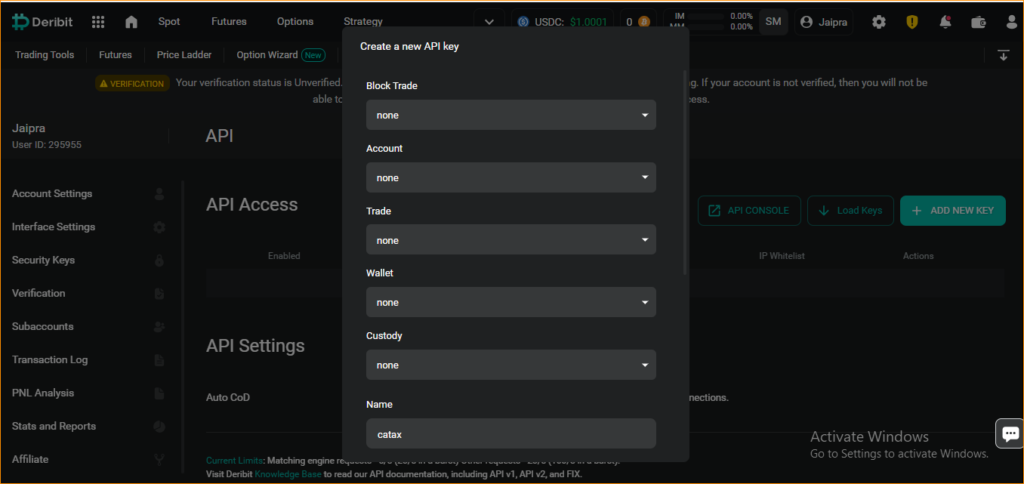

- choose ‘None’ under the categories of Block Trade, Trade, Wallet, and Custody. Name your API key like ‘Catax’.

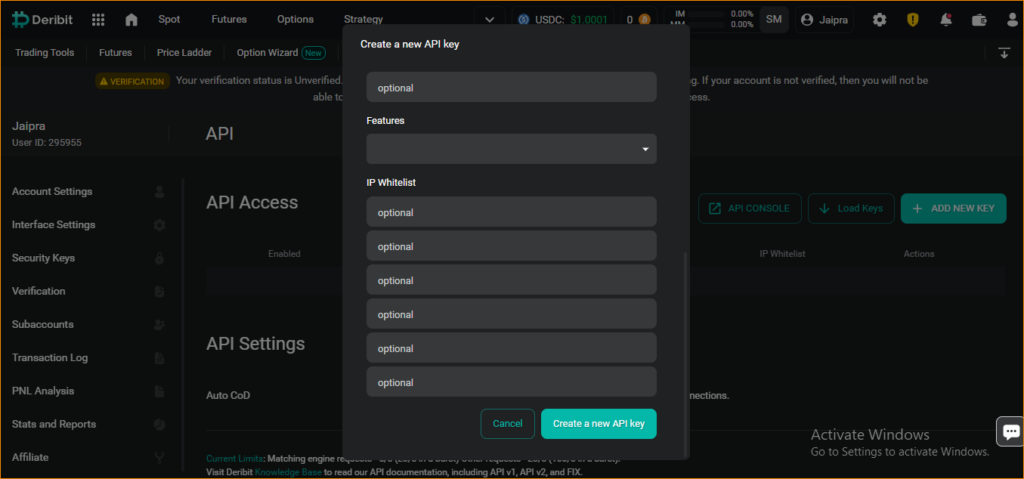

- Click On ‘Create a new API Key‘

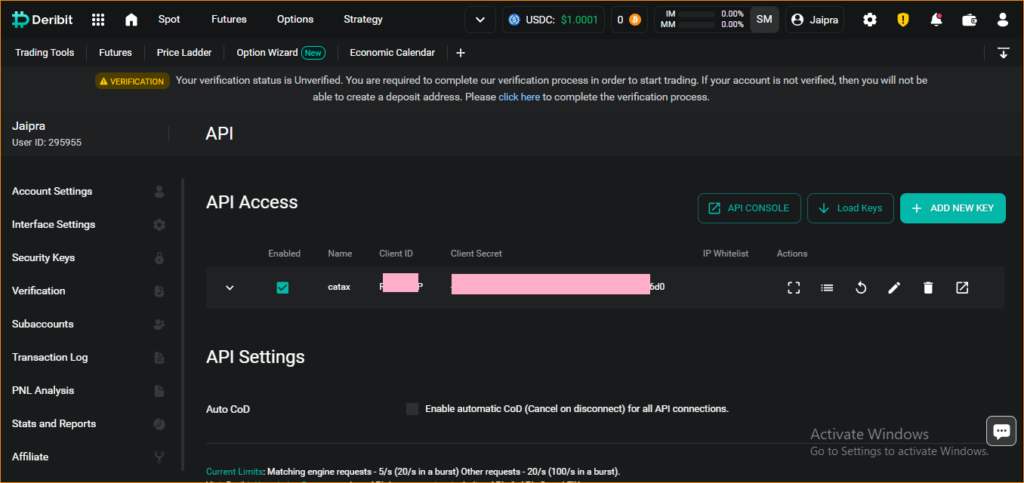

- Your Client ID and Client Secret will be ready.

Discover: How to Create API for Deribit in Brief?

For Catax:

- First, log in to your Catax account.

- Go to the ‘wallets’ section and add your Deribit wallet.

- Turn on auto-sync, then enter your Client key and Client secret to safely bring in your data.

Connect Buycoin Manually with Catax via CSV:

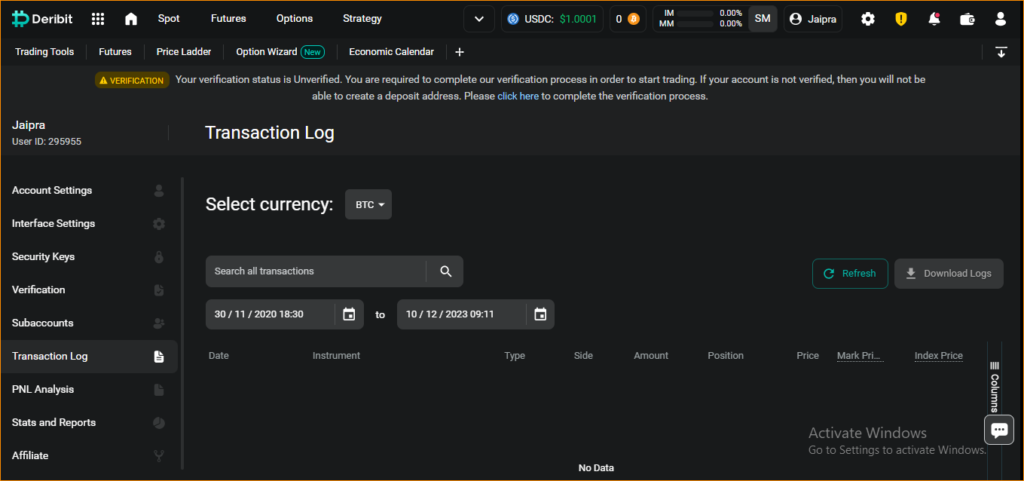

- After Logging in, Click On Transaction Log.

- Choose a time period that includes all your Deribit transactions.

- Then, click on ‘Download Logs’.

On Catax:

- Sign in to your Catax account.

- Head over to the ‘Wallets’ area.

- Tap on ‘Add New Wallet’ and pick ‘Deribit’.

- Choose ‘Import from File’.

- Upload your Deribit CSV file(s).