This guide offers a step-by-step approach for managing your Bitfinex taxes, designed to assist both new and seasoned traders in correctly handling their tax affairs related to Bitfinex transactions.

To make Bitfinex tax reporting simple, try using Catax, a great crypto tax calculator. Here’s the process:

- Account Setup on Catax: Start by creating an account on Catax. Select India as your country and choose INR as your currency.

- Linking Bitfinex to Catax: Then, securely connect your Bitfinex account to Catax. This step ensures the automatic transfer of your transaction data.

- Organizing Transactions: Next, Catax will sort your Bitfinex transactions into categories like profits, losses, and income.

- Downloading Tax Report: After organizing, you can easily download your cryptocurrency tax report from Catax.

- Filing Taxes: Lastly, use this report for online tax filing or hand it over to your tax professional for help.

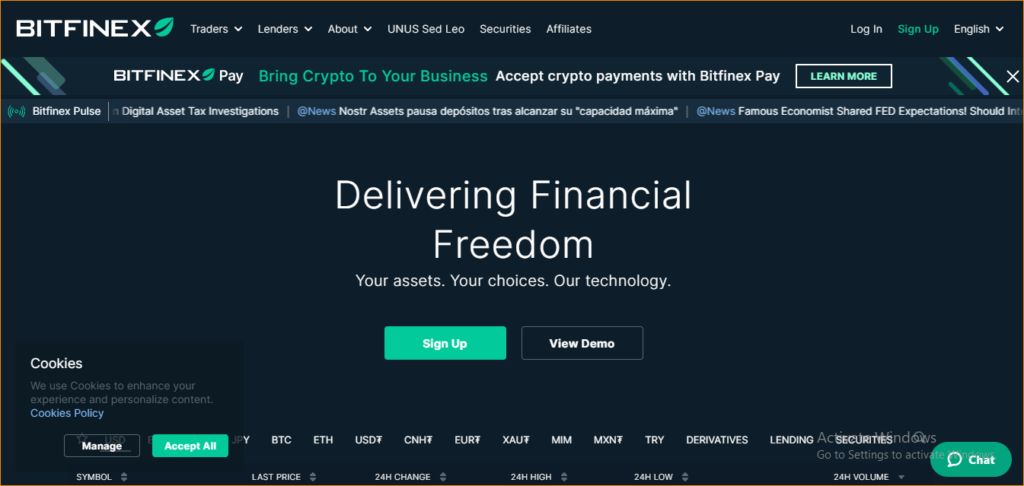

What is Bitfinex and How Does It Work?

Bitfinex is a well-known cryptocurrency platform, that provides a safe way to buy, keep, and understand crypto. It focuses on making crypto easy to use. Since 2013, Bitfinex has helped millions around the world invest in crypto safely.

How Do I File My Bitfinex Taxes?

To handle your Bitfinex taxes easily, using Catax is a smooth plan. Link your Bitfinex account to Catax either through an API for automatic updates or by uploading a CSV file of your trades. Catax then uses this information to accurately work out your tax needs.

Once linked, Catax categorizes your transactions to pinpoint taxable events. It applies tax rules tailored to your location. With its global design, Catax handles Bitfinex taxes for users in any country, aligning with local tax laws to ensure accurate and legal reporting.

Catax does more than just calculate; it organizes your Bitfinex taxes into clear reports, simplifying the typically complex nature of crypto tax reporting and reducing manual calculation errors.

These reports from Catax provide a comprehensive view of your Bitfinex taxes, aiding in understanding and filing them. Catax’s detailed breakdown offers clarity on your tax status from Bitfinex activities and their role in your overall tax duties.

In conclusion, Catax is a really useful tool for making Bitfinex tax calculations easier. It works well with Bitfinex, follows tax rules from all over the world, and creates clear, correct reports. This makes handling crypto taxes simpler for investors everywhere.

Connecting Catax and Bitfinex:

Connecting Bitfinex to Catax via API

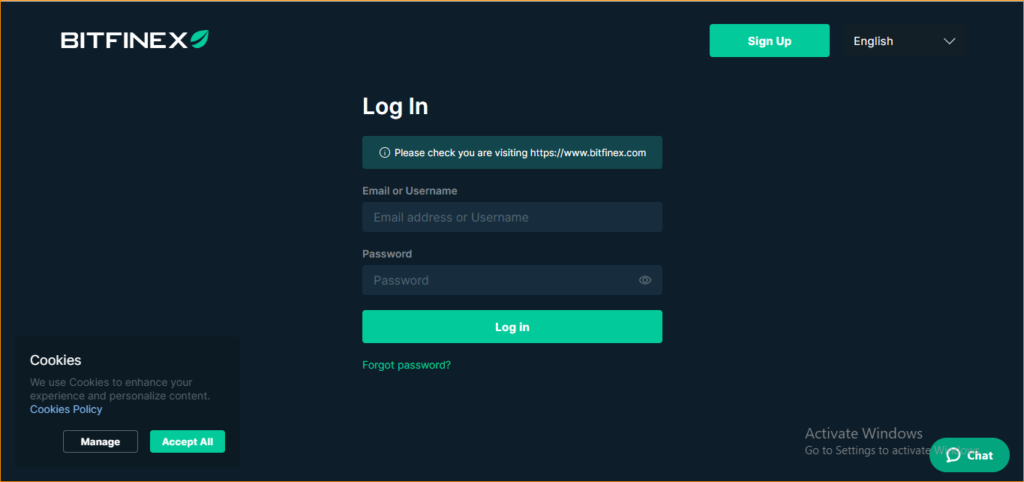

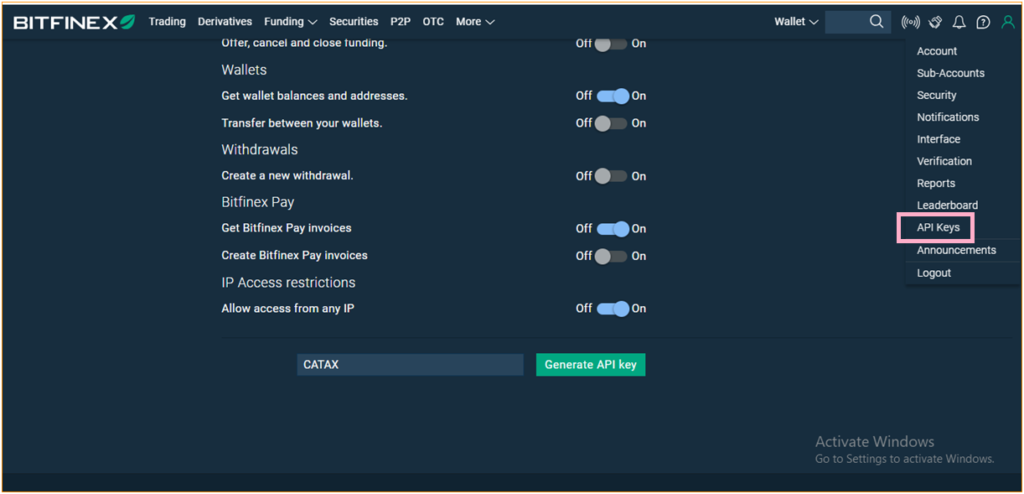

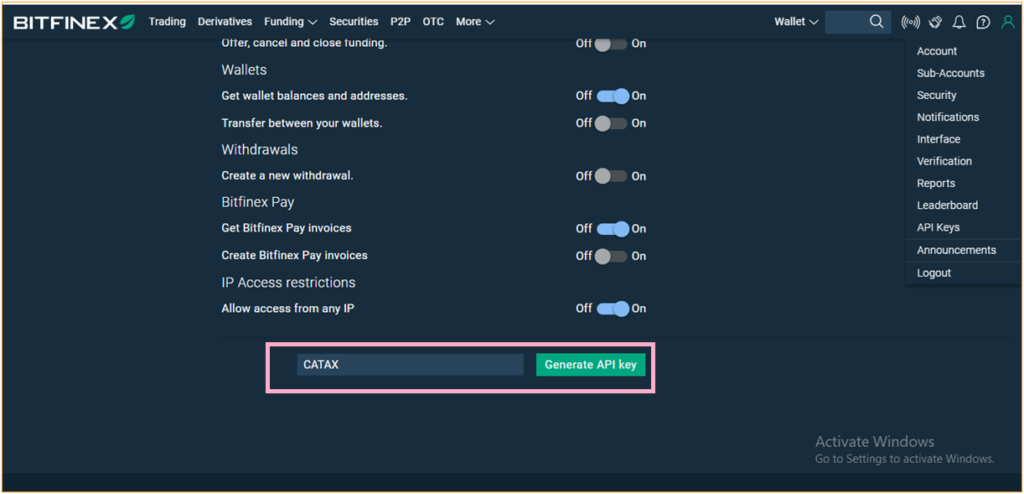

For Bitfinex:

- Sign in to your Bitfinex account.

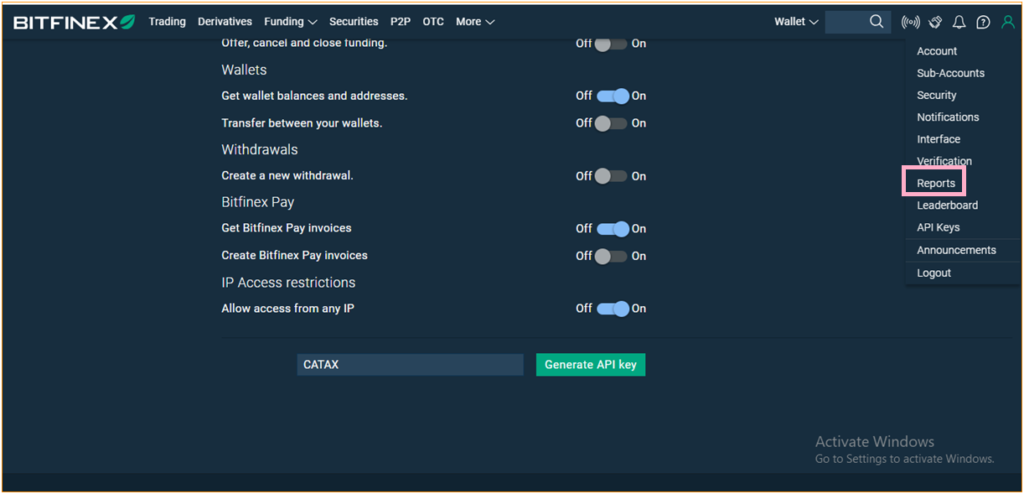

- Keep all settings as they are, label your API key as ‘catax’, and then click on ‘Generate API key’.

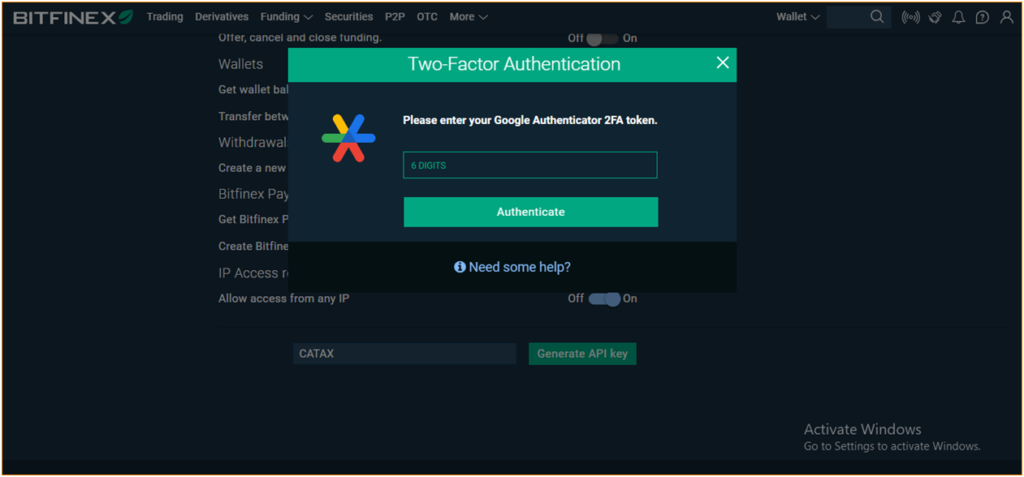

- Complete Your 2FA.

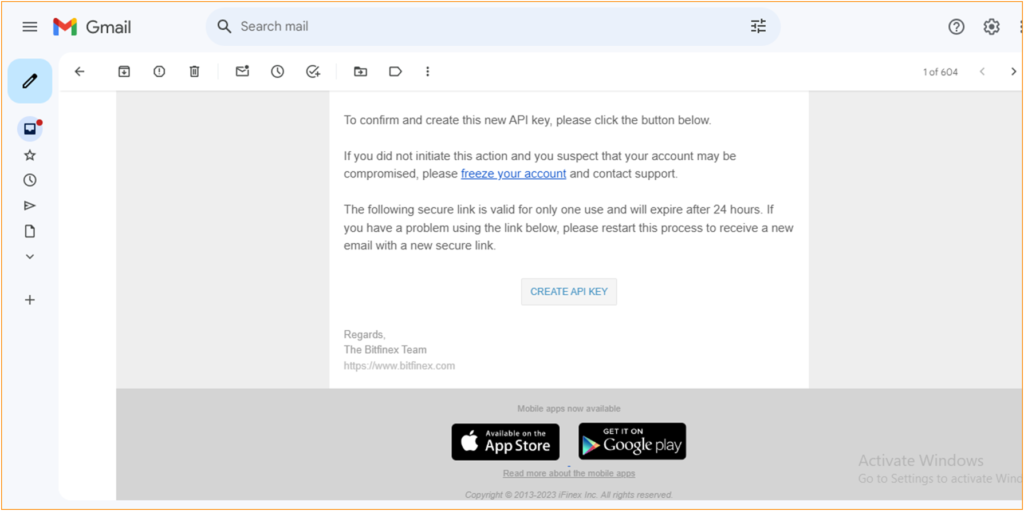

- You will receive an email at your registered email address. Then Click on ‘CREATE API KEY’

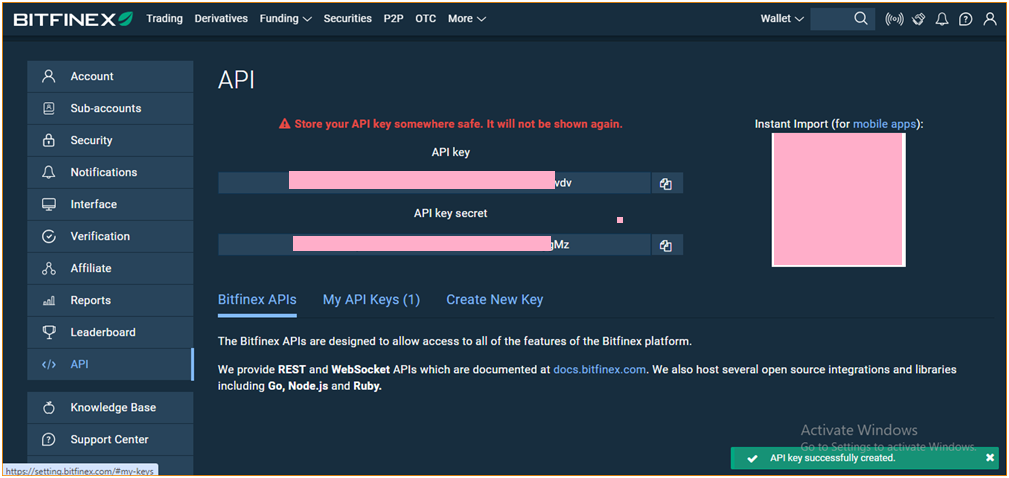

- Complete the steps, and then your API key, as well as the Secret key, will be successfully created.

Discover: How to Create API for Bitfinex in Brief?

On Catax:

- Start via logging into Catax.

- Head over to the wallets area and upload your Bitfinex wallet.

- Set it to auto-sync after which input your API key and mystery to safely import your records.

Connect Bitfinex to Catax to Calculate Bitfinex taxes manually via CSV file:

On Bitfinex:

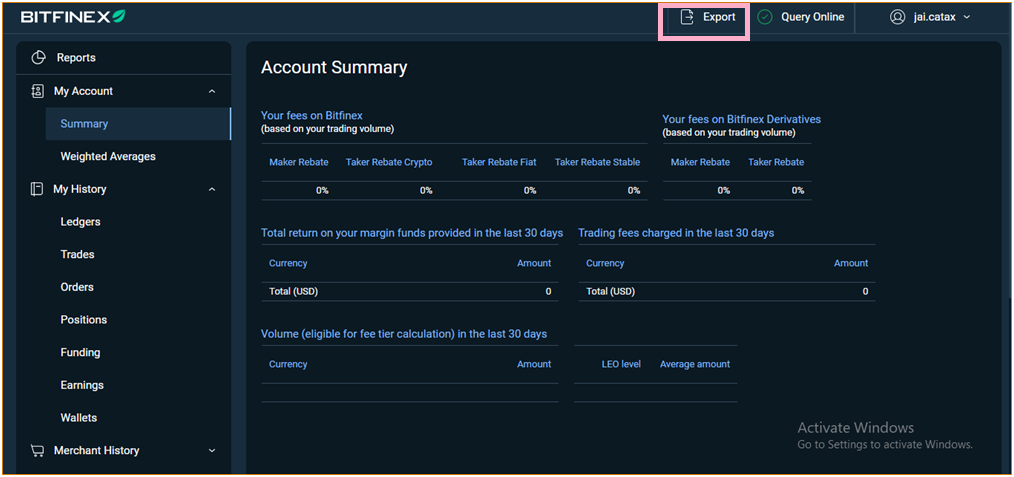

- After Logging in, Head to the profile Icon, and Select Reports.

- Next, proceed to click on ‘Export’.

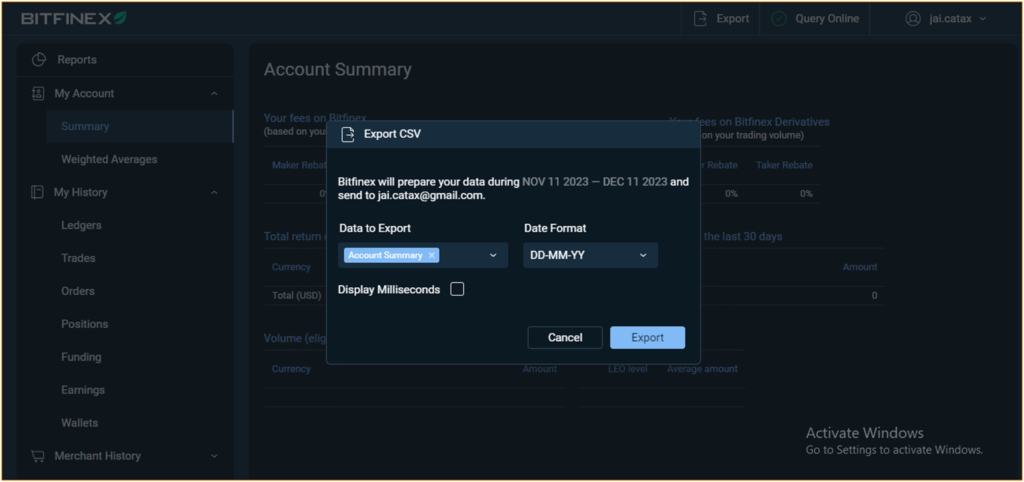

- First, choose the time period you need, and then click on ‘Export’ to complete the process.

- Once completed, your transaction history will be emailed to you directly.

To add Bitfinex transactions to Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’, choose ‘Bitfinex’.

- Select ‘Import from File’.

- Upload your Bitfinex CSV file.