This guide helps you manage your Circle taxes clearly and straightforwardly. It was created to assist both new and experienced traders in handling tax matters related to Circle transactions effectively.

To simplify your Circle tax reporting, consider using Catax, a highly efficient cryptocurrency tax calculator. Follow these simple steps:

- Commence Catax Account Setup: Initially, create your Catax account, selecting India as your country and setting the currency to INR.

- Secure Link with Circle: Establish a secure link between your Circle account and Catax for automatic transaction data transfer.

- Efficient Transaction Organization: Enable Catax to organize your Circle transactions efficiently, categorizing them into profits, losses, and income.

- Download Comprehensive Report: Easily download Catax’s cryptocurrency tax report for a detailed breakdown of financial activities.

What is Circle and how does it work?

Circle, a fintech company, uses USDC, a stablecoin that makes quick, low-cost global transactions simple. It’s crucial for international payments, making it easier to get US dollars, especially in growing markets. Circle’s platform includes digital asset trading and various financial services. It also incorporates Circle tax considerations, ensuring financial operations and tax compliance are as straightforward as sending an email.

How do I file my Circle taxes?

To streamline your Circle taxes, integrating Catax into your financial toolkit can be incredibly efficient. Start by connecting your Circle account to Catax, opting for either an API integration for real-time data or manually uploading your Circle transaction history through CSV. This initial step is crucial for Catax to assess your Circle taxes accurately.

Catax will then scrutinize your Circle transaction data, pinpointing taxable events and applying the relevant tax statutes specific to your location. The global functionality of Catax means that Circle taxes are calculated accurately for users from various jurisdictions, promoting adherence to diverse tax codes.

Beyond mere Circle tax calculations, Catax also organizes your data into coherent reports. This is especially advantageous for those unfamiliar with cryptocurrency taxation, as it reduces common manual errors.

The detailed reports from Catax provide a full perspective on your Circle taxes, aiding in comprehension and preparation for tax filing. With this tool, you can clearly understand your Circle tax obligations and their impact on your overall tax responsibilities.

In conclusion, Catax is an invaluable asset for simplifying your Circle taxes. Its seamless Circle account integration, adaptability to international tax laws, and generation of meticulous, regulation-compliant reports make Circle tax filing simpler for crypto investors globally.

Connecting Catax and Circle via API:

For Circle:

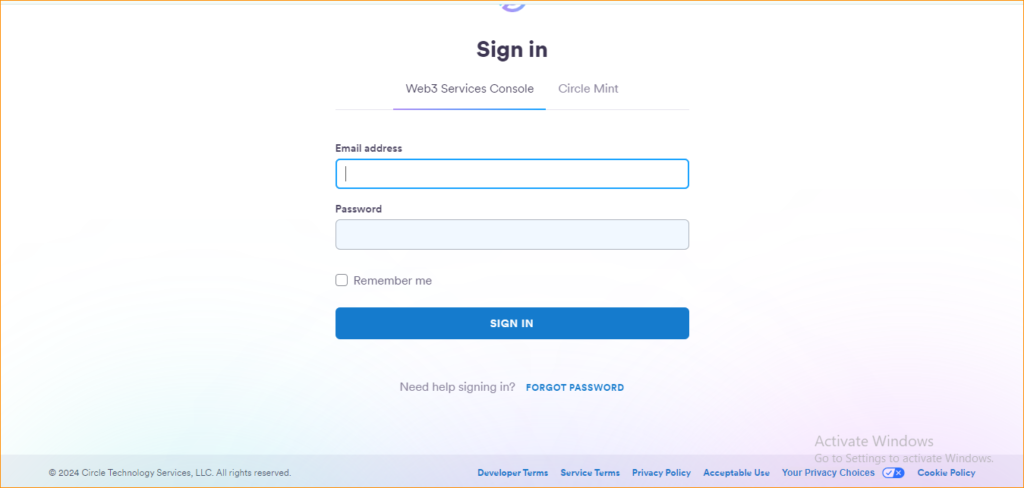

- Sign in to your Circle account.

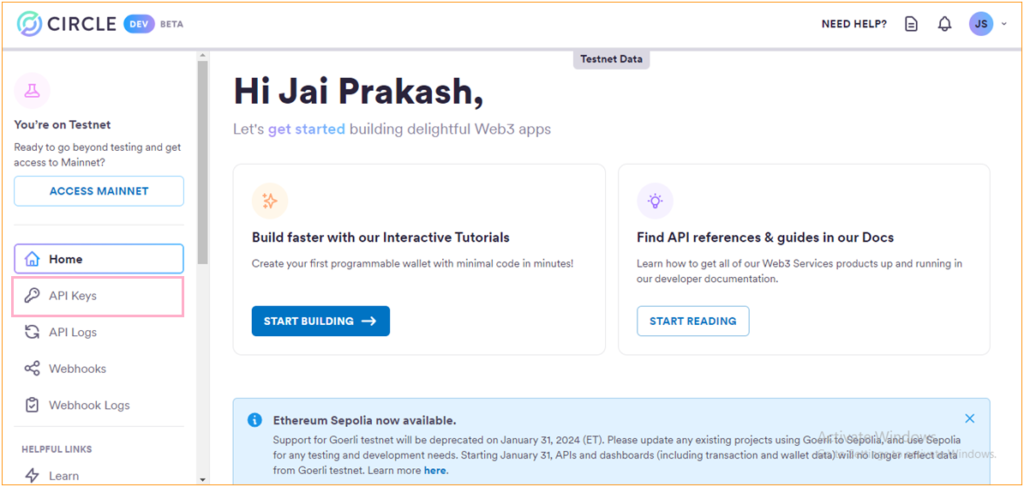

- After Logging in, Head to the ‘API keys’ Section.

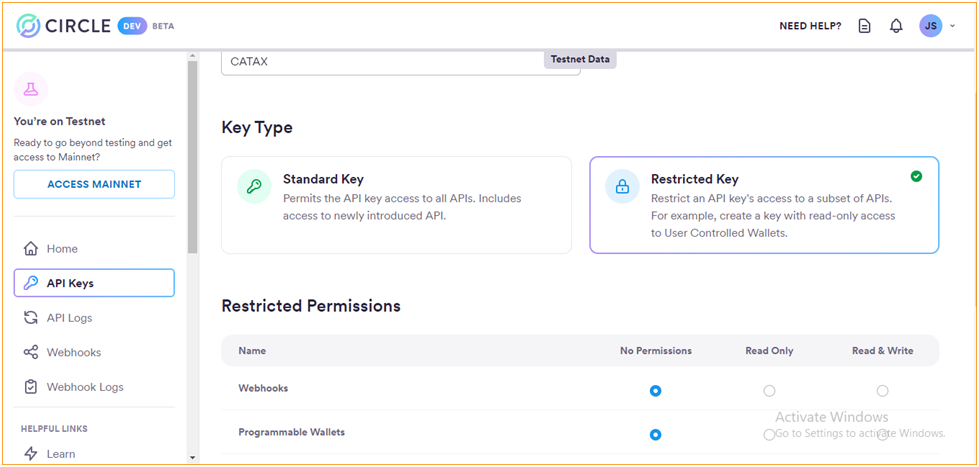

- In the ‘API keys’ segment, Click on ‘Create key’, Name your key(e.g. Catax), and Select the Key type on ‘Restricted key’.

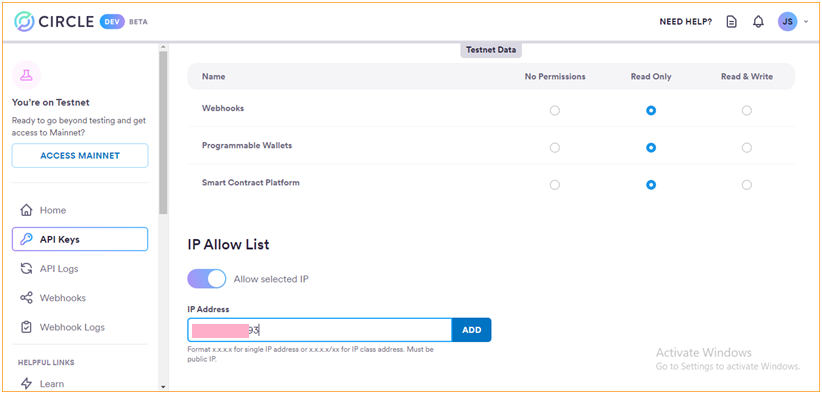

- Configure ‘Webhooks,’ ‘Programmable Wallets,’ and ‘Smart Contract Platform’ to Read-only. Add your IP address in the format of IPv4.

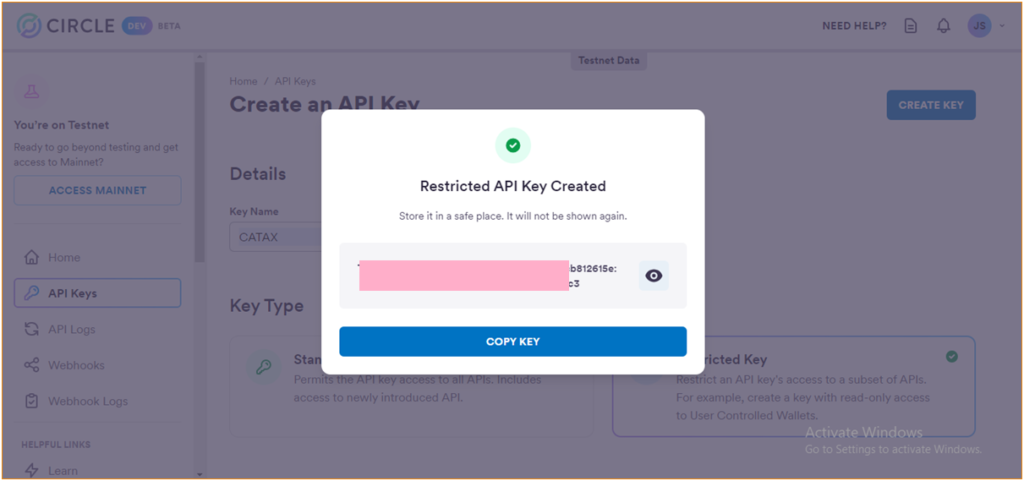

- Then go to the top and click ‘Create key.’

- Your API key will be Ready.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, and proceed to enter your API key and secret to import your data

Explore: