Exporting your Binance C2C Order History is a seamless and straightforward process, designed to enable you to maintain a comprehensive and detailed record of all your transactions for various essential purposes such as review, analysis, or tax reporting. Below, we present a meticulously crafted guide, enriched with clear transition words for ease of understanding, to guide you through the process of exporting your C2C Order History effectively and efficiently.

Why Export Your C2C Order History?

Exporting your C2C order history is essential for several reasons:

- Tax Preparation: Maintains a detailed record for tax reporting and ensures compliance with local tax laws.

- Performance Analysis: Helps you assess your trading strategies and make data-driven decisions.

- Record Keeping: Provides a backup of your transaction history for personal record-keeping or dispute resolution.

Step to Step explain how you can export your Binance C2C Order History.

- First, Logging In to your Binance Account with Your Credentials.

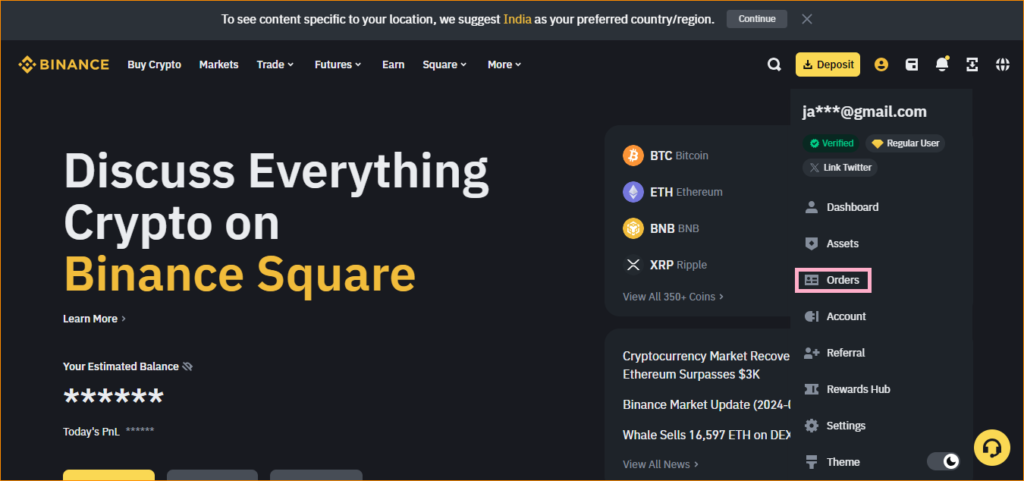

- Head to the Profile Icon, Then Select ‘Order’.

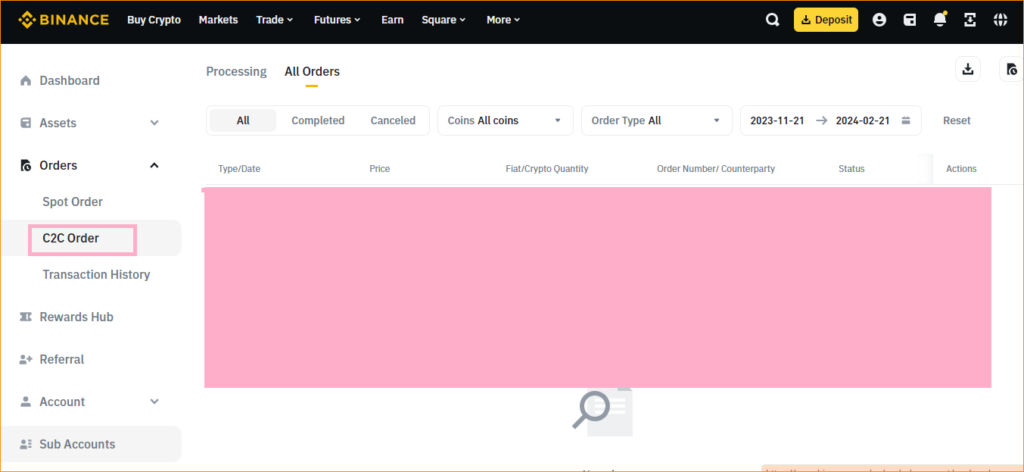

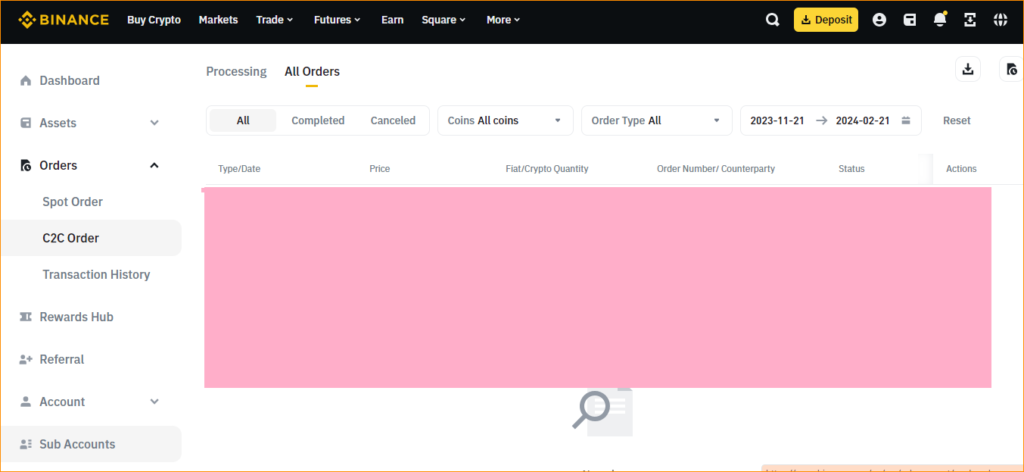

- In the ‘Order’ Section, Click on C2C Order.

- Keep Everything in all, choose your preferred date range then click on Export icon.

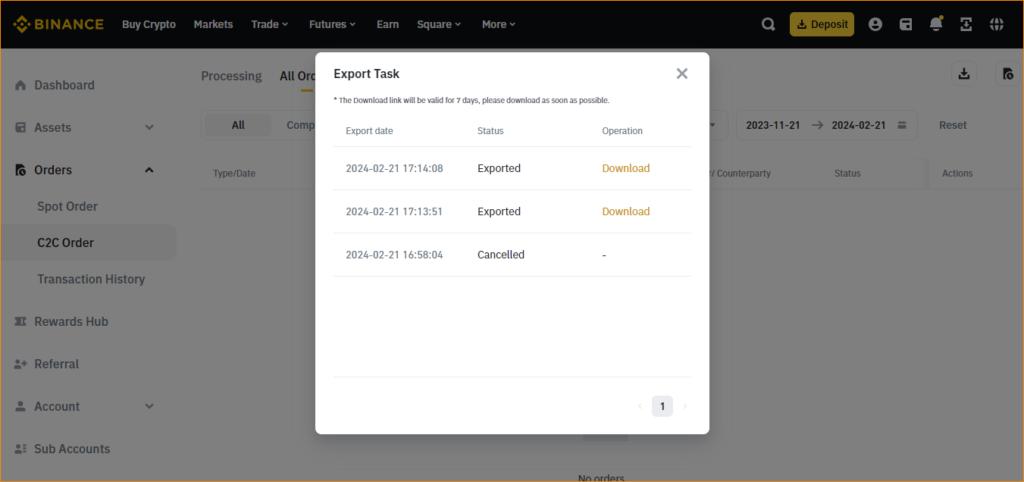

- Your C2C order history will be generated in a few seconds.

Why Connect Your C2C Order History with a Crypto Tax Calculator?

A crypto tax calculator helps you in many ways, here are some points explaining how it can help.

Accurate Tax Reporting: The complexity of crypto transactions can make tax reporting a daunting task. Additionally, by integrating your Binance C2C order history with Catax, you can automate the calculation of capital gains or losses. As a result, this ensures accuracy in your tax filings.

Compliance with Tax Laws: Tax authorities worldwide are increasing scrutiny on cryptocurrency transactions. Properly reporting your P2P trades with the help of tools like Catax ensures you remain compliant. Consequently, this can help you avoid potential penalties.

Time and Effort Savings: Manual calculation of taxes for numerous transactions can be time-consuming and prone to errors. Therefore, Catax uses your Binance C2C order history to streamline the process, ultimately saving you significant time and effort.

Comprehensive Tax Overview: Catax provides a holistic view of your crypto investments and tax obligations by analyzing your entire trading history. Additionally, this comprehensive overview is invaluable for making informed investment decisions and planning for tax season.

Minimize Errors: The complexity of determining the cost basis and identifying taxable events in crypto trading can lead to errors. Catax minimizes these risks by accurately processing your Binance C2C order history.

The Role of C2C History in Catax

Exporting your Binance Binance C2C order history and integrating it with a crypto tax calculator like Catax simplifies the complex task of crypto tax reporting. Moreover, it not only saves time but also ensures accuracy and compliance with tax regulations. Furthermore, as the crypto market continues to evolve, having a reliable method for tracking and reporting your transactions is indispensable for every trader. Therefore, staying proactive with your tax obligations is key to navigating the crypto space successfully.

Frequently Asked Question(FAQs)

Exporting your C2C Order History is crucial for tax preparation, performance analysis, record keeping, and ensuring compliance with local tax laws.

Connecting to Catax offers several benefits. For instance, it provides accurate tax reporting, ensuring compliance with tax laws. Additionally, it saves time and effort, while also offering a comprehensive tax overview. Moreover, it minimizes errors in tax calculation.

Catax uses your C2C Order History to calculate capital gains or losses, ensuring accurate tax reporting. It provides a holistic view of your crypto investments and tax obligations, simplifying the tax reporting process.

Yes, by linking your trade history to a crypto tax calculator like Catax, you can automate tax calculations. In addition, this can help simplify the process and ensure accuracy.