In this guide, we will explain the taxation of Binance transactions and provide you with a straightforward process to quickly report your Binance taxes. Additionally, we will outline the steps needed to ensure compliance with tax regulations. Furthermore, we will offer tips on organizing your transaction history and staying updated on changes in tax laws.

Managing Your Binance Taxes Efficiently.

To Calculate your Binance Taxes, securely connect to your Binance account to collect all your trading data. Then, Catax sorts everything into a clear report that’s easy to understand. It also works out how much tax you owe using the latest rules. Lastly, it gives you all the forms you need to send to the tax people. With Catax, you can handle your Binance taxes with confidence and ease.

- Create Your Catax Account: Sign up for Catax by selecting your country and preferred currency.

- Connect Binance with Catax: Safely transfer all your Binance trading data into Catax.

- Automatic Calculation: Automatically figures out your profits, losses, and income from Binance.

- Create Your Tax Report: Get your Binance tax report ready for download from Catax.

- Pay Taxes: Settle your Binance taxes online or through your crypto tax professional, trusting fully in your return’s precision.

What is Binance?

Binance, known as one of the biggest cryptocurrency exchanges globally, was started in 2017 by Changpeng Zhao, also fondly called “CZ.” With its main office in Malta, Binance is a significant player not just in Malta but all over the world. Binance is a place where you can trade many different cryptocurrencies, including well-known ones like Bitcoin, Ethereum, and Ripple.

Simplify your tax reporting with Catax

Catax works by importing your Binance transaction to calculate tax on Binance data to analyze what is taxable and what is not. Let’s look at an example: Below are some transactions on a Binance account.

Via import CSV files

- Sign in to your Binance account.

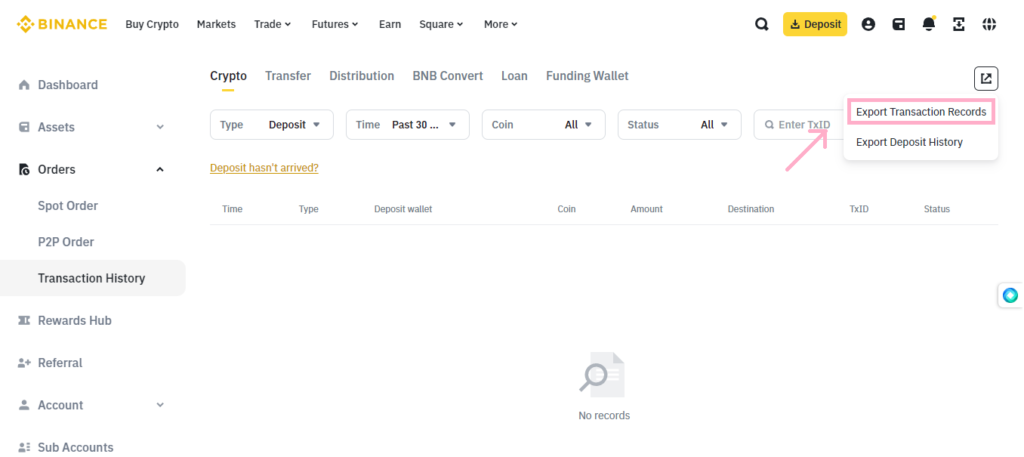

- Find and click on “Export Transaction Record” in the arrrow icon.

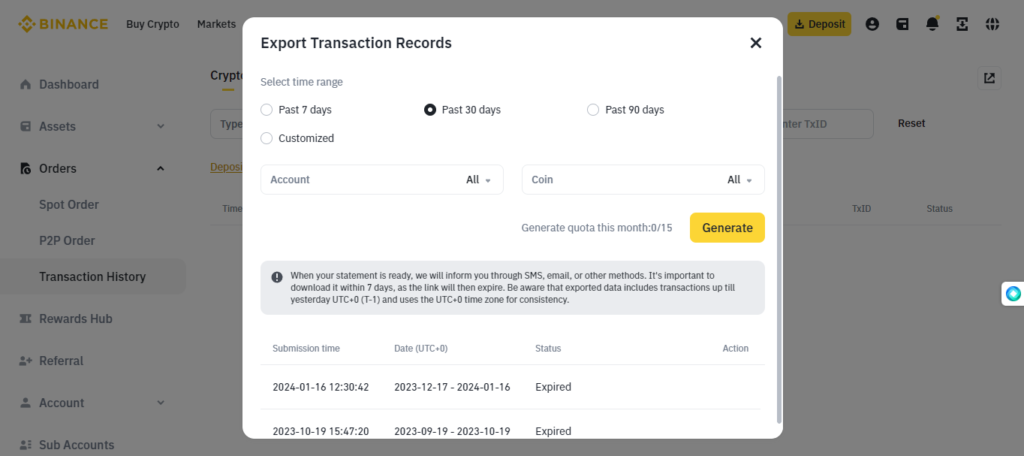

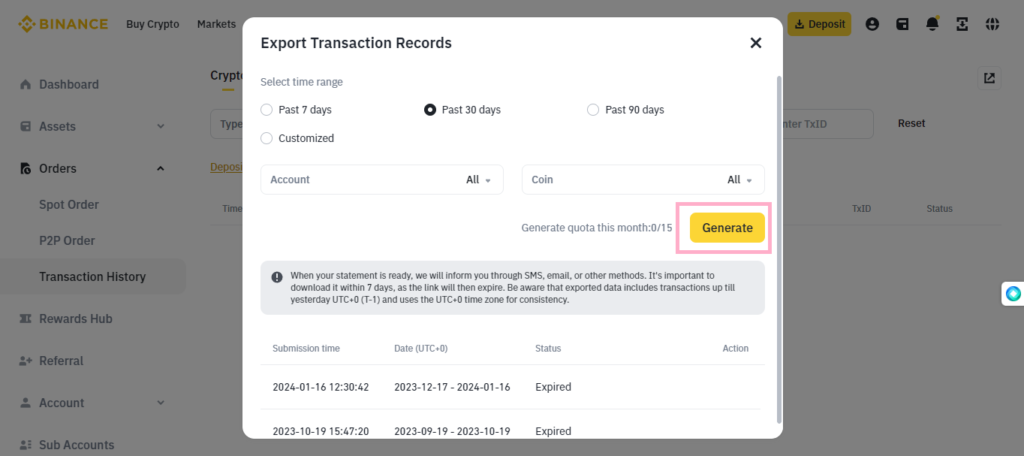

- Select “Customize” under ‘Range‘ and set start/end dates for each year.

- Click “Generate” and wait for the report. After that download it. if extract it’s a compressed format like ‘.zip’ before uploading

Your Transaction history will be ready in 3 hours.

On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select Cryptoforce.

- Choose ‘Import from File’.

- Upload your OKX CSV file.

via API keys

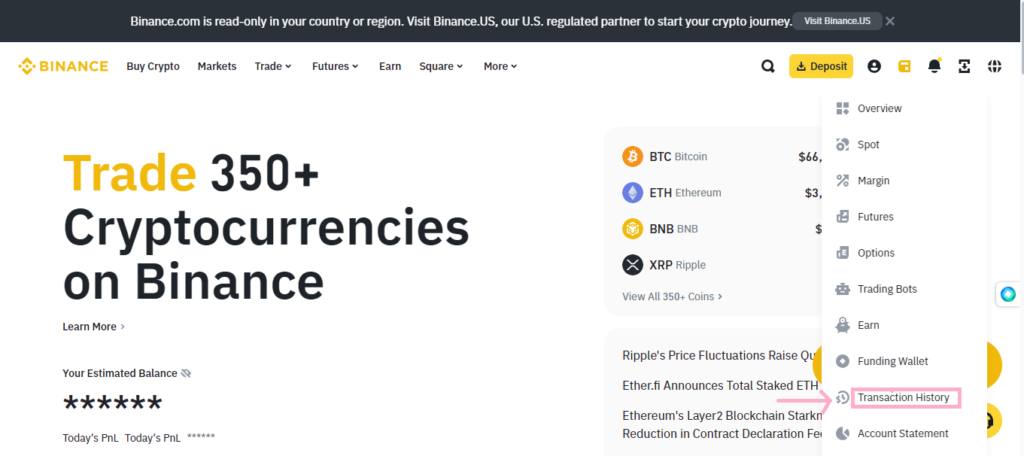

- Log in to Binance.

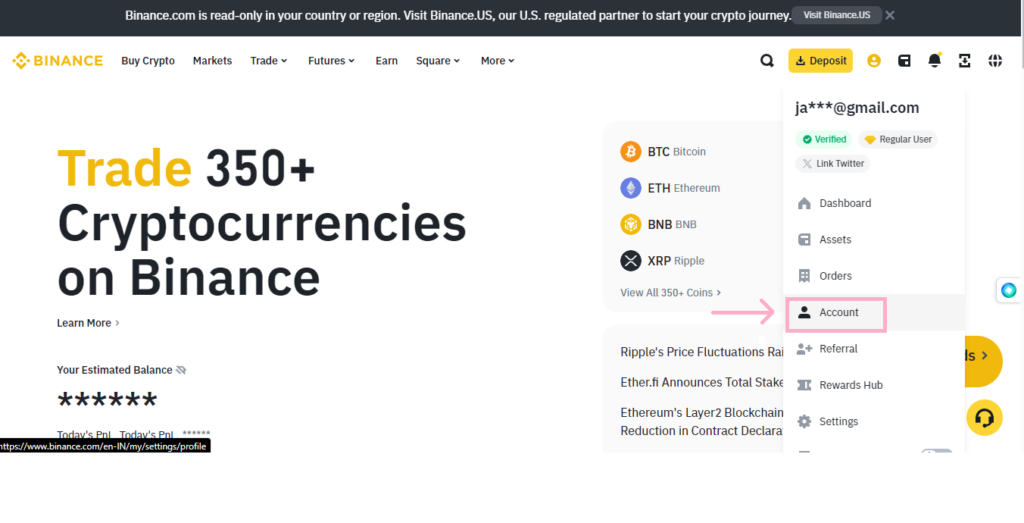

- Head to the Profile icon and click on the Account.

- In the Account section, go to API Management.

- Select Create Tax Report API – by default it is read-only.

- Copy the API key and API secret.

On Catax:

- Sign up or log in to Catax and head to the wallets page.

- Add a new wallet: Binance.

- Select Set up auto sync.

- Paste your Binance API key and API secret.

- Select secure import.

With Catax, managing your Binance taxes becomes a streamlined process, ensuring accurate reporting and peace of mind.

How Catax Helps You to Calculate Binance Taxes?

Catax helps you keep track of your taxes in real time, so you always know what you owe. It also gives you personalized tips to pay less tax. Catax works with many different types of money, which is handy if you live in different places. Plus, it keeps your financial info safe and secret with special codes. It can even find ways for you to pay less tax. Whether you’re just starting with crypto or you’re an expert, Catax makes doing your Binance taxes easy and even helps you save money.

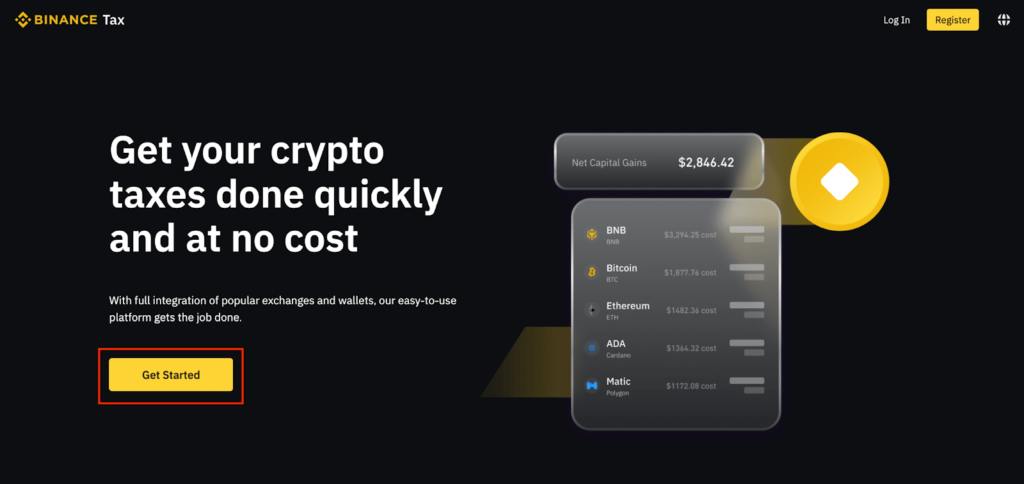

Catax Tax Calculator – Simplify Your Crypto Tax Reporting

Catax is a top-notch tool for handling your crypto taxes, especially if you trade on Binance. It’s made to make reporting and filing taxes on your crypto transactions super easy. Whether you’re trading for yourself or running a business, Catax has an easy-to-use platform that takes care of all your Binance tax stuff. It’s like having a helpful friend for your crypto taxes, making everything simple and stress-free. With Catax, you can manage your Binance taxes without any worries and have a smooth tax season. Say goodbye to the confusing parts of crypto taxes and hello to a hassle-free time doing your taxes.

Ensuring Your Crypto Security on Binance.

Yes, many people believe Binance is a safe place to trade crypto. It’s one of the biggest crypto exchanges globally and takes security seriously. Also, Binance uses advanced methods to keep your crypto safe, like storing most of it offline where hackers can’t reach it. They also watch for any strange activity and use strong encryption to protect your information. Also, Binance gives you tools to add extra security to your account, like special codes and notifications. But it’s smart to always be careful and keep your crypto in a secure wallet when you’re not using it.

Does Binance send tax forms?

No, and the best reason behind that. In addition, Binance serves millions of users worldwide. As a result, the exchange will be able to generate a large number of tax forms to serve all of its users. However, you can use a crypto tax calculator like Catax, the crypto tax expert, to easily get your Binance tax forms.

Get your Binance tax documents

You have two options for handling your cryptocurrency taxes. First, you can do it yourself by carefully looking at which transactions you need to pay taxes on. Then, you can figure out how much money you’ve made or lost from your crypto investments.

The easier and faster option is to use a cryptocurrency tax calculator like Catax. It’s a trusted company that helps with crypto taxes. With Catax, you can quickly find out how much money you’ve made, calculate your profits or losses, and even get a detailed report for tax purposes. This makes everything much simpler and less stressful for you.

FAQs (Frequently Asked Questions)

To ensure complete import, carefully follow the steps provided by Binance for exporting transaction data, either through CSV files or API. Double-check the date ranges to cover all your trading activity.

If discrepancies are noticed, review your transaction history for any missing or incorrect entries. You can manually adjust these within Catax or contact their support for assistance.

Yes, Catax is designed to handle transactions from multiple exchanges. You can add each exchange as a separate wallet within Catax for consolidated tax reporting.

Staying informed through reputable financial news sources, subscribing to cryptocurrency tax law updates, and using platforms like Catax, which update their algorithms according to the latest tax regulations, can help you stay compliant.

Yes, most tax authorities require the reporting of all cryptocurrency transactions, not just profitable ones. This includes trades, sales, and sometimes even transfers between wallets, depending on your country’s regulations.