Exporting your Bitmart Spot Trading History is a straightforward process that enables you to keep a detailed record of all your transactions for review, analysis, or tax purposes. Here is a simple Guide to Exporting your Bitmart Spot Trading History.

Why Spot Trading History Matters?

This history is crucial for a clear overview of your trading activities. Detailed records like your Bitmart Spot Trade History help you understand your investment performance over time and are essential for accurate tax reporting.

Step to Step explain how you can export your Bitmart Spot Trading History

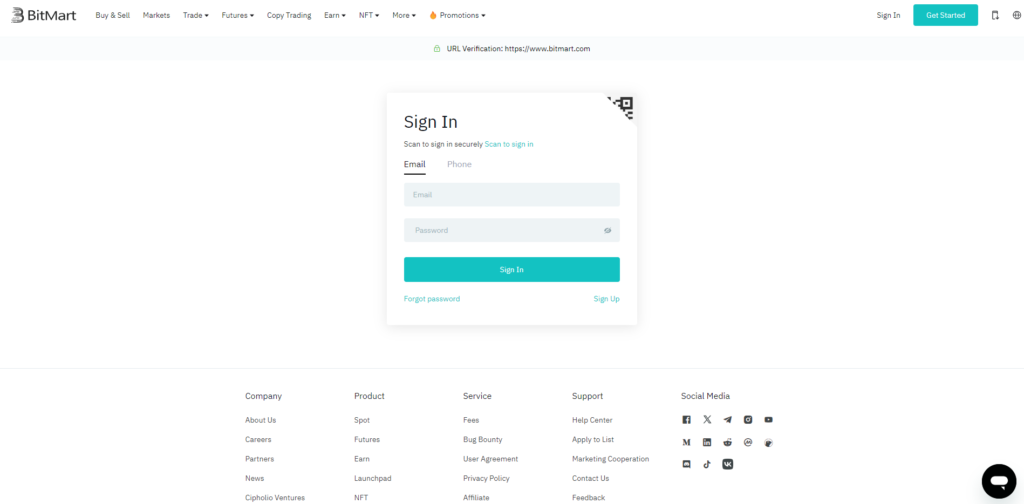

- First, Logging In to your Bitmart Account with Your Credentials.

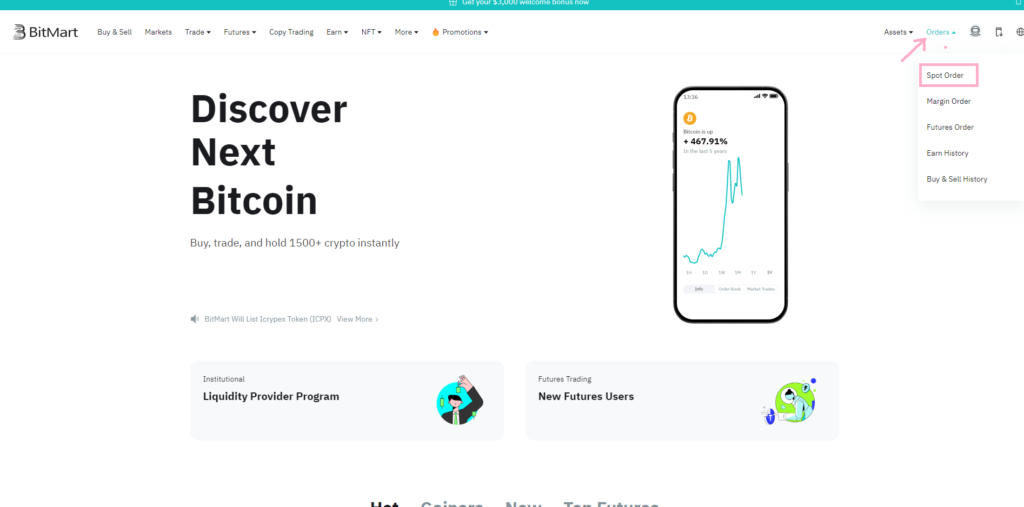

- Head to the ‘Orders’ Section, then Click on ‘Spot Orders’.

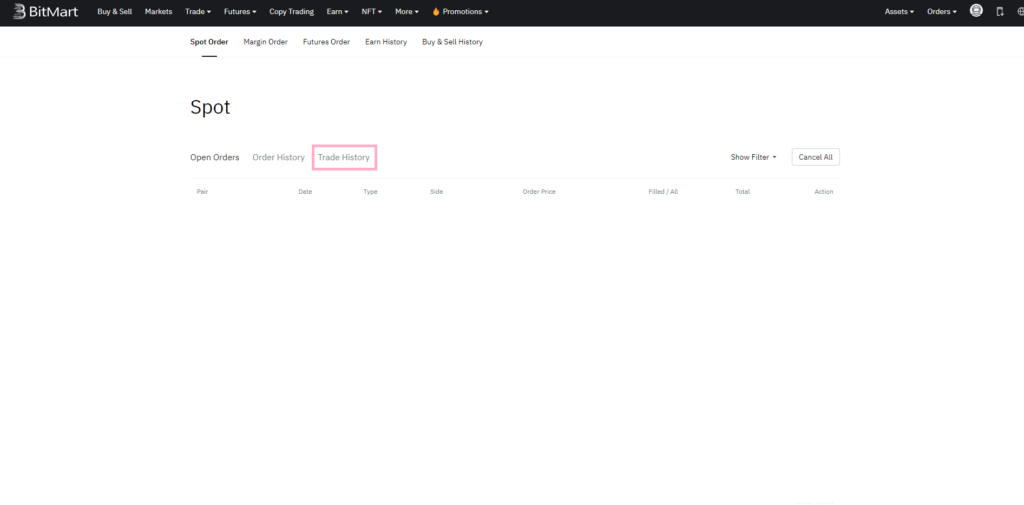

- In ‘Spot Order’ Section, Move to Trade History.

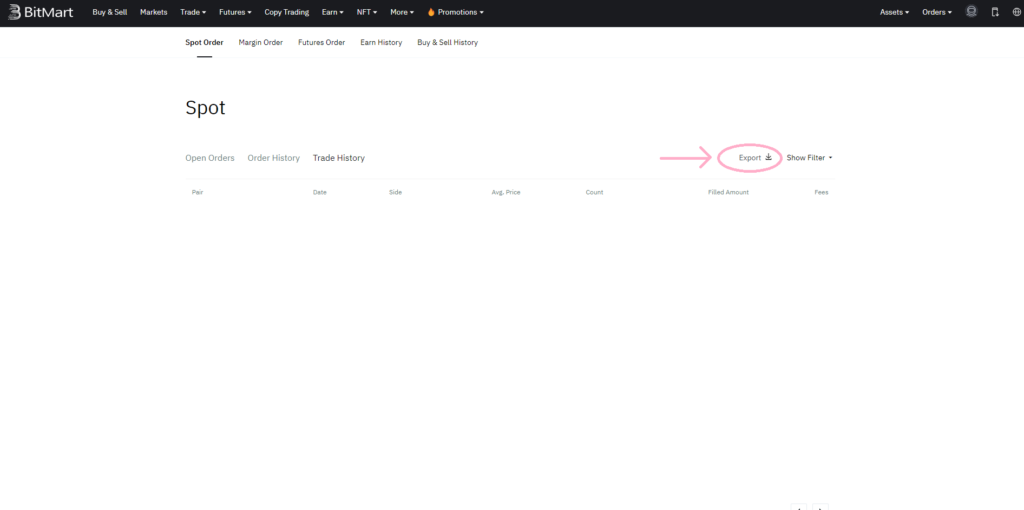

- After that, Click on Export in the top right corner of ‘Trade History’

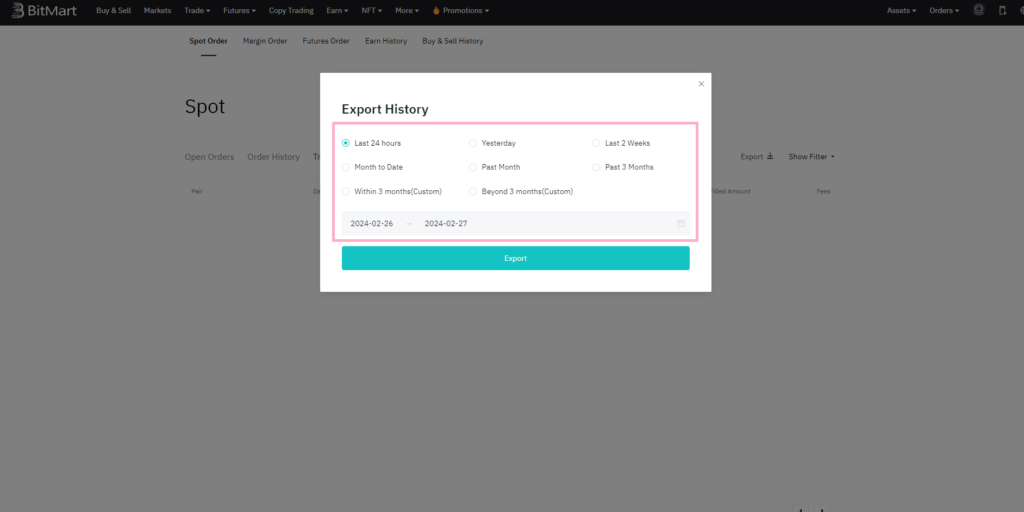

- Choose Your Preferred Date Range like ‘last 24 hours’, ‘last 3 months’ or You Can also choose a Custom date.

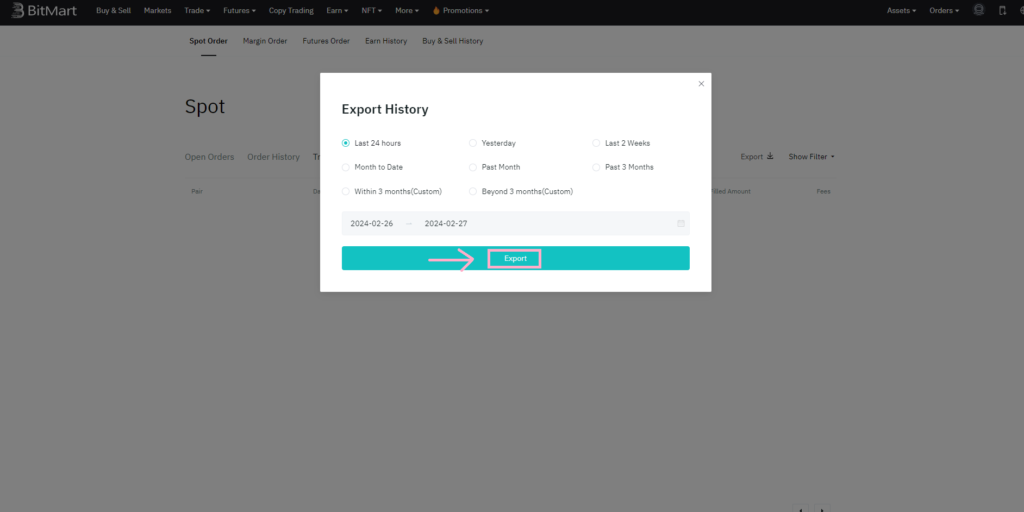

- In last, Click on ‘Export’ Your Bitmart Trade History will be Downloaded.

Is it Worth to Integrate Your Spot Trade History with Crypto Tax Calculator?

Integrating your Bitmart Spot Trading History with a Crypto tax Calculator will provide you with a comprehensive overview of your trading activities. Additionally, this will enable you to accurately assess your capital gains and losses. Moreover, it will simplify the process of generating tax reports, thereby saving you time and effort. Also, it will ensure that you are fully compliant with tax regulations, avoiding any potential penalties or legal issues. In conclusion, integrating your Bitmart Spot Trading History with a Crypto tax Calculator is crucial for effectively managing your cryptocurrency investments and meeting your tax obligations.

Simplifying Tax Calculations: Crypto tax calculators like Catax utilize your Bitmart Spot Trade History to calculate your taxes based on your trading activities automatically. Moreover, they consider the cost basis and calculate gains or losses, providing a easy approach to handling your cryptocurrency taxes.

Why Use a Tax Calculator?

Using a tax calculator like Catax, armed with your Bitmart Spot Trade History, simplifies the complex task of tax calculations. It ensures accuracy, aids in compliance with tax laws, and significantly reduces the time and effort you might otherwise invest in manual calculations.

The Role of Spot Trade History in Catax

Accurate Tax Reports: Your Bitmart Spot Trade report is key to allowing Catax to generate accurate tax reports. By inputting this detailed transaction data. Catax can apply the related tax rules to calculate your capital gains or losses accurately. Additionally, this information is crucial for ensuring compliance with tax regulations. Furthermore, by providing this data, you can ensure that your tax reporting is thorough and precise.

Minimizing Errors: Given the complexity of cryptocurrency transactions and tax regulations, manual tax calculations are prone to errors. Automating this process with a comprehensive Bitmart spot trade report minimizes these risks, ensuring that your tax reports are precise and reliable.

Frequently Asked Question(FAQs)

Once exported, you can review your Bitmart Spot Trade History, but editing or modifying the data may change its accuracy for tax reporting purposes. It’s advisable to keep the exported data intact for reliable tax calculations.

Integrating your Spot Trade History with a reputable Crypto Tax Calculator like Catax ensures your data’s security and privacy, as these platforms typically employ robust encryption and data protection measures.

If you encounter any errors during the export process, ensure that your internet connection is stable and try exporting again. If the issue persists, reach out to Bitmart’s customer support for assistance.

Yes, when you export your Spot Trading History from Bitmart, it should include details about fees associated with each trade, giving a overview of your trading activities.

Bitmart typically allows users to export Spot Trading History for various date ranges, including custom dates. However, it’s advisable to check their platform for any specific limitations or restrictions on date range selections.