Calculating taxes on BuyUcoin transactions, including those conducted on platforms like Wazirx and Coindcx, varies due to different tax laws. A general approach to managing your BuyUcoin taxes, applicable in various regions, may resemble the following.

How can you easily calculate and file your BuyUcoin taxes with Catax?

For a simplified process of BuyUcoin tax calculations and filings, just follow these Catax-assisted steps:

- Getting Started on Catax: Begin by registering on Catax. Enter your information, specify your country (e.g., India), and select your currency (e.g., INR) for region-specific tax computations.

- Linking BuyUcoin with Catax: Connect your BuyUcoin account to Catax securely. You can achieve this by either utilizing API keys for a direct link or uploading your transaction history. Catax ensures secure data import with read-only access.

- Automatic Transaction Categorization: Catax automatically sorts and categorizes your BuyUcoin transactions into capital gains, losses, and income.

- Reviewing Tax Summary: Catax then offers a detailed overview of your BuyUcoin tax obligations, providing clarity on owed amounts or eligible deductions.

- Downloading Tax Report: After data processing, obtain a comprehensive BuyUcoin tax report from Catax, tailored to your specific legal jurisdiction.

- Filing Taxes: Utilize the Catax report to complete your BuyUcoin tax filings. You can handle this process independently via your country’s Income Tax Return Portal or entrust it to a professional accountant for expert filing.

Why is keeping detailed records for BuyUcoin taxes important?

To accurately manage taxes on BuyUcoin, it’s crucial to meticulously track the cost base of your cryptocurrency, including each transaction’s date, and the proceeds from these transactions. Furthermore, calculating the real-world value of any crypto income in INR at the time it’s received is vital for precise taxes on BuyUcoin reporting. Moreover, this detailed approach ensures compliance with tax regulations and, consequently, facilitates a thorough understanding of your financial obligations regarding taxes on BuyUcoin. Additionally, by consistently monitoring these aspects, you can effectively manage your tax responsibilities and avoid potential pitfalls. Finally, this comprehensive strategy not only simplifies the tax process but also enhances your overall financial management.

Connecting BuyUcoin with Catax is straightforward. Here are the steps to do it:

Here are steps to Connect BuyUcoin via API:

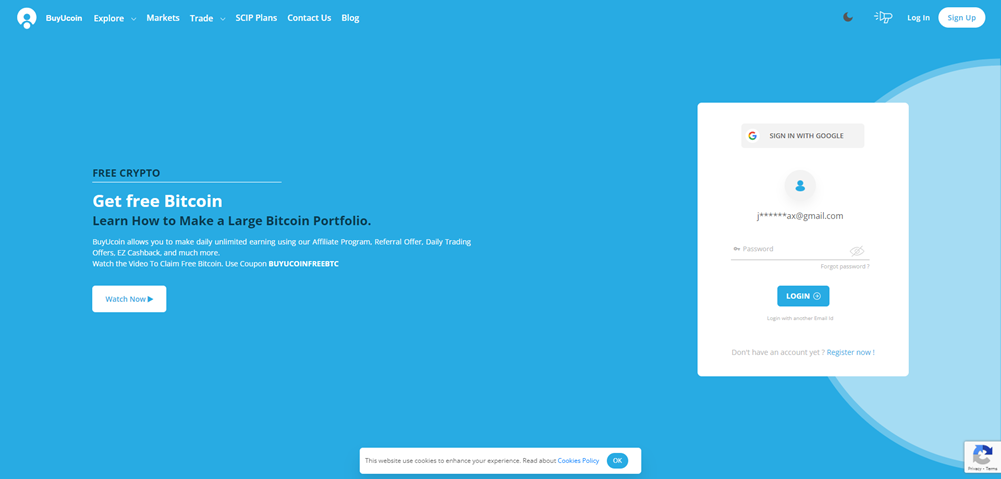

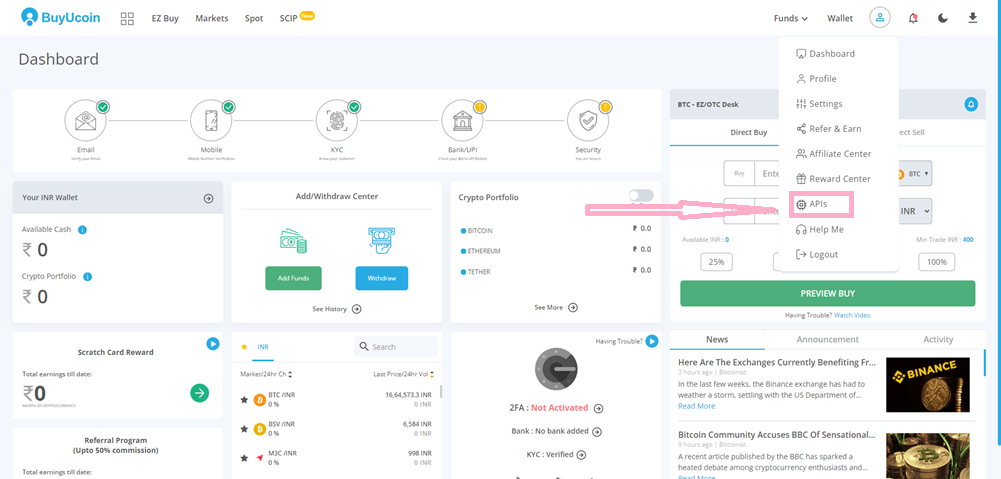

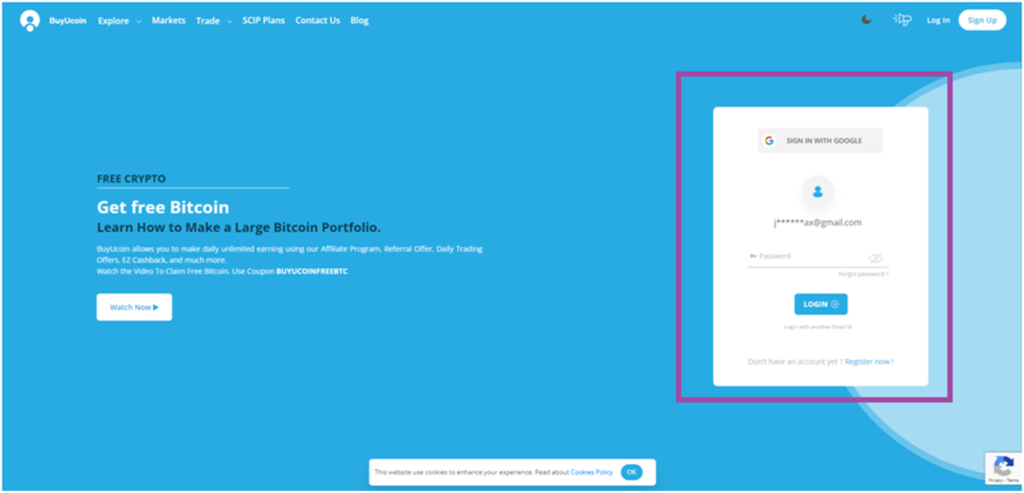

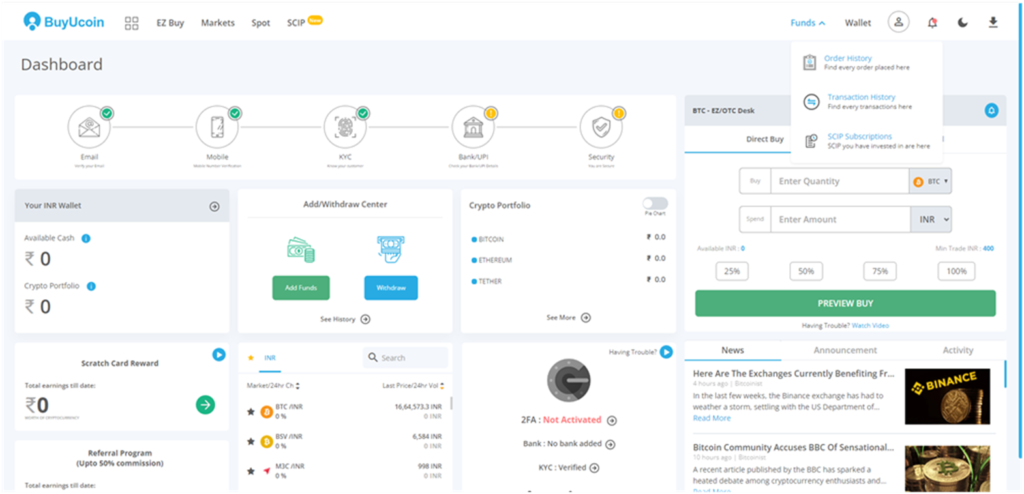

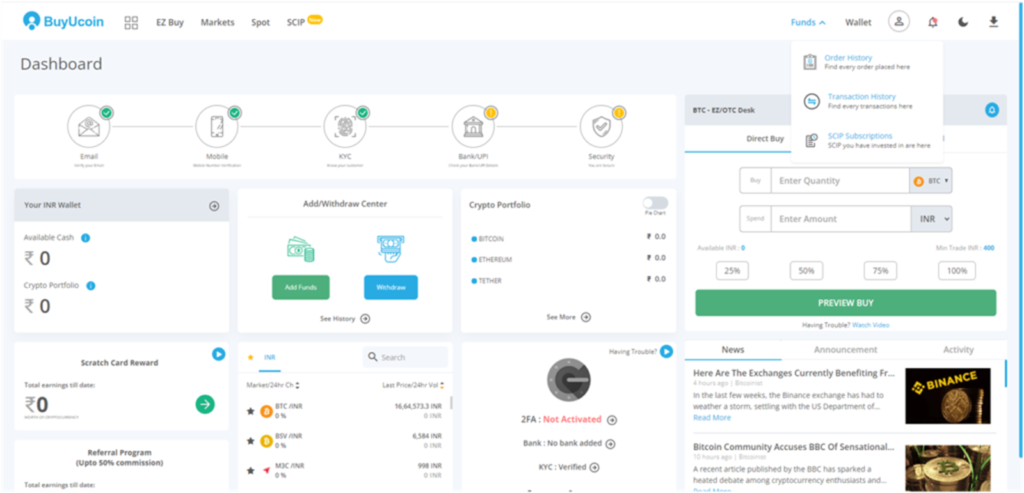

- Visit BuyUcoin.com and log in using your account details.

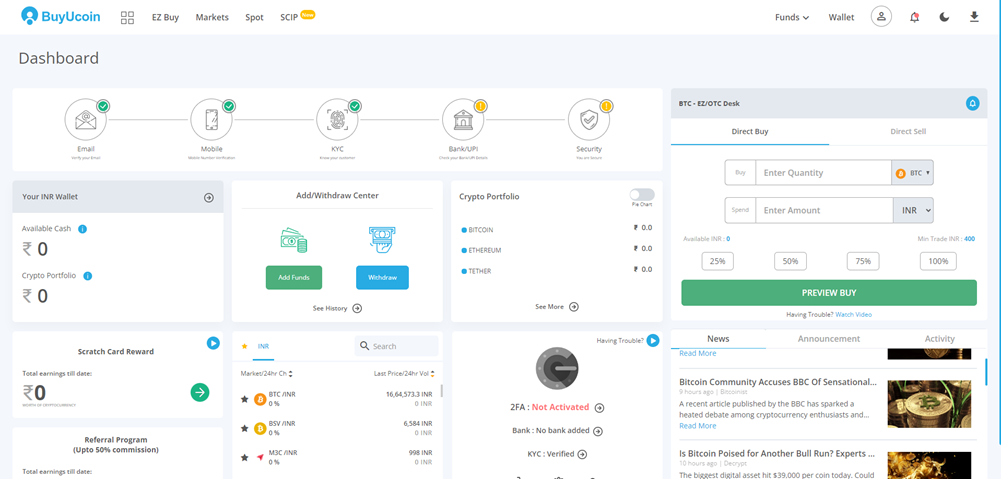

- On the dashboard, click on the profile icon located on the right side.

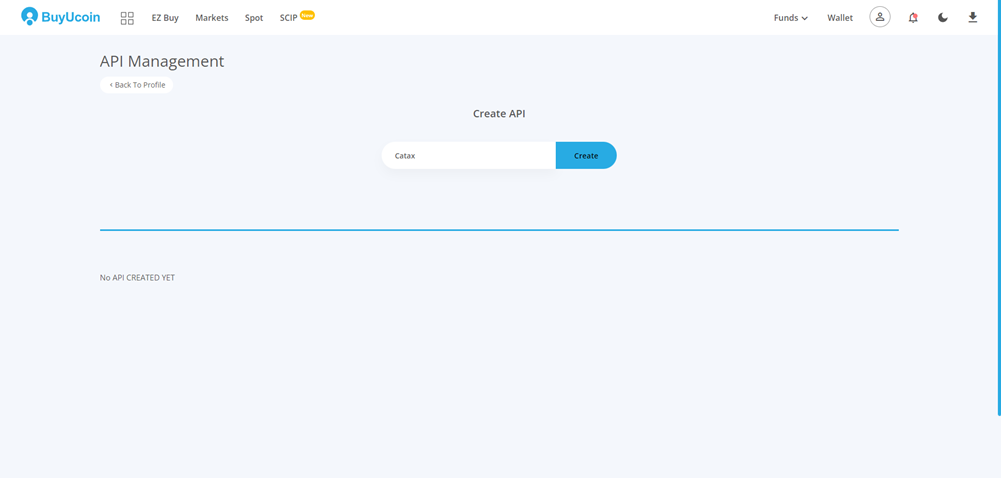

- Choose ‘API’s’ and then click on ‘Create API’.

- Name your API, something like ‘Catax’.

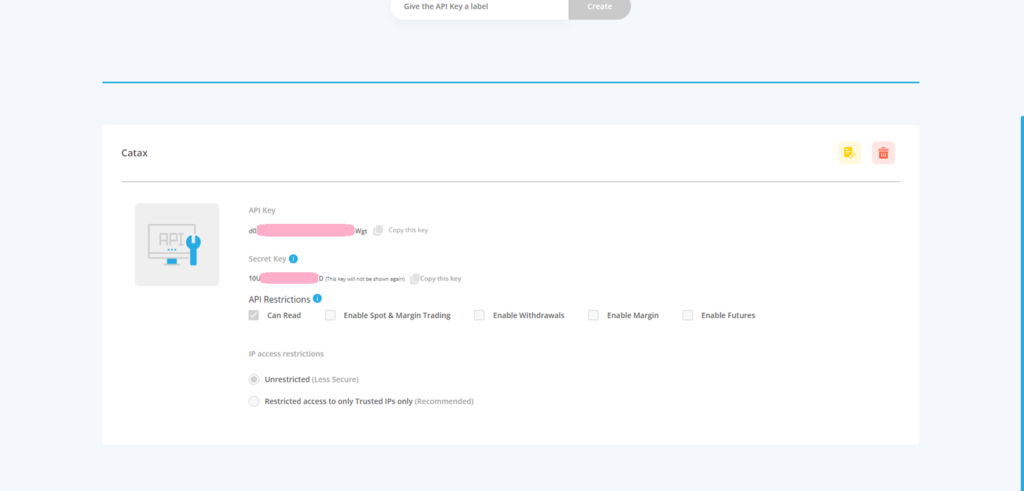

- Your API key will now be created.

On Catax:

- Log into Catax and go to the wallets section.

- Create a new Gemini wallet and enable auto-sync.

- Input your API key and secret.

Connect Buycoin Manually with Catax

- Go to BuyUcoin.com, log in to your BuyUcoin account.

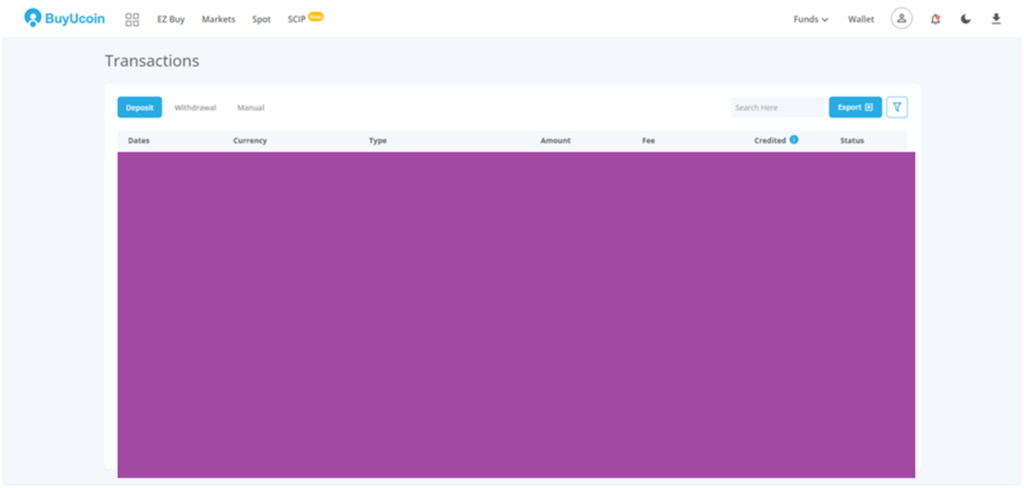

- In ‘Funds’ Section, Select Transaction History.

- Then Click on ‘EXPORT’ . Your BuyUcoin Transaction History will Send in Your email.

Check out How to Create BuyUcoin Transaction History in Brief.

On Catax:

- Go to Catax.app

- Add your Unocoin wallet,

- Choose the file import.

- Then Upload your CSV.