This guide provides a comprehensive approach to managing your Bitmart taxes. It’s designed to assist novice and seasoned traders in effectively handling tax affairs related to Bitmart transactions.

To make your Bitmart tax reporting easier, try using Catax, a simple cryptocurrency tax calculator. Here’s how to do it:

- Set Up Catax Account: First, sign up for a Catax account. Choose India as your country and select INR as your currency.

- Connect with Bitmart: Link your Bitmart account to Catax securely to automatically send your transaction details to Catax.

- Sort Transactions: Let Catax arrange your Bitmart transactions, putting them into categories like profits, losses, and income.

- Download Tax Report: You can then download a detailed tax report from Catax that outlines all your cryptocurrency dealings.

- File Taxes Easily: Use this detailed report to file your taxes online by yourself or hand it over to a tax expert for help.

What is Bitmart and how does it work?

BitMart, a leading digital asset trading platform, operates globally, serving millions of users across 170 countries. Additionally, it supports over 1,000 cryptocurrencies, including major names like Bitcoin and Ethereum, and offers a comprehensive suite of trading options. Furthermore, users enjoy a user-friendly platform, advanced trading tools, crypto staking, and an NFT marketplace, accommodating both novice and experienced traders. Moreover, security is prioritized with a multi-layered system, including cold storage and two-factor authentication, despite a significant hack in 2021 which the platform has addressed by reimbursing affected users. Lastly, BitMart’s fee structure is competitive, with tiered trading fees that reduce based on trading volume and BMX token holdings.

How do I file my Bitmart taxes?

To efficiently manage your Bitmart taxes, integrating Catax into your process offers a seamless solution. You can directly connect your Bitmart account to Catax, choosing either an API for ongoing data syncs or by uploading a CSV with your trading details. This crucial step allows Catax to accurately determine your tax responsibilities based on your trading activities.

Upon establishing this connection, Catax immediately begins sorting through your transactions to pinpoint taxable events. Additionally, it applies the relevant tax laws of your specific country. Designed for global use, Catax seamlessly adjusts to the tax regulations of various countries. For example, from India to the USA. This ensures your tax reports are both accurate and compliant.

Catax’s capabilities extend beyond mere tax calculation for Bitmart activities. It also organizes this information into user-friendly reports. This feature is particularly beneficial for those unfamiliar with the intricacies of crypto tax reporting, significantly reducing the risk of errors common in manual calculations.

Additionally, these detailed reports from Catax offer a transparent overview of your taxes from Bitmart trading. Consequently, they guide you on how to file them correctly. Furthermore, with Catax, you gain a comprehensive understanding of your tax situation. As a result, you can see how it integrates into your total tax liabilities and the steps needed for compliance.

In essence, Catax emerges as a vital tool for simplifying the tax calculation process for Bitmart users. Moreover, its streamlined integration with Bitmart, adaptability to international tax laws, and ability to produce clear, compliant reports simplify the complex world of crypto taxes for investors worldwide.

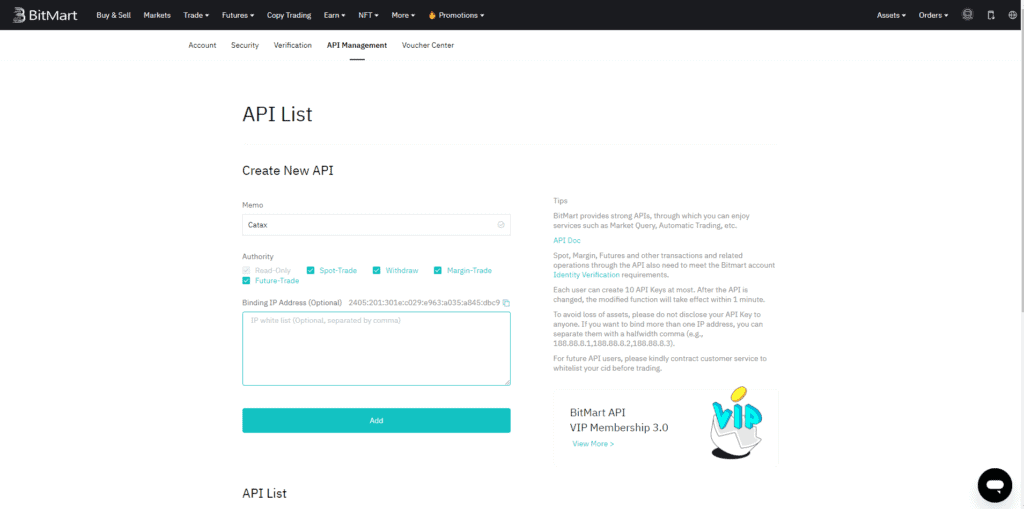

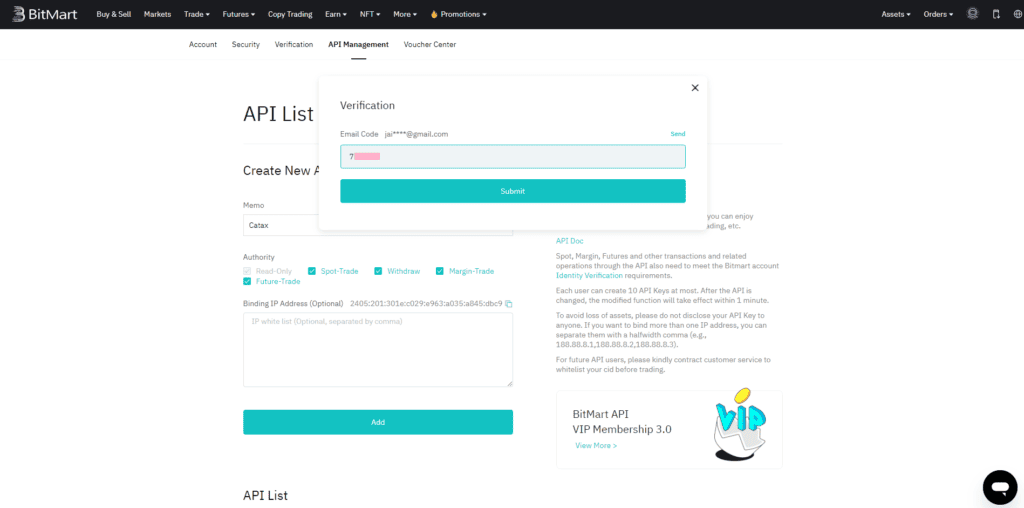

Connecting Catax and Bitmart via API:

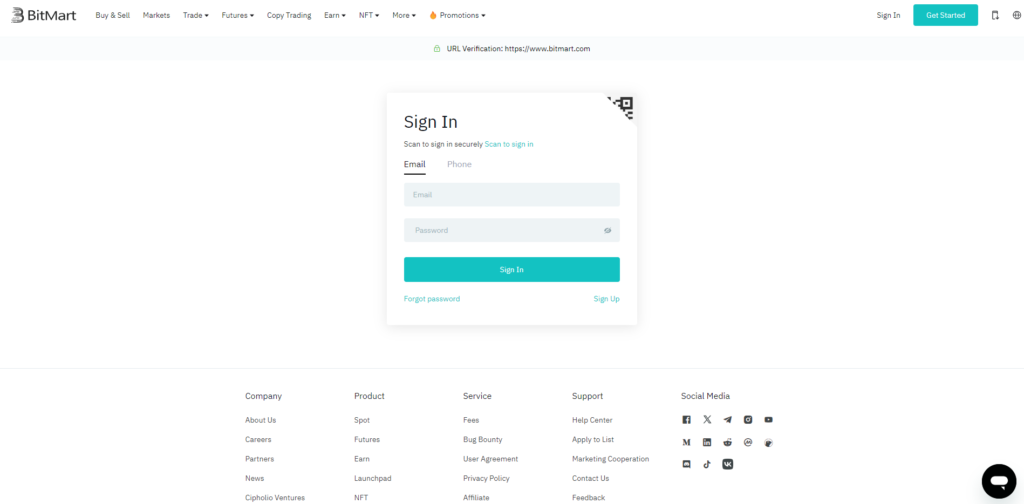

For Bitmart:

- Sign in to your Bitmart account.

- Complete Your 2FA(Two-factor authentication)

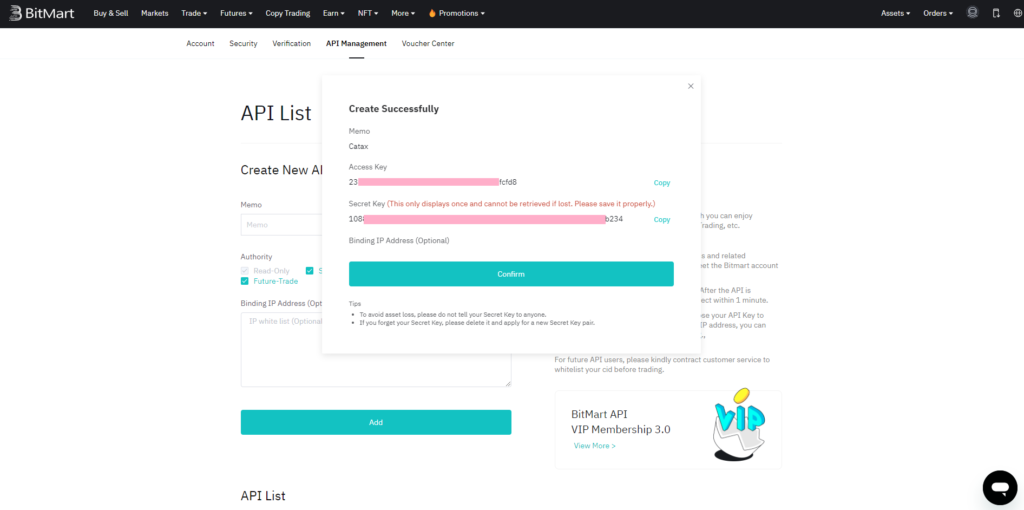

- Your API and Secret Key will be ready, copy it.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, and proceed to enter your API key and secret to import your data.

Connecting Catax and Bitmart via CSV:

For Bitmart:

BitMart does not directly provide a CSV export feature for transaction history on their platform. However, you can obtain a CSV file detailing your BitMart transactions by making a specific request for it. Keep in mind, receiving your CSV file from BitMart might take up to 15 days, so it’s advisable to request this well before your tax submission deadline to avoid any last-minute stress.

On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select ‘Bitmart’.

- Choose ‘Import from File’.

- Upload your Bitmart CSV file.

Frequently asked questions (FAQs)

BitMart does not automatically generate tax documents. Users must request a CSV of their transaction history for tax purposes.

You can request a CSV file of your transaction history from BitMart support to use for tax document preparation.

BitMart does not issue 1099 forms. Users are responsible for reporting their transactions using the data they compile.

BitMart does not offer direct tax form generation due to the complexity of global tax regulations and the diversity of user transactions. Users need to use external tools like Catax for tax reporting.

The BitMart CSV file for tax purposes typically includes details of your transactions, such as date, type (buy/sell/stake), amount, currency, and any fees associated.

For tax purposes, each trade between cryptocurrencies on BitMart must be reported as a disposal. Additionally, calculating the capital gain or loss based on the difference between the acquisition cost and the disposal value in your local currency is required..