This guide makes it simple to Calculate your OKX Taxes. It helps you whether you’re new or have been trading for a while, ensuring you can easily deal with taxes for your OKX transactions.

To simplify your OKX tax reporting, consider using Catax, a highly efficient cryptocurrency tax calculator. Follow these simple steps:

- Sign up for a Catax account and select India as your country and INR as your currency.

- Connect your OKX account securely to Catax to automatically transfer your transaction data.

- Catax will organize all your OKX transactions neatly, categorizing them into gains, losses, and income.

- Download the detailed tax report from Catax to get a clear overview of your crypto finances.

- Use the report to file your taxes online hassle-free or seek guidance from a tax expert.

How are OKX transactions taxed?

When you use OKX for your crypto transactions, the taxes you pay can be different depending on where you live. Generally, there are two types of taxes you might have to pay:

- Capital Gains Tax: This is the tax you pay if you make money from selling or exchanging cryptocurrency on OKX. If you sell it for more than you paid, you’ll owe tax on the profit.

- Income Tax: If you get new cryptocurrency from using OKX’s services, like lending or staking, you’ll pay income tax on them. The tax is based on what those new tokens were worth in your regular money (like dollars or rupees) on the day you got them.

How do I file my OKX taxes?

Using a tax tool like Catax can simplify handling your OKX taxes. First, you’ll connect your OKX account to Catax. You can do this instantly through a direct API link or by manually adding your transaction info with a CSV file.

Based on the tax rules in your area, Catax will check your OKX activity to find any transactions that might be taxed. It works for many countries, so it’s quite versatile.

The tool also organizes your transaction data into clear reports, which is helpful if you’re new to crypto taxes and want to avoid mistakes.

These detailed Catax reports will show you everything about your OKX taxes and help you prepare to file them. With Catax, you can see clearly what you owe and how it affects your overall taxes.

Overall, Catax is a useful tool to simplify your OKX tax filing. It helps you connect your account easily, handles international tax laws, and creates accurate reports. This makes it much easier for crypto traders worldwide to manage their taxes.

Connecting Catax and OKX via API:

For OKX:

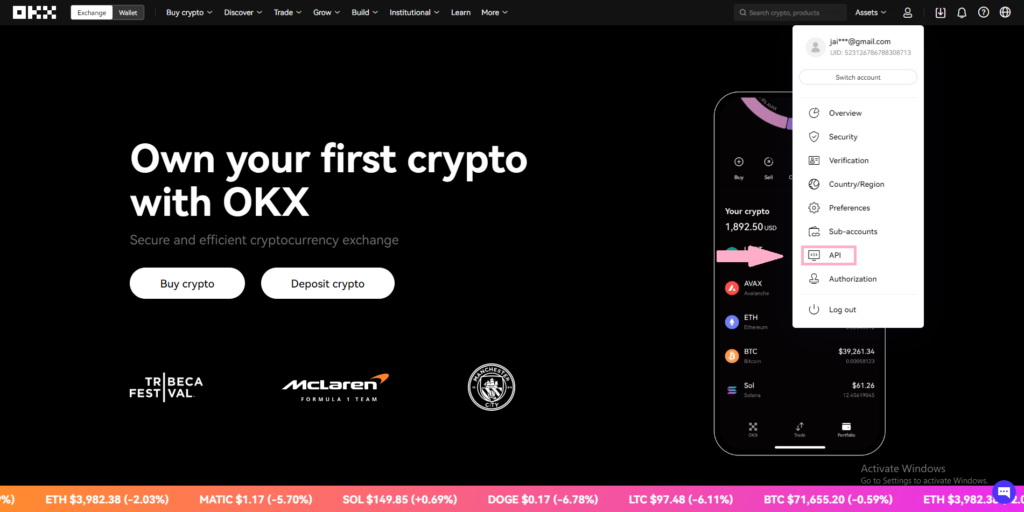

- Sign in to your OKX account.

- Head to the profile icon, then click on ‘API’.

- After, Click on the ‘Create API‘ button in the top right corner.

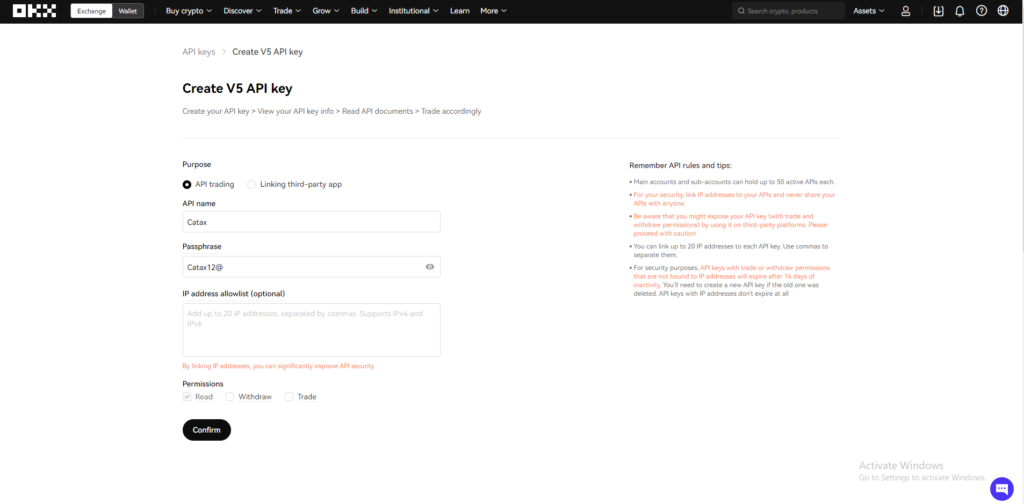

- After that, name your API key and set a passphrase. Keep permissions on ‘Read’ and click on ‘Confirm’.

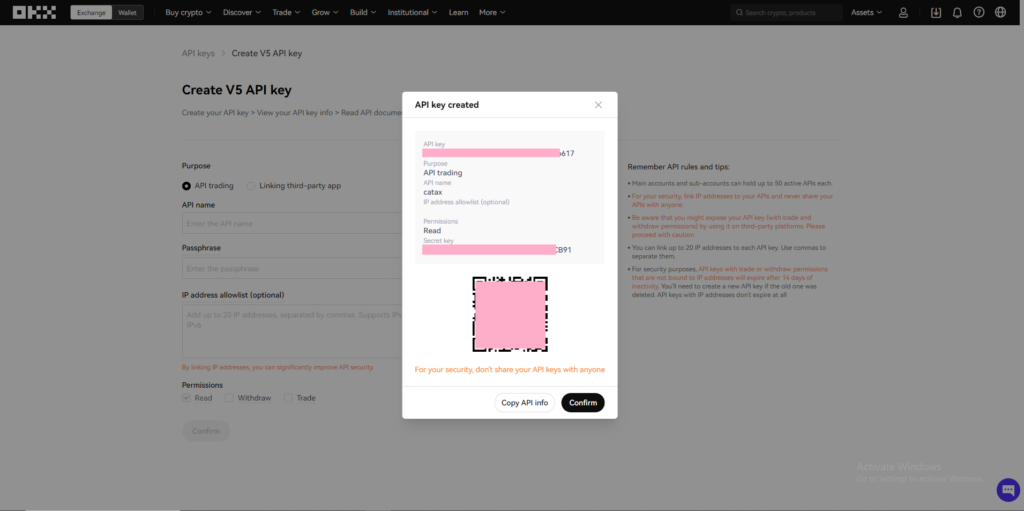

- your API key and Secret key will be ready.

On Catax:

- To begin, log in to your Catax account.

- Navigate to the wallets section, then upload your OKX wallet.

- Enable auto-sync, and proceed to enter your API key and secret to import your data

Connecting via CSV:

For OKX:

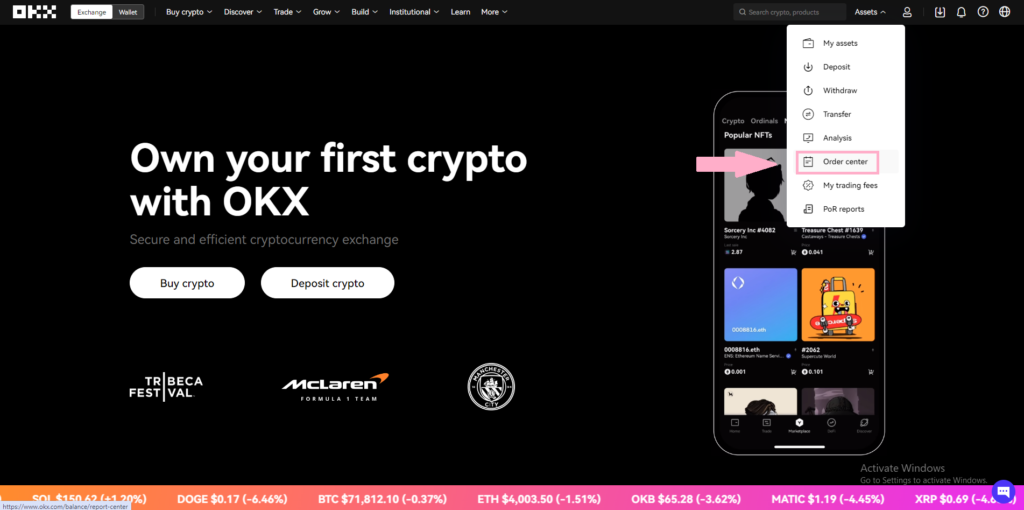

- After logging in, head to the ‘Assets‘ section and click on ‘Order Center’.

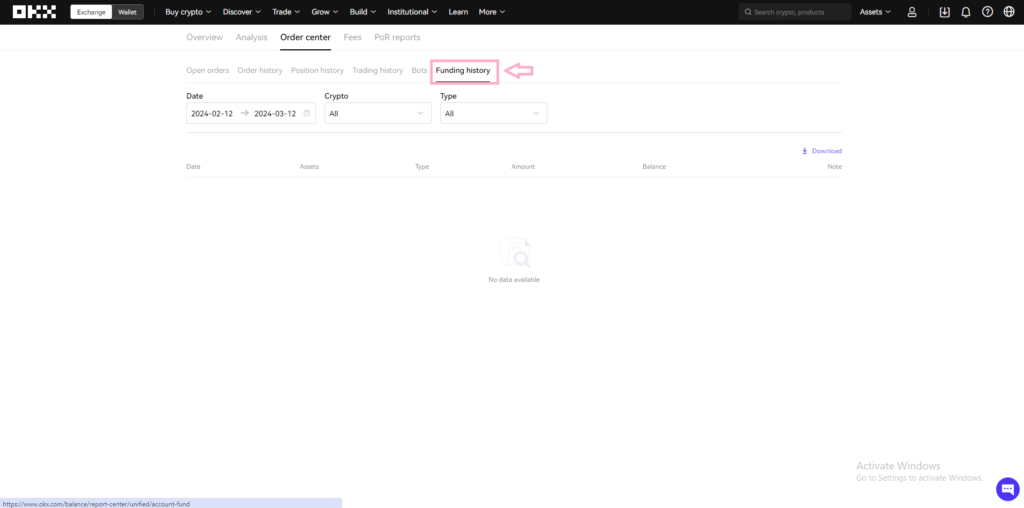

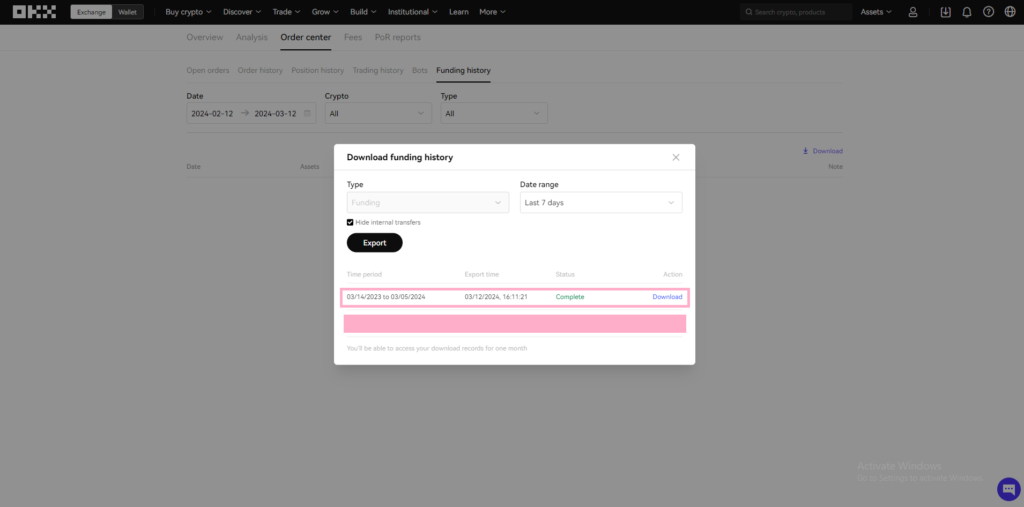

- In the ‘Order Center’ go to ‘Funding history’.

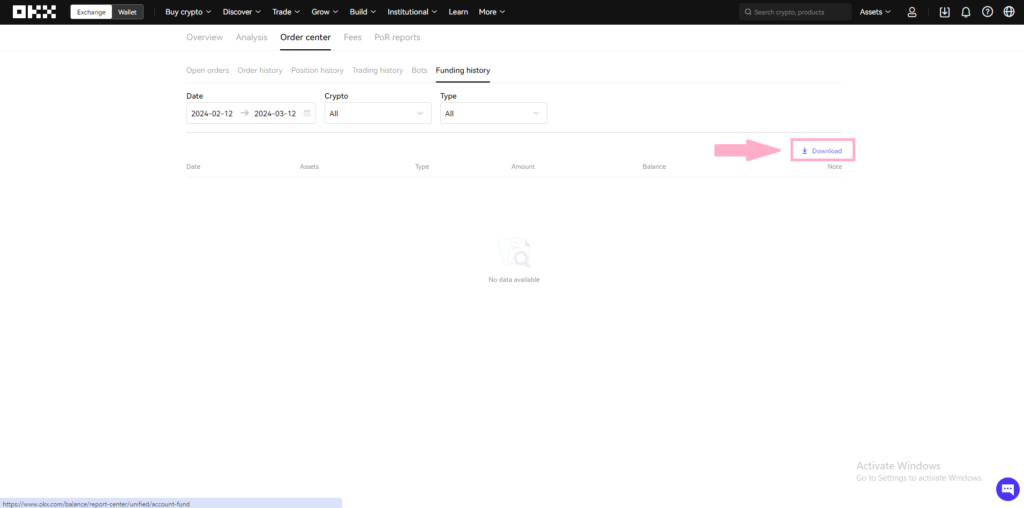

- Click on the Download button.

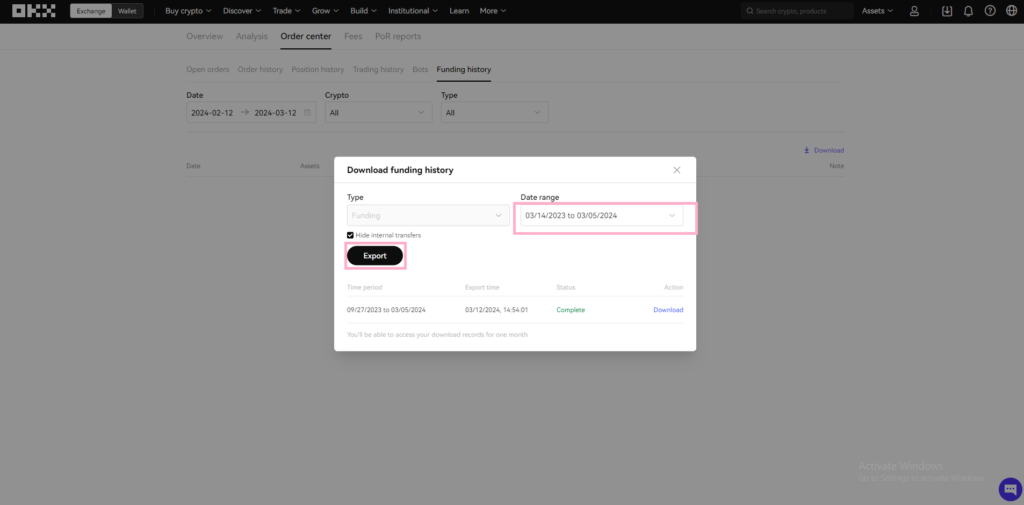

- Click on ‘Date Range‘ and choose your preferred date range. You can also customize your date range.

- Your report will be ready to download in a few minutes.

Now On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select OKX.

- Choose ‘Import from File’.

- Upload your OKX CSV file.

FAQs (Frequently Asked Questions)

Yes, Catax can work with tax rules from many countries, so you can use it no matter where you are.

No, you can either use an API to automatically sync your OKX transactions to Catax or upload a CSV file with your trading history.

OKX might offer transaction history downloads, but for a comprehensive tax report that meets your country’s regulatory standards, you may need to use third-party cryptocurrency tax software or consult with a tax professional.

Connecting your OKX account to Catax is secure, especially if you’re using the API with ‘Read’ permissions, which means Catax can’t make any changes or transactions.

Yes, most countries tax cryptocurrency trades as taxable events, regardless of whether you cash out to fiat currency or not. Swapping one crypto for another or using crypto to purchase goods and services can also trigger a taxable event.