This guide provides a comprehensive approach to managing your Phemex taxes. It’s designed to assist novice and seasoned traders in effectively handling tax affairs related to Phemex transactions.

To make your Phemex tax reporting easier, try using Catax, a simple cryptocurrency tax calculator. Here’s how to do it:

- Set Up Catax Account: First, sign up for a Catax account. Choose India as your country and select INR as your currency.

- Connect with Phemex: Link your Phemex account to Catax securely to automatically send your transaction details to Catax.

- Sort Transactions: Let Catax arrange your Phemex transactions, putting them into categories like profits, losses, and income.

- Download Tax Report: You can then download a detailed tax report from Catax that outlines all your cryptocurrency dealings.

- File Taxes Easily: Use this detailed report to file your taxes online by yourself or hand it over to a tax expert for help.

What is Phemex and how does it work?

Phemex is a big online platform where people from all over the world, in 170 countries, can trade over 1,000 types of digital money like Bitcoin and Ethereum. It’s easy to use and has lots of tools for trading, saving crypto to earn interest, and even a special area for trading digital art and collectibles. They take keeping users’ money safe very seriously, using strong security measures and have fixed a big security problem in 2021 by giving back money to users who were affected. Plus, the more you trade or if you hold certain tokens, the less you have to pay in fees, making it a good deal for traders.

How do I file my Phemex taxes?

To efficiently manage your Phemex taxes, integrating Catax into your process offers a seamless solution. You can directly connect your Phemex account to Catax, choosing either an API for ongoing data syncs or by uploading a CSV with your trading details. This crucial step allows Catax to accurately determine your tax responsibilities based on your trading activities.

Upon establishing this connection, Catax immediately begins sorting through your transactions to pinpoint taxable events. Additionally, it applies the relevant tax laws of your specific country. Designed for global use, Catax seamlessly adjusts to the tax regulations of various countries. For example, from India to the USA. This ensures your tax reports are both accurate and compliant.

Catax’s capabilities extend beyond mere tax calculation for Phemex activities. It also organizes this information into user-friendly reports. This feature is particularly beneficial for those unfamiliar with the intricacies of crypto tax reporting, significantly reducing the risk of errors common in manual calculations.

Additionally, these detailed reports from Catax offer a transparent overview of your taxes from Phemex trading. Consequently, they guide you on how to file them correctly. Furthermore, with Catax, you gain a comprehensive understanding of your tax situation. As a result, you can see how it integrates into your total tax liabilities and the steps needed for compliance.

In essence, Catax emerges as a vital tool for simplifying the tax calculation process for Phemex users. Moreover, its streamlined integration with Phemex, adaptability to international tax laws, and ability to produce clear, compliant reports simplify the complex world of crypto taxes for investors worldwide.

Connecting Catax and Phemex via API:

For Phemex:

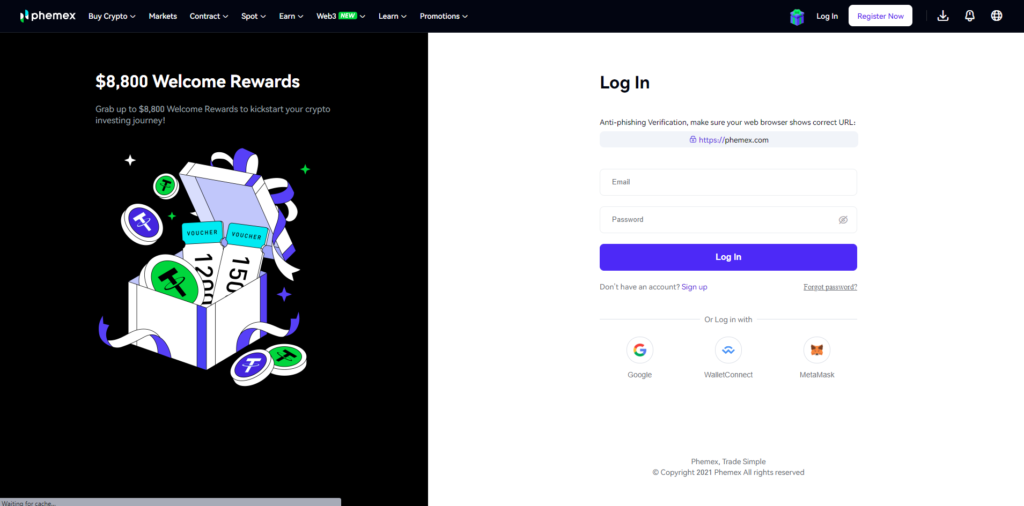

- Sign in to your Phemex account.

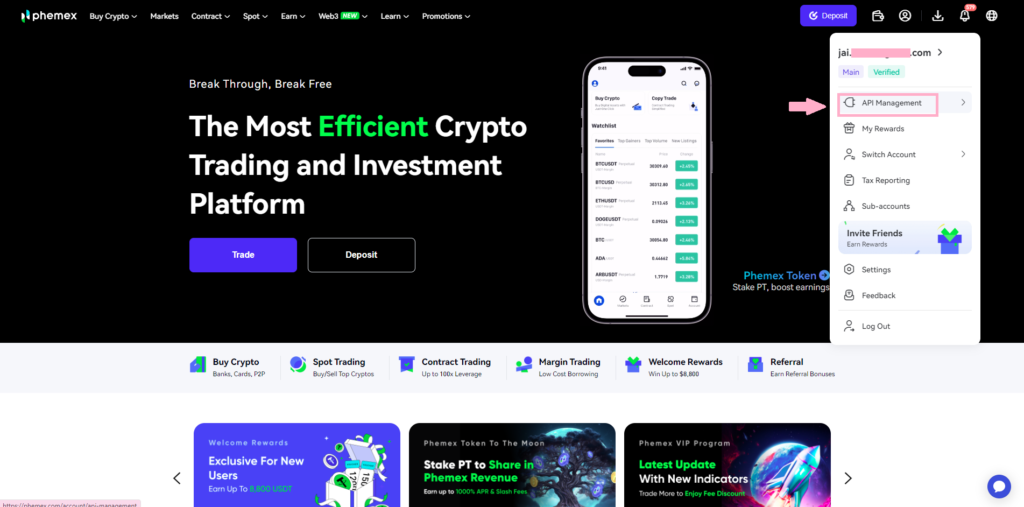

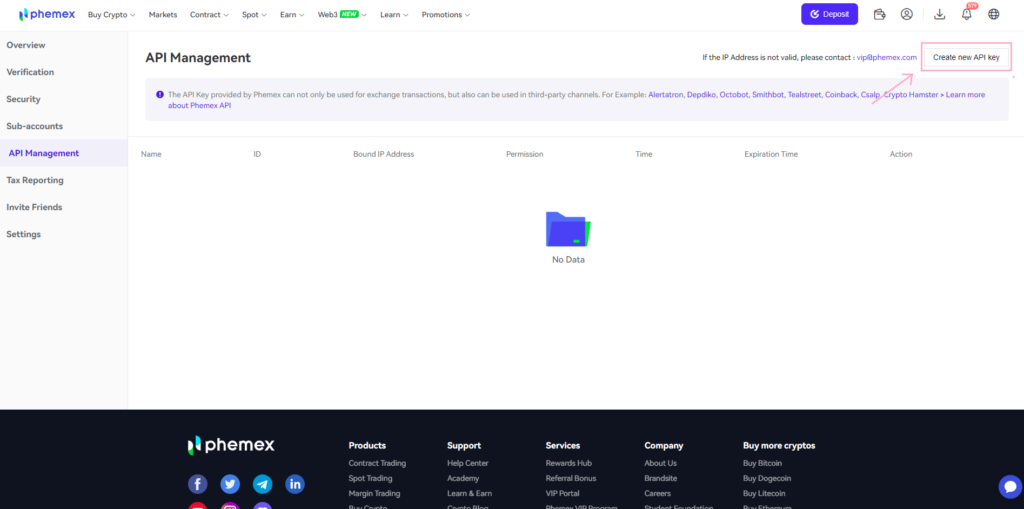

- After logging in, head to the profile icon then click ‘API management’

- Then click on ‘Create new API Key‘ shown in the top right corner.

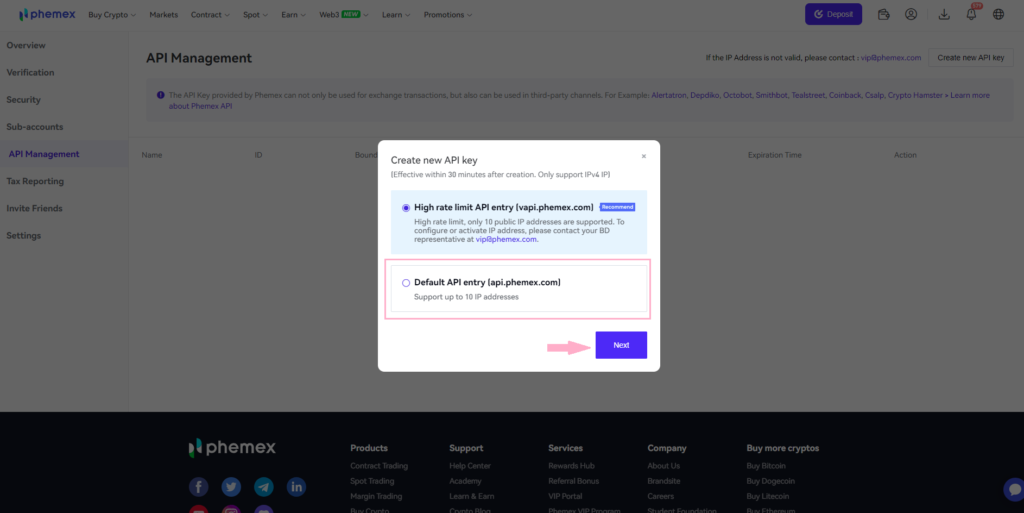

- Select ‘Default API Entry’ then click on ‘Next‘

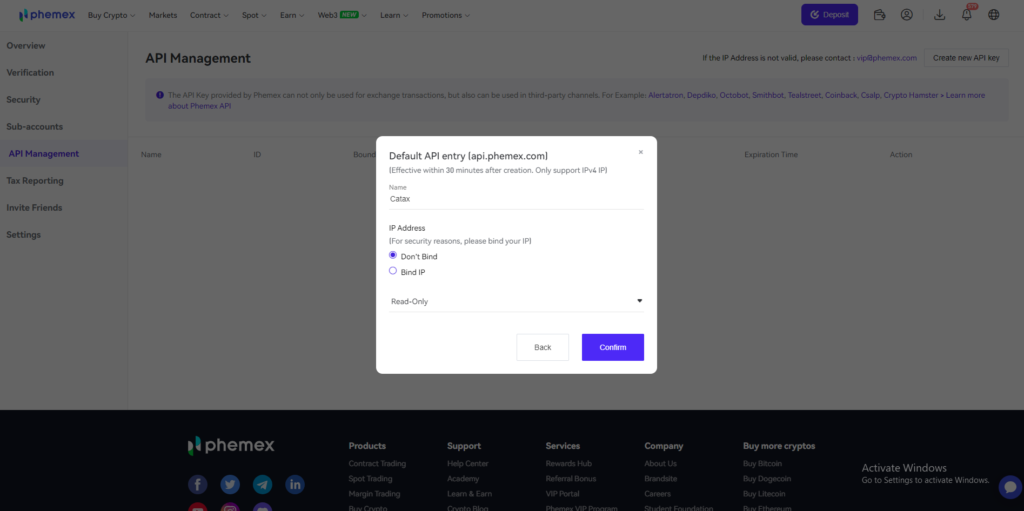

- Name your API key like ‘Catax’ keep IP address on ‘dont bind’ and and select ‘Read-only‘.

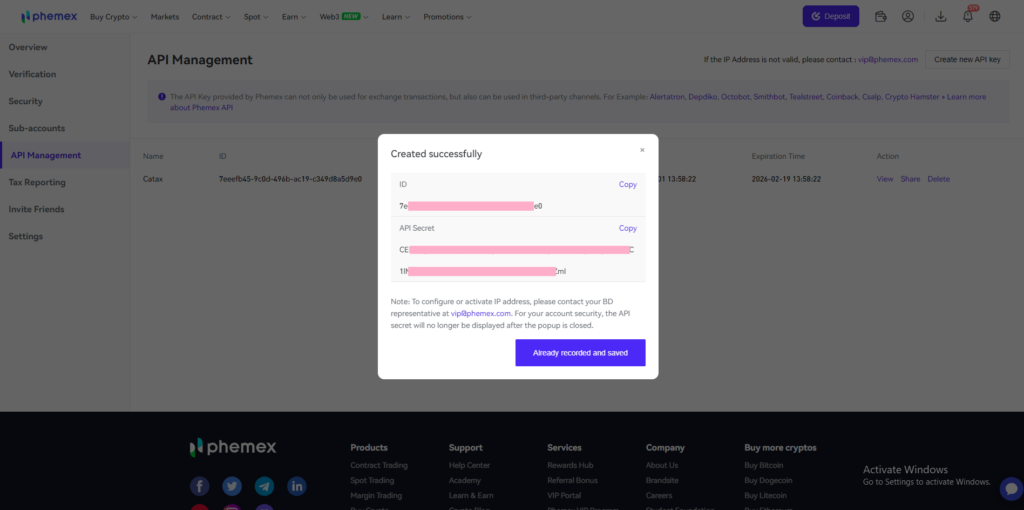

- After completing the verification, your API and secret key will be ready copy them.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, and proceed to enter your API key and secret to import your data.

Connecting Catax and Phemex via CSV:

For Phemex:

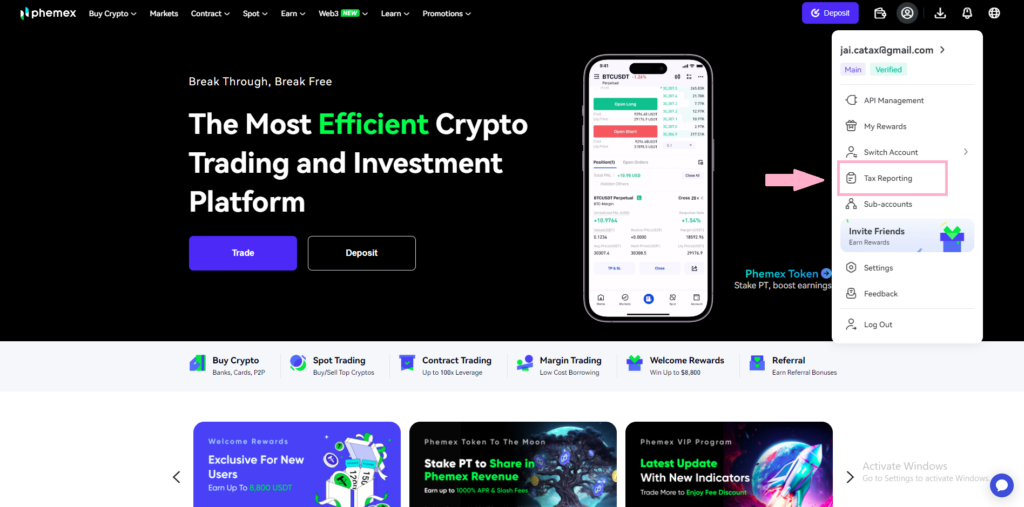

- For transaction history, head to the profile icon and Click on ‘Tax Reporting‘.

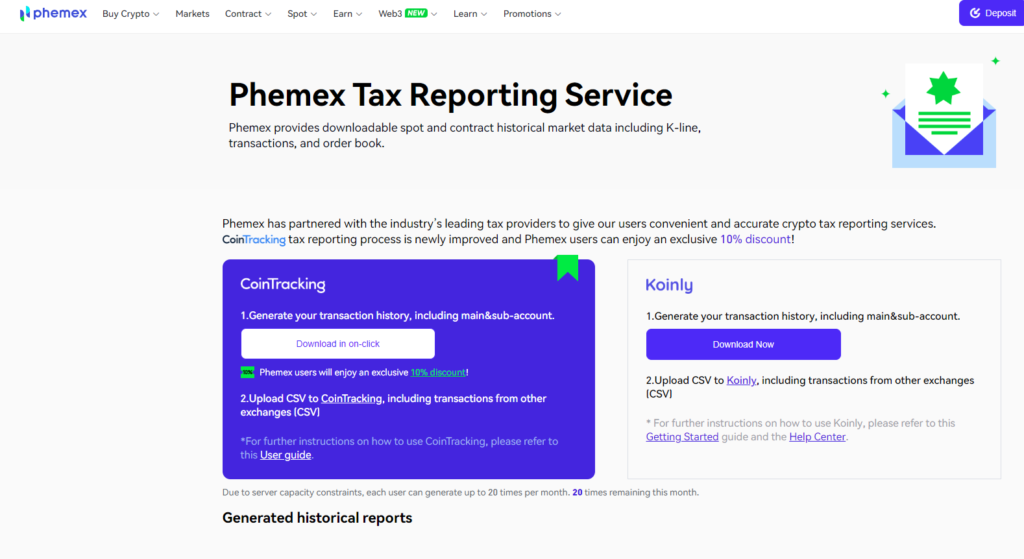

- Then click on Cointracking’s ‘Download in on-click’.

- Choose Your preferred period for Transaction History and click on ‘Generate‘

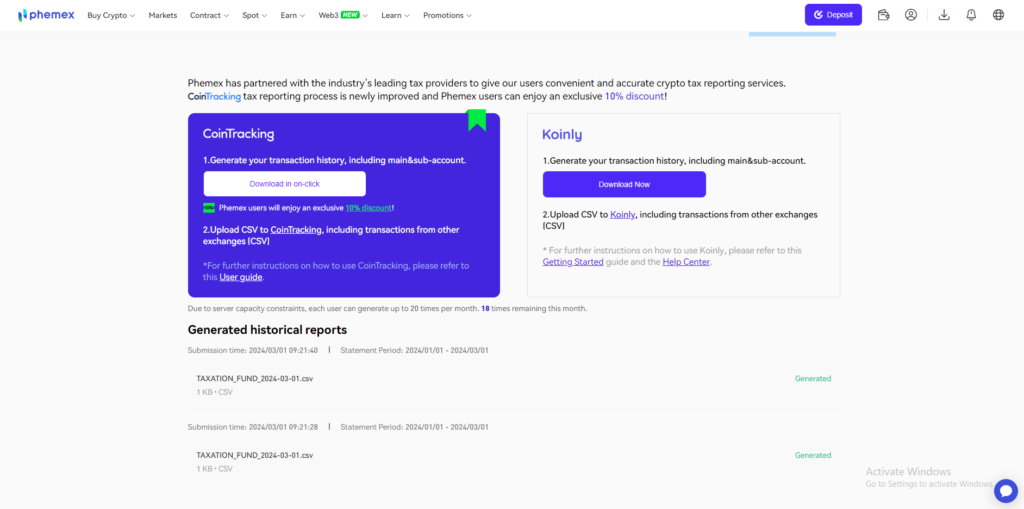

- Your Transaction history will be generated and ready for download in 5 minutes.

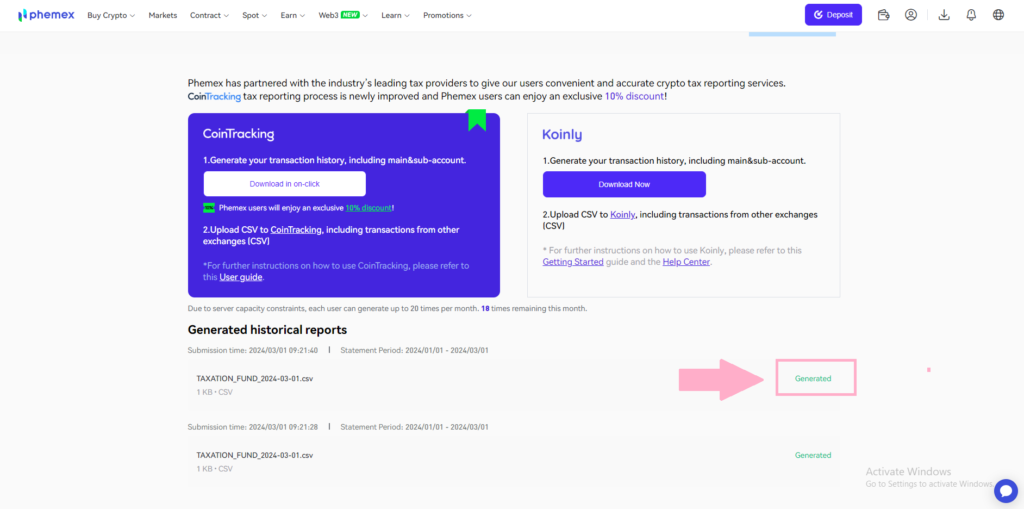

- Click on Generated in below. Your transaction history will be downloaded.

On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select ‘Phemex.

- Choose ‘Import from File’.

- Upload your Phemex CSV file.

FAQs (Frequently Asked Questions)

Taxable transactions on Phemex typically include selling cryptocurrencies for fiat, trading one crypto for another, earning interest from crypto lending, and receiving crypto as payment or rewards. Each transaction type can have different tax implications.

Yes, Catax can accurately adjust for crypto-to-crypto trades, taking into account the fair market value of the cryptocurrencies at the time of the trade, which is essential for accurate tax reporting.

Catax can identify losses from your trading activity on Phemex, which can often be used to offset other capital gains or up to a certain amount of ordinary income, depending on your jurisdiction’s tax laws.

Absolutely, Catax is designed to aggregate and analyze transactions across multiple exchanges. You can import data from various platforms to get a comprehensive tax report that includes all your cryptocurrency transactions.

If you discover an error in your previously filed taxes, it’s advisable to file an amended tax return. Catax can help recalculate your taxes with the correct data, which you can then use to correct the submission.

Catax employs robust security measures to protect your data, including encryption and secure server storage. Always ensure you’re granting read-only access to your trading data when using API keys for added safety.