This guide gives easy steps for managing your Changelly taxes. It’s useful for both newbies and experienced traders who need to deal with taxes from Changelly transactions.

How to Report Changelly Taxes with Catax:

- Create a Catax Account: Start by making your Catax account. When signing up, select India as your country and set the currency to INR.

- Securely Link with Changelly: Next, connect your Changelly account to Catax. This link helps transfer your transaction data automatically and securely.

- Organize Transactions: Once connected, Catax will organize your Changelly transactions neatly. It’ll sort them into profits, losses, and income, making it easier for you to understand.

- Download Report: Catax makes it easy to download a detailed cryptocurrency tax report. This report breaks down all your financial activities for easy reference.

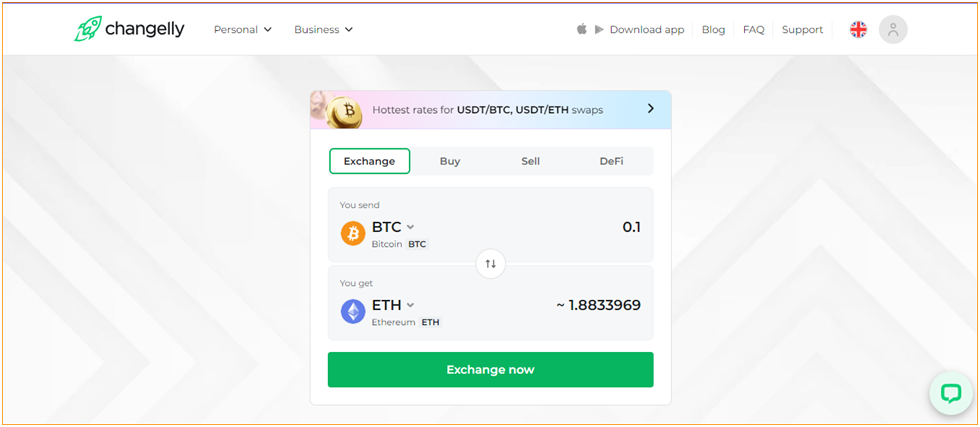

What is Changelly?

Changelly started in 2015 and is based in the Cayman Islands. It’s a quick cryptocurrency exchange that links users to lots of different cryptocurrency platforms. It’s known for offering trades in over 160 cryptocurrencies at good rates. Over time, Changelly became very popular because it lets people do different kinds of cryptocurrency trades, like margin and derivative trades, and even NFT transactions. It also lets users earn interest on their crypto, making its services even wider.

How Do I File My Changelly Taxes?

You connect your Changelly account to Catax, either by linking them directly or by uploading a file with your trades. Once connected, Catax figures out how much tax you owe.

After that, Catax organizes your transactions neatly, showing which ones you need to pay tax on. It adjusts the tax rules based on where you live, so you follow the right tax laws.

Catax makes reporting your Changelly taxes simple. It gives you clear reports that help you understand and file your taxes correctly. These reports also show how your Changelly activities affect your overall taxes.

Plus, Catax highlights exactly what taxes you need to pay for each transaction, making it easier to understand your Changelly taxes and stay on top of your financial responsibilities.

In short, Catax is a great tool for making Changelly tax calculations easy. It works well with Changelly, follows tax rules worldwide, and creates clear reports, simplifying crypto tax needs for everyone.

Connecting Changelly and Catax:

Connecting Changelly to Catax via API: Right now, you can’t connect your Changelly account with other platforms using an API. So, you have to do it differently. You’ll need to upload a CSV file. This file has all your transaction details like trades, deposits, and withdrawals from Changelly. Once you upload it, platforms like Catax can use the information to calculate your taxes and make reports. It’s not as easy as using an API, but it still helps you manage your Changelly transactions.

Connect Changelly via CSV file:

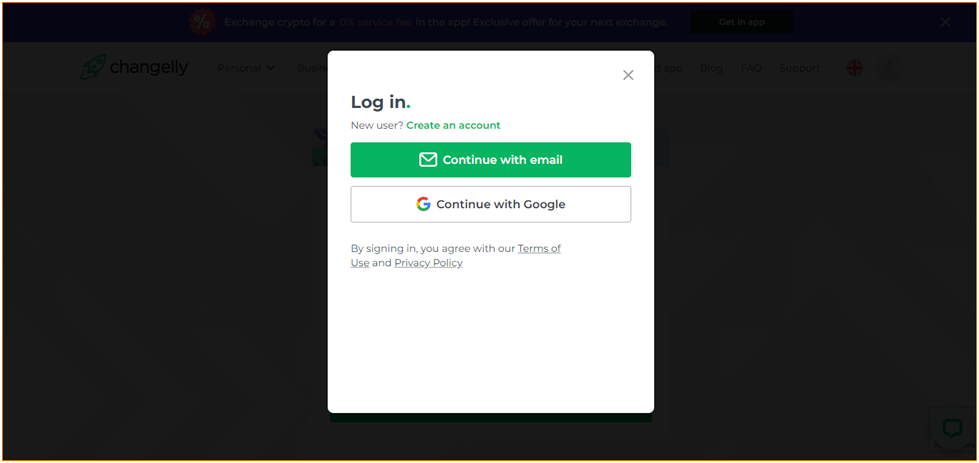

On Changelly:

- Log in to your Changelly Account.

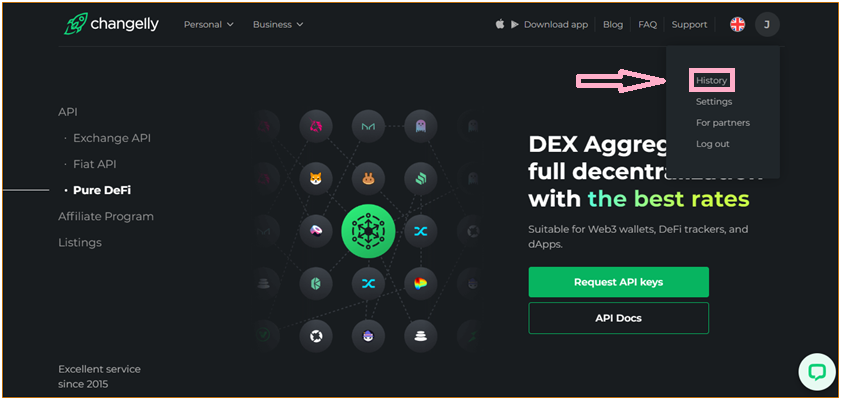

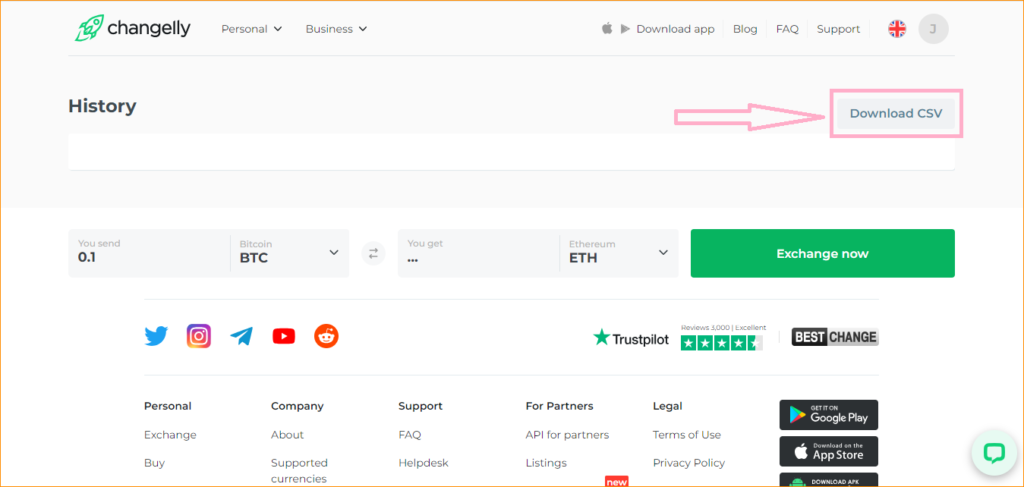

- After logging in, head to the profile icon, and then click on ‘History’.

- Then click on download CSV. Your CSV will be Downloaded.

On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select ‘Changelly’.

- Choose ‘Import from File’.

- Upload your Changelly CSV file.