Creating your coinswitch transaction history is straightforward and beneficial for monitoring your trades, deposits, and withdrawals. Follow these step-by-step instructions for easy guidance through each part of the process.

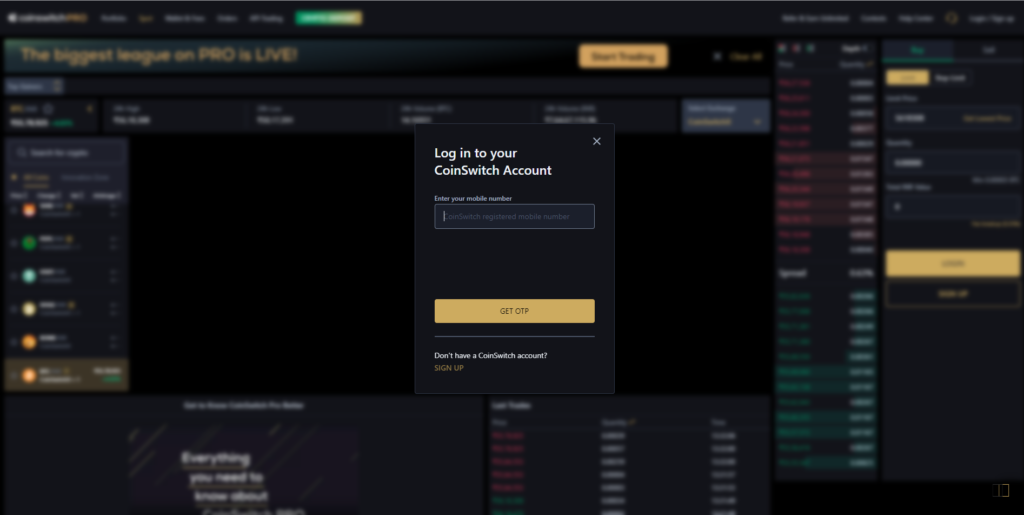

- Go to Coinswitch.co, click on ‘login to pro’ then sign into your Coinswitch account.

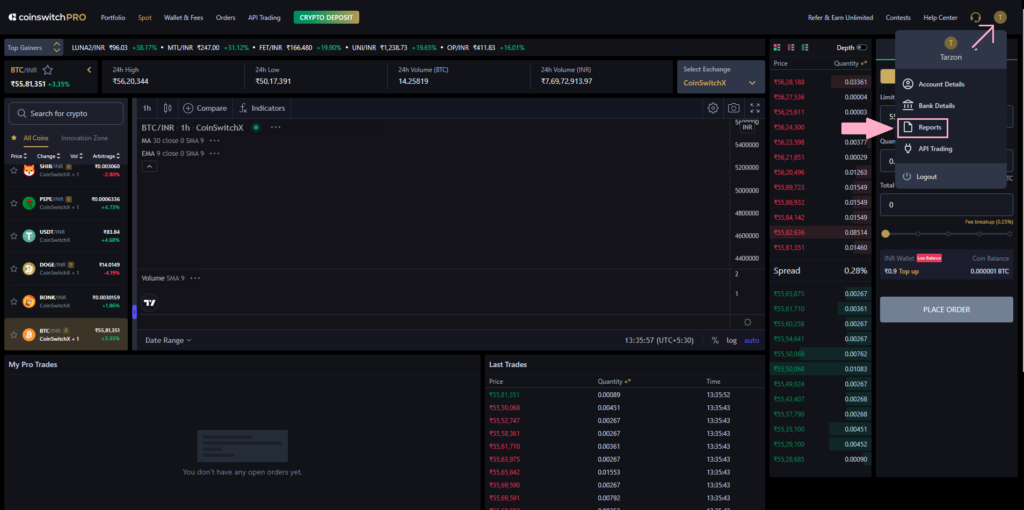

- After logging in, head to the profile icon in the top right corner then click on ‘Reports‘.

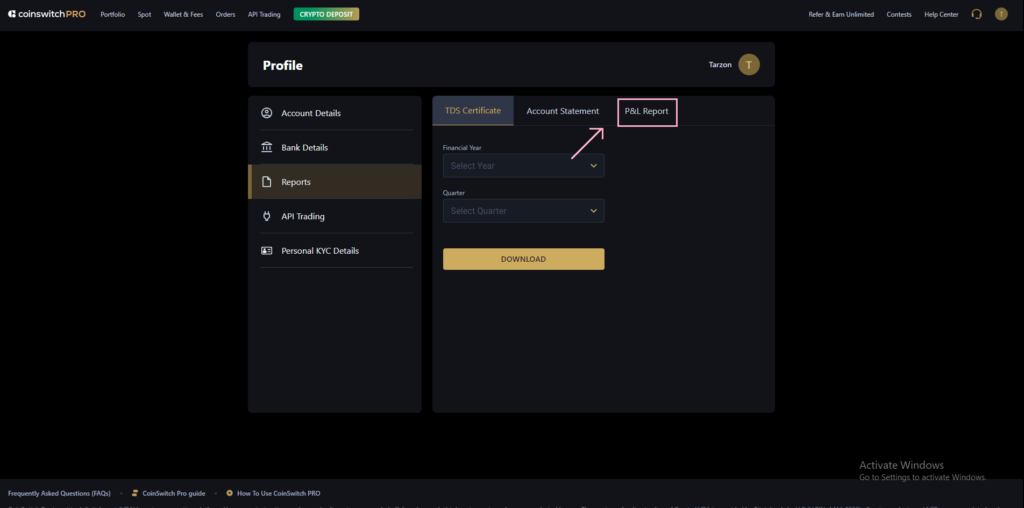

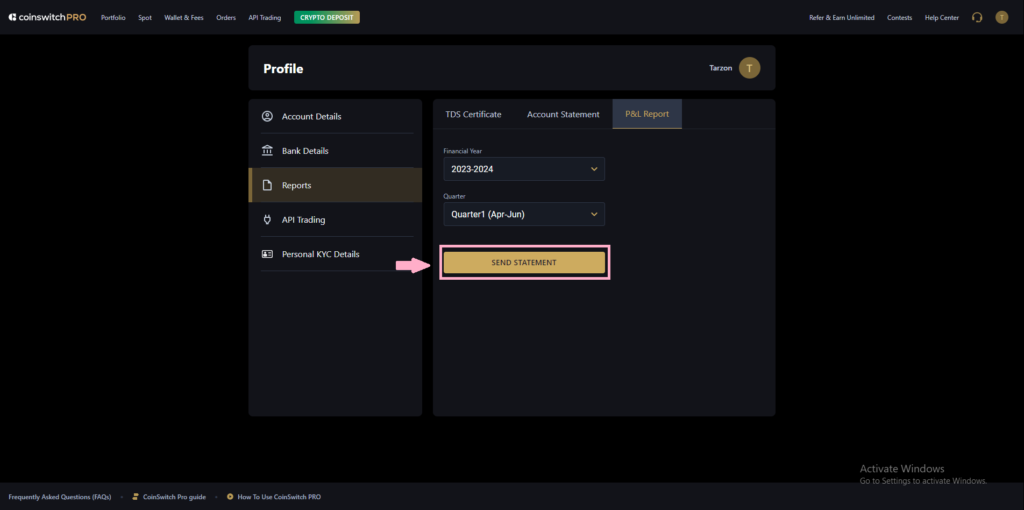

- In the Reports section click on ‘P&L Report‘.

- Next, select your financial year and quarter, then click on ‘Send Statement’.

“Your statement will be sent to your registered email address.”

Lets Calculate Taxes with Catax

Catax is a handy tool for managing crypto taxes, working smoothly with almost all major exchanges like Coinswitch, WazirX, Binance, and many more. It efficiently gathers your trade data, making it easy to track your profits, losses, and income, especially if you’re trading on multiple platforms and want to consolidate your tax details.

A Highlight of Catax:

An outstanding feature of Catax is its ability to seamlessly import your Transaction History. This significantly simplifies tax preparation, ensuring accurate calculations. Therefore, Catax has become a crucial tool for Coinswitch, WazirX, or Binance users, aiming to make tax handling during the tax season less challenging.

Is it safe to connect Coinswitch transaction history to Catax?

Yes, connecting your CoinSwitch transaction history to Catax is safe. Catax takes security very seriously and works hard to keep your financial information protected. It also makes calculating your taxes for CoinSwitch trades easier by looking at your transaction history. This helps keep your investments safe. Plus, many traders trust Catax to help them report their taxes simply and securely using their transaction history.

Strengthening Security for Coinswitch Transaction History:

To keep your CoinSwitch transaction history safe, do two important things. First, use different passwords for each of your accounts to make them more secure. also turn on two-factor authentication, which adds an extra step to check who you are and keeps your money and information safer.

The Role of Cryptotax Software:

Catax is better than old ways of doing taxes because it’s easier to use and works faster. It also gives updates right away, so you know it’s correct and follows the tax rules. Plus, it does things by itself, which saves time and cuts down on mistakes. This means people can handle their cryptocurrency taxes easily and with confidence.