This guide will help you step by step to manage your CoinW taxes easily and stay compliant. Whether you are a trader or an investor, reporting your crypto transactions correctly is important to avoid any tax problems.

Do I Need to Pay Taxes When Using CoinW?

Yes, in most countries, your crypto transactions on CoinW are taxable. You may have to pay either capital gains tax (if you make a profit by selling or trading) or income tax (if you earn crypto). Tax rules depend on your country, and some places may have exemptions based on how long you hold your assets or how much profit you make. If you’re unsure, it’s best to check with a tax expert like catax.

If doing taxes for your crypto trades on CoinW feels tricky, try Catax, a simple tool that helps you calculate your cryptocurrency taxes easily. Here’s how it works:

- Sign Up on Catax: Start by creating an account on Catax. Choose India as your country and select INR as your preferred currency.

- Connect Your CoinW Account: Link your CoinW account to Catax so it can automatically fetch all your crypto transactions. This saves you the trouble of manually entering each trade.

- Organize Your Transactions: Catax neatly organizes your imported transactions into different categories like profits, losses, and income. This gives you a clear view of your crypto activity.

- Download Your Tax Report: With just a few clicks, you can generate a detailed tax report that summarizes your crypto earnings and losses.

How Are CoinW Transactions Taxed?

Understanding how your CoinW transactions are taxed is important to stay compliant and avoid unexpected tax liabilities. Here’s a simple breakdown:

- Capital Gains Tax

- Selling or Trading Crypto – If you sell, trade, or swap crypto on CoinW and make a profit, you will be subject to capital gains tax.

- Tax Rates – The tax you pay depends on how long you hold the asset and the tax rules of your country.

- Income Tax

- Earning Crypto – If you earn crypto through staking, mining, or as payment, it is treated as income and taxed accordingly.

- Tax Rates – This income is taxed at your regular income tax slab rate.

Note: In India You have to pay tax under the Income Tax Act, 1961, as per Section 115BBH.

- Crypto Sales & Trades (Capital Gains Tax at 30%)

- If you sell, trade, or swap crypto on CoinW, you must pay 30% tax on profits (capital gains).

- No Deductions – You cannot claim any deductions, except for the cost of acquisition.

- No Loss Set-Off – Crypto losses cannot be set off against other income or carried forward to future years.

- Earning Crypto (Income Tax at Slab Rates)

- If you earn crypto through staking, mining, or as a payment, it is taxed based on your income tax slab rate.

- If you receive crypto as salary or business income, taxation follows the relevant salary or business tax rules.

- 1% TDS on Crypto Transactions

- This TDS is deducted when selling crypto and can be adjusted against your total tax liability.

- A 1% TDS (Tax Deducted at Source) applies to crypto transactions exceeding:

- ₹50,000 per year for individuals

- ₹10,000 per year for specified users (such as businesses)

Connecting Your CoinW Account with Catax via API

In CoinW:

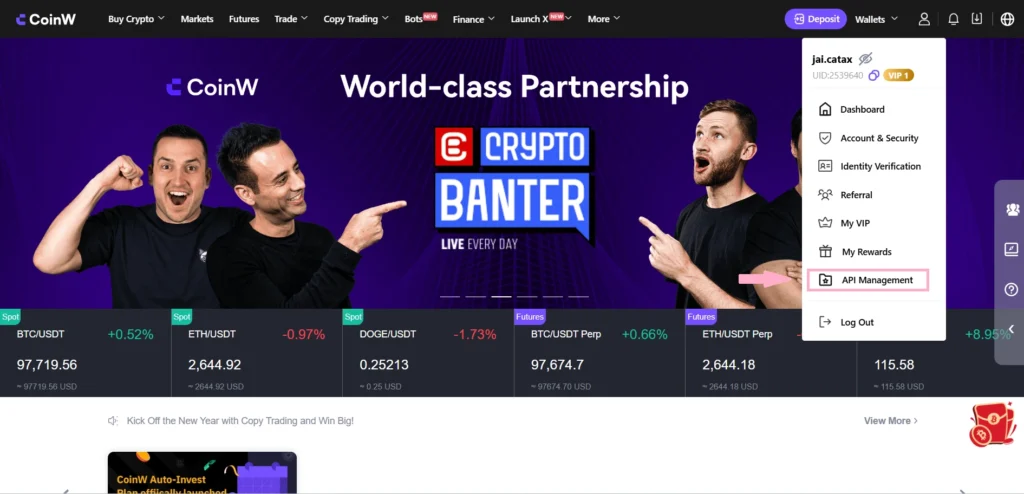

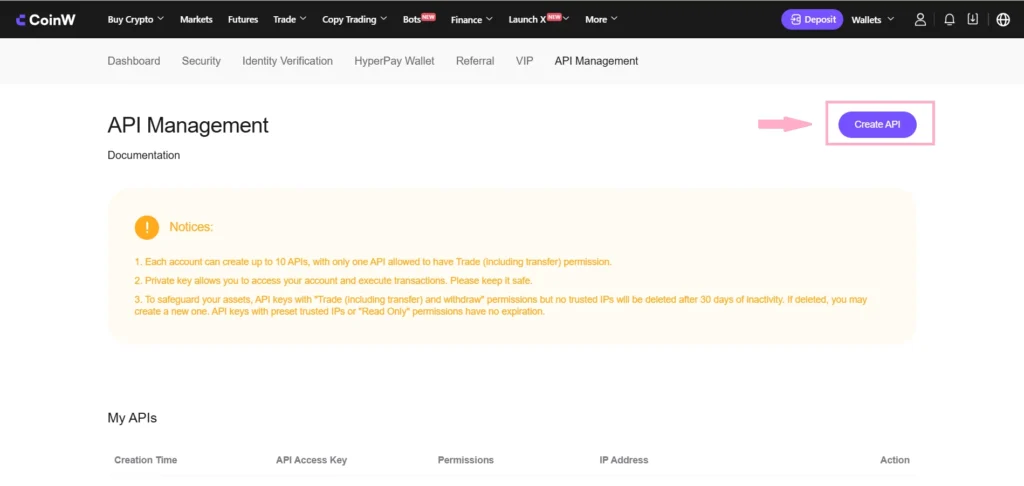

- In your CoinW exchange, go to the profile icon and select API Management from the dropdown menu.

- Click on the Create API.

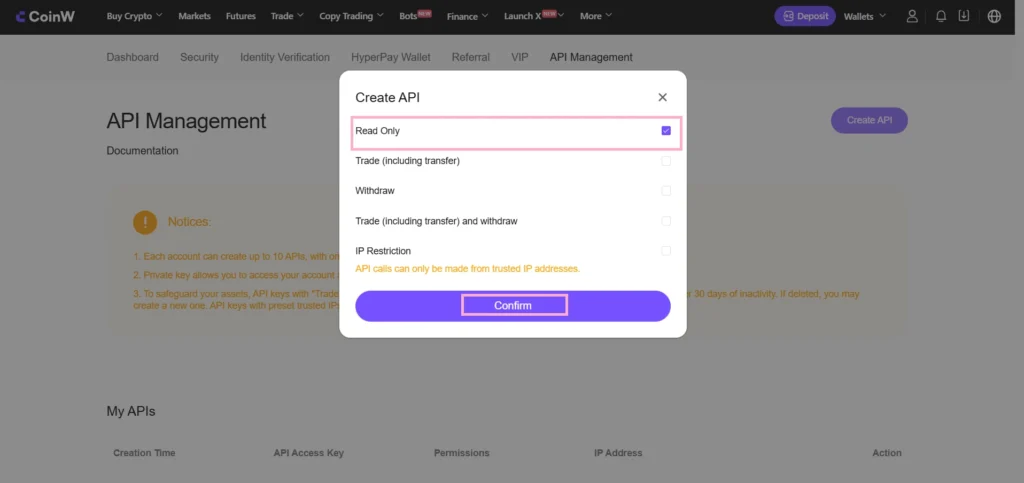

- Select on the Read Only mode and click Confirm.

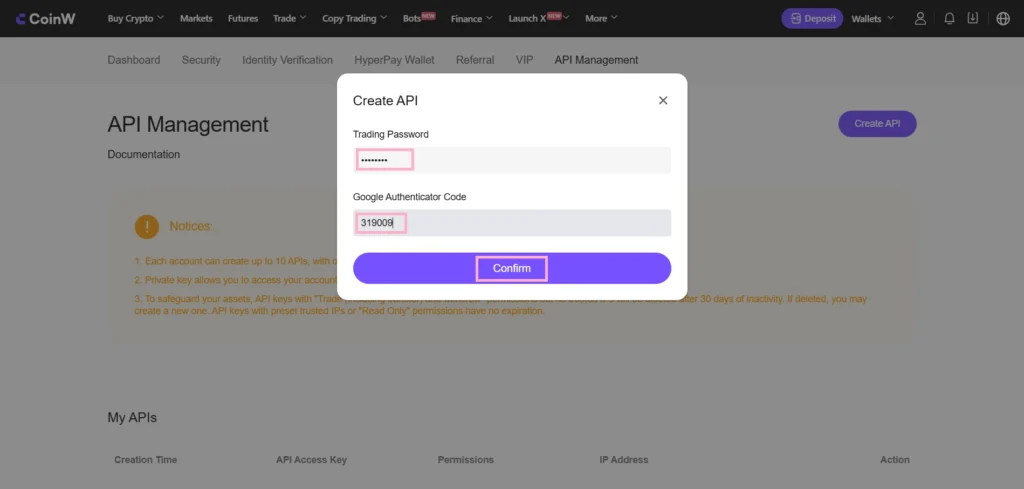

- Complete security verification.

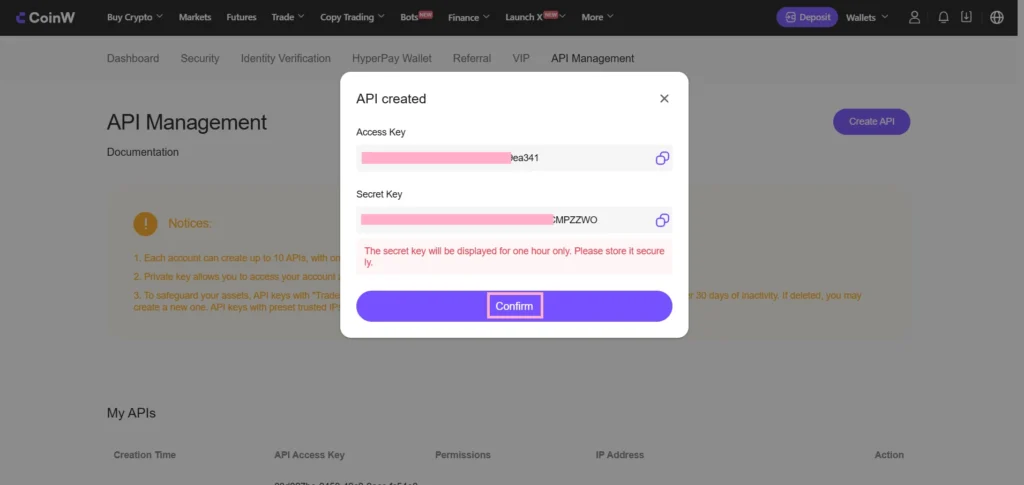

- Your API and Secret Key will be ready.

On Catax:

- First, log in to your Catax account.

- Go to the integration section select CoinW and enter your API and secret key.

- Enable auto-sync to sync the full transaction history.

FAQs (Frequently Asked Questions)

If you transfer funds from CoinW to another wallet, it is not a taxable event. However, if you convert crypto to fiat before withdrawing, you must pay capital gains tax on any profits.

Yes, the government taxes rewards earned from staking, lending, or interest on CoinW as income, based on their fair market value at the time of receipt.

You must report your crypto taxes annually when filing your regular income tax return. However, if you are an active trader, some tax authorities may require quarterly filings.

Yes, tax authorities apply capital gains tax when you sell NFTs for a profit. If you earn rewards from NFT activities like royalties or staking, those earnings are taxed as income.