This guide will help you step by step to manage your Delta Exchange taxes easily and stay compliant. Whether you are a trader or an investor, reporting your crypto transactions correctly is important to avoid any tax problems.

If reporting taxes from Delta Exchange feels complicated, try Catax, a simple cryptocurrency tax calculator. Here’s how you can use it:

- Sign Up on Catax – Create an account, select India as your country, also choose INR as your currency.

- Connect with Delta Exchange – Link your Delta Exchange account to Catax to automatically fetch your transactions.

- Organize Your Transactions – Catax will sort your transactions into gains, losses, and income so you can see everything clearly.

- Download Your Tax Report – Get a detailed tax report from Catax to understand your crypto finances.

Connecting Your Delta-Exchange Account with Catax via API

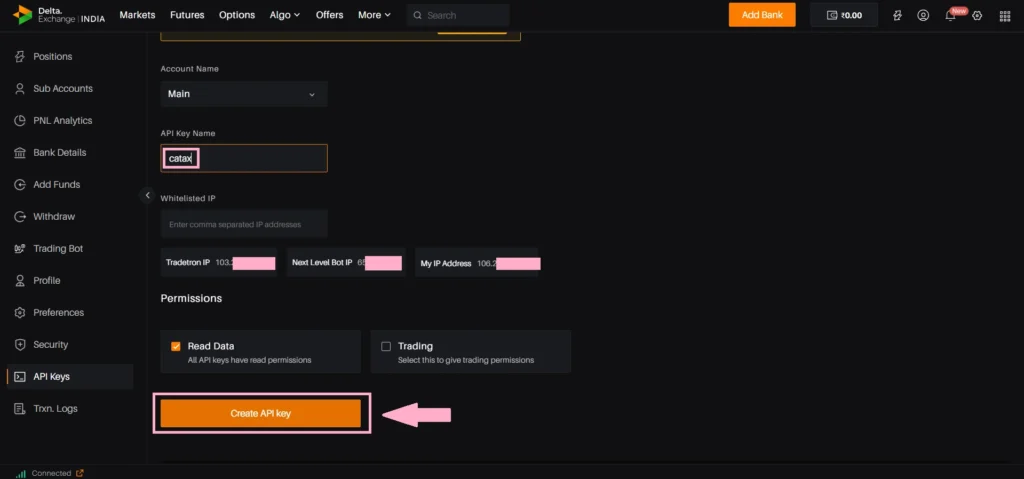

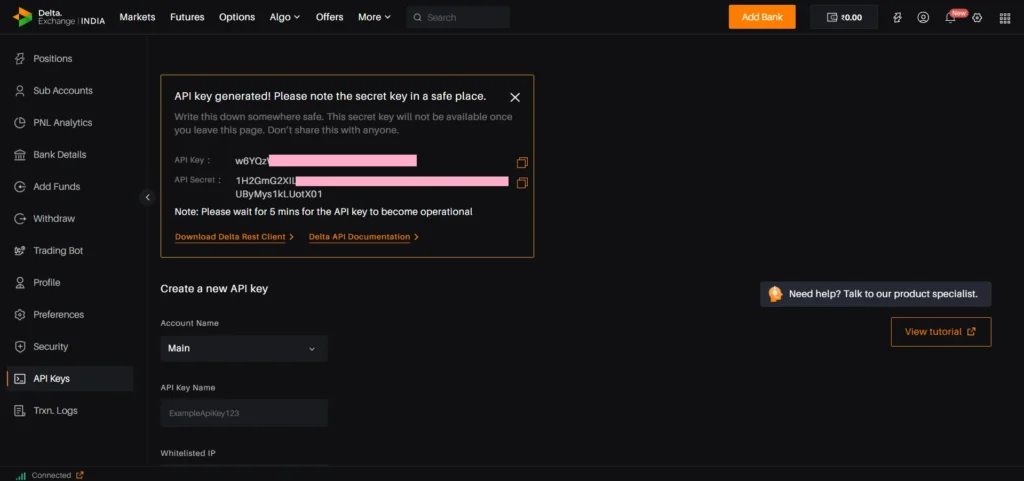

In Delta-Exchange:

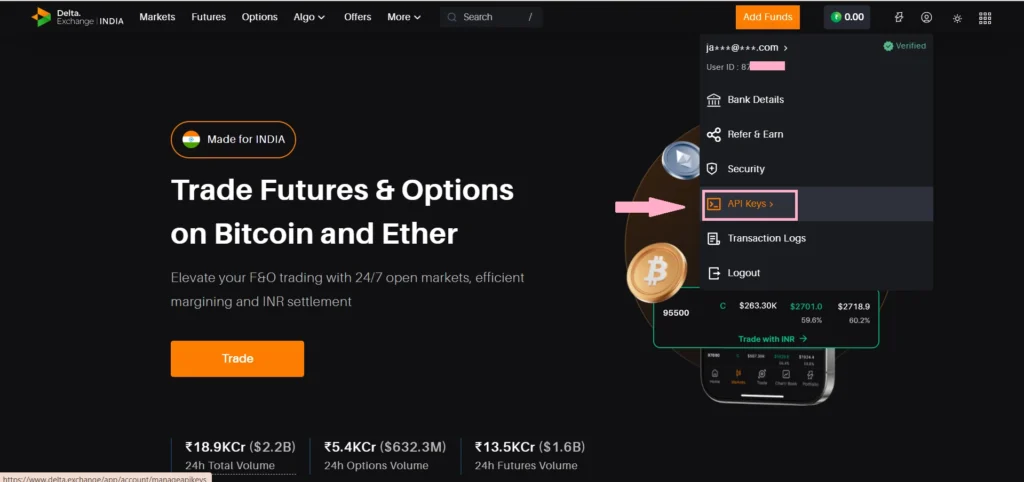

- In your Delta-Exchange, click on the profile icon in the top-right corner.

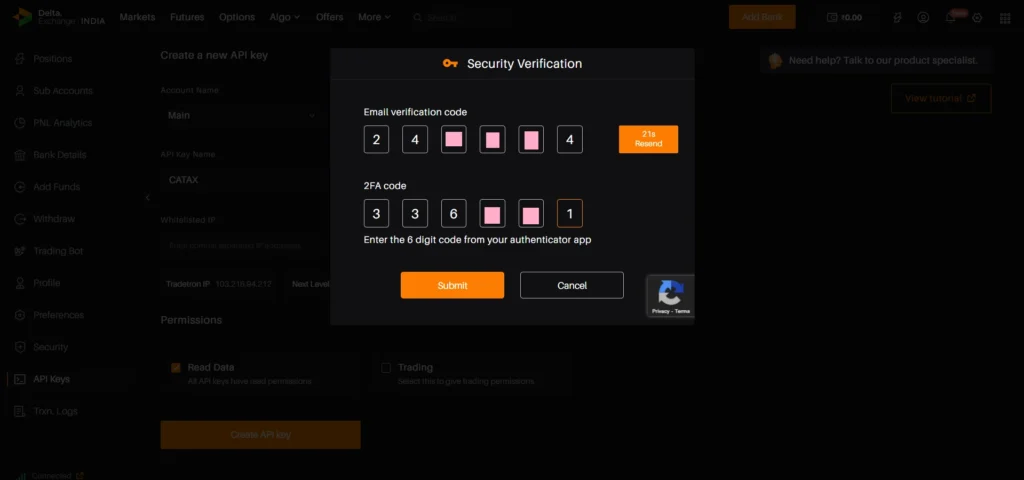

- Complete your Security Verification.

- Your API and Secret Key will be ready.

On Catax:

- First, log in to your Catax account.

- Go to the integration section select Delta-Exchange and enter your API and secret key.

- Enable auto-sync to sync the full transaction history.

Steps to Export Your Trade History from Delta- Exchange

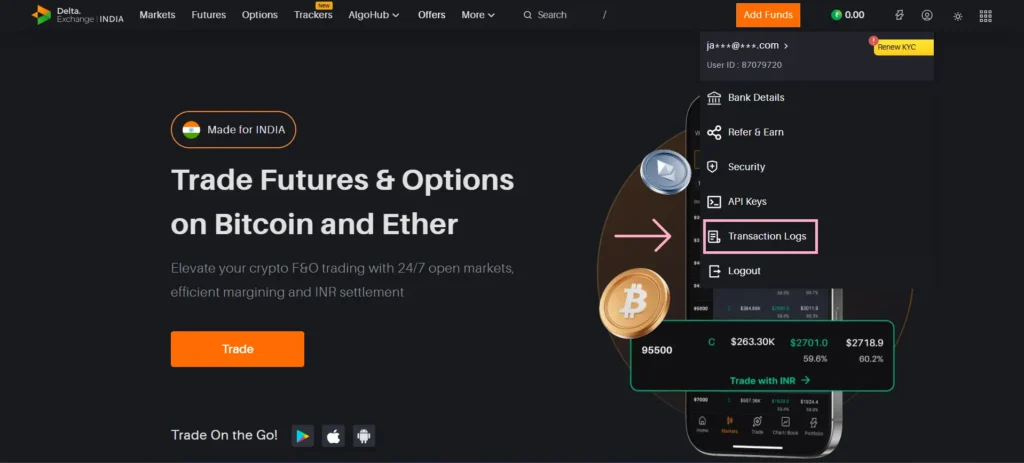

In Delta-Exchange:

- Click on the Profile Icon in the top-right corner

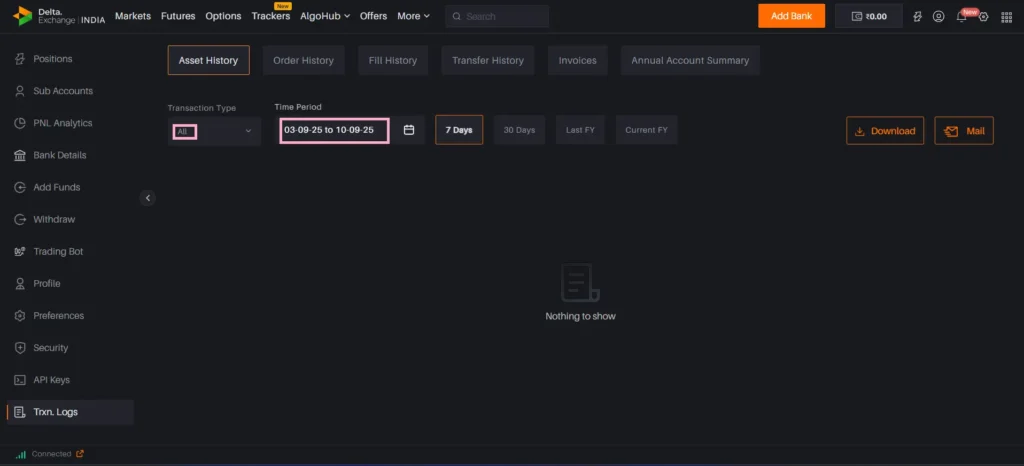

- In the Transaction Logs, choose Asset History, set transaction type to All, select the desired date and time, and then click Download.

4. Now choose Fill History set transaction type to All, select the desired date and time, and then click Download.

On Catax:

- First, log in to your Catax account.

- Go to the integration section and upload your trade history.