Creating your OKX transaction history is simple and useful for tracking your trades, deposits, and withdrawals. Follow these step-by-step instructions for clear guidance through every aspect of the process.

Step-by-step guide for exporting OKX transaction history

- Go to OKX.com and sign in to your OKX account.

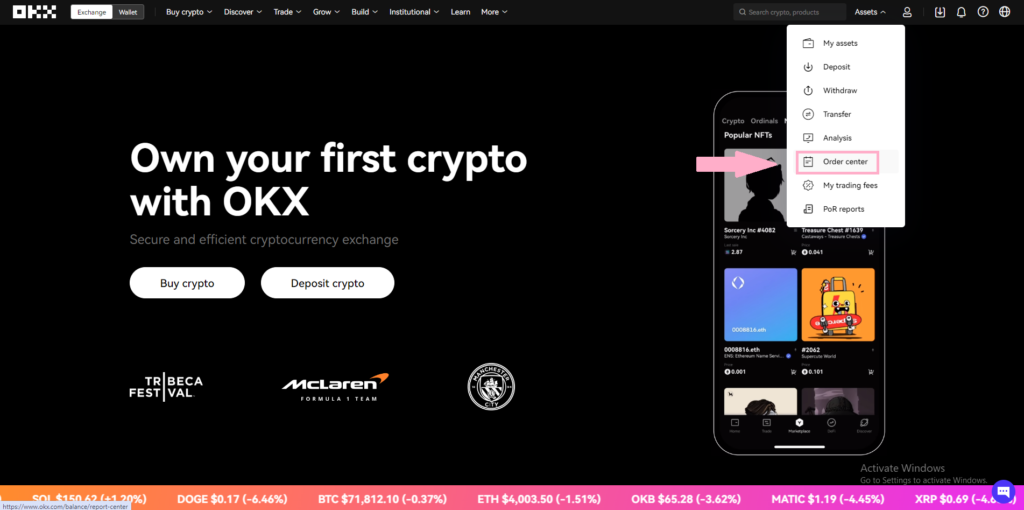

- After logging in, head to the ‘Assets‘ section and click on ‘Order Center’.

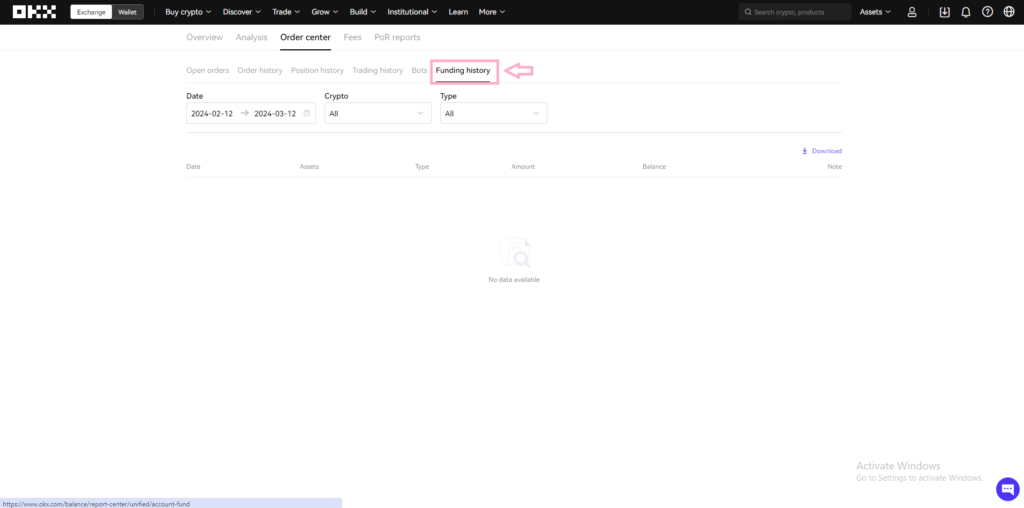

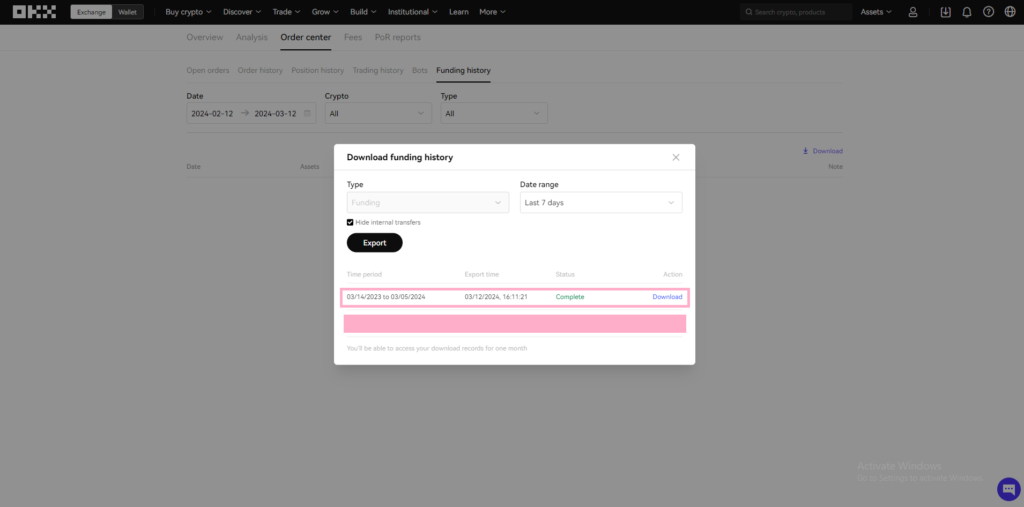

- In the ‘Order Center’ go to ‘Funding history’.

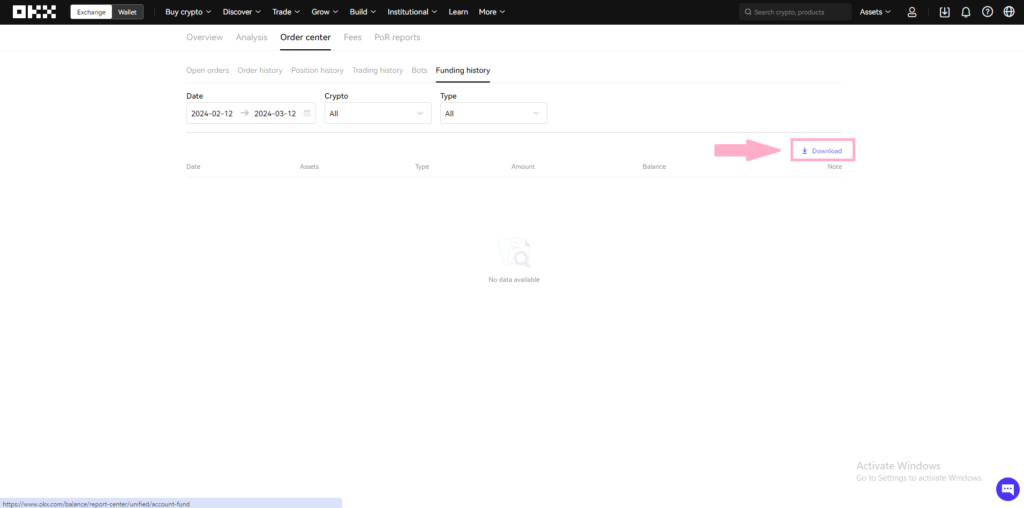

- Click on the Download button.

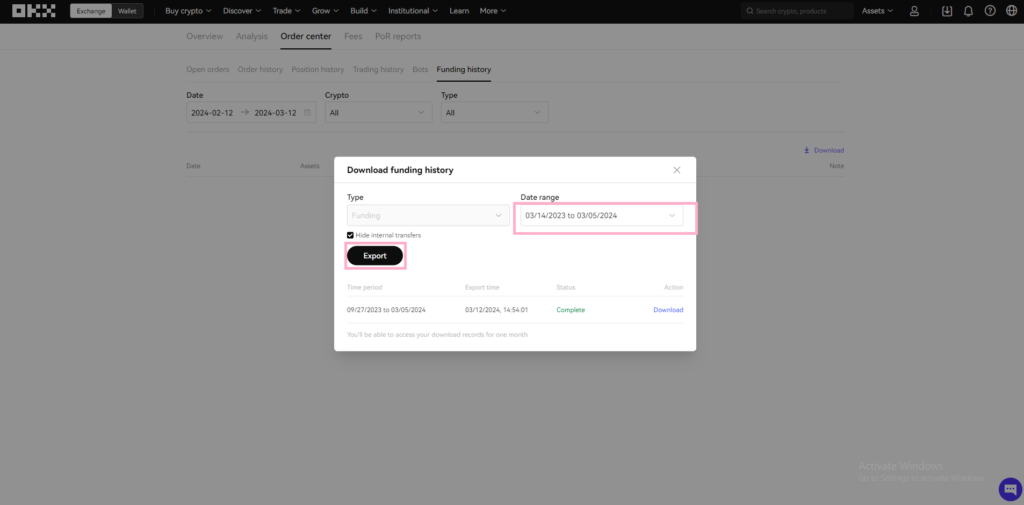

- Click on ‘Date Range‘ and choose your preferred date range. You can also customize your date range.

- Your report will be ready to download in a few minutes.

Lets Calculate Taxes with Catax

Catax is a helpful tool for handling your crypto taxes, and it works great with many big exchanges like OKX, WazirX, Binance, and lots more. Also, It collects all your trading information, making it simple to keep track of your gains, losses, and income. This is super handy if you’re trading on several platforms and need to pull all your tax info together.

A Cool Thing About Catax:

One of the best parts of Catax is how easily it pulls in your OKX transaction history. This makes getting ready for tax time much easier and helps make sure everything is calculated right. So, for people using OKX, WazirX, or Binance, Catax is an important tool to make tax season less of a headache.

Is it safe to add OKX trading history to Catax?

Yes, adding your OKX transaction history to Catax is safe. Catax cares about keeping your financial data secure. It makes figuring out taxes for OKX trades easier by checking transactions safely. Additionally, a lot of traders trust Catax for easy and secure tax reports with their trading history.

Making Your OKX Transaction History More Secure:

To keep your trading history extra safe, do two things. First, use different passwords for each account to beef up security. Second, turn on two-factor authentication for another layer of protection for your money and trades.

Why Crypto Tax Software Rocks:

Catax is way better than the old way of doing taxes because it’s user-friendly and quick. It updates in real-time, so you know the info is accurate and follows tax laws. Also, it automates stuff, saving time and reducing errors. This means folks can manage their crypto taxes smoothly and with peace of mind.