The Income Tax Department (ITD) in India has provided new rules for taxes on digital assets like Bybit cryptocurrencies, NFTs, and other tokens. First of all, these rules include a 30% tax, a 1% tax deducted at source (TDS), and possibly even paying tax based on your own tax bracket. Additionally, our complete guide to Bybit taxes in India has all the latest information you need. Furthermore, it includes how to report your Bybit crypto earnings, details on the tax rates, and how to file Schedule VDA properly.

Is crypto taxed in India?

Yes, in India, you have to pay taxes on Bybit cryptocurrency. Additionally, in the 2022 Budget, the government of India recognized cryptocurrencies as Virtual Digital Assets (VDAs) and set up rules for taxing them.

When you sell, exchange, or use Bybit crypto assets, you need to think about the taxes on any profits you make. In India, the profits from such transactions are subjected to a 30% tax rate, in addition to any applicable surcharges and a 4% health and education cess. This specific tax regulation is detailed in section 115BBH of the Indian tax code. It is important to highlight that crypto assets do not qualify for the advantage of reduced taxes on long-term gains. Moreover, it is worth noting that no expenses can be deducted, with the sole exception being the initial cost of purchasing the crypto.

To make sure everyone follows the rules, there’s a 1% tax that has to be taken out right away (Tax Deducted at Source or TDS) whenever Virtual Digital Assets (VDAs) are transferred. The 30% tax started on April 1, 2022, and the 1% TDS rule began on July 1, 2022.

if you’re filling out your Income Tax Return (ITR) for the financial year 2022-2023, you need to include your crypto profits under Schedule VDA. Also keeping up with these rules and reporting your Bybit crypto dealings accurately will help you manage your taxes properly.

The G20 talks highlighted that it wouldn’t be helpful to ban cryptocurrencies. Instead, they suggest gradually regulating them within an international framework. The Interim Budget of 2024 didn’t change anything about Bybit taxes in India, so the existing rules continue as they were.

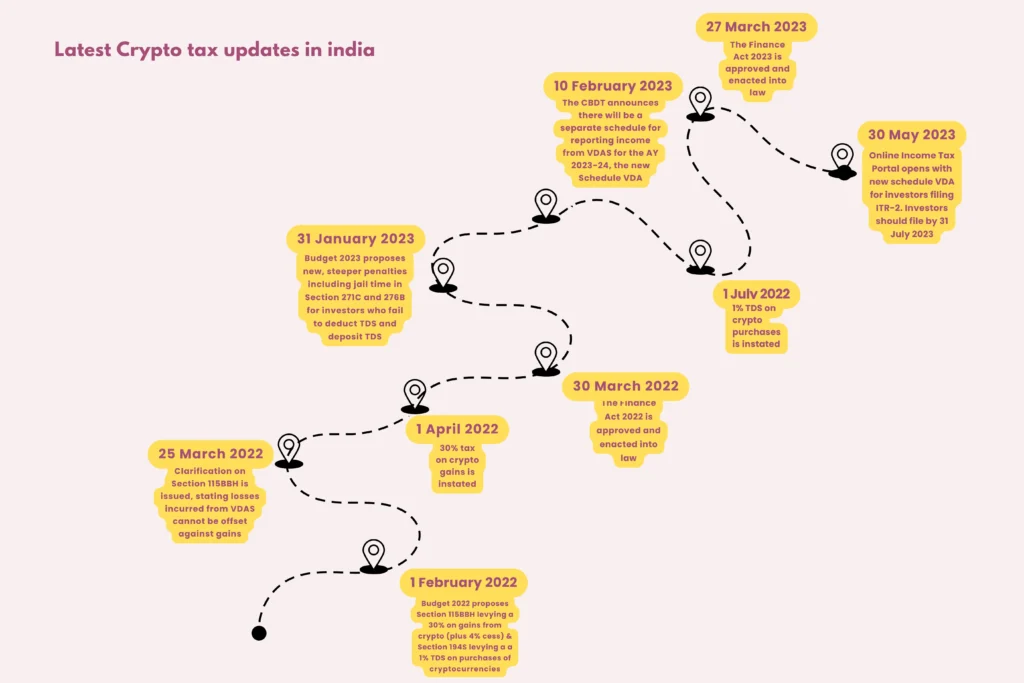

Latest Crypto tax updates in india

In 2022, the Union Budget of India made its first move to officially recognize and tax crypto assets. However, these assets are not seen as traditional “currencies” by the government but as “virtual digital assets.”

The Finance Bill, under section 115BBH, explains that a taxable event includes:

- Changing any digital asset into Indian Rupees (INR) or another country’s money.

- Swapping one type of digital asset for another, like trading between different cryptocurrencies or using stablecoins.

- Using digital assets to buy goods or services.

If your transaction is less than INR 10,000, there will be no extra tax added to it. In addition, the government has also proposed to require crypto exchanges to report any transactions above INR 10 lakhs to the tax authorities. Consequently, this means that there will be greater scrutiny on large cryptocurrency transactions.

When have to pay 30% tax on crypto in India?

Knowing when you must pay a 30% tax on crypto is crucial for ensuring compliance with the law when participating in cryptocurrency transactions. This tax rate applies in specific situations:

- Selling Crypto for Fiat: If you exchange your crypto assets for traditional currency like Indian Rupees (INR) or any other fiat currency, you’ll face a 30% tax on the profits from that transaction.

- Trading Crypto for Crypto: When you swap one type of cryptocurrency for another, or even if you trade your crypto for stablecoins, any resulting profits are subject to a 30% tax.

- Using Crypto for Purchases: Spending your crypto on goods or services also incurs taxation. In such cases, any gains made from the transaction are subject to the 30% tax rate.

Understanding and meeting these tax requirements helps you handle your crypto transactions legally. This knowledge is especially useful for managing taxes on Bybit crypto activities.

Keep these dates in mind for reporting Bybit taxes in India:

The financial year in India runs from April 1 to March 31 of the next year. For instance, the ongoing financial year started on April 1, 2022, and will end on March 31, 2023, known as FY 2022-23. When filing your taxes this year, you need to report the financial transactions that happened within this timeframe.

| Existing Tax Regime | New Tax Regime | ||

| Income Slab | Tax Rate | Income Slab | Tax Rate |

| Up to RS250,000 | 0% | Up to RS250,000 | 0% |

| RS250,001 – RS500,000 | 5% above RS250,000 | RS250,001 – RS500,000 | 5% above RS250,000 |

| RS500,001 – RS1,000,000 | RS12,500 + 20% above RS500,000 | RS5,00001 – RS750,000 | RS12,500 + 10% above RS500,000 |

| Above RS1,000,000 | RS112,500 + 30% above RS1,000,000 | RS750,001 – RS1,000,000 | RS37,500 + 15% above RS750,000 |

| – | – | RS1,000,001 – RS1,250,000 | RS75,000 + 20% above RS1,000,000 |

What is the 1% TDS on Crypto Assets?

The 1% TDS (Tax Deducted at Source) on crypto assets is a tax that’s taken out of a transaction at the moment you transfer (sell, trade, or use) crypto. However this rule, which started on July 1, 2022, helps the government keep track of crypto investments in India.

Here’s what you need to remember about the crypto TDS:

- The 1% TDS has been in effect since July 1, 2022.

- If you buy or sell on Indian crypto exchanges, the exchange takes care of the TDS and sends it to the government.

- For trades made on peer-to-peer platforms or international exchanges, the buyer needs to handle the TDS.

- In trades from one crypto to another, both parties will see a 1% TDS.

- There’s a special case where if someone, considered a “specified person,” doesn’t trade more than Rs 50,000 in one financial year, they don’t need to pay TDS.

For crypto investors, it’s also vital to understand how Bybit taxes work in India. This involves keeping track of your transactions and knowing how they might affect your taxes, all in simpler terms to help you stay on top of your financial obligations.

The process of reporting your Bybit transactions for income tax purposes in India

- Begin by logging into the Income Tax e-filing portal. If you’re new to filing, you’ll need to register first.

- Once you’re in, click on the ‘e-file‘ option and then choose ‘File Income Tax Returns‘. Proceed by selecting the relevant assessment year, which for the 2023-24 fiscal year would be AY 2024-25.

- Next, opt for ‘online‘ as your filing mode. Start a new filing as an individual and move forward to the form selection. Here, you’ll pick ITR-2 if it suits your transaction types.

- Now, explain your reasons for filing an ITR; your circumstances will guide this part. Continuing, under the ‘select schedule’ section, look for and choose ‘income’.

- Scroll to find ‘Schedule VDA‘ and tick the checkbox to include it in your filing, as this is where you’ll report your Bybit gains.

- At this point, it’s time to reference your Catax reports. Catax provides a clear outline of your capital gains and other income from crypto, which you’ll use to fill in Schedule VDA and the ‘Income from Other Sources‘ section on the ITR-2 form.

- You’ll likely need details from Catax reports such as the Capital Gains Report, Other Gains Report, and the income summary from the Complete Tax Report, depending on the nature of your Bybit activities.

- Use the figures from these Catax reports to accurately detail your trades and crypto transactions in the ITR-2. Once you’ve entered all the necessary information, confirm your entries to ensure they’re correct.

New penalties for not following TDS rules In India

crypto investors now face strict penalties if they don’t stick to the rules about Tax Deducted at Source (TDS).

The government says if you don’t cut the TDS from a transaction or don’t give it to the government, you might have to pay a fine that’s as much as the TDS itself. In some serious cases, you could even end up in jail for 3 to 7 years and have to pay an extra fine. Let’s dive into the details with an example.

Penalty for not cutting 1% TDS (Section 271C):

If you’re supposed to cut TDS and you don’t, you might have to pay a penalty that’s the same amount as the TDS. The Joint Commissioner is the one who decides this.

For Example:

Suppose Priya bought Rs 200,000 worth of Ethereum. According to Section 194S, she should cut 1% TDS, which is Rs 2,000, before paying the seller.

If Priya forgets to cut Rs 2,000 as TDS and doesn’t give it to the government, then she could be penalized Rs 2,000 by the Joint Commissioner.

Not giving TDS to the government (Section 276B):

If you cut TDS but don’t hand it over to the government, it can lead to jail time between 3 months and 7 years, plus a fine. The court decides this after the Income Tax Department asks, with the Joint Commissioner’s okay.

For example:

Let’s say Priya bought Rs 200,000 worth of Ethereum. She needed to cut 1% TDS, so Rs 2,000, for the seller.

If Priya did cut the Rs 2,000 as TDS but didn’t deposit it with the government, she might face jail time from 3 months up to 7 years and also have to pay a fine.

Which crypto tax free in india?

In India, you don’t have to pay taxes on every crypto move you make. If you’re just keeping your crypto without selling or if you move it from one wallet to another as long as both wallets are yours, there’s no tax for that. Also, if your friends or family give you crypto as a gift and it’s worth less than RS50,000, you don’t have to pay taxes. And if your very close family gives you any amount of crypto as a gift, that’s tax-free too.

So, you don’t have to worry about taxes in India when:

- You’re just keeping your crypto and not selling it (holding or HODLing).

- You’re moving your crypto to another wallet you own.

- Friends or relatives give you crypto worth less than RS50,000.

- Your close family gives you any amount of crypto as a gift.

How to Figure Out Your Bybit Taxes

To work out Bybit taxes in india on your crypto earnings, you need to know your ‘cost basis’. This means the price you paid to buy your crypto. Also, if you got your crypto for free, like as a reward or gift, then your cost basis is the crypto’s value in Indian Rupees (INR) on the day you got it. Remember, you can’t include extra costs like fees when you calculate this in India.

Calculating Your Profit (or Gain)

To find out your profit Bybit Taxes in india, take the amount you sold your crypto for and subtract your cost basis from it. If you used your crypto to buy something or traded it, subtract the cost basis from how much the crypto was worth in INR when you made the trade or purchase.

What if You Have Lots of Crypto Transactions?

For those who have bought and sold many different Bybit cryptos, figuring out the cost basis for each can be hard. However, you need to use a system to decide which crypto sales to count first. In India, you can use two methods. First, you can use the First In, First Out (FIFO) method. On the other hand, you can also use the Specific Identification method.

- First In, First Out (FIFO): This means you count the first crypto you bought as the first one you sold.

- Average Cost: This means you calculate the average cost of all cryptos you bought and use that as your cost basis.

Since calculating gains and losses on multiple cryptos can get complicated, using a crypto tax software like Catax can help you to keep track of all your transactions and cost basis.

Crypto Transactions that are Subject to Tax

Here is the list of crypto transactions that are subject to tax

| Transaction | Tax (Simplified) |

|---|---|

| Buying crypto | 1% tax, not always through exchange |

| Selling crypto | 30% tax on profit |

| Trading crypto for crypto | 30% tax on profit |

| Spending crypto | 30% tax on profit |

| Holding crypto | No tax |

| Moving crypto between your own wallets | No tax |

| Airdrops of crypto | Pay tax like your income, 30% on selling profit |

| Hard forks | Pay tax like your income, 30% on selling profit |

| Gifts of crypto | Taxed, but not always |

| Donating crypto | Only cash deductible, profit taxed at 30% |

| Mining rewards | Pay tax like your income, 30% on selling profit |

| Staking rewards | Pay tax like your income, 30% on selling profit |

Taxes on Crypto Gifts & Donations

In India, if you receive cryptocurrencies or NFTs as gifts, you are liable to pay income tax at a flat rate of 30%, plus applicable surcharges and cess. For instance, if you receive ETH worth INR 5000, this amount is added to your annual income, and you’ll need to pay a 30% tax on it.

Taxes on Crypto Airdrops

Crypto airdrops are taxable in two parts. Initially, the airdropped assets are taxed as “other incomes.” If you later sell these assets at a profit, the revised 30% crypto tax rate applies. For example, if you receive 100 XYZ tokens valued at INR 10 each, your taxable income increases by INR 1000.

Taxes on Mining Cryptos

Mining cryptocurrencies isn’t taxed, but the tokens earned from mining are taxable as business income. This means if you sell mined 0.25 BTC at INR 19,000, you’ll owe capital gains tax on the profit.

Taxes on DeFi Transactions

Earnings from DeFi activities, such as yield farming or mining, are initially taxed as business income. Later, if these assets appreciate and you sell them, you’ll be liable to pay a 30% tax on the profits.

Taxes on Non-Fungible Tokens (NFTs)

Profits from selling NFTs fall under the crypto tax laws. If you sell an NFT at a profit, this profit is subject to a 30% tax, along with a surcharge and 4% cess.

Using Catax to Manage Your Bybit Taxes in India: A Simplified Process

Connect Your Accounts Effortlessly: Start by linking your Bybit and Catax accounts. This process involves generating API keys, which create a secure connection for transferring your transaction details directly to Catax. So It’s a straightforward way to ensure your crypto activity is recorded precisely.

Import Your Transactions Seamlessly: With a single click, Catax will begin to import all your Bybit transactions, including trades, deposits, and withdrawals. It’s akin to having an efficient assistant who meticulously tracks every transaction. However, it’s still prudent for you to review the data to confirm its accuracy.

Review Your Data Thoroughly: Once your transactions are imported, take the time to verify that all details are correct. Addressing discrepancies early on is crucial for ensuring the integrity of your tax report.

Generate Your Tax Report with Ease: Catax simplifies the tax calculation process by generating a comprehensive report that clearly outlines your capital gains, losses, and potential deductions. On the other hand This report is a crucial document that streamlines your tax filing process.

File Accurately with the Authorities: With your checked report ready, the next step is to file it with the Indian tax authorities.

Check Out:

FAQs (Frequently Asked Questions)

To start, you’ll need to create API keys on Bybit and connect them to Catax. This setup lets Catax access your transaction details securely.

Catax can manage taxes for a wide range of cryptocurrencies and exchanges, not just Bybit. It’s designed to be versatile.

The 1% TDS is applied when transferring Virtual Digital Assets, like selling or trading crypto. However, there are exemptions, such as for small traders under a specific limit.

Catax imports transaction data directly from your exchange via API, but it’s always a good idea to review the information for any discrepancies.

Non-compliance can lead to penalties, including fines equal to the TDS amount and possibly imprisonment for severe cases.

Concentrating on long-term investments and meticulously documenting any losses can significantly mitigate your tax obligations. It is crucial, however, to always seek the guidance of a tax expert for advice tailored to your specific situation.