This guide provides easy steps for handling your Gate.io taxes, helping both new and experienced traders manage their tax needs related to Gate.io transactions correctly.

How to Report Gate.io Taxes with Catax:

Account Set-Up: Begin by creating your Catax account.

Integration: Link your Gate.io account with Catax. This can be done through API for a direct connection.

Data Synchronization: Catax will automatically sync and organize your Gate.io transaction data.

Tax Calculation: Catax calculates your taxes based on your transaction history, considering capital gains and income.

Tax Report Generation: Once your data is processed, download a detailed tax report from Catax tailored to your jurisdiction.

Filing Made Simple: Use the Catax report to file your taxes easily, either independently or with a professional’s help.

What is Gate.io?

Gate.io is a well-known cryptocurrency exchange, established in 2013 and based in the Cayman Islands. It offers various services like cryptocurrency trading, margin and derivative trading, NFT trading, and earning interest on cryptocurrency.

How Do I File My Gate.io Taxes?

To easily handle your Gate.io taxes, use Catax. First, connect your Gate.io account to Catax. You can do this either using an API for automatic data or by uploading a CSV file of your trades. Catax then quickly works out what taxes you owe.

Once you connect your Gate.io account to Catax, it organizes your details. This helps identify the taxable ones. Catax adjusts the tax rules based on your location. This is really helpful for Gate.io users in any country, ensuring you comply with your local tax laws.

Catax is more than just a calculator; it puts your Gate.io taxes into simple reports. This turns the often tricky job of reporting crypto taxes into something easier and more accurate.

Catax reports offer a complete overview of your Gate.io taxes, aiding in both understanding and accurate filing. These detailed summaries from Catax simplify tracking your Gate.io tax position, clearly showing how your Gate.io activities affect your total tax duties.

Furthermore, Catax reports clearly emphasize your taxes, shedding light on the tax impact of each transaction. This feature of Catax actively simplifies the complexities surrounding your Gate.io taxes, making sure you stay well-informed about your financial responsibilities.

Basically, Catax is a helpful tool for making your Gate.io tax calculations easier. It works well with Gate.io, follows tax rules from around the world, and creates clear, exact reports. This makes handling your Gate.io taxes and all your crypto tax needs simpler for investors everywhere.

Connecting Catax and Gate.io:

Connecting Gate.io to Catax via API

For Gate.io:

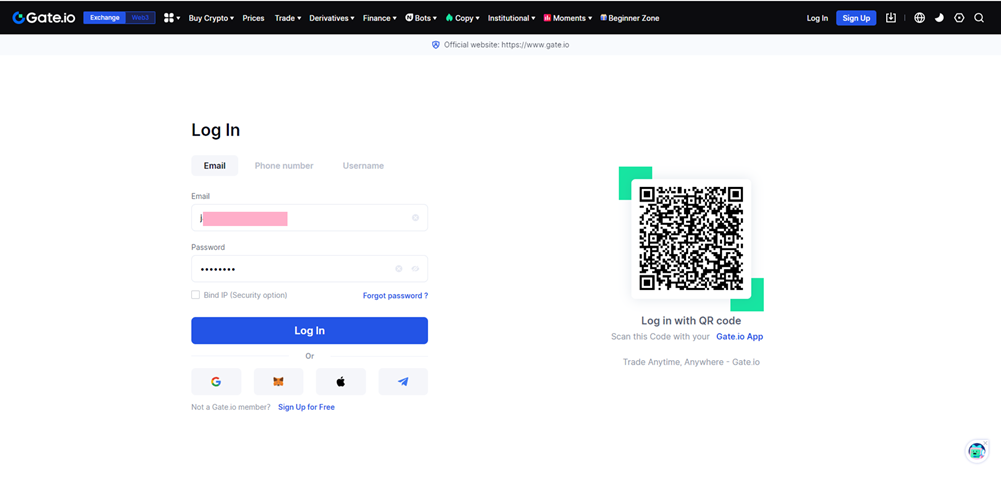

- Sign in to your Gate.io Account.

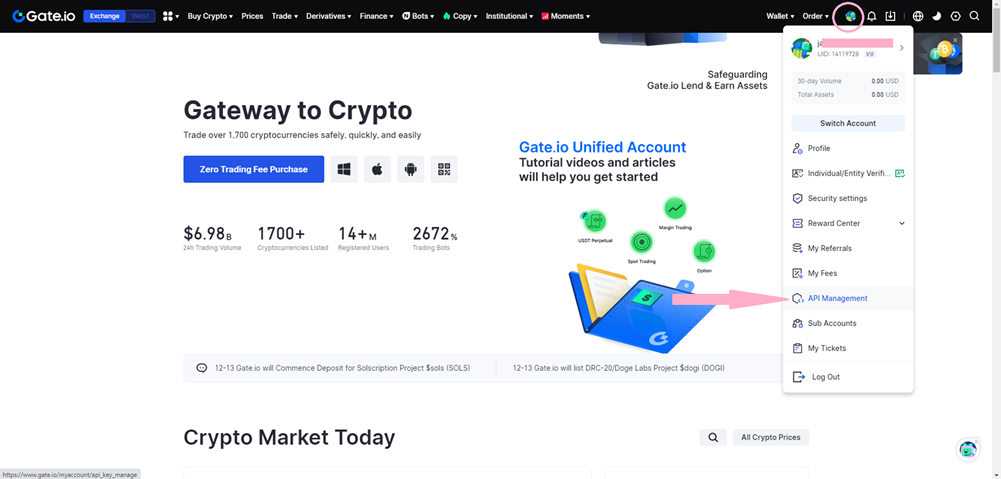

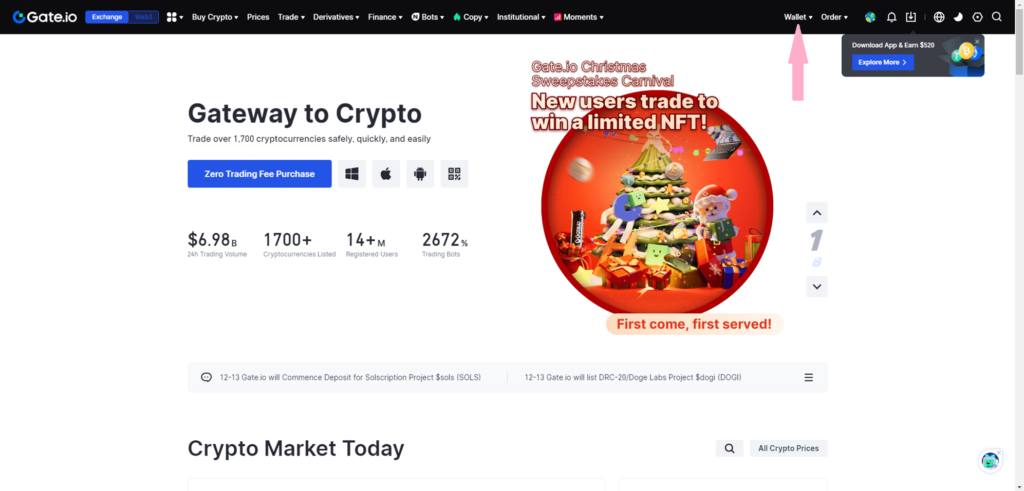

- Once on the dashboard, find and click the profile icon on the right.

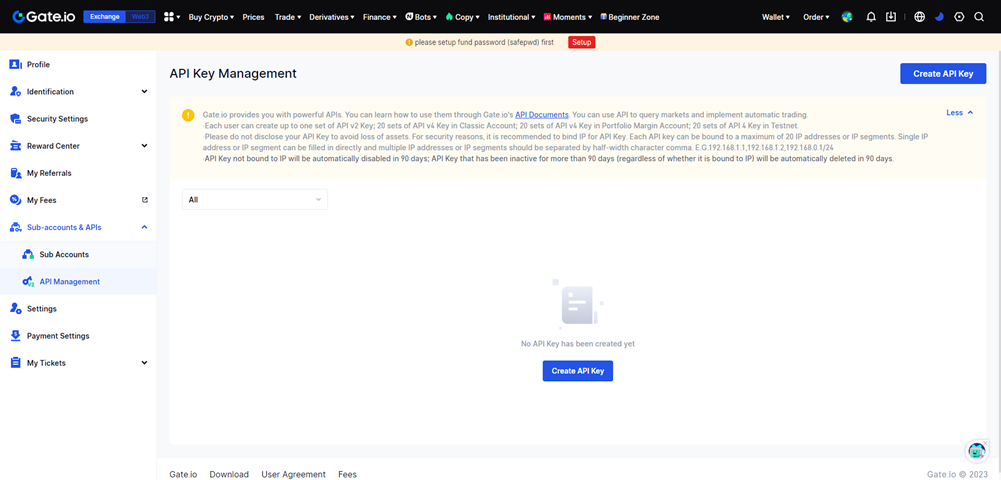

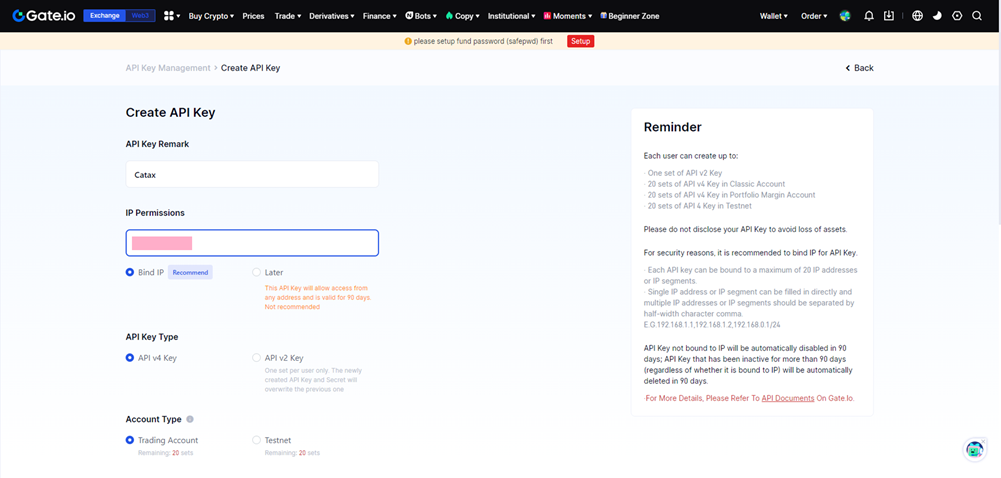

- Select ‘API Management’ and then opt for ‘Create API Key’.

- Name your API, for example, ‘Catax’. Add your IP address in the IPv4 format.

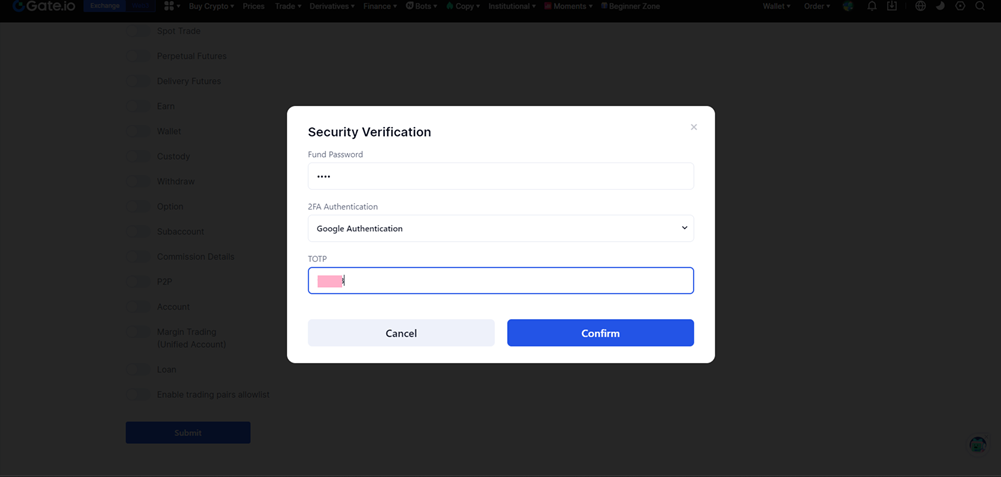

- Please input your fund password, and then complete the two-factor authentication process.

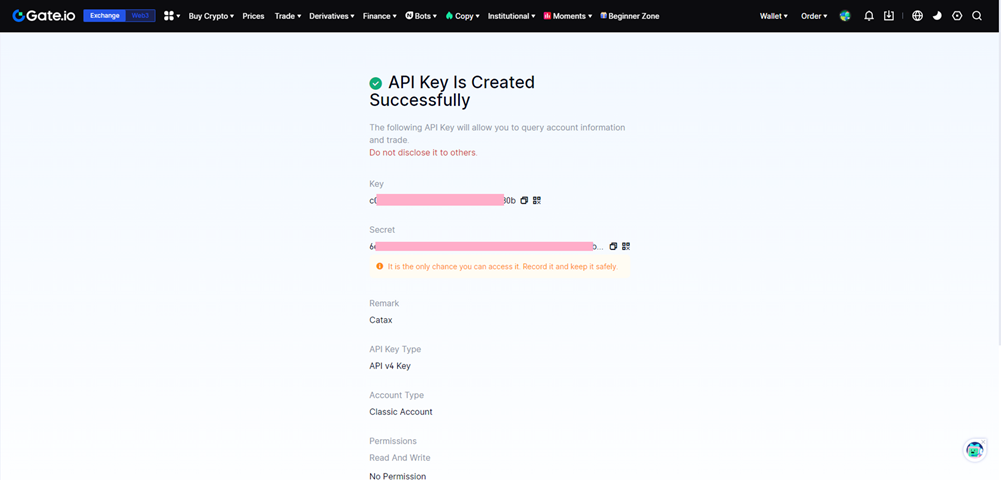

- Your API key will be generated.

Discover: How to Create API for Gate.io in Brief?

On Catax:

- Start via logging into Catax.

- Head over to the wallets area and upload your Gate.io wallet.

- Set it to auto-sync after which input your API key and mystery to safely import your records.

Connect Gate.io to Catax to Calculate taxes manually via CSV file:

On Gate.io:

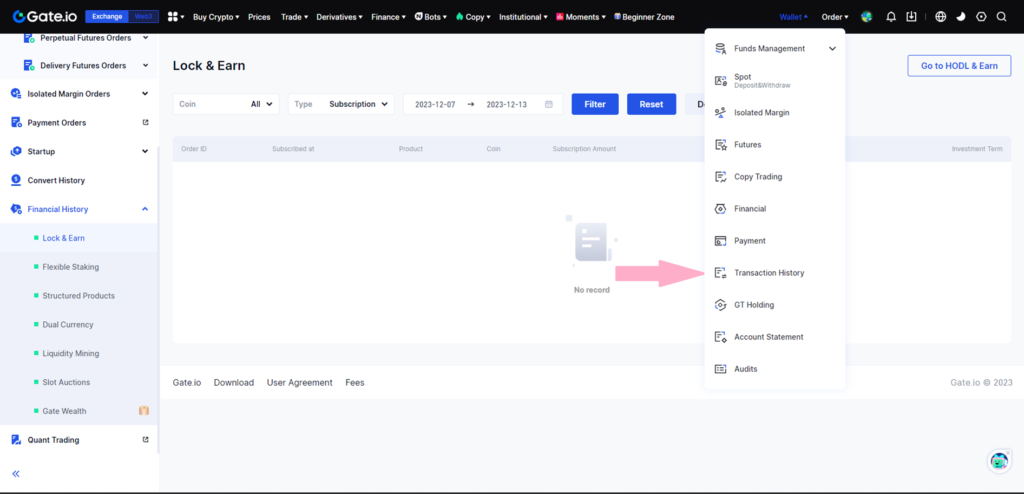

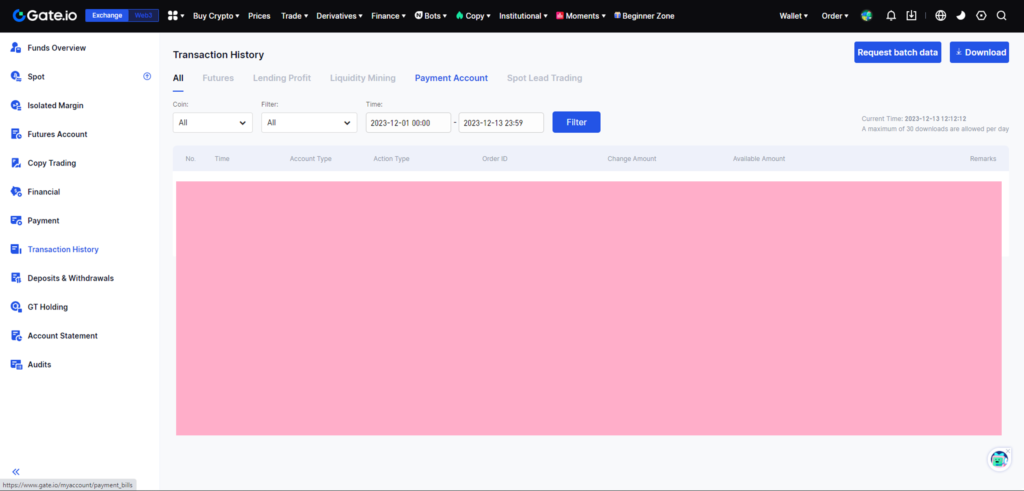

- After logging in, find and click the “wallet” on the right.

- Once on the wallet, find and click the “Transaction History” on the right.

To add Gate.io transactions to Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’, and choose ‘Gate.io’.

- Select ‘Import from File’.

- Upload your Gate.io CSV file.