This guide provides a comprehensive approach to managing your HTX taxes. It’s designed to assist novice and seasoned traders in effectively handling tax affairs related to HTX transactions.

To simplify your HTX tax reporting, consider using Catax, a highly efficient cryptocurrency tax calculator. Follow these simple steps:

- Commence Catax Account Setup: Initially, create your Catax account, selecting India as your country and setting the currency to INR.

- Secure Link with HTX: Establish a secure link between your HTX account and Catax for automatic transaction data transfer.

- Efficient Transaction Organization: Enable Catax to organize your HTX transactions efficiently, categorizing them into profits, losses, and income.

- Download Comprehensive Report: Easily download Catax’s cryptocurrency tax report for a detailed breakdown of financial activities.

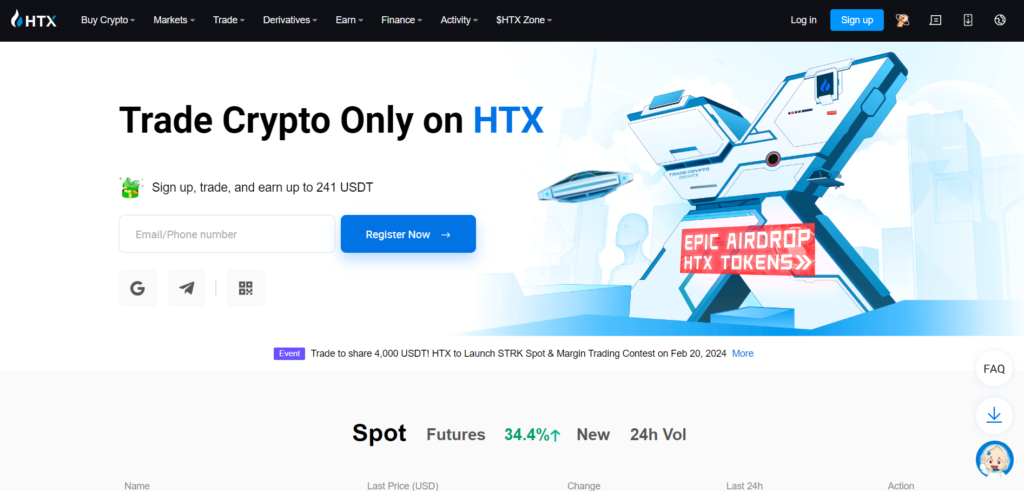

What is HTX and how does it work?

HTX is a global cryptocurrency exchange platform recognized for its comprehensive services since 2013. It facilitates trading in a wide array of digital currencies and offers specialized financial products to help users earn passive income on their crypto holdings. Through HTX Earn, users can engage in activities like asset lending and Proof of Stake (PoS) staking to grow their investments. Furthermore, the platform is designed with robust security measures. It offers reliable customer support, making it a trusted choice for both beginner and experienced traders looking to optimize their cryptocurrency investments in a secure environment.

How HTX operates and some of its key features:

- Diverse Cryptocurrency Offerings and Trading Services: HTX offers a wide range of cryptocurrencies for trading, such as Bitcoin, Ethereum, and Ripple, with various trading pairs. It specifically highlights Asian projects, positioning itself as an ideal choice for traders looking for diverse investment options.

- Robust Security Measures and User Protection: HTX emphasizes strong security and user protection by implementing measures like two-factor authentication. It also features a User Protection Fund, acting like insurance to safeguard against losses due to thefts, hacks, or other unexpected events, thereby increasing the trust and safety of trading on the platform.

- Accessible and User-Friendly Platform: HTX is designed for broad accessibility; in addition, it supports multiple platforms including Mac, Windows, iOS, and Android, allowing traders to manage their investments from anywhere at any time. Furthermore, it is recognized for its intuitive interface and mobile app that offers a comparable experience to the desktop version. Coupled with quick customer support, HTX ensures a smooth and efficient trading experience for its users.

How do I file my HTX taxes?

To effectively manage your HTX taxes, seamlessly integrate Catax into your process. First, link your HTX account to Catax. You can opt for an API connection for automatic data synchronization or manually upload a CSV file of your trading activities. This step is essential because Catax uses this data to accurately determine your tax obligations.

Once your HTX account is connected, Catax systematically analyzes your transactions to identify taxable transactions. It then applies tax rules specific to your location. Designed for global use, Catax supports HTX tax calculations for users worldwide, ensuring compliance with local tax laws and accuracy in reporting.

Catax’s functionality goes beyond simple tax calculation. It organizes your HTX taxes into clear, understandable reports, which can be beneficial for those new to crypto tax reporting. This method significantly reduces the chance of errors common in manual calculations.

Furthermore, Catax’s reports clearly outline your HTX taxes, making them easier to understand and file. With their in-depth analysis, you’ll easily see your tax due from HTX transactions and their impact on your total tax responsibilities. Consequently, it greatly simplifies HTX tax calculations. Moreover, it integrates well with HTX, adjusts to global tax laws, and provides compliant reports, easing the tax process worldwide.

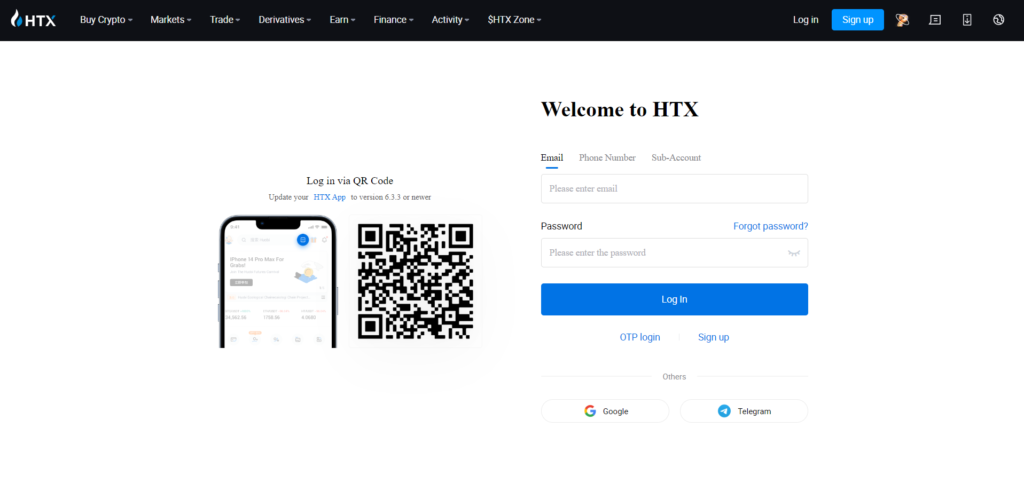

Connecting Catax and HTX via API:

For HTX :

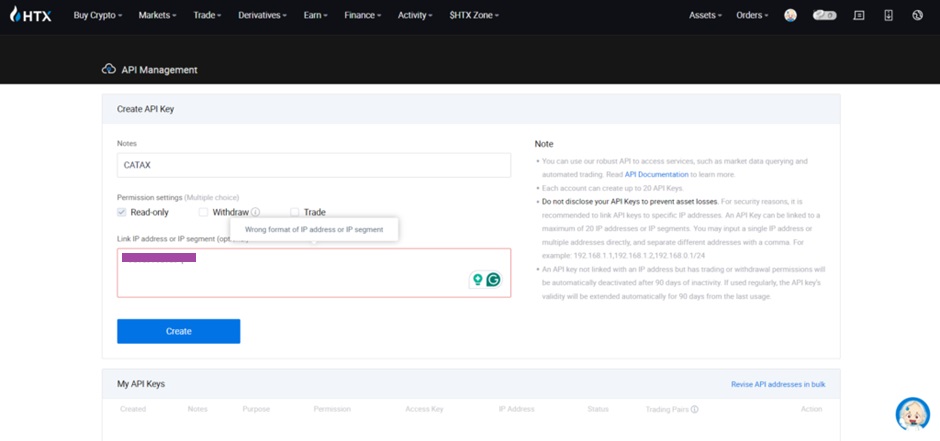

- Sign in to your HTX account.

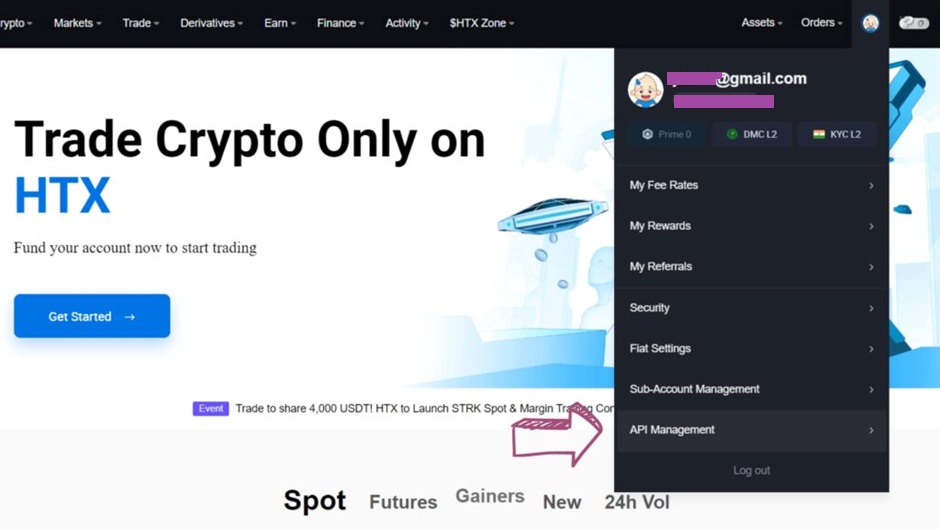

- Head to the Profile Icon and click on API Management

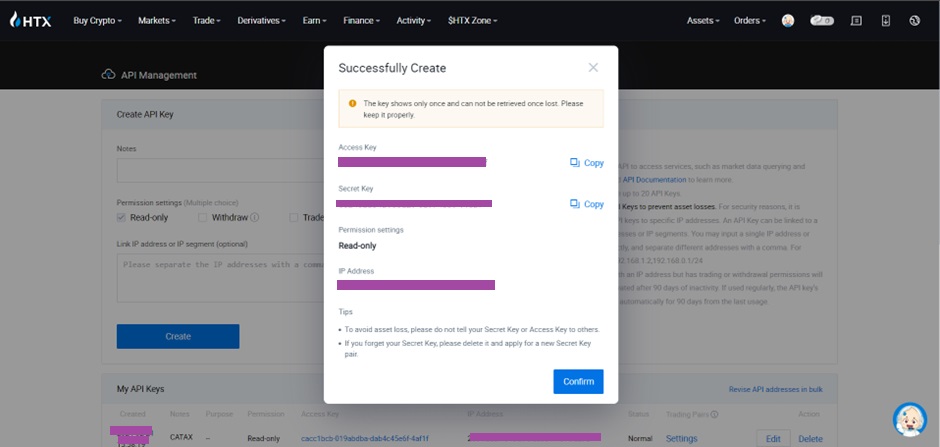

4. Enter the verification code sent to your registered email, and then click on the “Confirm” button.

- Your API key and Secret Key will be ready.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, and proceed to enter your API key and secret to import your data.

Connecting Catax and HRX via CSV:

For HRX:

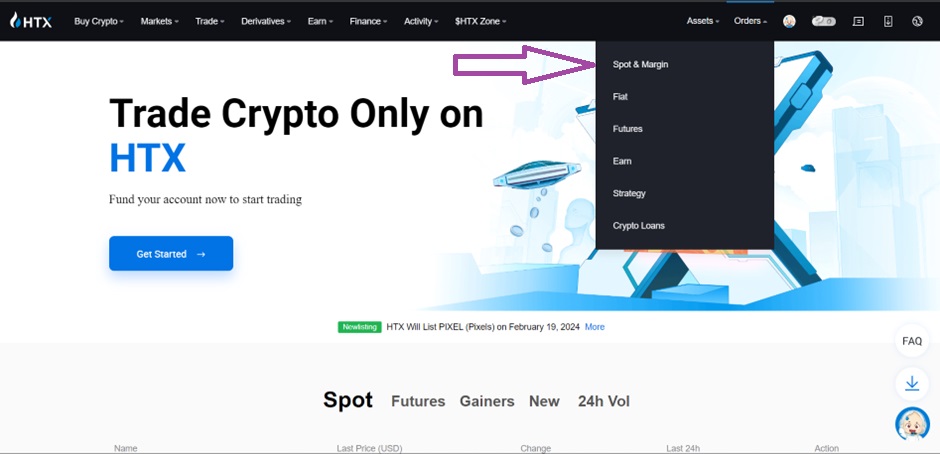

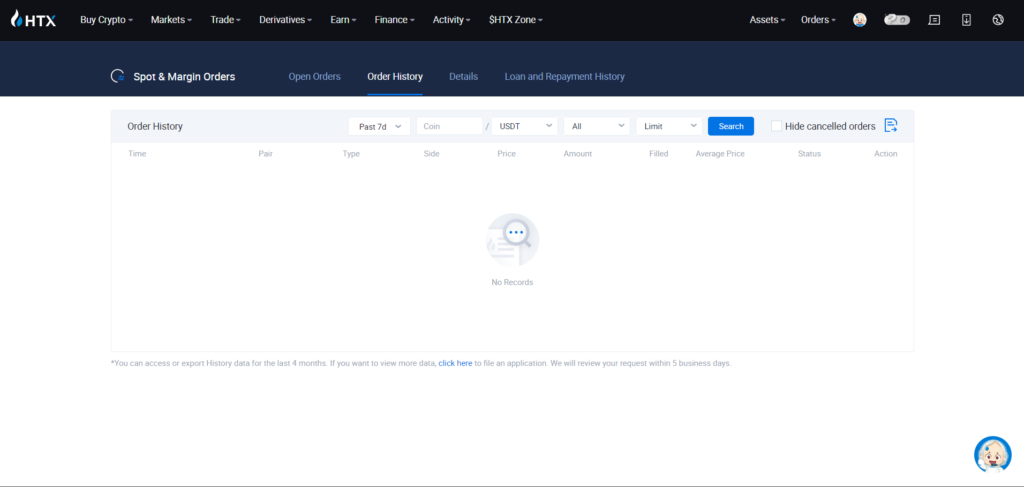

- Select the “Order History” section and click on it.

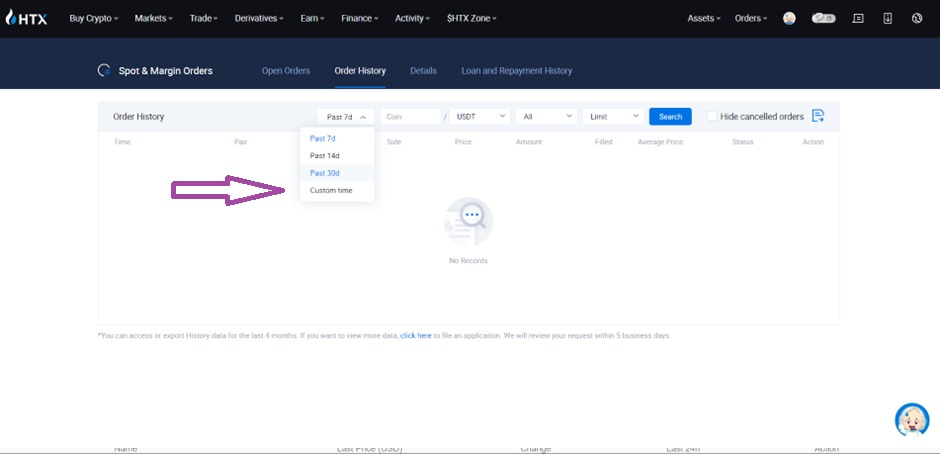

- Choose your desired date range.

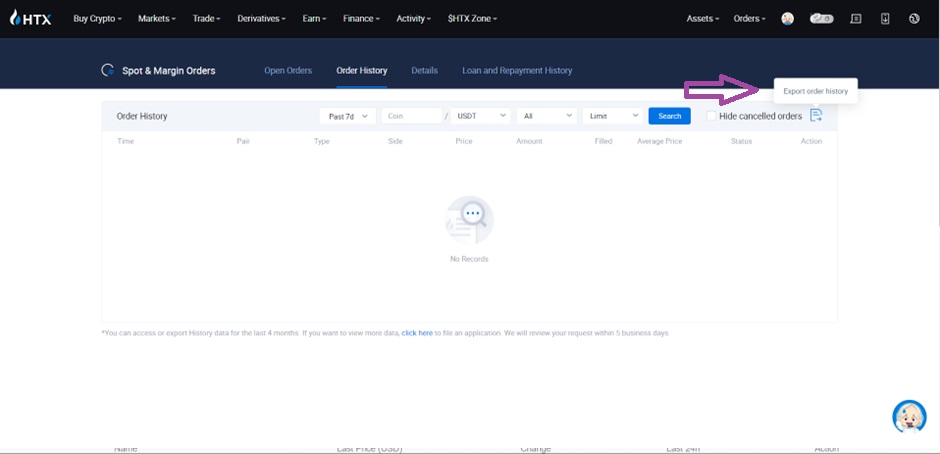

- Click the ‘Export’ option in the top right corner.

On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select ‘HRX’.

- Choose ‘Import from File’.

- Upload your HRX CSV file.

Frequently Asked Questions (FAQs)

To manage your HTX taxes efficiently, you can integrate Catax into your trading process. Catax helps automate the data synchronization from your HTX account, analyzes your transactions for tax obligations, and generates detailed reports for easy tax filing.

Yes, Catax is designed for global use and supports HTX tax calculations for users worldwide. It ensures compliance with local tax laws and accuracy in reporting, regardless of the user’s location.

HTX emphasizes strong security by implementing measures like two-factor authentication and maintaining a User Protection Fund, which acts as insurance against losses due to unexpected events like thefts or hacks.

To import transactions via CSV, download your HTX transaction history as a CSV file, then log into Catax, navigate to the wallets section, and upload your HRX wallet by selecting ‘Import from File’ and uploading the CSV file.