This guide helps you manage your Exmo taxes clearly and straightforwardly. It was created to assist new and experienced traders in effectively handling tax matters related to exmo transactions.

To simplify your Exmo tax reporting, consider using Catax, a highly efficient cryptocurrency tax calculator. Follow these simple steps:

- Catax Account Setup: Initially, create your Catax account, selecting India as your country and setting the currency to INR.

- Secure Link with Exmo: Establish a secure link between your Exmo account and Catax for automatic transaction data transfer.

- Efficient Transaction Organization: Enable Catax to organize your Exmo transactions efficiently, categorizing them into profits, losses, and income.

- Download Comprehensive Report: Easily download Catax’s cryptocurrency tax report for a detailed breakdown of financial activities.

What is Exmo and how does it work?

Exmo is a cryptocurrency exchange platform operating since 2014. It offers services for buying, selling, and trading various cryptocurrencies like Bitcoin, Ethereum, and others. The platform emphasizes ease of use, security, and a range of trading options for both beginners and experienced traders. It features a simple interface for straightforward transactions as well as advanced trading tools for more complex strategies. Exmo also prioritizes the security of funds, using top-class custodial providers and adhering to regulatory standards. Additionally, it provides a mobile app for trading on the go, various market information, and supports a multitude of currencies for trading.

How do I file my Exmo taxes?

Exmo is a cryptocurrency exchange that started in 2014. Additionally, it is trusted by over a million users worldwide for being reliable. Moreover, the platform is easy to use for both new and experienced traders. Furthermore, Exmo allows margin trading and has low fees. In addition, it also has a mobile app for trading anywhere. Besides, Exmo offers learning materials and market analysis to help users make smart choices. Moreover, it aims to be a good and trustworthy exchange for all traders. Lastly, Exmo is officially recognized and regulated in Lithuania, which adds to its trustworthiness.

Start by linking your Exmo account to Catax, either through API for live data or by uploading your Exmo transaction history as a CSV file. This helps accurately figure out your Exmo taxes.

Catax will also create tax reports for you. It makes things simpler by showing your tax events and what taxes you owe. Catax is easy to use, helping you manage your taxes well.

Catax doesn’t just calculate your Exmo taxes; it puts your data into clear reports. This is helpful, especially for those new to crypto taxes, as it reduces mistakes.

Additionally, Catax’s detailed reports provide a comprehensive view of your Exmo taxes, thereby making it easier to understand and prepare for tax time. Furthermore, with Catax, you gain a better understanding of your Exmo tax obligations and how they impact your overall taxes.

In summary, Catax is a great tool for simplifying Exmo taxes. Additionally, it offers easy account connection, works with international tax laws, and provides detailed, proper reports, making tax filing easier for global crypto investors.

Connecting Catax and Exmo via API:

For Exmo:

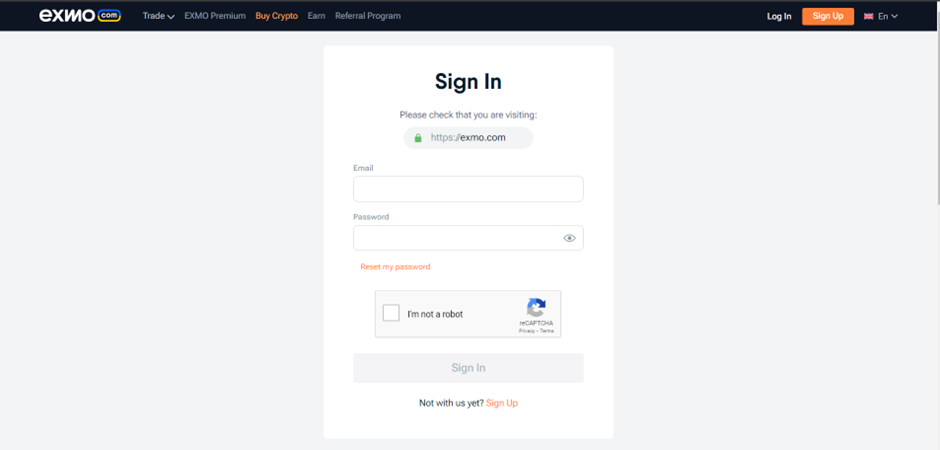

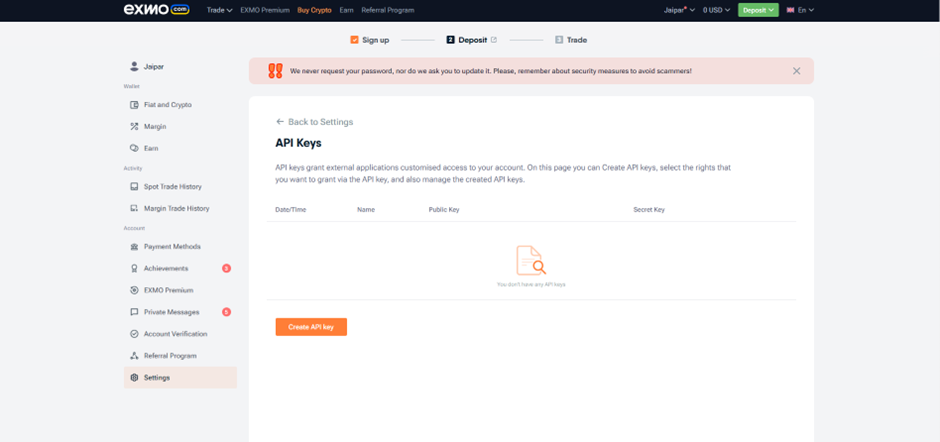

- Sign in to your Exmo account.

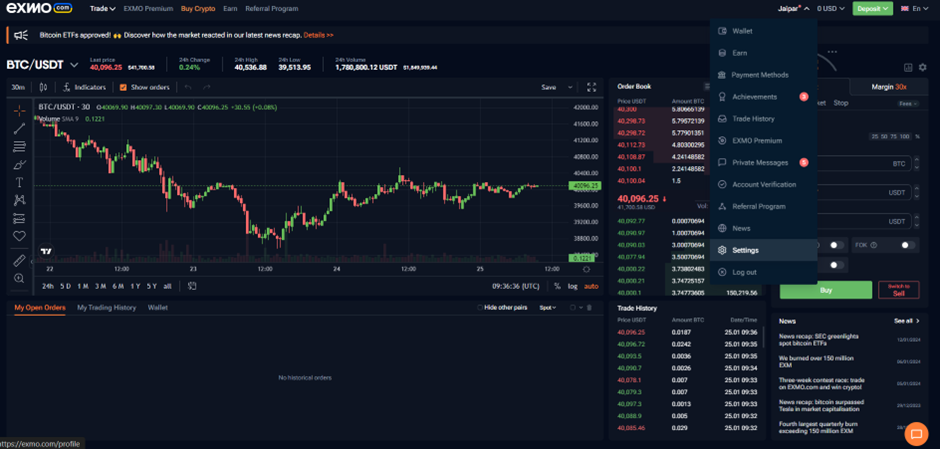

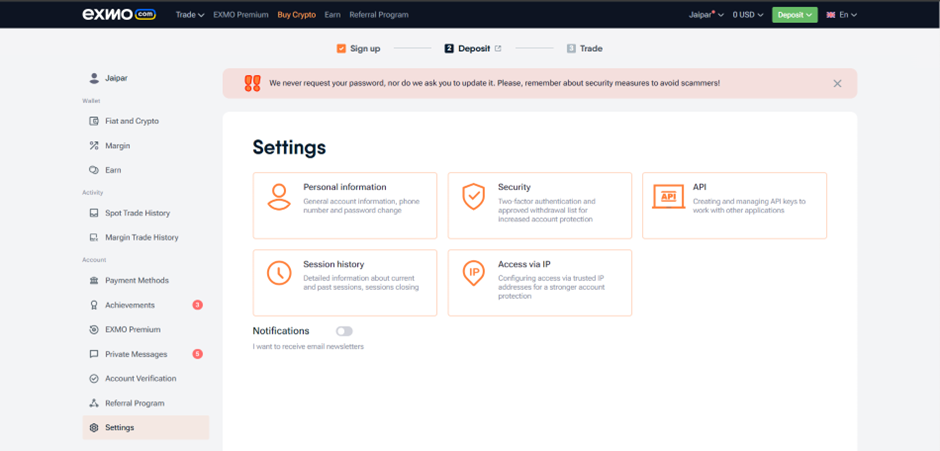

- After Logging in, click on your profile icon and then go to Settings.

- Select and click the API Section

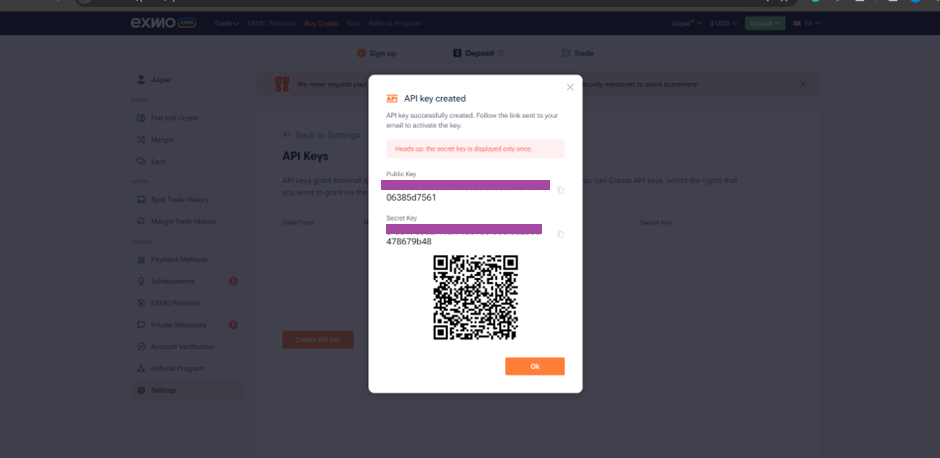

- Your API key will be created after this you have to activate this key from the link sent to your registered email.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, and proceed to enter your API key and secret to import your data

Connect Exmo to Catax to Calculate taxes manually via CSV file:

On Exmo

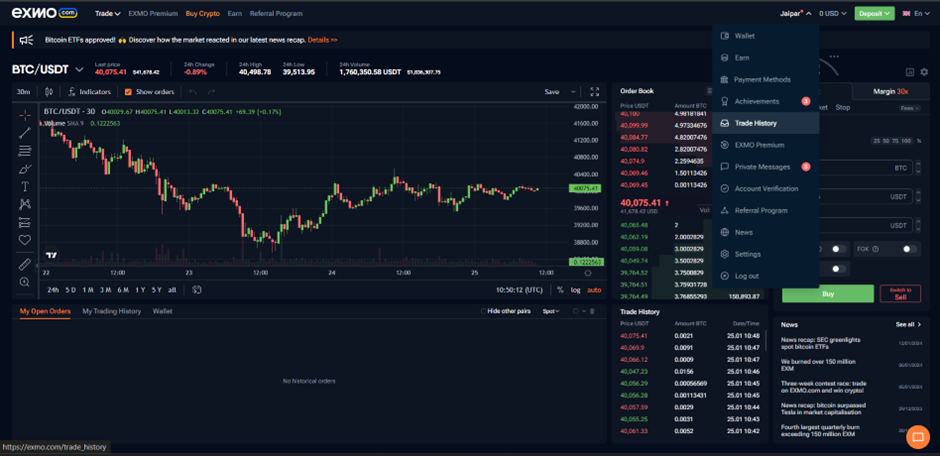

- After Logging in, click on your profile icon then go to the Trade History

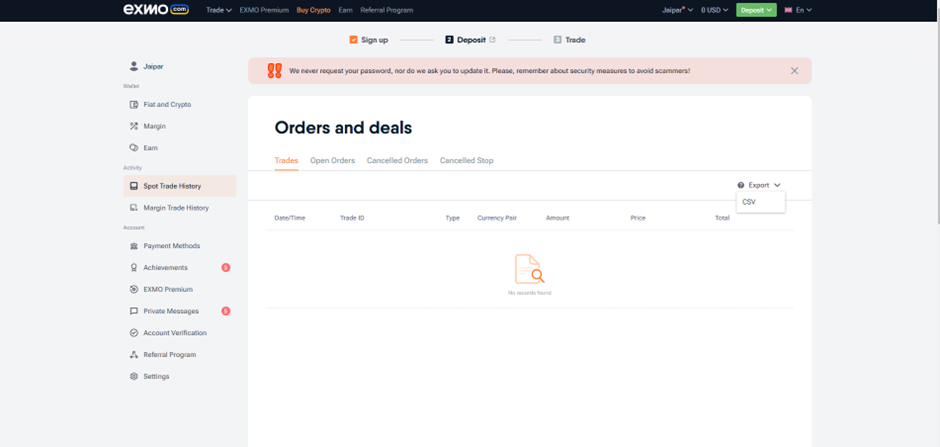

2. Click on the Export dropdown button in the Spot Trades history section

On Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’ and select ‘Exmo’.

- Choose ‘Import from File’.

- Upload your Exmo CSV file.

Explore: How to Calculate Your Bitget Taxes?

How to Calculate Your Tidex Taxes?

How to Calculate Your Gate.io Taxes?

visit: catax.app