This Guide will Help you calculate your taxes on AscendEX. Whether you’re new to trading or have been doing it for a while, it provides an easy method to manage your taxes for Cryptoforce transactions.

To simplify your AscendEX tax reporting, try using Catax, a very efficient cryptocurrency tax calculator. Here are the easy steps:

- Create a Catax account: Sign up and choose India as your country and INR as your currency.

- Connect with AscendEX: Link your AscendEX account to Catax to automatically import your transaction details.

- Sort your transactions: Catax will organize all your AscendEX activities into gains, losses, and income.

- Download your tax report: Get a detailed Catax tax report for a clear view of your crypto finances.

- File your taxes easily: Use the report to file your taxes online or give it to your tax advisor for assistance.

Do I have to pay taxes when using AscendEX?

Yes, transactions on AscendEX are considered taxable events under capital gains tax or income tax in many countries. The tax rates vary by jurisdiction, and some places may offer tax exemptions based on profit thresholds or how long you’ve held the assets.

How are AscendEX transactions taxed?

When you conduct crypto transactions on AscendEX, the taxes you owe may vary based on your location. Typically, you might encounter two types of taxes:

- Capital Gains Tax: This applies if you profit from selling or trading cryptocurrency on AscendEX. If you sell the crypto for more than what you paid for it, you’ll need to pay taxes on the profit.

- Income Tax: If you receive new cryptocurrency through AscendEX services, like lending or staking, you’ll owe income tax on these earnings. The tax amount is based on the value of the new tokens in your local currency (e.g., dollars or rupees) on the day you receive them.

Connecting Your AscendEX Account with Catax via API

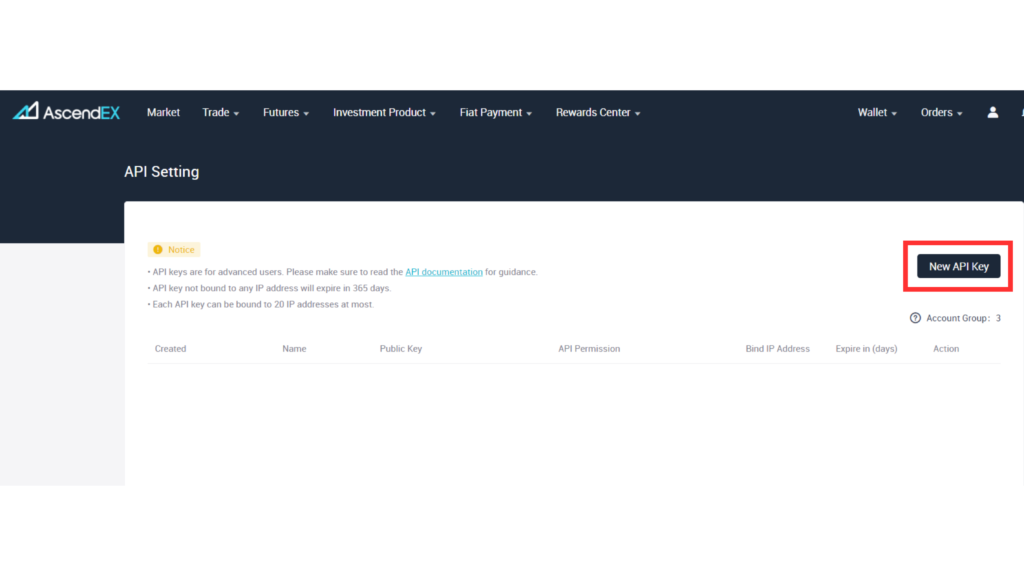

In AscendEX:

- Log in to your AscendEX account on your computer and go to the profile icon. Select [API Setting].

- Click [New API Key] at the top right of the page.

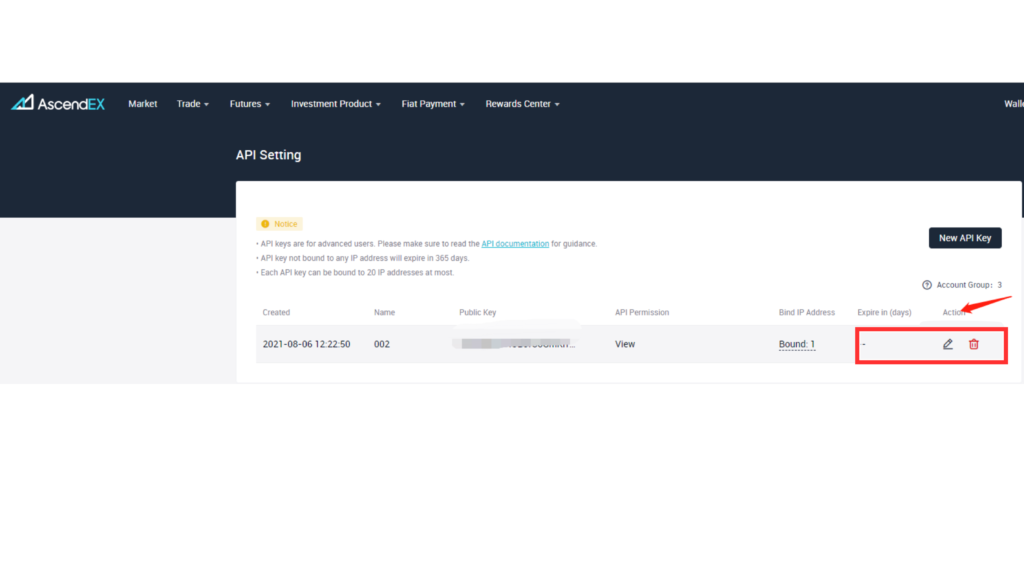

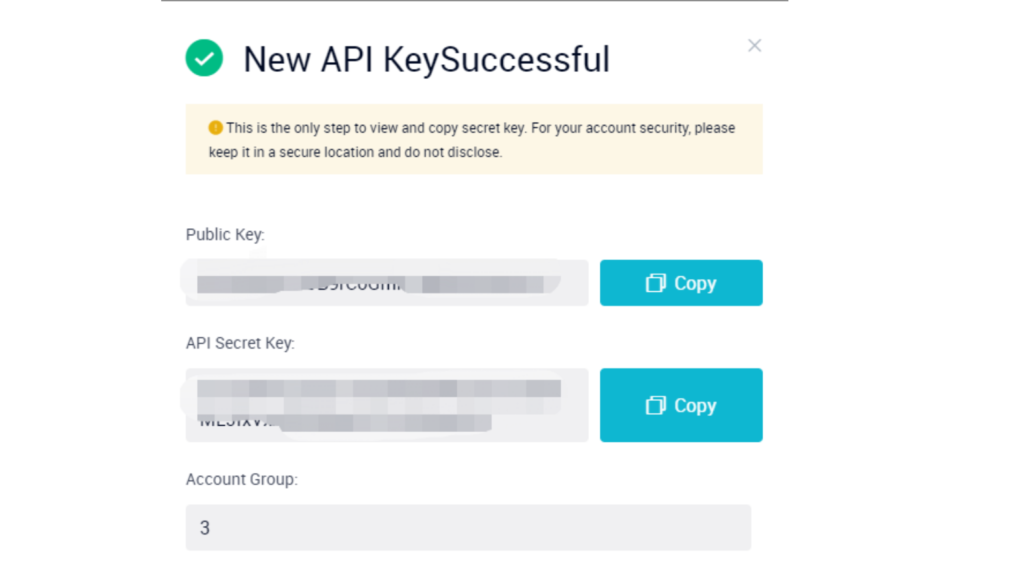

- Name your new API key, set the permissions, and specify IP address restrictions. Complete the three-step verification by entering your phone, email, and Google authenticator codes. Click [Generate API Key].

- You can edit or delete your API keys later under the Action tab.

On Catax:

- On Catax:

- First, log in to your Catax account.

- Go to the wallets section and upload your AscendEX wallet.

- Enable auto-sync, then enter your API key and secret to import your data.

FAQs (Frequently Asked Questions)

No, Catax automatically organizes your AscendEX transactions into gains, losses, and income, simplifying your tax reporting process.

Yes, transactions on AscendEX are taxable events and may be subject to capital gains tax or income tax, depending on your location and the nature of your transactions.

Yes, Catax offers customer support to assist you with any questions or issues related to your tax calculations and reporting.

Catax automatically imports and organizes your transaction data from AscendEX, ensuring that all details are accurately categorized into gains, losses, and income.