This guide makes it easy to Calculate your taxes on WhiteBIT. Whether you’re a beginner or an experienced trader, it provides a straightforward approach to managing your tax obligations for WhiteBIT transactions.

To simplify your Whitebit tax reporting, consider using Catax, a highly efficient cryptocurrency tax calculator. Follow these straightforward steps:

- Begin by creating a Catax account: Sign up and select India as your country and INR for currency.

- Securely connect with Whitebit: Link your Whitebit account to Catax to automatically import your transaction details.

- Effortlessly organize your transactions: Catax will categorize all Whitebit activities into gains, losses, and income for easy sorting.

- Download your comprehensive tax report: Obtain the Catax tax report for a clear overview of your crypto finances.

- File your taxes seamlessly: Utilize the report to file your taxes online or provide it to your tax advisor for assistance.

How are WhiteBIT transactions taxed?

The taxes you pay on WhiteBIT transactions depend on where you live and the type of transactions you’ve made. In general, you might need to pay either capital gains tax or income tax on your cryptocurrency dealings on WhiteBIT.

Capital gains tax: If you sell a cryptocurrency for more than what you bought it for, you make a profit called a capital gain. But if you sell it for less than what you paid, it’s a capital loss, which can help lower your taxes in many cases.

Income tax: Typically, any cryptocurrency you receive from activities like staking, earning interest, bonuses, or referral rewards on WhiteBIT is viewed as taxable income. You’ll need to report it when you file your taxes.

How to Handle Your WhiteBIT Taxes?

By utilizing tax software like Catax, you can significantly simplify the process of managing your Whitebit taxes. The first step is to link your Whitebit account to Catax. You have the option to either use a direct API connection for real-time data transfer or manually upload your transaction details via a CSV file.

Catax will then analyze your Whitebit activities to identify any transactions that may be taxable, applying the tax regulations specific to your area. It’s designed to accommodate the tax laws of numerous countries, making it adaptable to various tax environments.

The software organizes your transaction data into neat reports, which is particularly helpful if you’re new to crypto taxes and want to minimize errors.

The comprehensive reports from Catax provide detailed insights into your Whitebit taxes, aiding in your tax preparation. Additionally, Catax offers transparency regarding your tax obligations and their impact on your overall tax situation.

In summary, Catax is a valuable tool for easing the tax filing process for Whitebit users. It facilitates easy account integration, navigates international tax regulations on your behalf, and produces precise, compliant reports. This tool significantly eases the burden for crypto traders around the globe in managing their taxes.

Connecting Your WhiteBIT Account with Catax via API

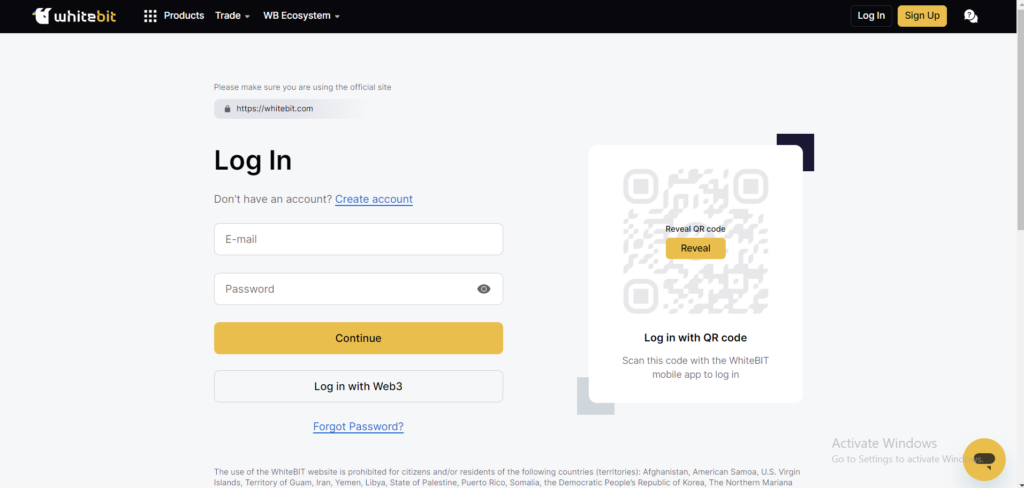

In WhiteBIT:

- Sign in to your WhiteBIT account.

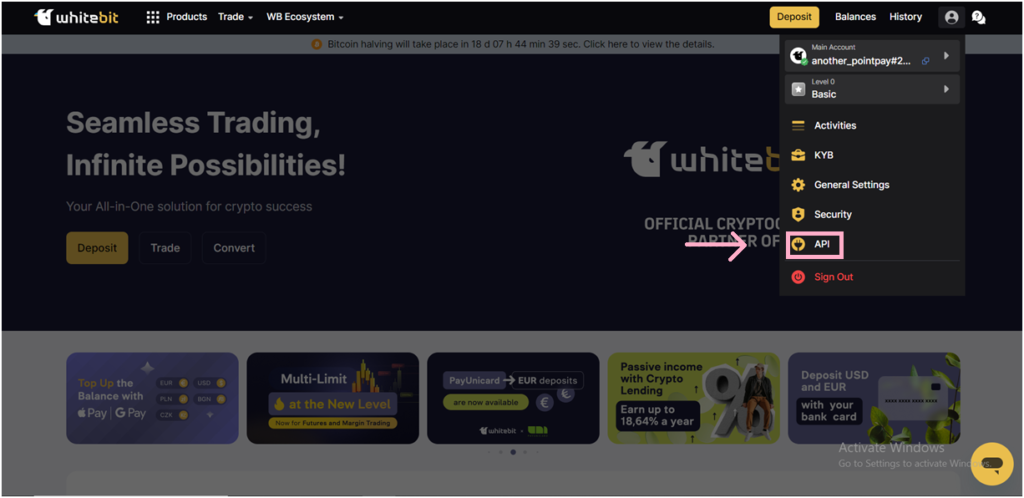

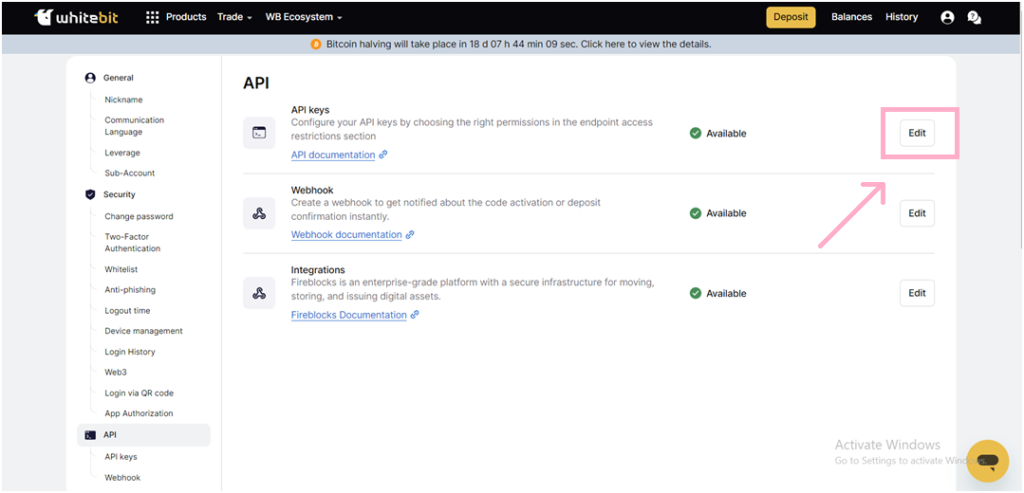

- After logging in, Head to the profile icon and click API.

3. Click on the Edit button in the API section.

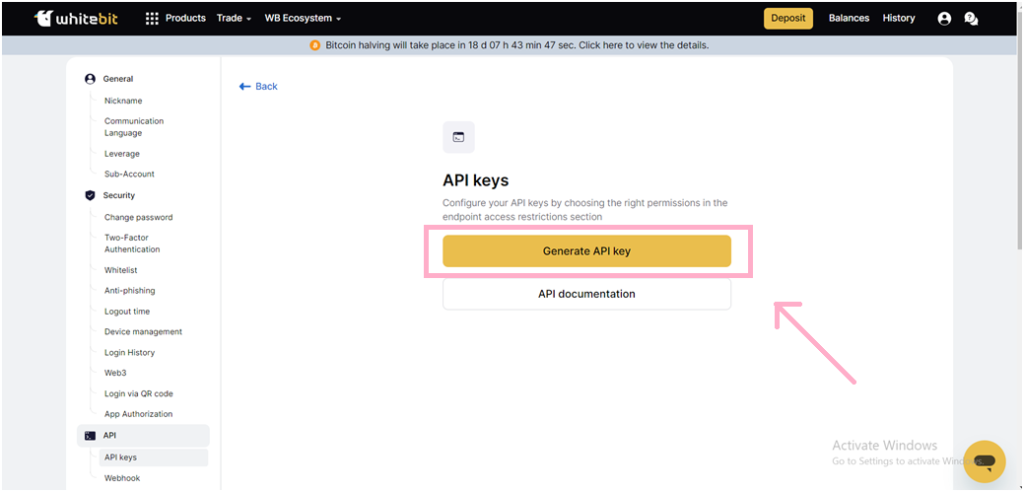

- Click on ‘Generate API Key’.

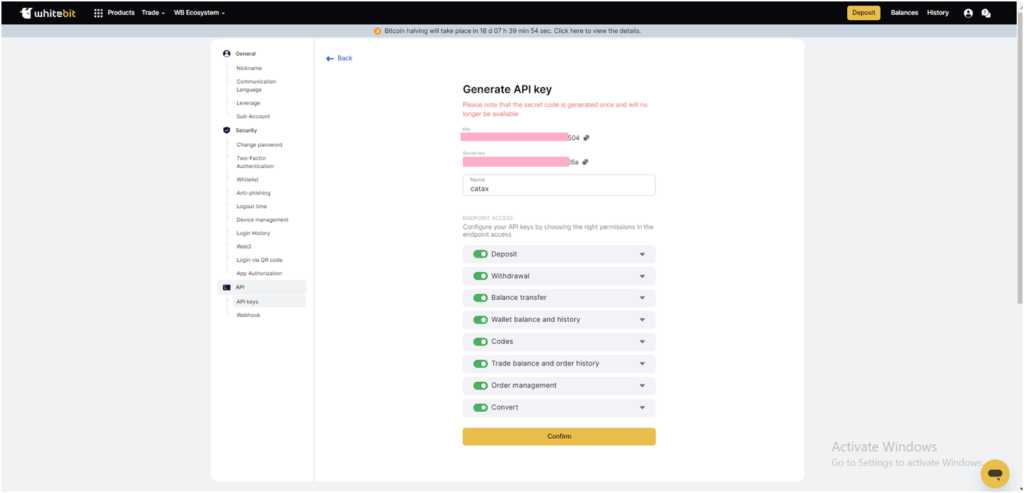

- Your API key and Secret key will be ready. Click ‘confirm’, and then it will be ready for use.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, then proceed to enter your API key and secret to import your data

FAQs (Frequently Asked Questions)

You can begin by creating an account on Catax and selecting India as your country with INR as your currency. Then securely connect your WhiteBIT account to Catax to import your transaction details automatically.

Catax categorizes all your WhiteBIT activities into gains, losses, and income to simplify sorting and organization for tax reporting.

You can utilize the tax report generated by Catax to file your taxes online or provide it to your tax advisor for assistance. Also, making the process smooth and hassle-free.

Yes, Catax is designed to accommodate tax laws from various countries, making it adaptable to different tax environments and providing accurate tax calculations for WhiteBIT transactions.