Exporting your Coindcx Future Trade History is straightforward and beneficial for monitoring your trades, deposits, and withdrawals. Follow these step-by-step instructions for easy guidance through each part of the process.

Importance of future trade

Before we jump into the details, let’s discuss why exporting your Coindcx future trade history is crucial. Maintaining a thorough record of your trades is a good decision. This practice allows you to go through your trading patterns, evaluate your performance, and, notably, stay on the right side of tax regulations. Exporting your trade history transforms it into a valuable asset, serving both as a tool for audits and as a means to scrutinize and enhance your trading strategies.

Step-by-Step Guide to Exporting Coindcx future trade Report

- Go to Coindcx.com, sign in to your account with your credentials.

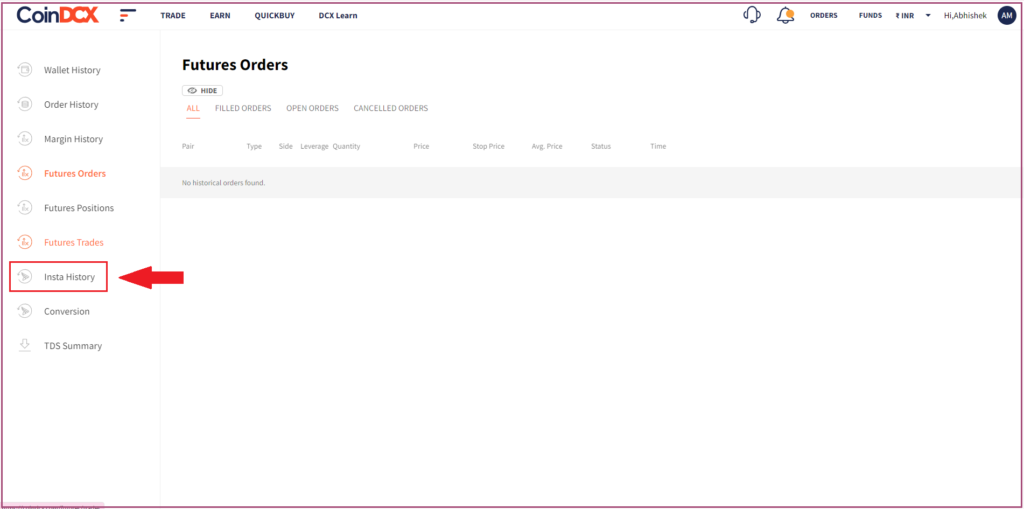

- After that, head to the ‘Orders‘ section and click on Futures History.

- Then click on the ‘Future trades‘ in the sidebar menu.

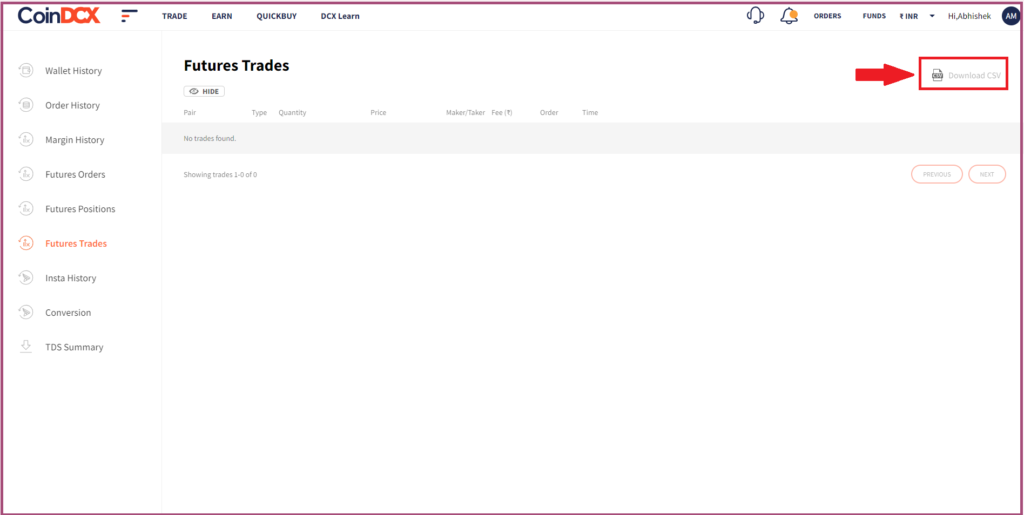

- In Future Trade section, click on ‘Download CSV’

Your Coindcx Future Trade History will be Downloaded.

Is it Worth Integrating Your Coindcx future trade history with Catax?

Integrating Coindcx future trade history with a crypto tax calculator like Catax offers multiple advantages for cryptocurrency traders and investors. Here’s a simpler explanation:

1. Accurate Tax Reporting: Trading futures on Coindcx, especially when using leverage, involves complex transactions.This complexity can make tax calculations tricky. By using a Catax, traders can automate the tax reporting process, ensuring they stay in line with tax laws and avoid mistakes.

2. Easier Calculations: Manual tracking of future trades is complicated. A tax calculator simplifies this by automating the computation of important figures like the initial investment, profits, losses, and the cost of leverage. This leads to fewer errors and precise tax calculations.

3. Saves Time: Calculating taxes manually, especially with many trades, takes a lot of time. Integration speeds up this process, freeing up time for traders to concentrate on refining their trading strategies and managing their portfolios.

4. Avoids Penalties: Mistakes in tax reporting can lead to penalties. Automated calculations minimize this risk, offering traders peace of mind and potentially saving them from unnecessary expenses due to errors.

5. Analyzes Performance: Integrating a history of future trades allows traders to look back and analyze their trading performance. This insight helps in planning both trading and tax strategies, aiming for better profitability and tax efficiency.

6. Better Record-keeping: Keeping detailed records is essential for complying with tax laws and for financial planning. Integration ensures that every transaction is logged and organized, making it easier to deal with tax authorities.

7. Informed Decision-making: Understanding the tax impact of trades can influence trading choices. By incorporating tax calculations, traders receive instant insights into the tax effects of their trades. This helps them make more informed decisions.

The Role of Future Trade History in Catax

Accurate Tax Reports: Your Coindcx future Trade History is very important for Catax to be able to make correct tax reports. By entering this thorough information about your transactions, Catax can correctly apply the tax rules to figure out whether you have made or lost money on your capital gains. In addition, this information is necessary to make sure that tax rules are followed. You can also make sure that your tax return is complete and correct by giving this information.

Minimizing Errors: Because cryptocurrency trades and tax rules are so complicated, doing tax calculations by hand is prone to mistakes. Having a full Coindcx future Trade History automates this process lowers these risks and makes sure that your tax returns are correct and reliable.