This guide offers a comprehensive approach to managing your Kraken taxes. It’s designed to assist you, whether you’re a beginner or a seasoned trader, in accurately handling your tax affairs linked to your Kraken transactions.

Kraken, a major global crypto exchange, is a platform where you can buy, sell, trade, and even stake various cryptocurrencies. No matter the level of your investment activities, Catax is a tool that can help simplify your Kraken tax calculations for your Kraken account.

Here’s what you need to do:

- First, sign up for Catax and select your country and the currency you use.

- Next, link your Kraken account to Catax. This ensures all your trading activities on Kraken are imported into Catax securely.

- Catax then organizes your transactions from Kraken. It sorts them into categories like profits, losses, and income.

- Based on these categories, Catax calculates your taxes for capital gains and income derived from your Kraken activities.

- After the calculations, you can download your complete tax report directly from Catax.

- Finally, you can use this report to file your taxes online, or you can take it to a professional accountant who specializes in Kraken Taxes & crypto taxes.

Does Kraken report User Information to the IRS?

Yes, Kraken must report to the IRS. Here’s how it works: if you’re living in the US and you make over $600 through Kraken, maybe by earning staking rewards, Kraken will give you a tax form known as 1099-MISC. This form is important because it’s not just you who gets it; the IRS gets a copy too. This means the IRS knows about the income you’ve made on Kraken.

Moreover, there was a significant development in June 2023. A court decided that Kraken had to share its customers’ information with the IRS. This decision was made to help the IRS check if people were paying all the taxes they should be. Specifically, the IRS was interested in anyone who had traded $20,000 or more in cryptocurrencies in any one year from 2016 through 2020. This move by the court shows a clear effort by the IRS to keep a close eye on crypto transactions for tax purposes.

In managing Kraken taxes from your crypto transactions, especially if you use Kraken, a tool like Catax can be incredibly helpful. Catax helps you organize and calculate your crypto taxes, making it easier to understand and meet your tax obligations. With Catax, you can keep track of all your transactions and income, ensuring that you’re ready when it’s time to file your Kraken taxes.

Connecting Kraken and Catax via API for Kraken tax purposes is an easy process. Here’s a quick guide:

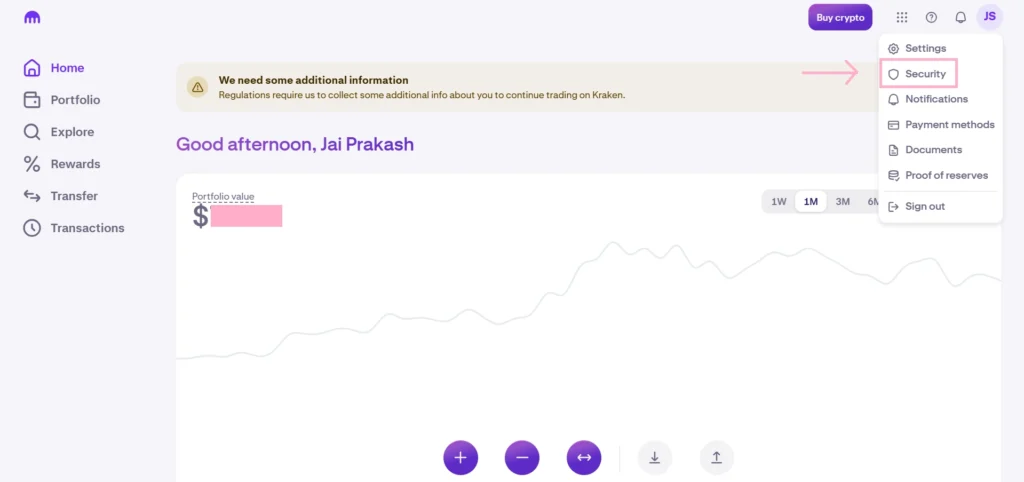

In Kraken:

1. Go to your Profile and select Security from the drop-down menu.

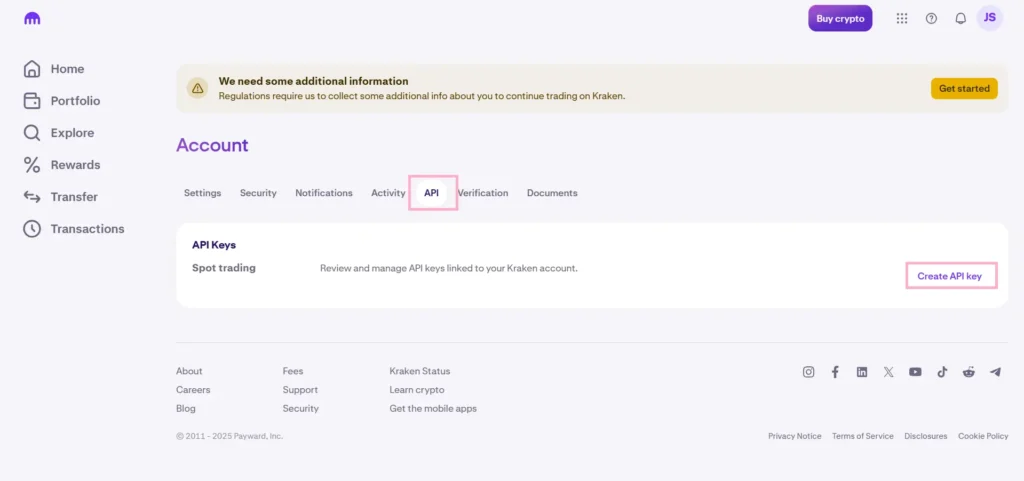

- Open the API section and click Create API Key.

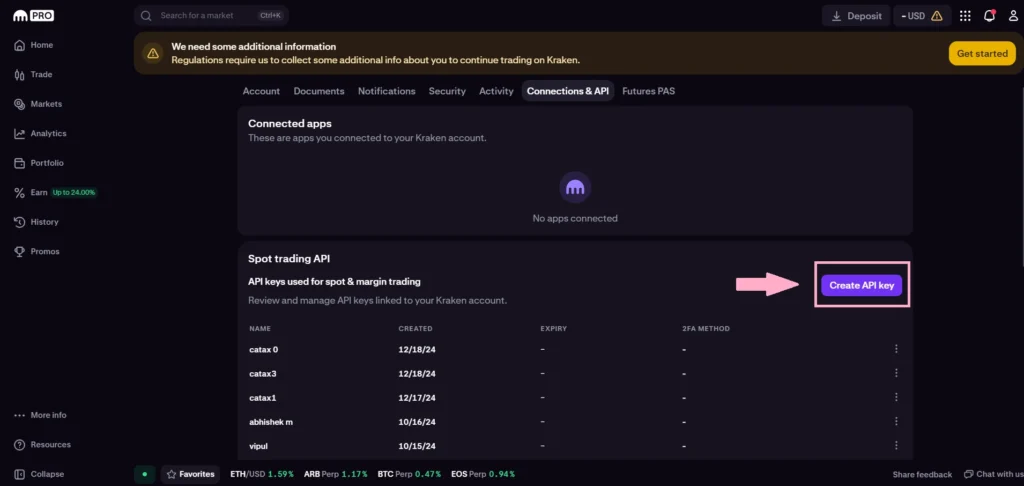

- You will be redirected to Kraken Pro. Click Create API Key again.

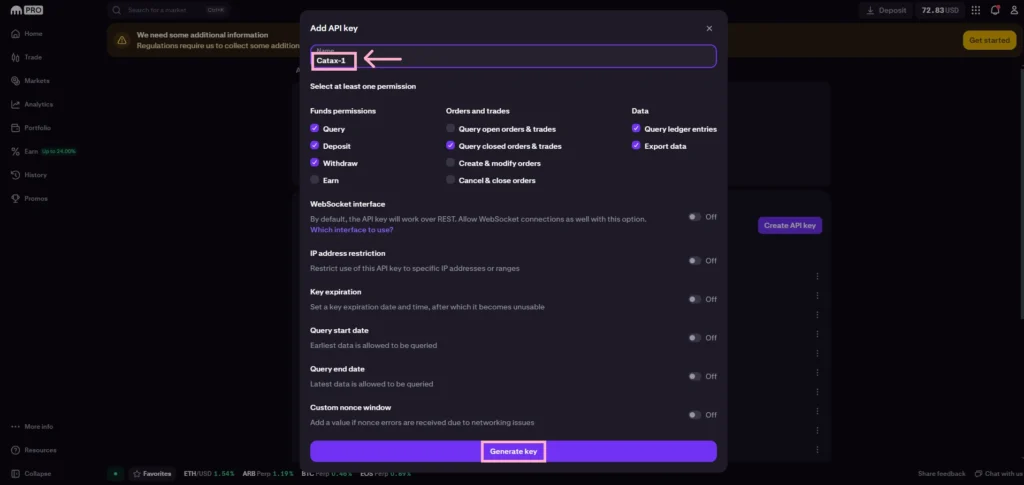

- Name your API key and enable these permissions: Query, Deposit, Withdraw, Query Closed Orders & Trades, Query Ledger Entries, and Export Data. Then, click Generate Key.

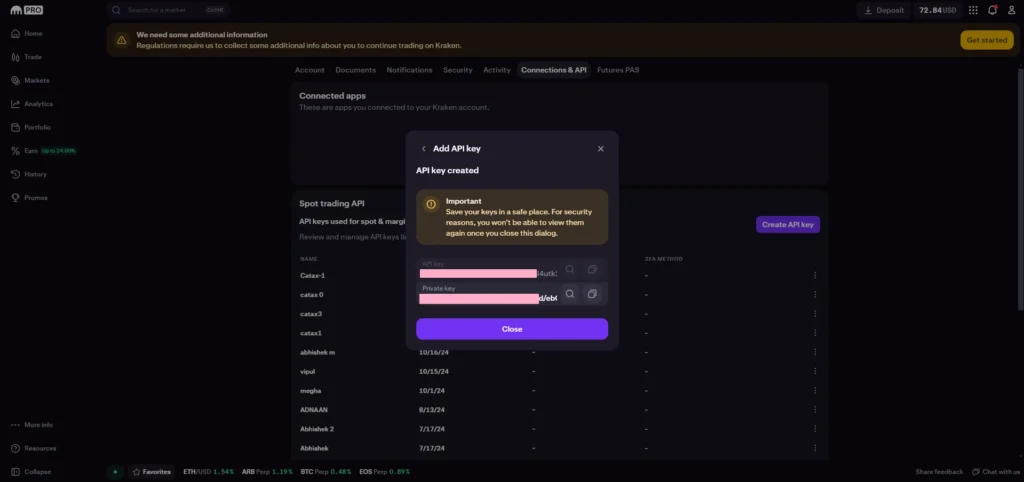

- Your API key will be created. Copy and save it securely, as you can only view it once.

For Catax:

1. Login or sign up to Catax and go to the wallets page.

2. Choose ‘add new wallet: Kraken’.

3. Click on ‘set up auto-sync’.

4. Paste your Kraken API key and secret.

5. Click ‘secure import’.

For Kraken:

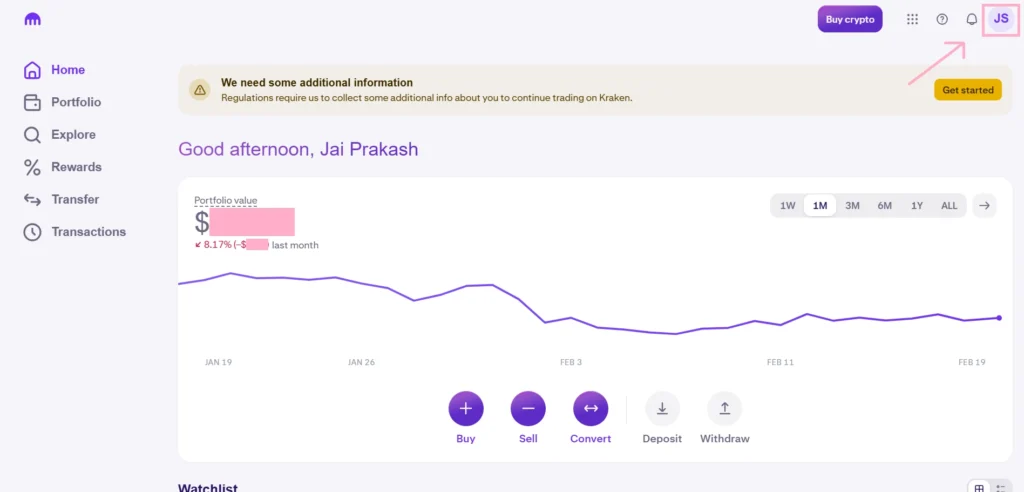

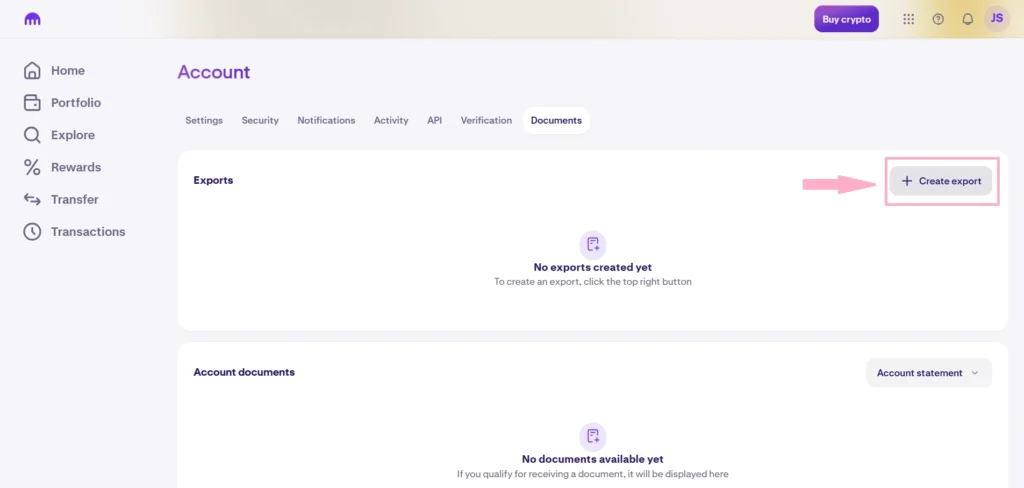

- Click on the profile icon in the top right corner.

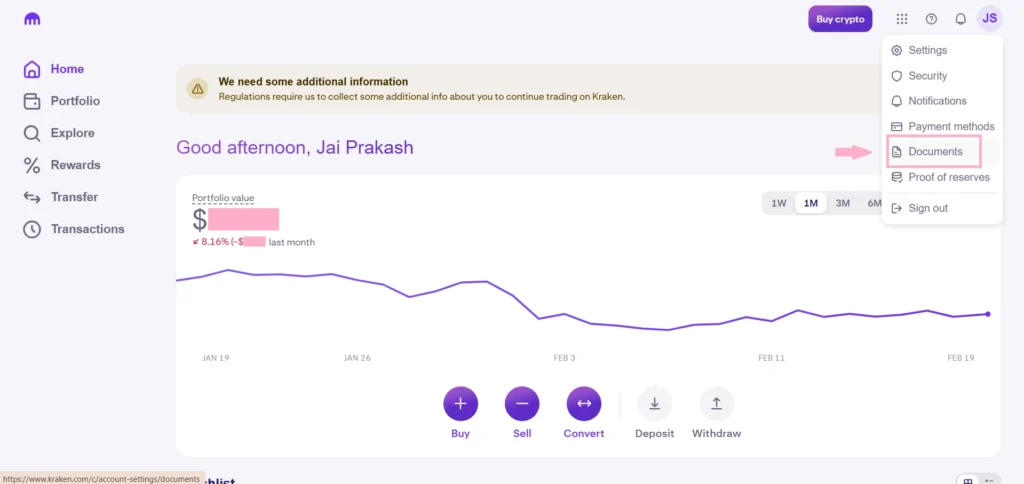

- Select Documents from the drop-down menu.

- Click the Create Export button on the right.

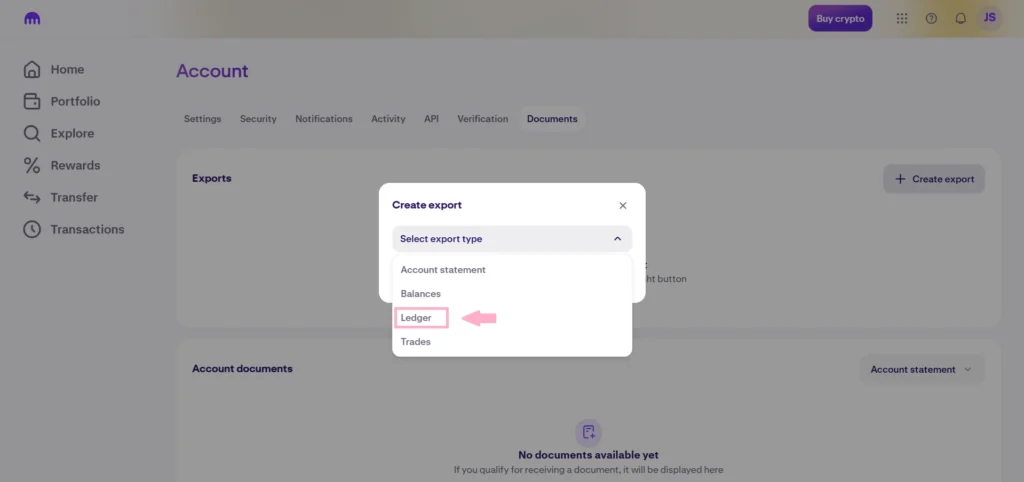

- Choose Ledger from the Select Export Type menu.

- Set the Start and End Date, select All for Transaction Types, Assets, and Fields, and choose CSV as the format.

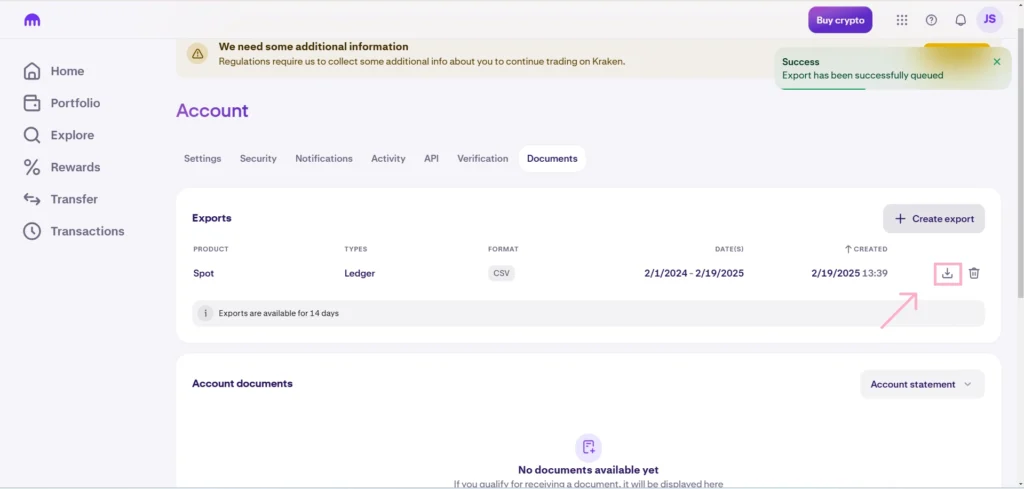

- Finally, click on the Download icon to save the generated trade history.

For Catax:

1. Go to wallets and select ‘add new wallet: Kraken Futures’.

2. Set up auto-sync and paste your API key and secret.

3. Finally, select ‘secure import’.

That’s it! Your Kraken synced with Catax, making tracking your Kraken Taxes and crypto activities cool and ease

How to Calculate OKX Taxes?

FAQs (Frequently Asked Questions)

You can easily access your tax information on Kraken by navigating to your account settings and selecting the tax information section.

Yes, if you’ve made profits from trading cryptocurrencies on Kraken, you’ll likely need to pay taxes on those gains according to your country’s tax laws.

Common issues may include accurately calculating gains and losses, understanding the tax implications of different types of trades, and ensuring compliance with tax regulations specific to your jurisdiction.