This guide outlines straightforward steps for managing your KuCoin taxes, beneficial for both beginners and seasoned traders dealing with KuCoin transactions.

How to Handle KuCoin Taxes Using Catax:

- Setting Up Your Account: Start by creating an account on Catax.

- Linking KuCoin to Catax: Connect your KuCoin account with Catax. This is achievable through API integration for a seamless connection.

- Synchronizing Data: Catax will automatically synchronize and arrange your KuCoin transaction data.

- Tax Computation: Based on your trading history, Catax computes your taxes, taking into account both capital gains and income.

- Generating Tax Reports: After processing your data, download a comprehensive tax report from Catax, customized for your specific jurisdiction.

- Simplified Filing Process: Utilize the Catax report for an effortless tax filing experience, whether doing it yourself or with professional assistance.

Understanding KuCoin:

KuCoin, established in Seychelles in 2017, garnered a significant investment of $20 million from IDG Capital and Matrix Partners in 2018. The platform is celebrated for its user-friendly mobile application and a diverse range of available cryptocurrencies. Presently, KuCoin caters to a global user base of 10 million individuals and has executed over 800,000 trades.

Filing KuCoin Taxes Efficiently:

To manage your KuCoin taxes with ease, choose Catax. Start by linking your KuCoin account to Catax, using either an API for automated data or by uploading a CSV file of your trades. Catax quickly assesses your tax responsibilities.

Once your KuCoin account is connected to Catax, it organizes your transaction information. This is crucial to identify which transactions are taxable. Catax adjusts tax calculations based on your location, making it very useful for KuCoin users globally, ensuring compliance with your local tax laws.

Catax does more than just calculations. it effortlessly transforms your KuCoin tax data into user-friendly reports, greatly simplifying the usually intricate crypto tax reporting process, thus enhancing accuracy..

Furthermore, Catax’s reports make KuCoin tax reporting simpler by detailing each transaction’s tax impact. This helps you easily keep track of your tax obligations.

To sum up, Catax is an effective tool for KuCoin tax management. It aligns with KuCoin, follows global tax regulations, and creates straightforward, accurate reports. This makes dealing with your KuCoin taxes and overall crypto tax needs easier, no matter where you are.

Connecting Kucoin to Catax via API:

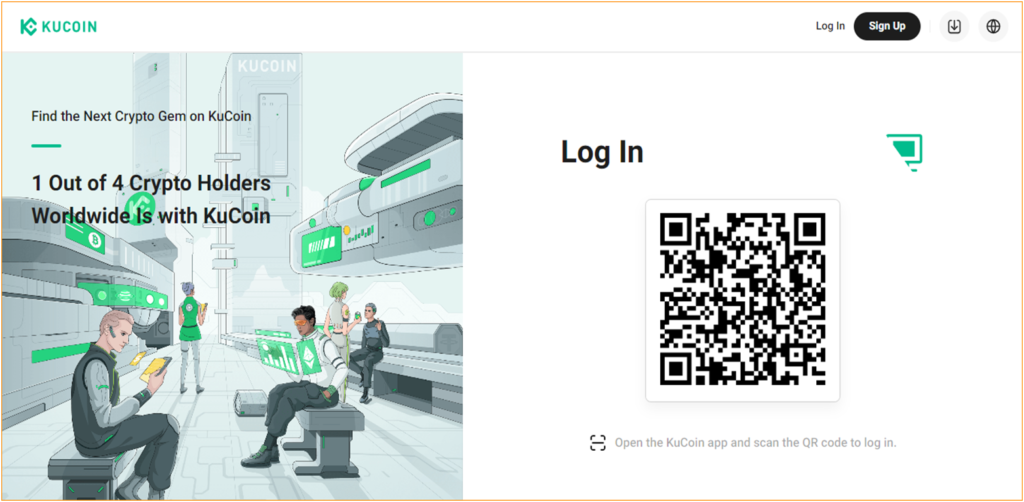

On Kucoin:

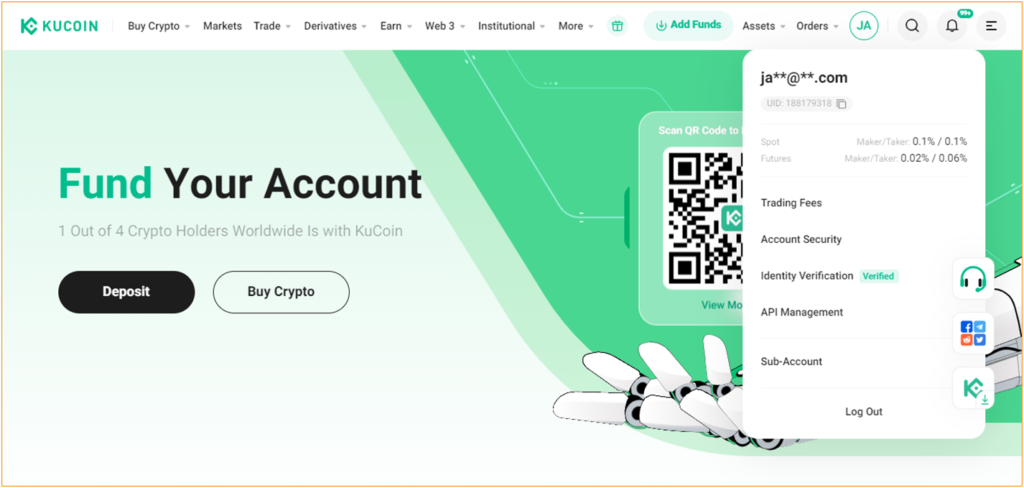

- Sign into your Kucoin account.

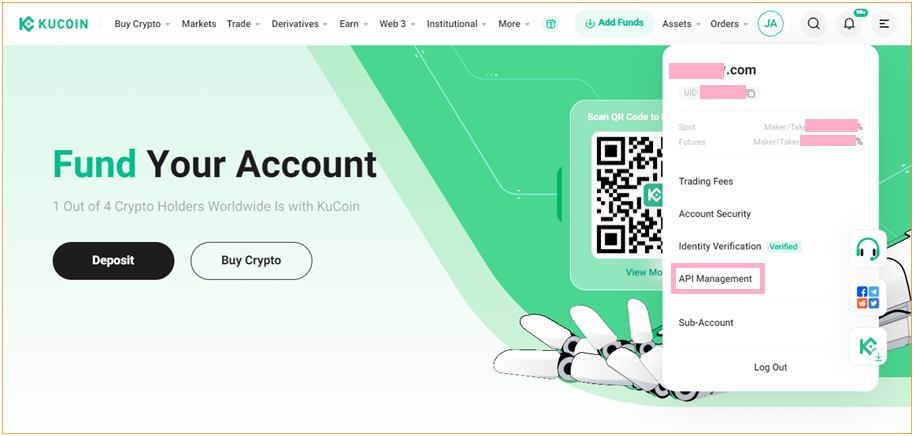

- Click on your account in the top right corner.

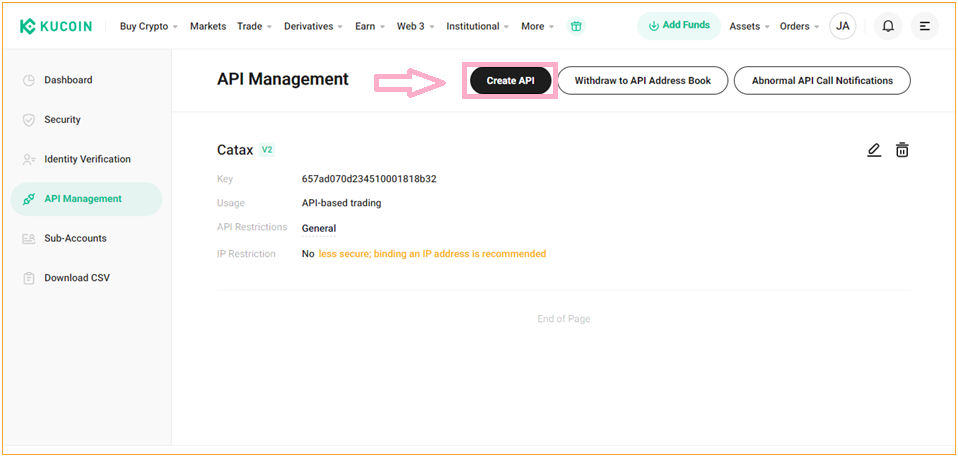

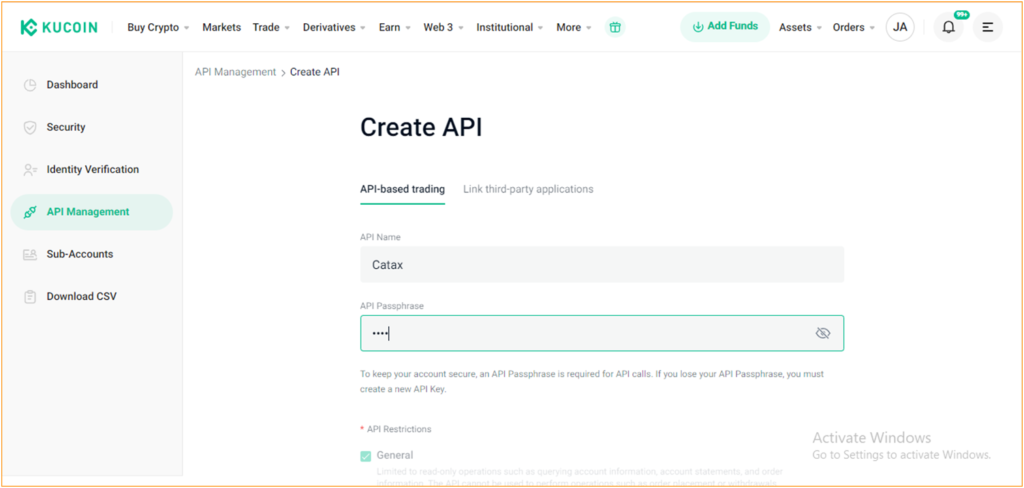

- In API-based trading Section. Name Your API label ,Enter your API Passphrase.

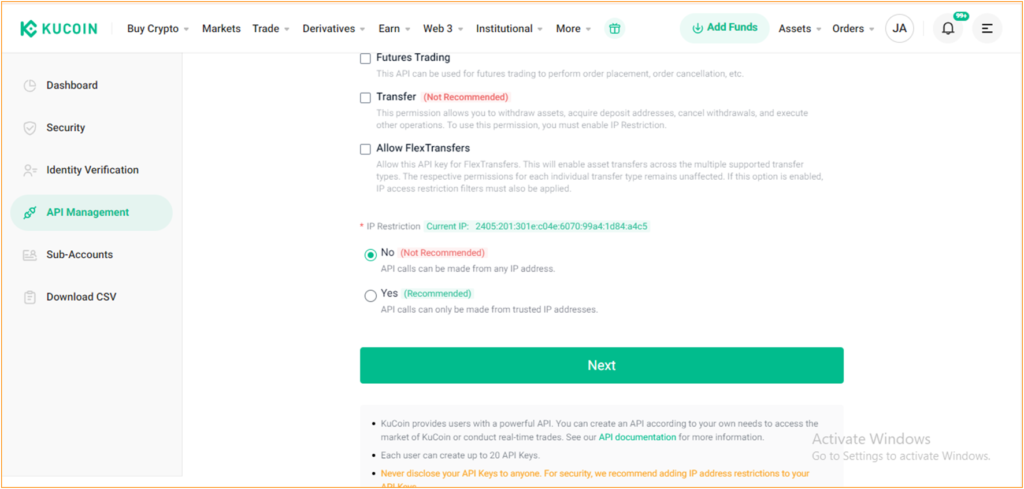

- Set the access to ‘Read-only’ and for IP restriction, select ‘No’. After that, click on ‘Next’.

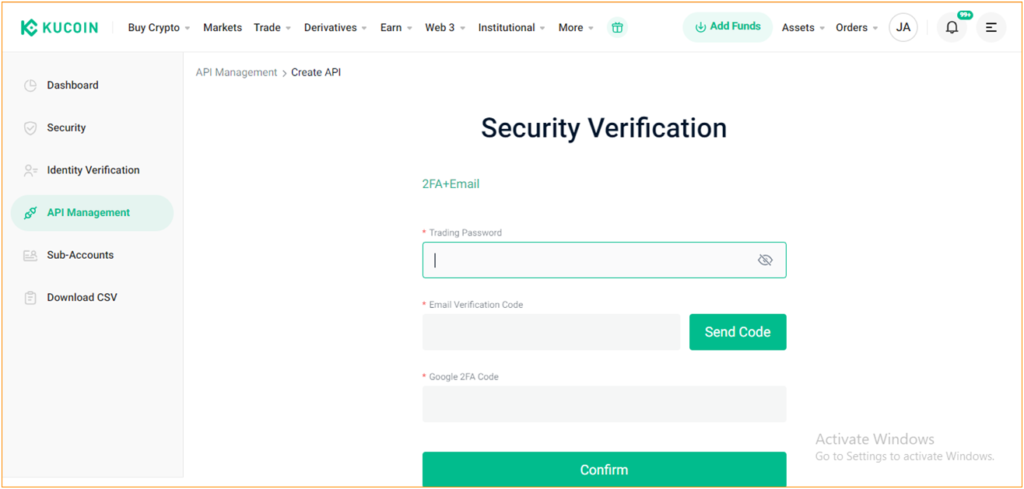

- Complete 2 Factor Authentication.

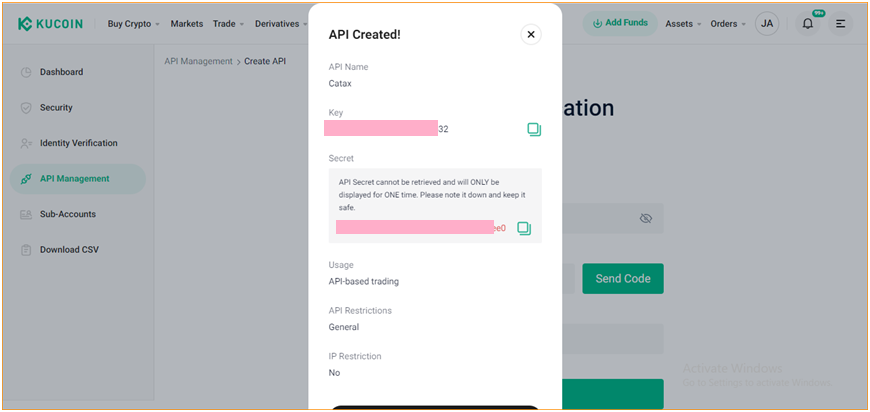

- Your API and Secret key will be generated.

On Catax:

- To begin, log in to your Catax account.

- Enable auto-sync, and proceed to enter your API key and secret to securely import your data.

Connect KuCoin to Catax to Calculate taxes manually via CSV file:

On KuCoin:

- After logging in, click on your profile icon, then go to the API Management section.

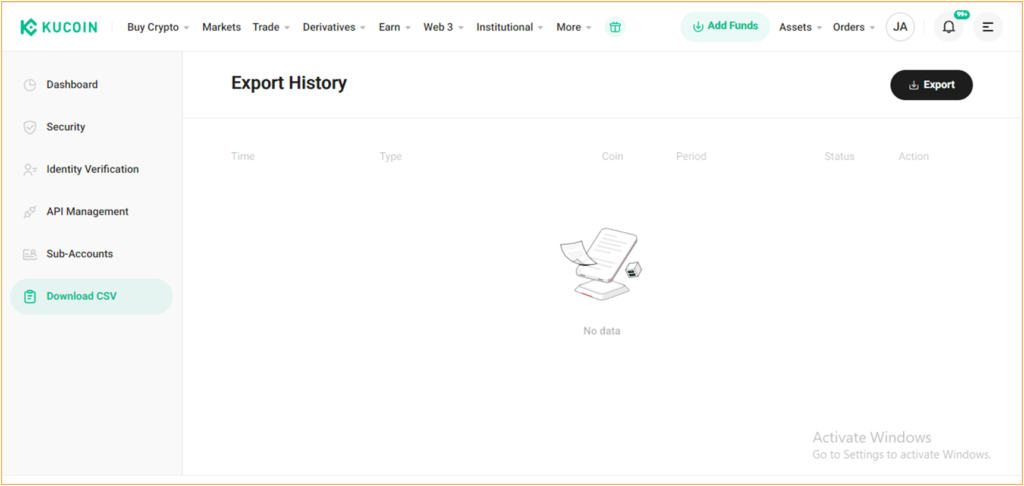

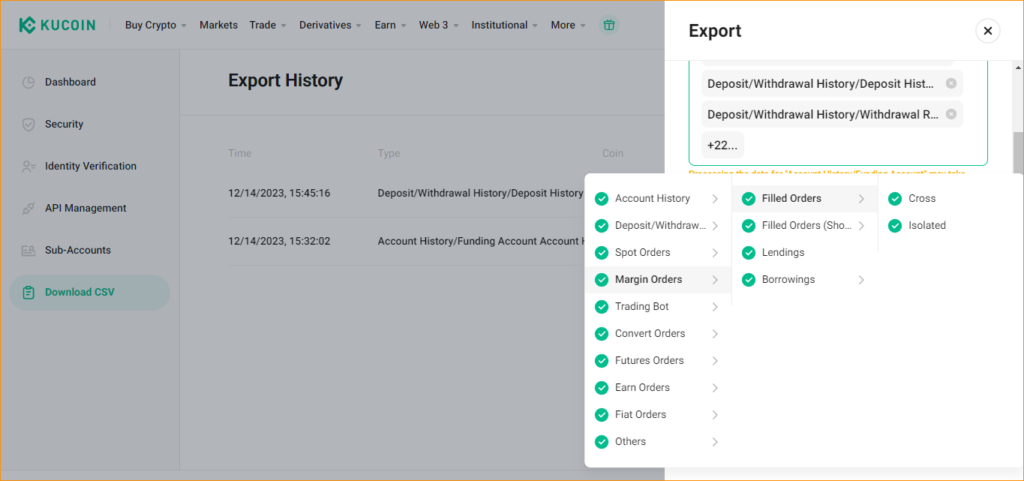

- In the API management section, click on “Download CSV.”

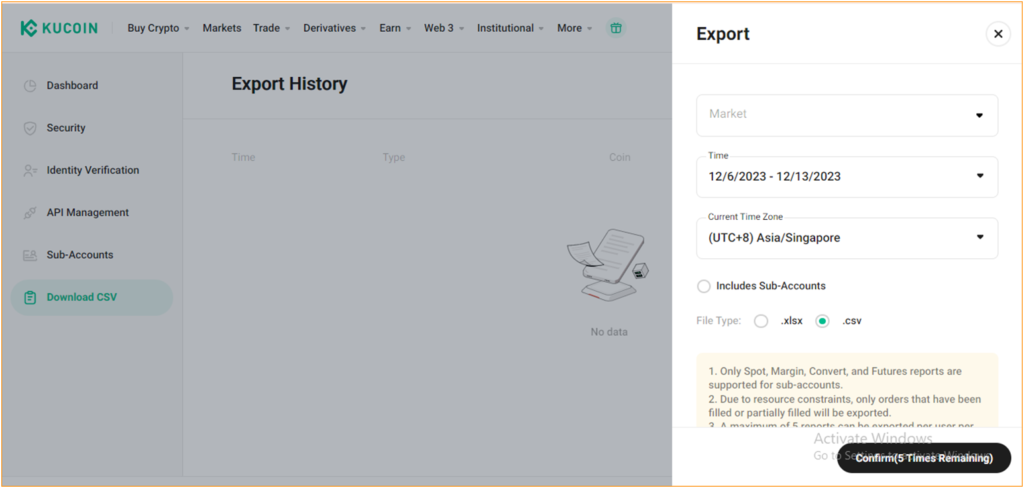

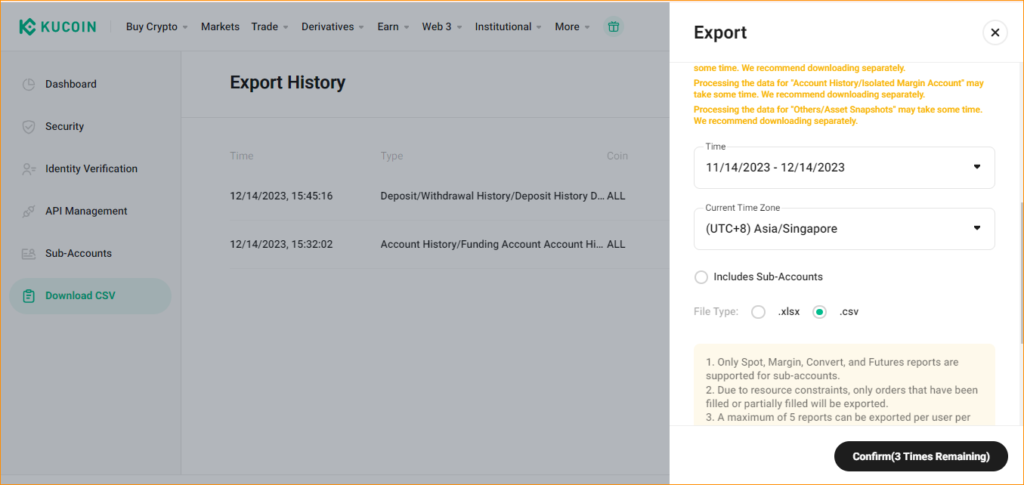

- Select Export in the top right corner.

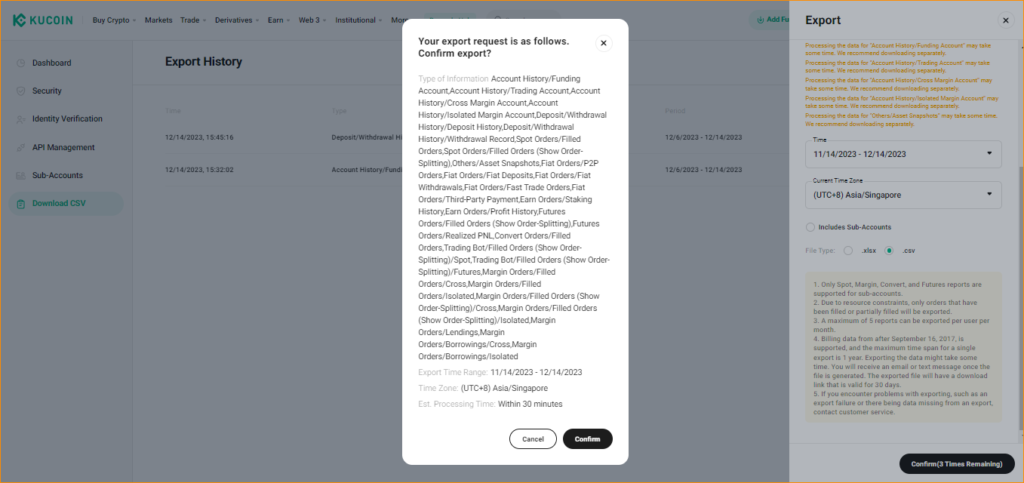

- Ensure that the timezone is listed as (UTC+8) Asia/Singapore. Choose “.csv” as the file type, then confirm your selection and confirm again in the popup.

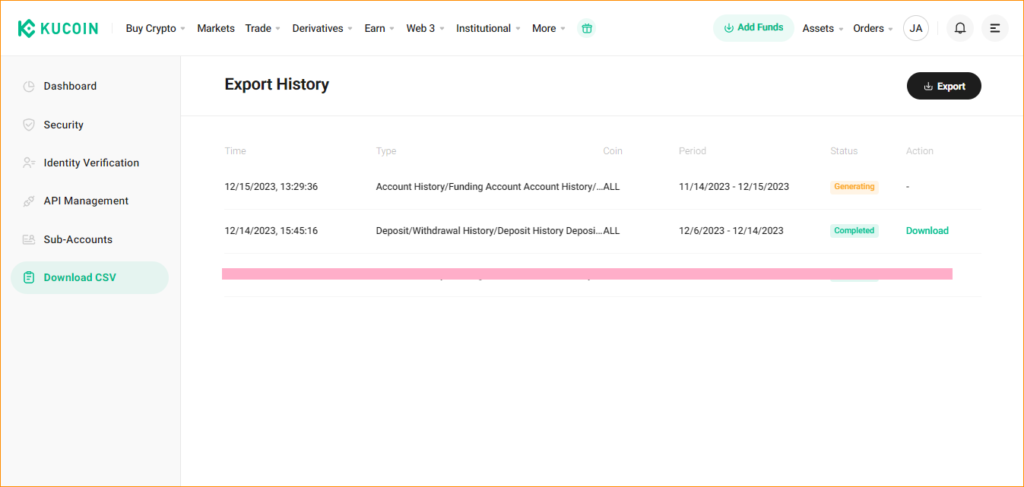

- Your transaction history will be generated shortly. Please check it after some time.

To add Kucoin transactions to Catax:

- Log into Catax.

- Go to ‘Wallets’.

- Click ‘Add New Wallet’, and choose ‘Kucoin’.

- Select ‘Import from File’.

- Upload your Gate.io CSV file.

KuCoin charges maker and taker fees starting at 0.1% per trade, which can be reduced based on your trading volume or by using KuCoin Token (KCS) for fee discounts. Deposit fees are usually free, but withdrawal fees vary depending on the cryptocurrency.

KuCoin itself does not impose taxes, but you are required to pay taxes based on your country’s laws. In India, for example:

Capital Gains Tax: 30% on crypto profits.

TDS (Tax Deducted at Source): 1% on transactions above a certain limit.

KuCoin does not automatically report user transactions to tax authorities. However, some countries may require exchanges to share data. It’s important to keep track of your trades and report your taxes correctly to avoid penalties.

Yes, rewards from staking, lending, or interest are taxed as income based on their market value at the time you receive them.