Poloniex, a widely used global cryptocurrency exchange, sees a vast amount of trading activity daily, including spot, margin, and derivatives trading, as well as earning opportunities. For all your Poloniex tax needs, Catax is here to assist. Here’s how:

- Register on Catax, select your country, and set your preferred currency.

- Safely link your Poloniex account to Catax to bring in all your trading data.

- Catax automatically sorts your Poloniex transactions into profits, losses, and earnings.

- Catax computes your Capital Gains Tax for Poloniex and Binance US Income Tax.

- Easily download your cryptocurrency tax report from Catax.

- File your crypto taxes online, by mail, or with a tax professional who specializes in crypto.

Does Poloniex share information with tax authorities?

Poloniex, a well-known exchange, recently faced pressure to reveal user transactions to tax bodies, especially after the IRS issued a John Doe summons for information. As a result of these events, Poloniex chose to halt its services in the U.S.

What is poloniex and How does it work?

Founded in 2014, Poloniex is a renowned cryptocurrency platform, known for its diverse investment offerings through Poloniex Earn. Users have widely praised this feature for its attractive investment options, making it simpler to increase their crypto holdings.

Many recommend Poloniex to those interested in exploring cryptocurrency investments. However, it’s crucial for users to keep in mind their tax obligations. Fortunately, Catax offers an efficient solution for handling poloniex taxes. It streamlines the calculation process and ensures adherence to tax regulations.

How can I file My Poloniex Taxes?

Filing your Poloniex taxes is important. You must declare any profits or losses from Poloniex trades when you do your yearly taxes. You can do this manually by tracking each transaction, figuring out the tax type, and working out your gains, losses, or any income. However, this can be quite a task.

Many investors choose to use a crypto tax tool like Catax for this. Catax simplifies the process by calculating your taxes and preparing a report for your tax authority. Here’s how you can connect your Poloniex account to Catax for easier tax filing.

How to Connect Poloniex with Catax:

Connecting Poloniex to Catax Automatically Via API

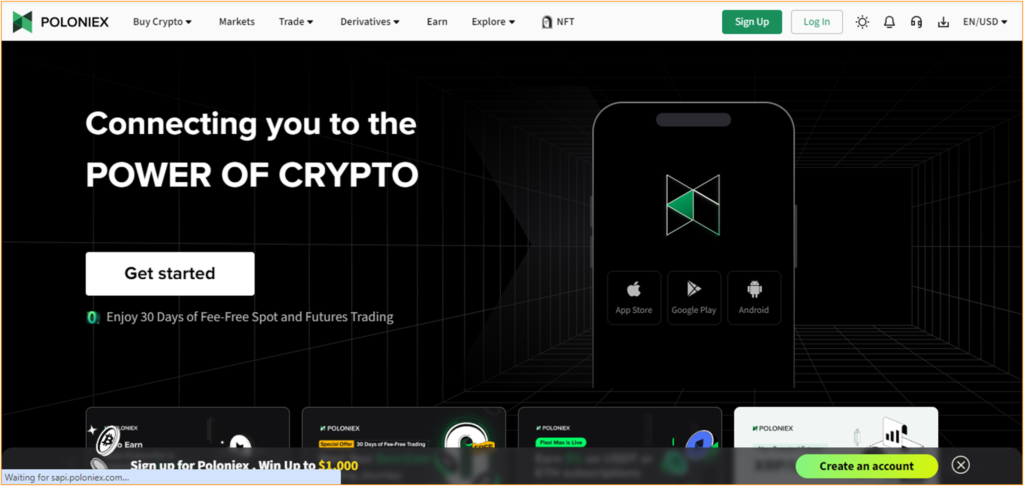

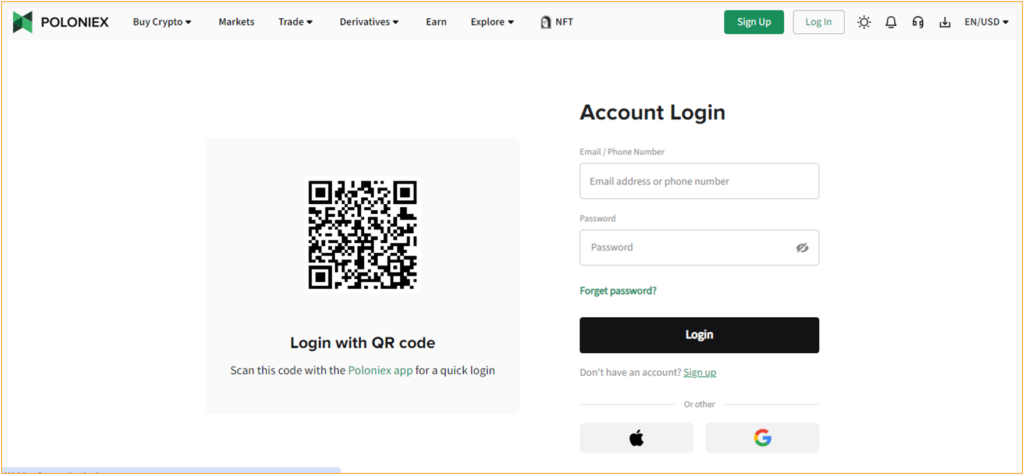

- Visit Poloniex.com, Login with Your Information.

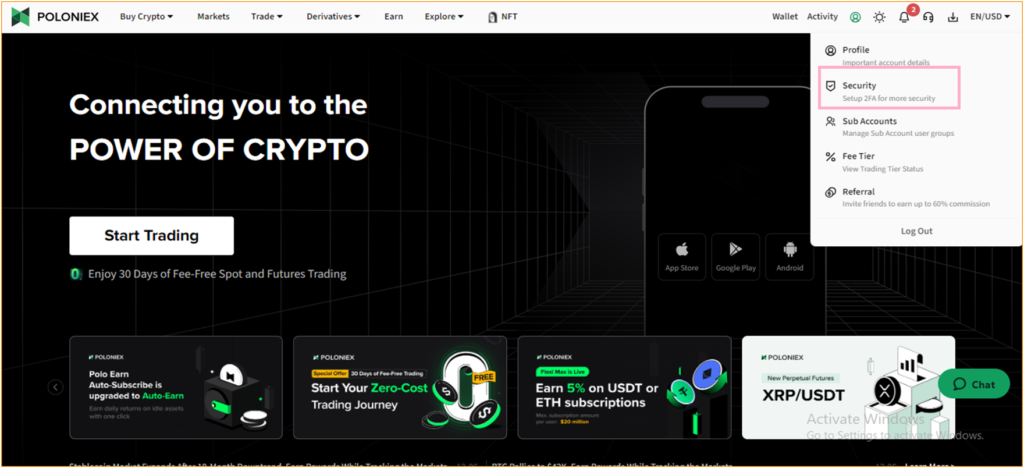

- Click on Profile icon, Select ‘Security’ section.

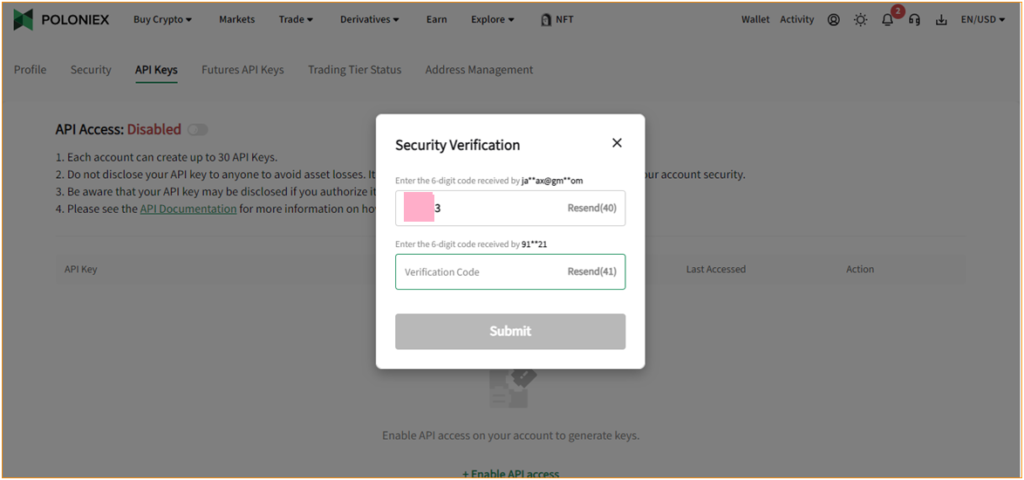

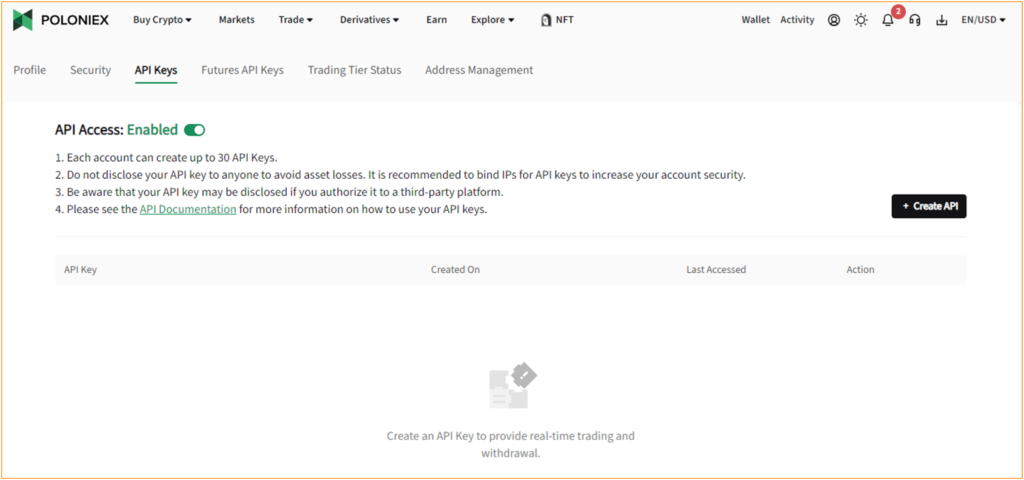

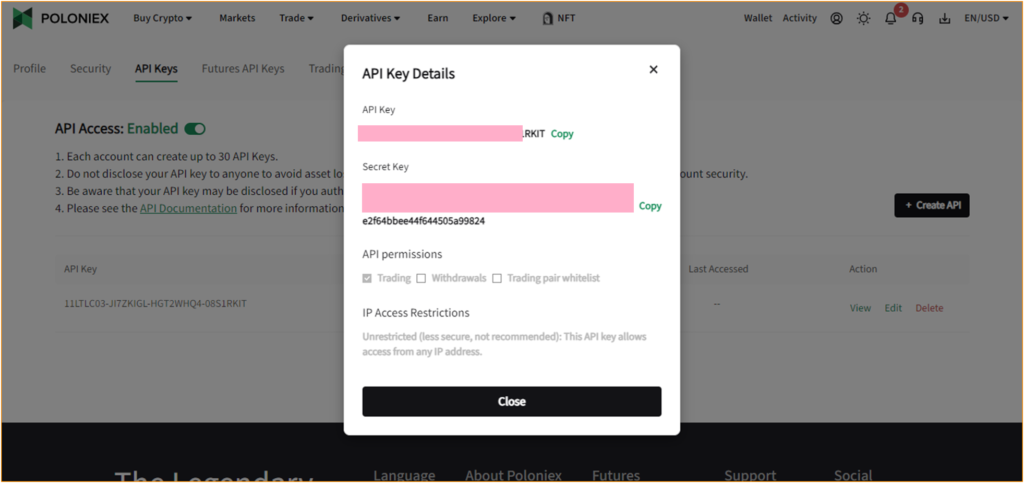

- Go to ‘API keys’ section. Complete Your security verification.

- Then Click on Create API.

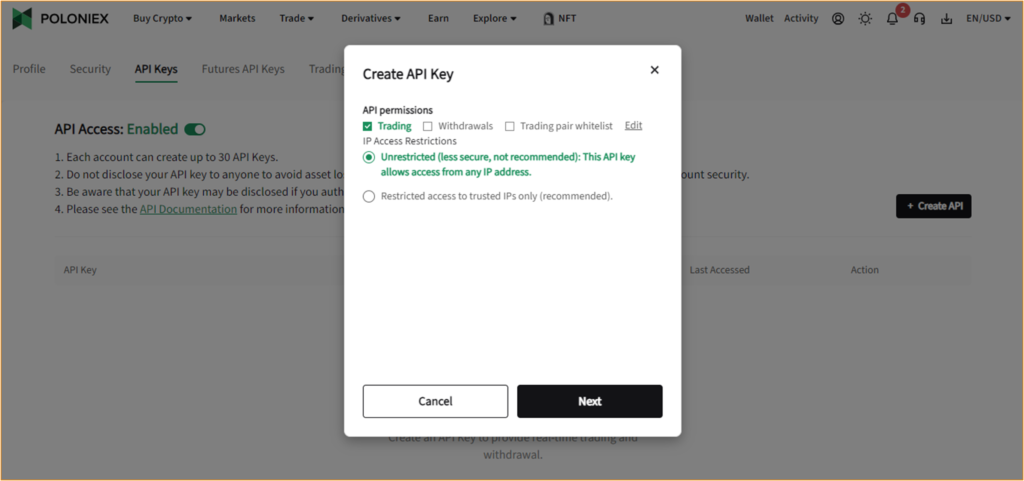

- Then select ‘Trading’ and “Unrestricted” in IP Access Restriction Section.

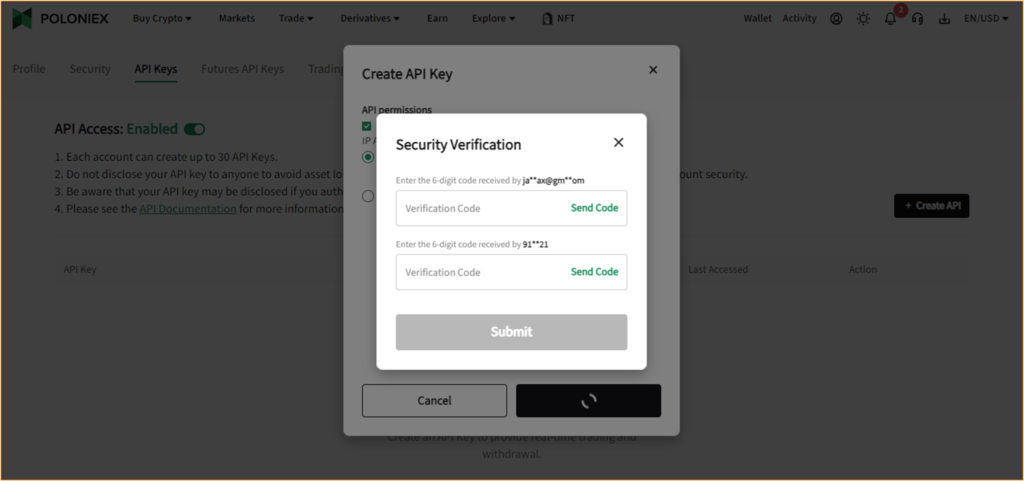

- Complete Security verification.

- Your API key and your Secret Key will be ready.

Discover: How to Create Poloniex API?

On Catax:

- Log into Catax and go to the wallets section.

- Create a new Poloniex wallet and enable auto-sync.

- Input your API key and secret.

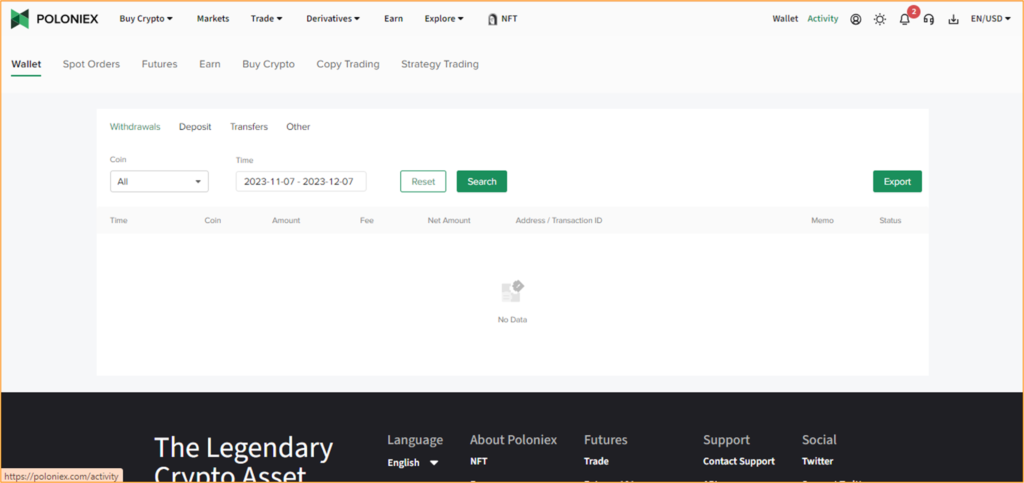

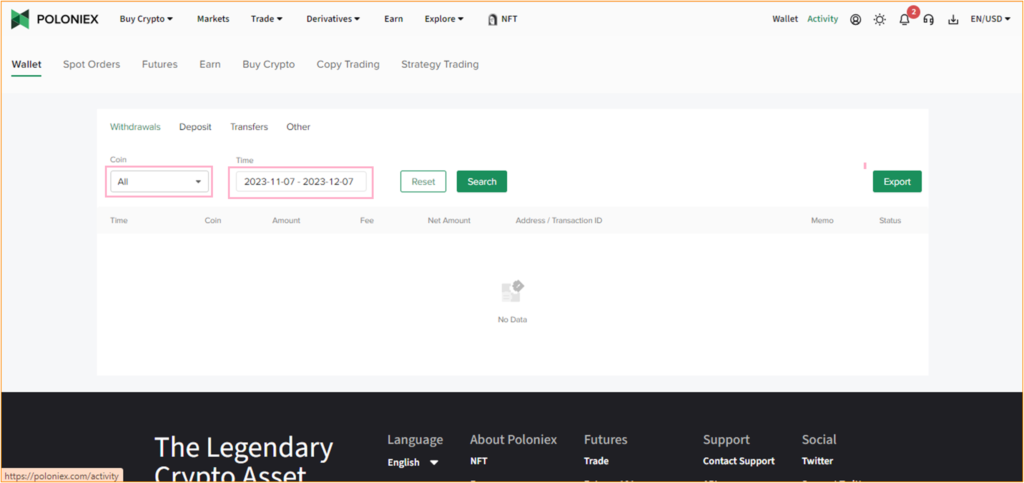

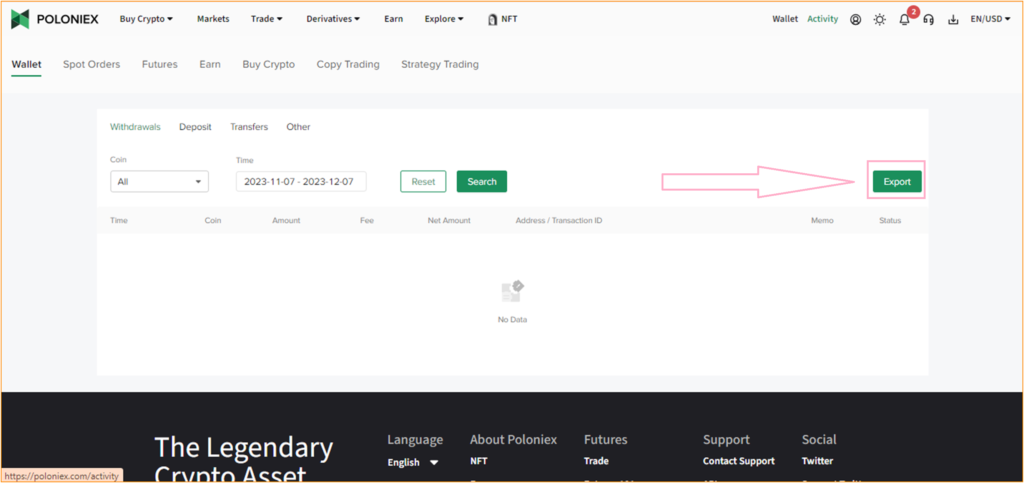

Connecting Poloniex to Catax Manually Via transaction History(CSV)

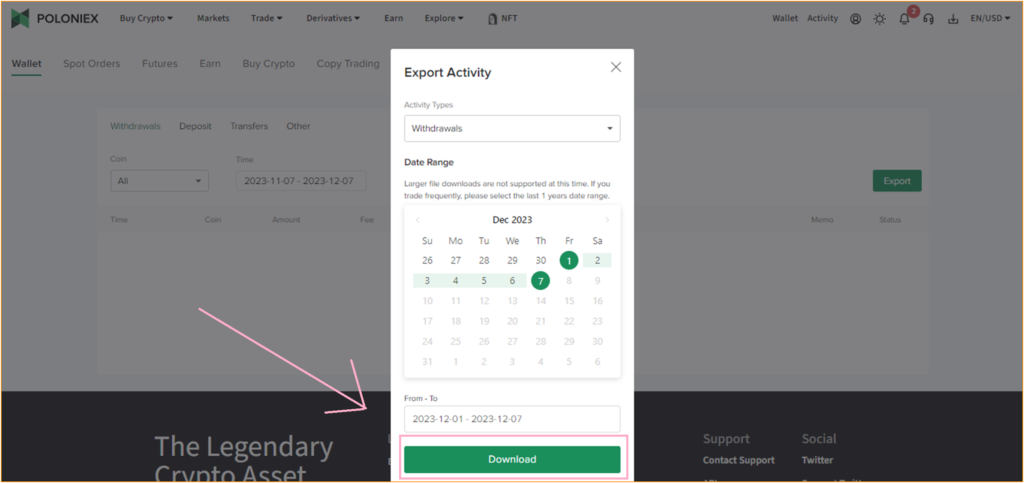

- Then Click on ‘Export’.

- Then Click on ‘Download’ Your Transaction will be Downloaded.

Discover: How to Export Poloniex Transaction History?

For adding your Poloniex transactions to Catax:

- Log into your Catax account.

- Go to the ‘Wallets’ section.

- Click on ‘Add New Wallet’ and choose ‘Poloniex’.

- Select ‘Import from File’.

- Upload your Poloniex CSV file(s).