Steps to Generate Coindcx History:

- Login to Coindcx.com: Go to the Coindcx website or app and login to your account.

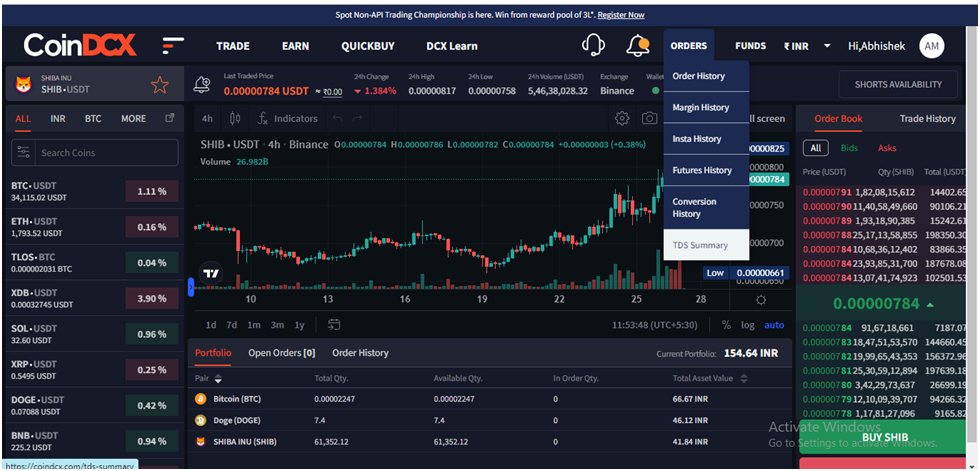

- Go to Order History: Go to ‘Order History’ from the Orders on your dashboard

- Select Financial Year: Select your Financial year

- Click on Download CSV: After clicking on Download CSV Repeat the same for ‘Margin History’ & ‘Insta History’. Cross-verify to see if all the transactions are downloaded

Lets Calculate Taxes with Catax

Catax is a powerful crypto tax calculator designed to simplify the often cumbersome process of reporting cryptocurrency transactions. This new tool seamlessly integrates with various cryptocurrency platforms, including popular exchanges like CoinDCX, WazirX, and Binance, providing a versatile solution for crypto enthusiasts.

Catax aggregates transaction data from these exchanges, allowing users to track their profits, losses and revenues in a centralized way. This integration proves especially beneficial for individuals who have conducted trades on multiple platforms, guaranteeing a correct and accurate assessment of their tax liability.

The key feature of Catax is its ability to read Transaction History for Coindcx, allowing users to import and classify their CoinDCX trades effortlessly. By automating these processes, Catax not only simplifies tax reporting but also helps users pay taxes more efficiently. So, whether you are a CoinDCX, WazirX, or Binance user, Catax can be an invaluable tool to ensure smooth and accurate cryptocurrency tax reporting.

Is it safe to input CoinDCX transaction history into Catax?

Yes, it’s safe to put your CoinDCX transaction history into Catax. When you enter your CoinDCX transaction details into Catax, it’s a secure process. Catax is designed to handle cryptocurrency transaction data in a safe and efficient way. It uses advanced security measures and encryption to keep your financial information safe.

Putting your transaction history for CoinDCX into Catax makes it easier to figure out your cryptocurrency taxes. Catax uses a read-only API key, which means it can view your transaction data for tax purposes but can’t make changes or take out money from your account. This way, your assets stay safe. Lots of cryptocurrency investors use Catax to make tax reporting simpler, and it has a good record for keeping your financial information secure.

To be even more secure, it’s a good idea to follow some online safety tips, like using strong and unique passwords and turning on two-factor authentication for your exchange accounts.

How Can Crypto Tax Software Help You?

Crypto tax software, like Catax, makes handling your taxes easier. It connects to your different crypto accounts, organizes your data, and quickly calculates your profits, losses, and income. It then creates accurate tax reports in just a few minutes.

You can try it for free by signing up and get a sneak peek of your gains and losses.